Legal problems and lawsuits can be expensive—and stressful. Whether you’re trying to hire a lawyer, pay court filing fees, or simply cover basic expenses during a long lawsuit, you may need financial help to stay afloat. That’s where legal loans and lawsuit loans come in.

Although the terms sound similar, legal loans and lawsuit loans are two distinct types of financial products designed for different situations.

This guide explains what they are, how they work, and how to decide which one might be the right choice for you.

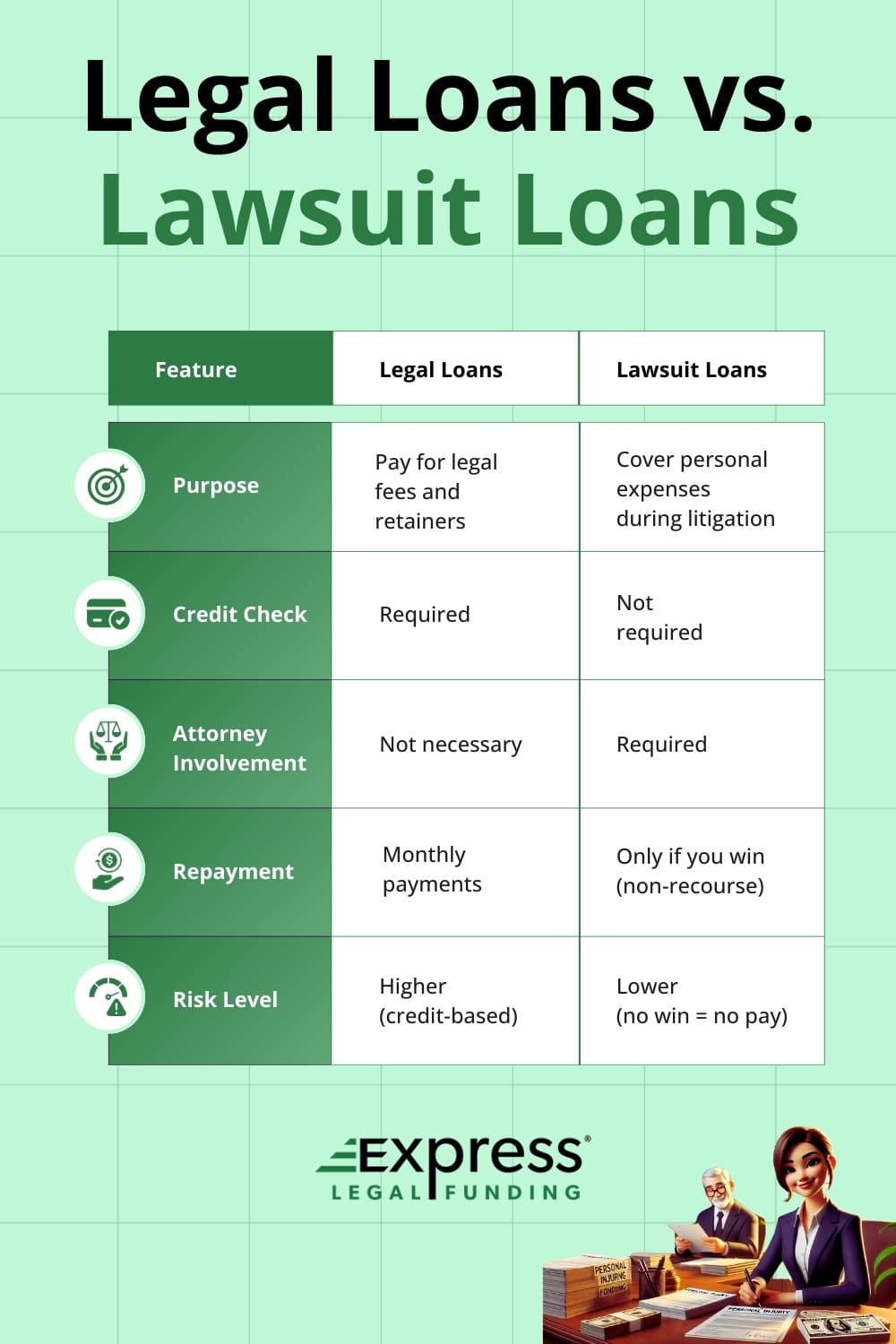

Here is an infographic to jumpstart your understanding of this legal finance topic.

Legal Disclaimer: This article is for informational purposes only and not legal or financial advice. The term loan is used for readability; lawsuit loans are non-recourse advances, not traditional loans.

What Are Legal Loans?

