Motor vehicles are an integral facet of modern society that allows us to traverse large distances in short periods.

While cars, trucks, and motorcycles are not as expedient as aircraft, they provide efficient transportation and are more practical for most daily commutes.

Considering the distance the average person must travel to and from work and commerce centers, motor vehicles are vital to modern society.

The need for motorized transportation has led to almost every American adult having a motor vehicle.

The number of vehicles on the road has increased over the years to the point where traffic is at an all-time high.

This has had an unfortunate side effect on how safe it is to drive by increasing the number of accidents proportionate to the number of drivers.

Fortunately, modern vehicles are fitted with multiple safety measures to protect drivers in the event of an accident.

One of the main safety features in cars and trucks is the airbags, specially designed to protect drivers and passengers from serious injuries upon impact.

While airbags are crucial for keeping people safe during car accidents, they usually only deploy after a significant accident (in contrast to minor fender benders occurring at low speeds).

The crash sensors are tuned to avoid premature and unnecessary deployment, which leads people to assume that airbag deployment is a sign that the vehicle is damaged beyond repair.

The question and primary focus of this article is: Is a car totaled if the airbags deploy?

Your Airbags Deployed, Is Your Car Totaled?

Before discussing the concept of airbag deployment and totaled cars, let’s begin by clarifying the basic concept of what causes airbags to deploy in the first place.

What Causes Airbags to Deploy? [Video]

Airbags are designed to deploy in moderate to severe car accidents when a vehicle’s crash sensors detect rapid acceleration (increase in speed) or deceleration (decrease in speed) changes.

For example, getting hit from behind by another vehicle traveling fast will cause your car to suddenly speed up, or crashing into a house will cause it to drastically slow down.

Both situations will likely cause a car’s airbags to deploy to mitigate the chance of the vehicle’s occupants suffering serious injuries.

Still, a seemingly benign car accident can cause the airbags to deploy even if the damage is negligible. With that said, airbags do not typically deploy in minor fender benders and sideswipe accidents.

From a safety measure standpoint, car manufacturers set up their vehicle’s airbag systems to not deploy unnecessarily (in minor accidents) because deployed airbags can cause secondary injuries not directly related to the car collision’s impact.

What Speed Do Airbags Deploy at?

There are several details a vehicle’s sensors will look for before setting the minimum miles per hour needed for the airbags to deploy. However, on average, airbags will deploy at 16 mph.

The criteria for airbags deploying in a car crash changes depending on the following details:

- Location of impact

- Whether they are the front or side airbags.

- Whether the driver and passenger(s) have their seatbelts fastened.

The airbag system’s sensor first determines whether the driver and passengers have their seatbelts fastened.

Airbags deploy at different speeds, which are partially based on car sensors designed to detect whether the belt is fastened, affecting whether the airbags will deploy sooner.

Typically, the mph for airbag deployment pertaining to whether seatbelts are fastened is about the following:

- If your safety belt is buckled, the front airbags will only deploy when the collision occurs at a speed of at least 16 miles per hour.

- If the belt is not secured, the threshold lowers to 12 miles per hour since there is less protection.

A lower minimal speed threshold is required for side airbags to compensate for there being less distance between the side of the car and its occupants (in contrast to frontal airbags), allowing for even more immediate deployment.

What Speed do Side Airbags deploy?

Typically, all side airbags deploy (regardless of a seatbelt) in impact collisions with minimal speeds between 8 and 18 miles per hour, which adjusts based on how narrow (or wide) the object that hits the side of the car is. For instance:

- Narrow and more pinpoint objects, such as light poles and street signs, will be subject to the eight mph deployment threshold.

- Broader and less pinpoint objects, like cars or trucks, will be subject to the 18 mph higher end of the threshold.

That said, side airbags typically only deploy after a side impact rather than a head-on collision.

How do Airbags Inflate?

Airbags have evolved in terms of deployment methods, with the original model being an air compression system designed by a United States Navy veteran. The most common deployment model is a system that uses a controlled explosion to inflate the airbags.

