Navigating the aftermath of an unexpected event, whether it’s a car accident, a home disaster, or a health emergency, can be overwhelming. Amidst the chaos, insurance companies are supposed to be the beacon of hope, providing financial relief and support.

However, many policyholders and personal injury victims find themselves entangled in a web of delays and bureaucratic hurdles that seem to stretch endlessly. These delay tactics, often employed by insurance companies, can transform a straightforward claim process into a frustrating ordeal.

Understanding why your claim is taking so long is crucial, not only to alleviate stress but also to empower you to take action. This guide aims to shed light on the common strategies used by insurers to stall claims and offers practical advice on how to counteract these tactics effectively.

By equipping yourself with knowledge and strategies, you can navigate the insurance landscape with confidence, ensuring that you receive the compensation you deserve in a timely manner.

Whether you’re facing a minor property claim or recovering from a serious injury, understanding how to push back against insurance delays can be crucial to securing the compensation you need and reclaiming control over your recovery.

What Are Insurance Company Delay Tactics?

Insurance company delay tactics are strategic methods used by insurers to slow down the claims process, making it more difficult for policyholders to receive timely compensation. These tactics are often designed to reduce payout amounts, discourage claimants, or buy time for the insurer to hold onto funds.

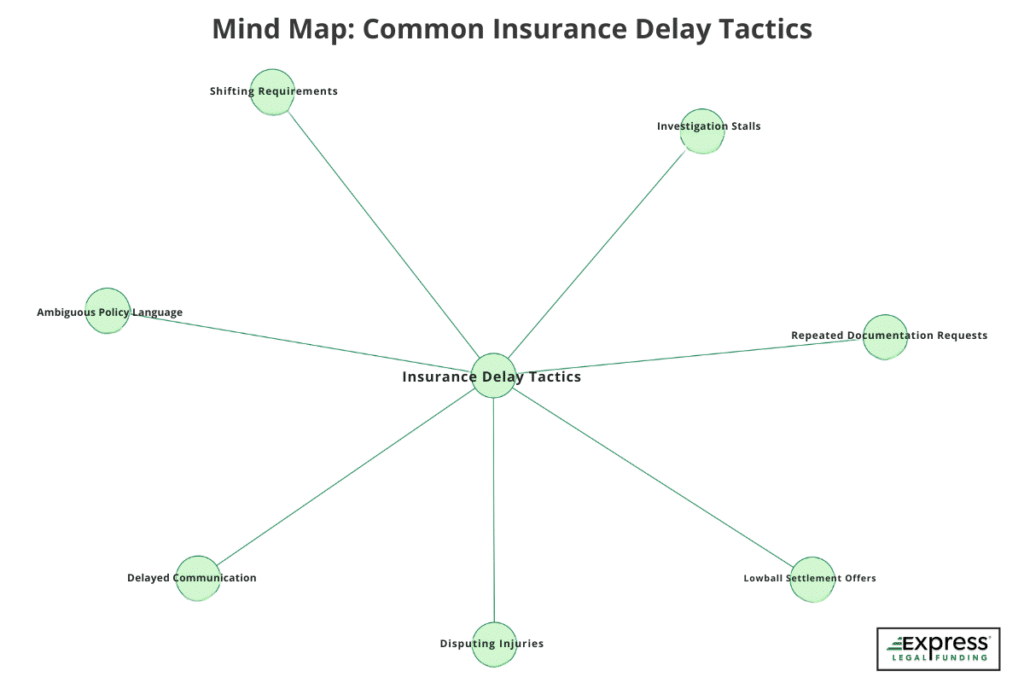

Common Delay Tactics Used by Insurance Companies:

- Repeated documentation requests: Asking for the same forms or additional paperwork to stall the process.

- Delayed communication: Taking weeks to respond to calls, emails, or status updates.

- Ambiguous policy language: Using confusing jargon to limit what’s covered or deny claims.

- Investigation stalls: Conducting lengthy and unnecessary reviews under the pretense of verifying legitimacy.

- Shifting requirements: Adding new demands after initial documentation has been submitted.

These tactics can cause significant financial stress and emotional frustration—especially when policyholders rely on timely payouts to recover from a loss. Recognizing these behaviors early empowers claimants to respond proactively and avoid being pressured into an unfair settlement.