Legal loans are typically personal loans used to pay for legal services. If you need an attorney for a divorce, criminal case, immigration issue, or civil dispute and can’t afford the fees upfront, a legal loan may help.

Key Features of Legal Loans

- Fixed interest rates and monthly installment payments

- Approval based on your credit history and income

- Used to pay legal professionals directly or reimburse case-related expenses

Purpose of Legal Loans

To help individuals pay for legal representation, especially when large retainers or hourly fees are required before a case can proceed.

What Are Lawsuit Loans?

Lawsuit loans, also called pre-settlement funding, are a completely different type of financial product. They’re non-recourse cash advances given to plaintiffs involved in lawsuits—primarily personal injury or civil cases—based on the expected value of their future settlement.

Key Features of Lawsuit Loans

- No monthly payments

- Only repaid if you win or settle your case

- Approval does not depend on your credit score or employment status

Purpose of Lawsuit Loans

To help injured or wronged plaintiffs cover everyday expenses (rent, groceries, medical bills) while their case is ongoing.

Important Note: Lawsuit loans are not used to pay legal fees and typically require attorney cooperation.

🤝 Read about the importance of attorney cooperation in our guide: Can I Get Pre-Settlement Funding Without Attorney Consent?

Comparing the Differences Between Legal Loans and Lawsuit Loans

Legal Loans vs. Lawsuit Loans: Key Differences

| Feature | Legal Loan | Lawsuit Loan (Pre-settlement Funding) |

|---|---|---|

| Used For | Attorney fees, court filings | Personal/living expenses during a lawsuit |

| Repayment | Monthly payments required | Only if you win your case (non-recourse) |

| Credit-Based? | Yes | No |

| Attorney Involvement | Not required | Required |

| Risk to Borrower | High (can impact credit) | Low (no repayment if you lose) |

Why Consider Legal Loans?

Legal loans can be helpful in a range of situations where you need to pay legal fees upfront but do not have the financial means to do so.

Common Scenarios Where Legal Loans Help

- Divorce & Family Law: Hiring an attorney for a contested divorce or child custody hearing.

- Criminal Defense: Paying a private defense attorney for DUI or drug-related charges.

- Immigration Cases: Covering legal fees for green card applications or deportation defense.

- Civil Lawsuits: Funding lawyer fees in breach of contract or tenant-landlord disputes.

Benefits of Legal Loans

- Provides fast access to funds

- Fixed interest rates and predictable monthly payments

- Can be used for any legal expenses

- May assist with building a positive credit history as long as you make all your payments on time

Drawbacks of Legal Loans

- Requires good credit or steady income

- Repayment is required regardless of your case outcome

- May increase your overall debt burden

- May temporarily lower your credit score

Alternatives to Legal Loans

- Credit cards (usually higher interest)

- In-house payment plans offered by law firms

- Legal aid programs (if eligible)

Why Consider Lawsuit Loans?

If you’re awaiting a settlement but facing financial hardship, a lawsuit loan may provide much-needed relief.

Common Case Types Where Lawsuit Loans Help

- Personal Injury: Car accidents, slip-and-fall injuries, or dog bites

- Workers’ Compensation: Injuries sustained on the job, especially those that prevent you from returning to work

- Wrongful Death: Supporting families pursuing claims after the loss of a loved one

- Mass Torts & Product Liability: Victims involved in long-term class action lawsuits and multidistrict litigation

Benefits of Lawsuit Loans

- No credit check, no income requirement, or proof of employment

- Funds are typically available in as little as 24 hours after approval

- No repayment is required if you lose your case

Drawbacks of Lawsuit Loans

- Higher fees and funding multipliers (can reduce final payout) than traditional loans

- Only available for specific case types

- Requires full attorney cooperation

Alternatives to Lawsuit Loans

- Borrowing from friends or family

- 401K loan

- Home Equity Loan (HELOC)

💡 Read Our Complete Guide to 15 Lawsuit Loan Alternatives: Compare Pros, Cons, and Application Steps

Potential Risks and Pitfalls of Legal Loans and Lawsuit Loans

Legal Loans

- Impact on Credit Score

Legal loans are typically credit-based. A hard credit check is usually required, and missed payments can lower your credit score. - Debt Accumulation

Taking out a legal loan adds to your debt load. If your case drags on or legal costs rise, it could strain your finances. - Interest Rates and Fees

While interest rates are often fixed, they can still be high—especially for borrowers with low credit scores. - Repayment Obligations

You must repay the loan whether you win or lose your case. This can become burdensome if the outcome is unfavorable.