This model was created by a Japanese engineer and is considered the best method in modern automobiles. Finding a vehicle without this deployment system is rare and ultimately less effective.

Now that we have clarified what causes airbags to deploy, we can move on to discuss whether having your airbags deployed renders your vehicle a total loss or if and how insurance companies use the value of your car to calculate whether your car can still be salvaged after an accident.

Is a Car Totaled if Your Airbags Deployed?

No, a car is not automatically considered totaled if the airbags deploy. Determining whether a vehicle is a total loss involves a comprehensive assessment of several factors.

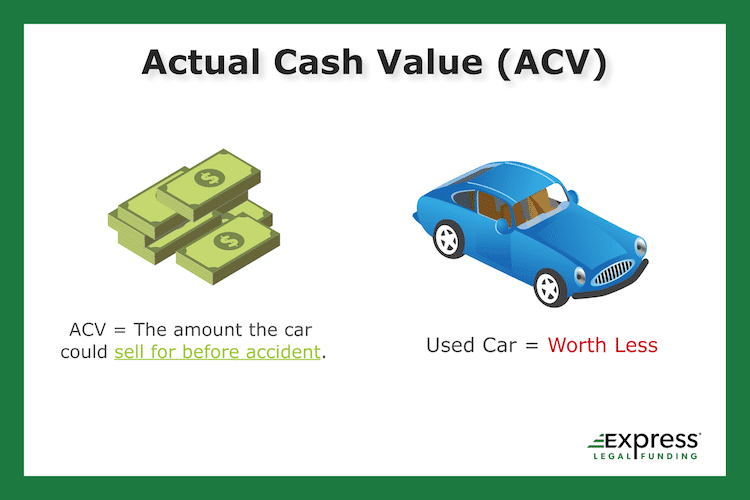

One of the primary determinants is the car’s actual cash value (ACV) compared to the cost of repairs required to make it roadworthy again.

Quick definition: In the property and casualty insurance industry, actual cash value (ACV) is not the same as replacement cost value (RCV) as the calculation factors in depreciation.

The ACV will always be a lower dollar amount than it would cost to replace the damaged or destroyed item. It is less favorable for the person filing a claim.

When deployed airbags are a part of the damage equation, the complete cost of repairs will inevitably be higher (typically by at least a few thousand dollars).

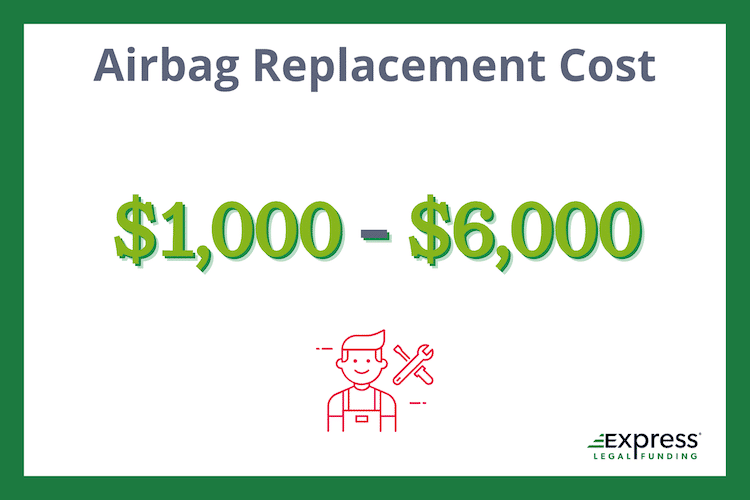

How Much Does it Cost to Replace Airbags?

The average airbag replacement cost is between $1,000.00 and $6,000.00, depending on the make and model and the accident’s severity.

This is expensive, not just because of the new airbag’s price but also due to the labor involved in correctly installing it and ensuring the airbag system’s integrity.

The vehicle’s airbags are an essential, yet costly, component of its safety mechanism.

When they deploy, it’s not just about replacing the bag itself. The entire airbag system must be checked and sometimes replaced, from the sensors to the inflators.

