Losing a lawsuit is stressful enough—worrying about having to repay pre-settlement funding shouldn’t add to that burden. Pre-settlement funding is a non-recourse cash advance designed to reduce financial pressure while your case is ongoing.

Do you have to pay pre-settlement funding back if you lose your legal claim?

The FAQs below explain what “non-recourse funding” means, what happens if you lose your case, and when repayment is required, so you can understand your options with confidence.

What happens if I lose my case after getting legal funding?

If you lose your case, the pre-settlement funding is simply written off. Because legal funding is non-recourse, you do not owe repayment, your attorney is not responsible, and no debt or credit obligation is created—unless there was fraud or a contract violation.

What is pre-settlement funding?

Pre-settlement funding is a form of legal financing provided to plaintiffs during active litigation, like personal injury lawsuits. It helps cover living expenses while waiting for a lawsuit to resolve. Unlike loans, repayment depends entirely on the outcome of the legal claim, not the borrower’s credit or income.

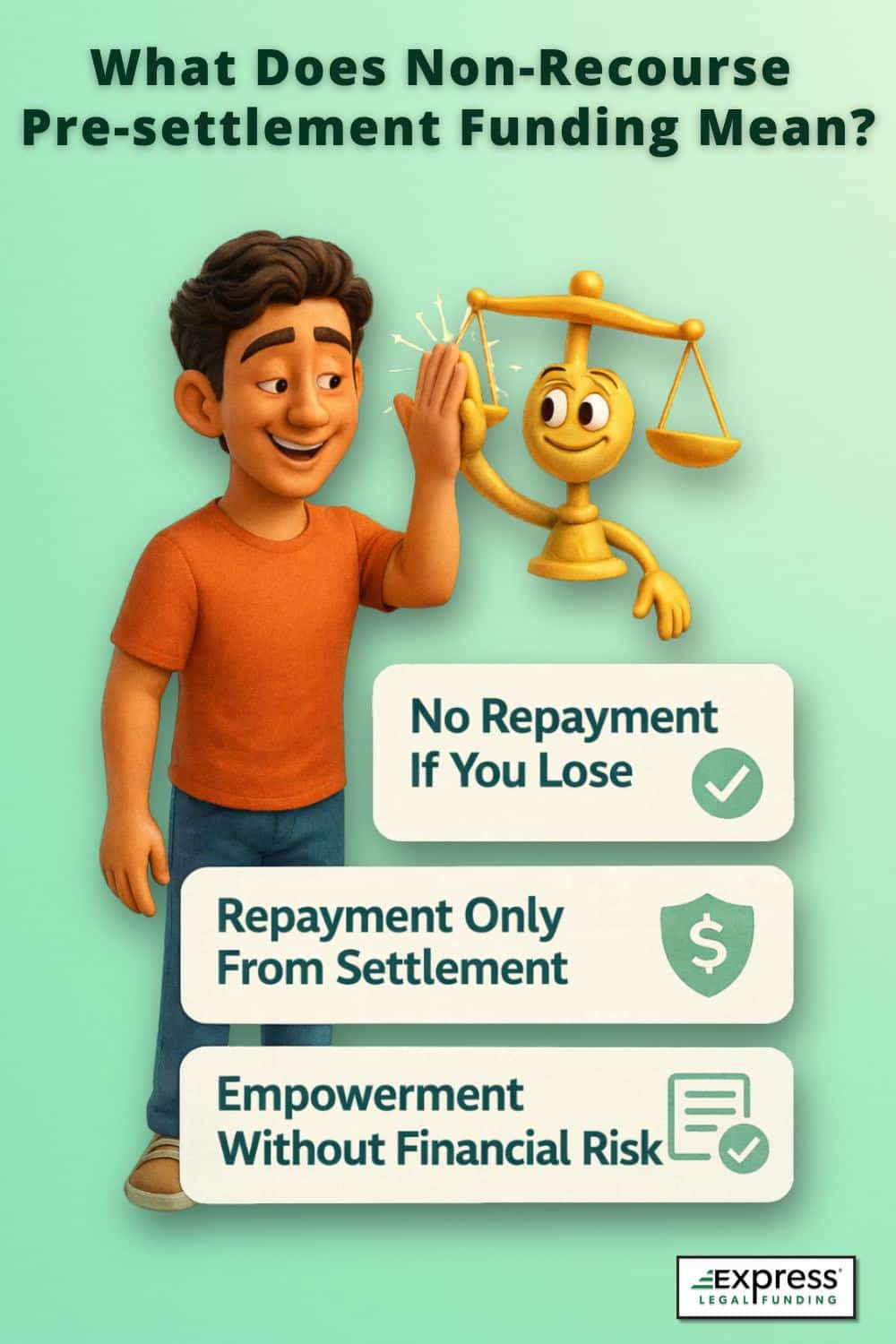

What does non-recourse pre-settlement funding mean?

Non-recourse pre-settlement funding means repayment is conditional. If your lawsuit results in a settlement or judgment, repayment occurs from the proceeds. If there is no recovery, the funding company cannot pursue you personally or report unpaid amounts as debt.