Lawsuit Loans

- High Fees and Funding Multipliers

These loans may charge significant fees. For example, borrowing $5,000 might result in a repayment obligation of $10,000–$15,000 from your settlement. - Limited Availability

Lawsuit loans are generally only available for personal injury, wrongful death, or similar claims. They also require your attorney’s full cooperation. - Impact on Settlement Amount

Since the loan is repaid from your settlement, you may receive less than expected once the case concludes. - Dependency on Case Outcome

While non-recourse (you owe nothing if you lose), the lender takes on risk—reflected in the higher cost and stricter terms.

Regulation and Legality of Legal and Lawsuit Loans by State

The availability and regulation of legal loans and lawsuit loans vary widely across the United States. While legal loans (as personal loans) fall under standard consumer lending laws, lawsuit loans—also known as pre-settlement funding—operate in a more complex and less uniformly regulated space.

Key Legal Considerations:

- Legal Loans are typically regulated under state and federal lending laws, such as the Truth in Lending Act (TILA) and state usury laws, which govern interest rates and loan disclosures.

- Lawsuit Loans are not considered traditional loans because they are non-recourse advances. This means you only repay if you win or settle your case. As a result, they are not subject to lending laws in most states, and their regulation depends on how each state classifies this type of funding.

Examples of State Differences in Legal Loan Regulations

- Strictly Regulated States: States like California and Massachusetts have strong consumer protection laws. Lenders must be licensed, follow strict interest rate caps, and provide detailed disclosures under both state law and the federal Truth in Lending Act (TILA).

- Permissive States: States such as Utah and Delaware allow higher interest rates and have fewer loan restrictions. These business-friendly rules attract high-interest lenders but may expose borrowers to higher costs and less oversight.

- States with Rate Caps: In places like North Carolina and Arkansas, interest rates are tightly capped—often under 30%. Lenders must be licensed and comply with strict regulations, which can limit loan options for high-risk borrowers.

Examples of State Differences in Lawsuit Loan Regulations

- Highly Regulated States: States like Illinois, Missouri, and Oklahoma require lawsuit funding companies to be licensed, post bonds, and follow strict disclosure rules under Consumer Legal Funding Acts.

- Moderately Regulated States: States such as New York regulate contract terms, mandatory disclosures, and fee structures but don’t require licensing. New York was the first to adopt this middle-ground approach.

- Prohibited or Restricted States: Arkansas and West Virginia have laws with such low rate caps that lawsuit funding is essentially unavailable in those states.

- Unregulated States: Many states offer little or no oversight, allowing wide variation in rates, fees, and contract terms.

What This Means for You:

Before entering any legal or lawsuit funding agreement, it’s essential to:

- Understand your state’s specific laws.

- Carefully review all contract terms and fees.

- Work with a transparent, reputable company that complies with industry best practices.

For more information, consult your attorney or check with your state’s attorney general office or consumer protection agency.

Trusted Lawsuit Loan Provider

If you’re involved in a personal injury case and need financial support while waiting for your settlement, consider Express Legal Funding.

They are a trusted, direct provider of pre-settlement advances, offering fast, risk-free cash advances without relying on legal funding brokers.

- No credit checks or hard credit pulls

- Fast approvals (often in 24 hours)

- No repayment is required if you lose your case.

How Legal Loans Work

- Apply Online or In Person: Choose a lender and complete the application.

- Submit Documentation: Provide proof of income, credit score, legal invoices, etc.

- Get Approved: Based on your creditworthiness—not the outcome of your legal case.

- Repay Monthly: Through a fixed-interest installment plan.

How Lawsuit Loans Work

- Apply Online or by Phone: Apply with a reputable lawsuit loan company, such as Express Legal Funding.

- Initial Review and Case Evaluation: Express Legal Funding contacts your attorney, and its underwriters review your case, determining its value and potential settlement timeline.

- Approval & Funding: If approved, you receive a lawsuit cash advance—often 24 hours or less.

- Repayment: You only repay if your case settles successfully. If you lose, you owe nothing. Your attorney is responsible for facilitating the disbursement of funds.

How to Choose the Right Type of Legal Financing

Ask yourself these questions:

- Am I paying a lawyer now or waiting for my case to settle?

- Do I need funds for legal services or to pay personal bills?

- Can I qualify for a personal loan?

- Is my attorney open to working with a lawsuit funding company?