Furthermore, the steering wheel, often housing the driver’s side airbag, may also sustain damage during the deployment.

If the steering wheel components are affected, additional costs may be related to its repair or replacement.

It’s important to note that while the visual damage may seem limited to the steering wheel and deployed airbags, there could be unseen structural damage, which only becomes evident upon a more thorough inspection.

Auto insurance policies play a critical role here, as insurers evaluate the total cost of repairs in relation to the car’s ACV.

How to Know Your Car is Totaled?

If repairing the vehicle—considering all damages, including the airbag system and related components—exceeds or even approaches the vehicle’s actual cash value (in most states), the insurance company has to declare it a totaled car, as it met the “total loss threshold.”

Total Loss Threshold by State – 2023

The exact percentage of the total loss threshold (TLT) is set by each of the 50 states’ laws. So, the amount will change from state to state.

However, it is essential to note some states, like California and New York, use a total loss threshold formula that factors in the salvage value of a vehicle instead of only a percentage based on the actual cash value of a car or truck.

Some examples of ACV laws for a couple of the most populated states include the following:

Florida Total Loss Threshold

The total loss threshold in Florida is 80% of the car’s value before the accident.

So, if an insurance adjuster deems the total cost of repairs will be 80% or more of a car’s actual cash value, the car is considered totaled, and the insurance company must, by law in Florida, provide the value of the car pre-accident.

Texas Total Loss Threshold

The total loss threshold in Texas is 100% of the car’s value before the accident.

So, if an insurance adjuster determines that a vehicle’s total cost of repairs will be 100% or more of its actual cash value, the vehicle is considered totaled, and the insurance company must, by Texas law, provide the totaled vehicle’s value before the accident.

The only other state with a TLT of 100% is Colorado.

It’s always recommended to consult with a trusted mechanic, auto body shop, and auto insurance provider to understand the extent and cost of the damage so you can determine the most viable way forward.

If There is No Car Insurance Coverage

Generally, this will be a moot point if your auto insurance policy does not include collision insurance, as the damage to your car will not be covered.

That means it will be an out-of-pocket expense, and up to you to pay for the cost of replacing your totaled car.

The Aftermath of Airbag Deployment

When you are in a motor vehicle collision, and your airbags deploy, it can be disorienting (a symptom of whiplash and concussions), and you might not have the wherewithal to understand the situation immediately.

At the very least, you will not be overly concerned about your car’s condition and will be more interested in ensuring you and any passengers are unharmed.

When airbags are deployed, it is common for people to assume their vehicle has been severely damaged and is a total loss.

However, whether it can be classified as “totaled” by insurance adjusters is another story.

The law definition of a “totaled” vehicle refers to a scenario where the car is so heavily damaged that repairing it would cost more than its current replacement value.

How Do Adjusters Determine if a Car is Totaled?

Generally, several details affect the value of the car. Insurance adjusters use these factual attributes to determine whether it can be repaired without exceeding that dollar amount (plus or minus depending on the relevant state’s law).

The main criteria are:

- Age and Value: Every year, major motor vehicle manufacturers release new versions of their main catalog with updated features and designs. While some older vehicles (i.e., collector cars) maintain their value, most common cars lose their value the older they get.

For example, a Toyota Sienna from 1998 (the oldest version of the model) would not be worth repairing since its current value averages around $740.00 in outstanding condition.

Furthermore, parts for that specific version are no longer manufactured and virtually impossible to acquire.

Conversely, a new car like a 2023 Toyota Sienna starts at over $36,000.00 on average, making it more likely that the damage to the vehicle will not exceed the replacement value. - Previous Accidents: A vehicle involved in multiple collisions sustains damage to the internal components.

Regardless of repairs, that damage is exacerbated by subsequent collisions (i.e., if the frame was slightly dented in a previous accident, it could be beyond salvaging after another). - Mileage: Like the age, a car’s value depreciates the longer it is driven, with odometers providing a clear picture of how long a car has been used.

