Waiting for a legal settlement can take months—or even years. That’s why many people turn to legal funding, also known as lawsuit loans, to help pay bills while their case is ongoing. But one of the first questions they ask is:

“How Much Will Pre-Settlement Legal Funding Cost Me?”

The exact cost of legal funding depends on several factors, including the provider you choose, the details of your case, and how long it takes to reach a settlement.

This guide breaks down typical legal funding rates, explains how repayment works, and shows you how to avoid hidden fees and paying too much.

Disclaimer: All rates, fees, and repayment examples provided are for illustrative purposes only and do not constitute a guarantee, offer, or commitment to fund. Actual terms may vary based on individual case details, applicable state laws, and underwriting approval.

Please review your agreement carefully before accepting any funding.

What Is Legal Funding?

Legal funding is a cash advance provided to plaintiffs with active legal claims. It is not a traditional loan. Instead, it’s classified as non-recourse funding, which means:

- You only repay the advance if you win or settle your case.

- If you lose, you owe nothing—there is no personal liability.

- Approval is based on the strength of your case, not your credit score or employment history.

Legal funding helps plaintiffs cover essential living expenses during long legal battles without taking on personal debt.

Types of Legal Funding

The most common types of legal funding include:

- Pre-settlement funding: Given while your case is still open.

- Post-settlement funding: Offered after your case is won but before the payout is received.

- Medical lien funding: Pays medical bills upfront in exchange for repayment from your settlement.

How Legal Funding Costs Are Calculated

The cost of legal funding isn’t one-size-fits-all. Funding companies evaluate several factors to determine your rates and repayment terms. Understanding what drives these costs can help you compare offers and avoid overpaying.

Here are the main factors that influence how much legal funding will cost:

1. Type of Case

Not all cases carry the same risk. Common examples include:

- Car accidents with clear liability may receive lower rates.

- Medical malpractice or product liability cases often involve more uncertainty and higher costs.

The more predictable the case outcome, the more favorable the pricing may be.

2. Estimated Case Value

Larger expected settlements usually qualify for higher funding amounts. However:

- Higher case value can reduce perceived risk, lowering your rate.

- But higher funding requests may result in larger total repayment amounts over time.

3. Time Until Case Resolution

Legal funding accrues costs over time, so the longer your case takes to settle, the more fees and interest can accumulate, especially if compounding interest is involved.

Tip: Choose a trustworthy legal funding provider with non-compounding interest and capped repayment terms to reduce long-term costs.

4. Risk Assessment

Funding is non-recourse, meaning you don’t repay unless you win. So, the more risk your case presents, the more a provider may charge to offset that risk.

Factors that raise the risk include:

- Unclear liability

- Incomplete medical records

- Delayed or disputed treatment

Legal funding companies use different ways to charge for their services. Some charge monthly interest, while others use flat fees. The next section explains how each method works and how it affects what you’ll pay back.

What Fees Do Pre-Settlement Funding Companies Charge?

Pre-settlement funding companies often apply a range of fees when offering cash advances on pending lawsuits, and these charges can vary widely depending on the provider and case specifics. Common fee types include:

- Monthly interest rates: Typically 2% to 4%, charged as simple or compounding interest

- Application or processing fees: Sometimes deducted from the upfront advance

- Underwriting or administrative costs: Additional fees for reviewing the case

- Broker markups: Extra charges if the provider uses a third-party broker instead of direct funding

Explore the Guide: Legal Funding Brokers vs. Lawsuit Loan Companies – Learn the differences

Tip: Always ask whether fees are deducted from your advance and if there’s a cap on total interest to avoid paying more than expected.

Typical Legal Funding Costs: What Interest Rates and Fees Plaintiffs Can Expect

| Cost Factor | What You Can Expect |

|---|---|

| Monthly Rate | Usually between 2% and 4% per month |

| Interest Type | May be simple (flat) or compounding (interest-on-interest) |

| Repayment Timeline | Generally 12 to 36 months, depending on case length |

| Application / Upfront Fees | Varies by provider – some charge $0, while others may add processing or setup fees |

| Hidden Costs | Beware of broker markups, referral commissions, or administrative surcharges |

Why Choose Express Legal Funding Instead of Other Companies?

- No Upfront or Hidden Fees: Transparent terms with zero surprise charges.

- Capped Fees: Fees are capped to help protect your settlement.

- Free Delivery of Funds: No extra charge to receive your money.

- Free, No-Obligation Case Review: Fast approval process without any risk.

- 100% Risk-Free Guarantee: You only repay if you win or settle your case—no win, no repayment.