Financial Planning Tips for Lawsuit Loans

- Only borrow what you truly need

- Understand all repayment terms before signing

- Consider how lawsuit funding may affect your final settlement

- Discuss your options with your attorney or a financial advisor

Legal Loan and Lawsuit Loan Companies to Consider

Choosing the right lender is an important step. Below are two lists: one with reputable legal loan providers and the other with trustworthy lawsuit loan companies.

Each lender offers financial support tailored to different legal needs—whether you need help paying for an attorney or covering everyday expenses while waiting for a case to settle.

Always compare interest rates, fees, contract terms, and customer reviews before applying to ensure you’re making the best financial decision.

Legal Loan Providers (Personal Loans for Legal Fees)

These lenders offer credit-based personal loans that can be used to pay attorney retainers, court filing fees, and other upfront legal costs:

- LawPay: Partners with Affirm to offer Buy Now, Pay Later legal loans, allowing clients to pay legal fees over time with structured installment plans.

- LightStream: Offers low-interest personal loans with no fees for borrowers with good credit.

- Upstart: Provides loans based on education, employment history, and location, not just credit scores.

- LendingClub: A peer-to-peer platform with fixed monthly payments and transparent fees.

Lawsuit Loan Providers (Pre-settlement Funding)

These companies provide non-recourse cash advances to plaintiffs involved in ongoing lawsuits. You repay only if your case settles successfully:

- Express Legal Funding: A direct, trusted pre-settlement funding company offering fast approvals, low interest, and does not require repayment if you lose your case.

While many companies offer lawsuit funding, it’s crucial to choose one that provides transparent terms and direct funding—not a broker acting as a middleman. Express Legal Funding stands out for its honesty, speed, and customer-first approach.

👉 Discover the Top 10 Best Legal Funding Companies: Expert Rankings and What to Consider

Frequently Asked Questions About Legal Loans vs Lawsuit Loans

Legal loans are personal loans used to pay for legal services, such as attorney fees and court costs. They are credit-based and require monthly repayments. Lawsuit loans, also known as pre-settlement funding, are non-recourse settlement advances given to plaintiffs to cover personal expenses during a lawsuit. They are repaid only if the case is won or settled.

You can pay for a lawyer without money by seeking free legal aid, using contingency fee agreements, or arranging payment plans. Legal aid organizations offer free help to those who qualify based on income.

In personal injury and some civil cases, lawyers may work on a contingency fee basis, meaning they only get paid if you win. Some attorneys also offer sliding-scale fees or flexible payment plans.

Depending on your situation, you can also explore legal financing options, such as legal loans or pre-settlement funding.

📘 Read our FAQ guide about how hiring a No-Win, No-Fee Attorney works.

No, lawsuit loans are not intended for paying legal fees. They are designed to help plaintiffs cover everyday living expenses while awaiting a settlement.

Interest rates for legal loans can vary based on your credit score and the lender’s terms. They may be higher than traditional personal loans, especially if you have a lower credit score. It’s important to compare offers and understand all associated fees.

Yes, lawsuit loans often come with high fees and can significantly reduce your final settlement amount. They are also only available for certain case types and require attorney cooperation.

If you lose your case, you are not required to repay the lawsuit loan. This non-recourse feature is a key benefit of lawsuit loans, but it also contributes to their higher cost.

For legal loans, the approval and funding process can vary, but funds are typically available within a few days to a week. Lawsuit loans can provide funds as quickly as 24 to 48 hours after approval, depending on the lender and case evaluation.

While you can technically apply for both a legal loan and a lawsuit loan, doing so is uncommon and often impractical. Legal loans are typically used to pay attorneys working on an hourly or flat-fee basis, while lawsuit loans require a contingency-fee attorney.

Since lawsuit funding relies on the attorney being paid from the settlement, using both types of financing is usually incompatible.

When choosing a lender, consider factors such as interest rates, fees, repayment terms, and customer reviews. It’s also important to ensure the lender is reputable and transparent about their terms.

Yes, alternatives include in-house payment plans offered by law firms, credit cards (though they may have higher interest rates), and legal aid services if you qualify.

To make the best decision, assess your financial situation, understand all loan terms and conditions, and consult with legal and financial advisors. Avoid overborrowing and plan for potential impacts on your credit and settlement amounts.

Conclusion: Understanding the Differences Between Legal Loans and Lawsuit Loans

Legal loans and lawsuit loans both serve important roles in helping people through difficult legal situations—but they serve very different purposes:

- Choose a legal loan if you need help paying legal fees upfront.

- Choose a lawsuit loan—such as those from Express Legal Funding—if you need cash now and are waiting on a settlement.

Understanding your financial options helps you protect your case—and your future inside and outside the courtroom.