Most people avoid purchasing used cars with over 70,000 miles on them because the value has depreciated, and the parts have seen significant wear and tear in that time.

Therefore, if your car had 70,000 miles on it by the time of the accident, that could severely affect its value and render it a total loss.

Let us say that your car has a market value of $18,000.00 due to age and mileage, and you are involved in a motor vehicle accident.

If the damage to your car costs $20,000.00 to repair due to outdated parts or extensive damage, then it would be classified as a total loss by mechanics and insurance company adjusters.

When this happens, the insurance company will deem the car as damaged beyond repair from a financial perspective and will issue a salvage title, which means the car is totaled, and any warranty will be voided.

You might have noticed that none of the criteria mention airbags. We will address the reason for that now.

Is a Car Totaled if Airbags Deploy?

Simply put, deployed airbags do not automatically mean a car is totaled. The same concept of how insurance adjusters calculate if a car is totaled applies to deciding if a car with deployed airbags has severe and costly enough damage to warrant a car replacement.

That means if your car has enough value for it to make sense to pay for the cost of installing new airbags in addition to other repairs, your car will not be totaled, as the insurance company will opt to pay for the repair costs.

In contrast, if the damage from a car accident involving airbags deploying is severe and costly enough, your car will be totaled.

Car Insurance Policy Deductibles

It’s important to note that even when you have car insurance, you will have to pay the deductible to get the car insurance company to pay for the rest of the repair or replacement costs.

This can easily cost $1,000 or more, depending on the policy (the lower the insurance rate of the premium you have to pay per month, typically the higher your deductible will be).

Unfortunately, even with insurance and being able to afford the deductible, a car crash could still injure you and your passenger(s).

When you are in a car accident (totaled or not), you must pay for your medical expenses caused by the accident.

These treatment costs (and missed work) add up quickly, creating an overwhelming financial situation for most people.

Fortunately, the American justice system offers legal recourse, specifically civil lawsuits, for victims of car crashes when the other driver was at fault.

Filing a Civil Claim

The United States justice system has empowered people (both legal and nonlegal residents) to sue for money after a car accident if they were not responsible.

These cases are called personal injury claims and are filed with civil courts so victims can claim monetary compensation from the person or organization responsible for their predicament.

Car accidents are prevalent and have become a prominent civil and financial issue.

They account for a large portion of personal injury claims and add up to billions of dollars each year for the injuries alone.

Insofar as the physical damage is concerned and whether a car will be totaled, civil claims also offer recourse for the injured party to ensure they are not financially liable for the wreck.

When a Crash Results in Property Damage?

Typically, car accidents result in damage to a car’s body, which opens the door for filing a property damage claim (excluding bodily injury) to pay for the loss caused by the accident. Property damage claims are primarily negotiated soon after the car accident with the defendant’s claims adjuster.

They will assess their client’s liability and determine a reasonable collision damage settlement amount to offer (assuming they accept that their client is the at-fault driver).

Car Damage: Repair or Replace

The state of your car after the accident determines a portion of what you are paid in response to the accident.

If the car can be repaired, the adjusters will compensate you for the cost of the repairs to ensure you are not liable to pay for the for damage caused by their client.

If your car was totaled in the accident, the adjusters will not compensate you for repairs but will purchase the wrecked car instead. The car is scrapped, and the amount you are paid is usually congruent with the car’s current value.

The point is you will be appropriately compensated for the value of the vehicle instead of the repair costs.

Often, the actual cash value of a vehicle that cannot be repaired will not be worth enough to purchase a new one at full price. However, it is usually sufficient to be used for the down payment for a new one.

This sum can help you get a head start on replacing your vehicle, but it is not the only compensation you will receive.

Personal Injury Medical Bills

The main focus of any personal injury claim (including when the airbags are deployed) is to compensate auto accident victims for their injuries.

That ensures the injured victim is not responsible for having to bear the cost of the medical expenses that were a result of the car accident.

It does not take long for combined medical bills to reach tens of thousands of dollars, so paying for them independently when the accident was someone else’s fault, and wrongdoing is considered “legally unfair.”