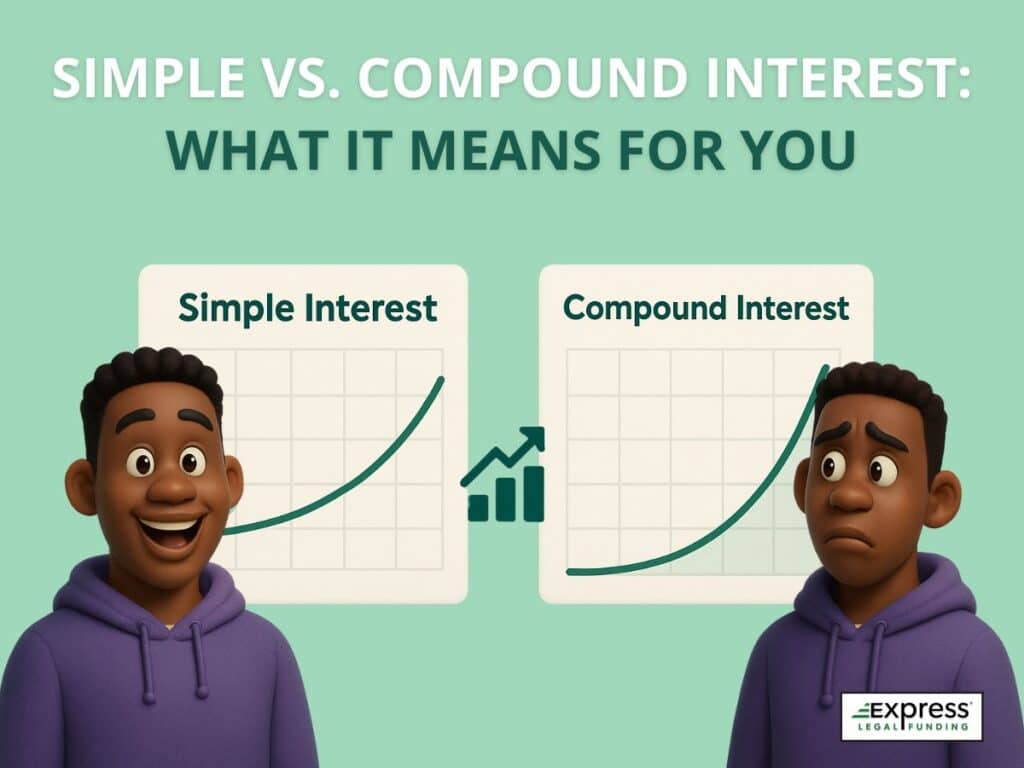

Simple vs. Compound Interest Rates: What It Means for You

Simple Interest:

- Based only on the amount you borrow.

- Easier to predict.

- Lower total repayment.

Compound Interest:

- Interest is charged on both the amount you borrowed and the interest already added.

- Costs grow faster the longer your case takes.

- Can double or triple your repayment.

Express Legal Funding only uses low interest rates with optional caps to protect your settlement.

Examples: How Much You Might Repay for the Cost of Pre-Settlement Funding

Here are real-world examples to show how much legal funding can cost depending on the provider:

Estimated Pre-Settlement Legal Funding Repayments with Monthly Compounding Interest

| Pre-Settlement Advance Amount | Case Duration | Estimated Payback (Compounding 3%/Month) |

|---|---|---|

| $2,000 | 12 months | $3,280 |

| $10,000 | 24 months | $19,200 |

| $25,000 | 36 months | $65,000+ |

What This Means:

Even a small monthly compounding interest rate (3%) can double or triple the total repayment amount if your case takes a year or more to resolve. That’s why it’s crucial to ask about:

- Whether the rate is compounding or flat

- Whether there’s a cap on total repayment

Pre-Settlement Legal Funding Repayment Estimates with Simple Interest

| Pre-Settlement Advance Amount | Case Duration | Estimated Payback (Simple 3%/Month) |

|---|---|---|

| $2,000 | 12 months | $2,720 |

| $10,000 | 24 months | $17,200 |

| $25,000 | 36 months | $52,000 |

Why Simple Interest Matters:

- Simple interest is calculated only on the original funding amount, not on the interest that’s already added.

- This keeps your repayment amount predictable and fair, especially for longer cases.

Real Example: How Much Did Emily Repay on Her Legal Funding?

Emily was injured in a rear-end car accident and couldn’t work while waiting for her case to settle. She applied for legal funding to help cover her rent and groceries.

- Settlement Advance Amount: $5,000

- Repayment Type: Simple interest (3% monthly, capped after 24 months)

- Case Duration: 18 months

When Emily’s case finally settled, her attorney paid back $7,800 from her settlement, covering the original funding amount and interest. Thanks to the company’s non-compounding and capped fee model, she avoided the ballooning costs that many other providers would have charged.

💡 Had she chosen a provider using monthly compounding interest, her repayment could have exceeded $9,000.