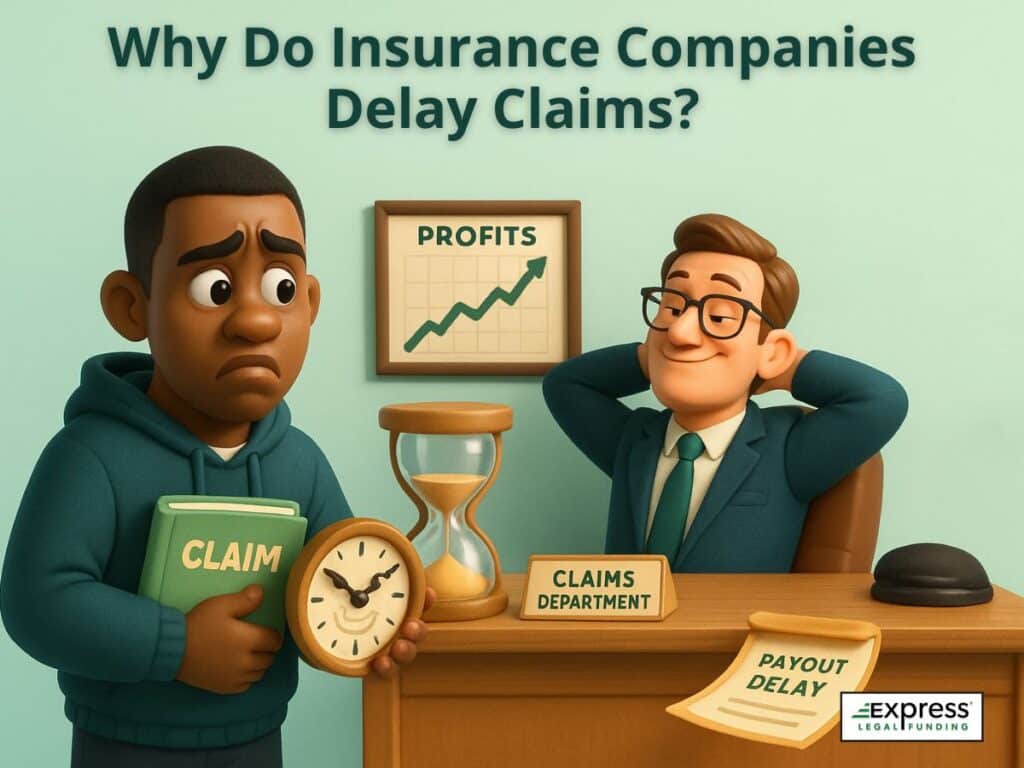

Why Do Insurance Companies Delay Claims?

Insurance companies often delay claims not because they have to—but because it benefits them financially. While they may market themselves as fast and customer-focused, these delays are frequently strategic and profit-driven. The longer it takes to settle a claim, the more leverage insurers gain over the policyholder.

Here are two primary reasons insurers intentionally delay claims:

1. To Earn Interest on Unpaid Settlement Funds

Insurers set aside money in reserves for pending claims—but instead of paying promptly, they often invest those funds in low-risk assets like U.S. Treasury bonds or other fixed-income securities. This strategy generates passive income while your payment is on hold. Every day your compensation is delayed, it’s quietly earning interest—for the insurance company, not for you.

According to the National Association of Insurance Commissioners (NAIC), U.S. insurance companies held over $8.98 trillion in total cash and invested assets as of year-end 2024. Approximately 60.4% of that portfolio was invested in bonds, including Treasuries—illustrating just how central interest-bearing assets are to their business model.

The longer insurers hold onto settlement funds, the more they profit from interest, while policyholders bear the cost of the delay.

To put the potential profits from this strategy into perspective, State Farm disclosed in 2024 that it held $8.81 billion in claim reserves—an amount that, at current interest rates, could generate over $300 million in annual interest income for the company.

This profit model incentivizes insurance companies to hold onto settlement funds as long as possible.

Example of an Insurance Company Profiting from Delaying Settlement

Let’s say an insurance company owes a claimant $100,000 in a personal settlement.

Instead of paying immediately, the insurer delays the payout for 6 months—a common stalling tactic.

If the company keeps that $100,000 in an interest-bearing account earning 4% annual interest, here’s what happens:

- 4% annually = 2% over 6 months

- 2% of $100,000 = $2,000 in interest earned

By the time the insurer finally pays the claimant the full $100,000, it has already earned $2,000 in interest. That means the real cost of the payout was only $98,000—while the policyholder endured unnecessary delays, stress, and possibly financial hardship.

Bottom line: Delaying payouts is a calculated business strategy. Every day the insurance company stalls, it’s your money making them more money.

2. To Pressure You Into Accepting Less

Delays are a tool to wear down claimants—especially when you’re dealing with medical bills, lost wages, or repair costs. As time drags on, financial stress builds. Many policyholders, desperate for any form of relief, will accept a lowball settlement offer just to move forward, even if it’s far below the actual value of the claim. This saves the insurer money and closes the case quickly on their terms.

Common Types of Insurance Delay Tactics Explained

Insurance companies use a range of tactics to slow down the claims process and limit payouts. Below are the most common strategies claimants should watch for.

The Waiting Game (Delayed Communication)

One of the most frustrating delay tactics is a lack of timely communication. Insurers intentionally delay updates and avoid accountability.