Fortunately, civil law agrees with this sentiment, which is why you can file a legal claim to recover the money you spent and owe for undergoing medical treatment.

These medical expenses serve as the baseline for calculating personal injury settlements.

Personal Injury Settlement Negotiation

Unfortunately, even with these legal provisions in place, filing a claim and getting compensated is not as simple as identifying the defendant and claiming they are at fault.

Although less stringent than in criminal cases, the burden of proof falls on you, and you must present evidence that shows the other driver was responsible for the accident.

How to Negotiate With Insurance Adjusters?

It is possible to negotiate effectively with the defendant’s auto insurance adjuster even though they will not make it easy. Adjusters look for and happily take any excuse to avoid paying out or keep the settlement value as low as possible (it’s part of their job).

Fortunately, there is usually plenty of evidence you can use to support your claim and ensure the other driver is held accountable.

Important note: Hiring a skilled personal injury lawyer to represent you will make that task more manageable and likely increase your settlement amount.

What Evidence is Needed for a Personal Injury Claim?

The primary evidence for how much compensation you should receive from a personal injury claim is the copies of your medical records and other bills associated with the accident (attempting to pass previous medical costs as part of the accident is fraud and will hurt your settlement’s value).

You can further corroborate and prove your side of the story by presenting evidence relating to your car. Some examples of evidence in car accident claims include photos of the vehicle after the accident, witness statements, and traffic camera footage.

While this claim will help you recover from the financial damage caused by the accident in the long run, you won’t receive any of the settlement until it is agreed upon by both you and the defendant (not including the six-week average wait time it takes to get a settlement check in your hands after signing the release).

At the end of the day, it can easily take more than a year for your case to fully settle, which means you have to deal with the fallout and financial burden of the car accident in the meantime.

Closing Statements on Airbag Deployment and Totaled Cars

Car accidents have become a common issue for modern motorists, and the damage to the vehicles and passengers involved can be critical.

Airbags within those cars and trucks are designed to protect drivers and passengers from severe and fatal injuries.

When you get in an accident, and your airbags are deployed, your vehicle will likely have sustained severe damage, which can be indicated by your car’s airbag light turning on.

So, your vehicle must be assessed by a licensed mechanic to ensure it is in working order before you drive it.

Still, the deployment of airbags alone is not a sign that the vehicle is totaled.

A vehicle can only be considered totaled when the repair bill costs close to or more than the car is worth.

Unfortunately, the more significant issue not considering airbag deployment is surviving the financial strain caused by car accidents and the need to file subsequent lawsuits.

Most people do not have the financial resources to get by without noticing the extra costs resulting from a car crash.

Pre-settlement Funding: Money for Car Accident Lawsuits

Fortunately, when people find themselves in a severe version of this situation, they can apply for pre-settlement funding from our team at Express Legal Funding.

Legal funding works by companies providing non-recourse cash advances to people with an ongoing claim (such as a car accident case), not as a loan.

That means the pre-settlement money is provided to the client (a plaintiff if they already filed a lawsuit) in exchange for receiving a right to a portion of the case’s potential proceeds (settlement or court award money).

Due to the fact that payment to the funder is contingent upon there being case proceeds, people who obtain pre-settlement funding do not have to worry about owing the legal funding company money if they lose their claim.

(However, that is not technically the case for recourse lawsuit loans, which is the only type of consumer legal financing permitted in some states.

That will no longer be the case for the state of Missouri. As of August 28, 2023, the Missouri Division of Finance will regulate non-recourse pre-settlement funding.)

Apply Now:

There is an excellent chance that you are a perfect candidate to qualify for legal funding if you have an ongoing car accident injury claim and need a boost of cash to help cover the cost of daily living.

If this sounds like your situation, give us a call or apply online, anytime, 24/7, to learn more about and apply for pre-settlement funding.

We are here to help and always strive to make the process as quick and easy as possible.

Most of all, we understand that our clients call us when they need lawsuit funding help today, not just in a few days.