Are There Upfront or Hidden Fees?

Yes, some pre-settlement funding companies add extra fees that aren’t always obvious at first. These hidden costs can significantly increase your total repayment, sometimes by hundreds or even thousands of dollars.

Common hidden or upfront fees may include:

- Application or processing fees

- Underwriting or administrative fees

- Broker markups (especially if the provider is not a direct funder)

- “Compliance” or “setup” charges

- Servicing and maintenance fees

- Electronic document storage fees

Tip: Always request a clear breakdown of all fees before signing. Look for companies that offer transparent, no-fee funding, like Express Legal Funding.

Watch Out for Upfront Deductions

Some legal funding companies may deduct fees directly from your advance, meaning you receive less money upfront than what you were approved for. Worse, you may still be charged interest on the full funded amount, including the portion you never actually received.

These upfront deductions can include:

- Application fees

- Processing or underwriting fees

- Broker or referral markups

- Delivery fees

Tip: Always ask whether the advance amount listed is net or gross and whether any fees are taken out before the funds are disbursed.

Are There Any Hidden Fees with Express Legal Funding?

No, there are absolutely no hidden fees with Express Legal Funding. Transparency is one of the core principles that sets us apart and is widely recognized by both clients and attorneys.

Express Legal Funding has no upfront fees or hidden costs. Every term is clearly explained in your agreement before you sign—there are no application fees, no surprise charges, and no out-of-pocket costs. You only pay if you win your case, and because our pre-settlement funding is non-recourse, you owe nothing if you lose.

How Does Repayment Work for Legal Funding?

Repayment is simple. Here’s how it works:

- Your case settles.

- Your lawyer receives the settlement check.

- The funding amount + agreed fees and interest are repaid from the settlement to the legal funding company.

- You get the rest of the money.

Legal funding has no monthly payments, no credit reporting, and no debt collection. If you lose your case, you owe nothing.

Can I Estimate My Legal Funding Cost?

Yes, you can estimate potential costs using a legal funding calculator or by reviewing a sample repayment table like the one below.

Please note: these examples are for illustration purposes only and do not represent an offer or pricing from Express Legal Funding. Actual rates, funding amounts, and eligibility are determined on a case-by-case basis and may vary depending on your case details and applicable state laws.

Sample Repayment Estimates for $1,500 Pre-Settlement Legal Funding (Simple Interest)

| Case Duration | Monthly Interest Rate | Total Interest Accrued | Estimated Total Repayment |

|---|---|---|---|

| 3 months | 3% | $135 | $1,635 |

| 6 months | 3% | $270 | $1,770 |

| 9 months | 3% | $405 | $1,905 |

| 12 months | 3% | $540 | $2,040 |

| 18 months | 3% | $810 | $2,310 |

| 24 months | 3% | $1,080 | $2,580 |

This helps you:

- Understand how long-term cases affect repayment

- Compare offers from different companies

- Avoid overpaying for short-term cash relief

Want a free cost estimate for your legal funding? Contact us, and we’ll show you exactly what you’ll owe—before you commit.

What to Look for in a Legal Funding Company

Not all lawsuit funding companies are created equal. Here’s what to check:

- Transparent contracts

- Low interest rates

- No hidden fees

- Capped repayment options

- Direct funding (not a broker)

- Attorney-friendly process

Watch out for:

- Complex or unclear terms

- Pushy salespeople

- Promises of “guaranteed funding” with no case review

- Unregulated or offshore companies

Risks to Consider

While legal funding offers financial relief, it’s important to understand the trade-offs:

Risks:

- Less money left after your case settles

- High rates from some providers

- Longer cases can cost more if there’s no fee cap

How to Minimize Risk:

- Only borrow what you need

- Read the contract closely

- Ask about caps and interest types

- Get your attorney’s input

Read our 2025 legal funding company comparison guide to find and choose the best pre-settlement funding provider for your needs.

How to Apply for Legal Funding

At Express Legal Funding, getting started is quick and free:

Legal Funding Process Steps

- Apply online or call us for a free review.

- We contact your attorney to confirm your case details.

- Our team reviews your case and makes an offer.

- You sign the contract.

- We send the money, often the same day your contract is signed.

There’s no cost to apply and no obligation to accept.

Final Thoughts: Is Legal Funding Worth the Cost?

Legal funding helps injured plaintiffs access the cash when they need it most. But it’s crucial to understand the costs and choose a trustworthy provider.

By working with Express Legal Funding, you can:

- Avoid excessive fees

- Get simple, capped pricing

- Non-recourse funding: Only pay if you win

Apply With Express Legal Funding Today

Get the financial help you need. Apply for legal funding online or call us at 888-232-9223 to speak with a team member today.

Still have questions? Contact us for a free, no-pressure quote and find out how much you qualify for.