Non-recourse funding means:

- No repayment if the case is lost

- No personal liability for the plaintiff

- No obligation without a settlement or judgment

- Risk is assumed by the funding company

Learn more with our guide on how non-recourse legal funding works.

When do you have to repay pre-settlement funding?

You repay pre-settlement funding only after your case settles or you receive a court award. Repayment is typically made directly from the settlement proceeds at the conclusion of your case. There are no monthly payments, and no repayment is required while the case is ongoing.

Example scenario: How repayment works in real life

Let’s say you receive a $3,000 pre-settlement advance while waiting for your car accident lawsuit to resolve. Six months later, your attorney negotiates a $30,000 settlement.

After attorney fees and case costs, the legal funding advance is repaid directly from your portion of the settlement.

If the case were lost, you wouldn’t owe anything back to Express Legal Funding.

Does pre-settlement funding accrue interest?

It depends. Pre-settlement funding isn’t a traditional loan, but the amount owed can increase over time based on the funding agreement’s pricing (for example, a monthly use fee or a simple-rate fee). You typically owe nothing unless you recover through a settlement or court award, so review the contract terms carefully.

Learn more about how much pre-settlement funding costs.

Is pre-settlement funding the same as a loan?

No. Pre-settlement funding is not a loan. Loans require repayment regardless of outcome and often involve interest rates and credit checks. Pre-settlement funding is a non-recourse cash advance, meaning repayment depends solely on whether your legal claim succeeds.

Does pre-settlement funding affect my credit score?

No. Pre-settlement funding does not affect your credit score or credit history. Express Legal Funding does not perform hard credit checks and does not report to credit bureaus. Approval is based on the strength of the lawsuit, not the plaintiff’s financial profile.

Relevant reads:

- Does Pre-Settlement Funding Affect Your Credit Score?

- Do Pre-Settlement Funding Companies Require Credit Checks?

Are there any exceptions where I could owe money?

Yes, but they are limited. Repayment may be required in cases of fraud, intentional misrepresentation, or a material breach of the funding agreement. If you are truthful and follow the agreement, you generally don’t have to worry about owing money if you lose your case.

Outside of these situations, losing your case does not create personal liability or debt under a non-recourse funding contract.

Exceptions may involve:

- Fraud or intentional misrepresentation

- Material breach of the funding agreement

How is pre-settlement funding repaid if I win my case?

If you win or settle your case, repayment is made from the settlement proceeds. The funding company typically places a lien on the case, which your attorney resolves during the settlement distribution process before remaining damages are paid to you.

Settlement proceeds are often distributed in this order:

- Attorney fees and case costs

- Legal funding payoff

- Medical liens and other liens

- Remaining settlement money is paid to the plaintiff

Exact lien priority can vary based on the case, state law, and negotiated lien reductions.

Does my attorney have to repay the funding if I lose?

No. Your attorney is not personally responsible for repayment if the lawsuit is unsuccessful. The repayment obligation applies only to settlement or judgment proceeds. If there is no recovery, neither the plaintiff nor the attorney owes repayment.

What happens if I settle for less than expected?

If your case settles for less than expected, repayment comes only from the settlement proceeds. You are never required to pay out of pocket. After attorney fees, case costs, and the legal funding payoff are resolved, any remaining funds go directly to you.

Key points to remember:

- Repayment comes only from settlement proceeds

- No out-of-pocket payment is required

- A lower settlement does not create personal debt

Scenario: Settling for less than expected

Emily receives $5,000 in pre-settlement funding while her personal injury lawsuit is ongoing. She and her attorney originally expected a larger settlement, but the case ultimately settled for less than anticipated due to liability disputes.

When the case resolves, the funding repayment is made only from the settlement proceeds, after attorney fees and case costs. Emily is not required to pay anything out of pocket, even though the settlement amount was lower than expected.

How do I know if a legal funding company is truly non-recourse?

A legitimate non-recourse legal funding company makes it clear that repayment is required only if you recover compensation. Look for “no win, no repayment” and “if you lose your case, you owe nothing” language, no personal guarantees, and attorney-coordinated repayment. Express Legal Funding’s contracts clearly define these protections in writing.

Look for:

- “No win, no repayment” language

- “Not a loan” language

- No personal guarantee requirement

- Attorney-managed repayment process

- Transparent terms, like those in Express Legal Funding’s non-recourse agreements

What types of lawsuits qualify for pre-settlement funding?

Pre-settlement funding commonly applies to personal injury cases, motor vehicle accidents, wrongful death claims, and other civil litigation involving damages such as medical expenses, lost wages, pain and suffering, or punitive damages. Case eligibility depends on liability and expected settlement.

How Express Legal Funding protects plaintiffs if a case is lost

Express Legal Funding provides true non-recourse pre-settlement funding. If litigation ends without a settlement or court award, the plaintiff owes nothing. There are no risky loans, no credit risk, no personal guarantees, and no repayment unless the case successfully resolves.

Visit the Express Legal Funding homepage to learn more about how we help clients stay financially secure during their lawsuits.