How the Waiting Game Works

- Fail to respond to calls or emails for days or weeks.

- Repeat vague messages like, “Your claim is under review.”

- Switch adjusters mid-claim without explanation.

- Require manager or supervisor approval—then go silent.

Why It’s Effective for Insurers

This silence increases anxiety and uncertainty, often leaving claimants feeling powerless and more likely to settle quickly.

Example Scenario:

- Week 1: You file your auto accident claim.

- Week 2: The insurer confirms receipt—no further contact.

- Week 3: You follow up. They say it’s “with a claims adjuster.”

- Week 4: Still no update. You receive a vague message: “Still under review.”

- Week 5: They request documents that you have already submitted.

Meanwhile, bills are piling up, and you’re tempted to accept a quick, low settlement just to move forward.

The Documentation Shuffle

This tactic involves repeatedly requesting additional or redundant paperwork—even when the policyholder has already submitted the necessary documentation.

How the Documentation Shuffle Works

Repeat Requests:

- Ask for medical records, police reports, or repair estimates again.

- Claim documents were “unreadable” or never received.

New Mid-Process Demands:

- Request wage verification letters from your employer.

- Demand updated medical records with new dates.

- Ask for notarized affidavits after already stating your case.

Irrelevant or Excessive Documentation Requests:

- Ask for full tax returns instead of pay stubs.

- Request past medical history unrelated to your injury.

- Require duplicate ownership documents or previously submitted photos.

Learn how your medical records can make or break your claim: How Medical Records Impact Car Accident Settlements

Why It’s Effective for Insurers

- Wastes time and energy: Chasing down documents becomes a job in itself.

- Creates inconsistencies: Minor discrepancies can be used to dispute or deny the claim.

- Shifts blame: If you’re late resubmitting, they can blame you for the delay.

Example Scenario:

A car accident claimant submits all necessary documents:

- Week 1: Medical bills, accident report, and damage photos sent.

- Week 2: The insurer requests additional unrelated medical history.

- Week 3: A wage verification letter is now required.

- Week 4: The adjuster says a new form must be completed before review.

Each new request resets the process and increases pressure on the claimant to settle quickly.

Investigation Stalls

Insurance companies often drag out claim investigations as a stalling tactic, even when they already have sufficient information.

How Investigation Stalls Work

Prolonged “Verification” Process:

- Claim the need for a more in-depth review with no clear timeline.

- Continue to state, “Still under review,” for weeks or months.

Requests That Delay Resolution:

- Ask for multiple interviews or written statements.

- Require unnecessary inspections or third-party evaluations.

- Delay decisions until a “specialist” or “supervisor” signs off.

Tactics Framed as Due Diligence:

- Justify delays by claiming they’re “ruling out fraud.”

- Use vague terms like “pending liability determination.”

- Prolong surveillance or background checks beyond what’s necessary.

These actions may look official on the surface, but their true intent is to delay and frustrate claimants into giving up or accepting less.

Why It’s Effective for Insurers

- Delays Payout Without Denial: By dragging out the investigation, insurers can avoid paying the claim while technically keeping it open—without facing legal consequences for denial.

- Wears Down the Policyholder: Long, unexplained delays frustrate claimants, increasing the chance they’ll settle for less or abandon the claim altogether.

- Justifies Inaction: Citing the need to “rule out fraud” or “verify damages” gives insurers a reason to avoid progress while appearing compliant.

- Builds a Defense: Prolonged investigations give the insurer time to gather evidence and prepare to dispute or deny the claim more effectively if challenged.

Confusing Policy Jargon and Fine Print

Insurance companies often rely on complex, ambiguous language to confuse policyholders. This makes it harder for claimants to know what is truly covered—and easier for insurers to manipulate outcomes.

Common Examples of Misleading Insurance Language

- Reasonable and customary charges: Used to underpay medical bills by claiming your treatment cost more than the “average”—a number they don’t define.

- Actual Cash Value (ACV): Policies may claim to cover replacement costs but actually pay only the depreciated value of the item.

- Material misrepresentation: A vague clause that can justify claim denial if the insurer believes any information, no matter how minor, was misstated.

- Occurrence-based coverage with exclusions:

Sounds like broad coverage but hides restrictions that limit payouts if events occurred outside specific windows.

Why It’s Effective for Insurers

- Creates Ambiguity: Vague or technical terms make it hard for policyholders to understand what’s covered—giving insurers more room to interpret policies in their favor.

- Discourages Appeals: When claimants don’t fully understand the reason for denial, they’re less likely to challenge it or file a formal complaint.

- Shifts Blame to the Policyholder: Insurers can claim that the misunderstanding was the claimant’s fault for not reading the contract closely.

- Limits Payouts: By citing exclusions or loopholes buried in fine print, insurers reduce how much they have to pay—sometimes denying valid claims entirely.

Mind Map: Common Insurance Delay Tactics

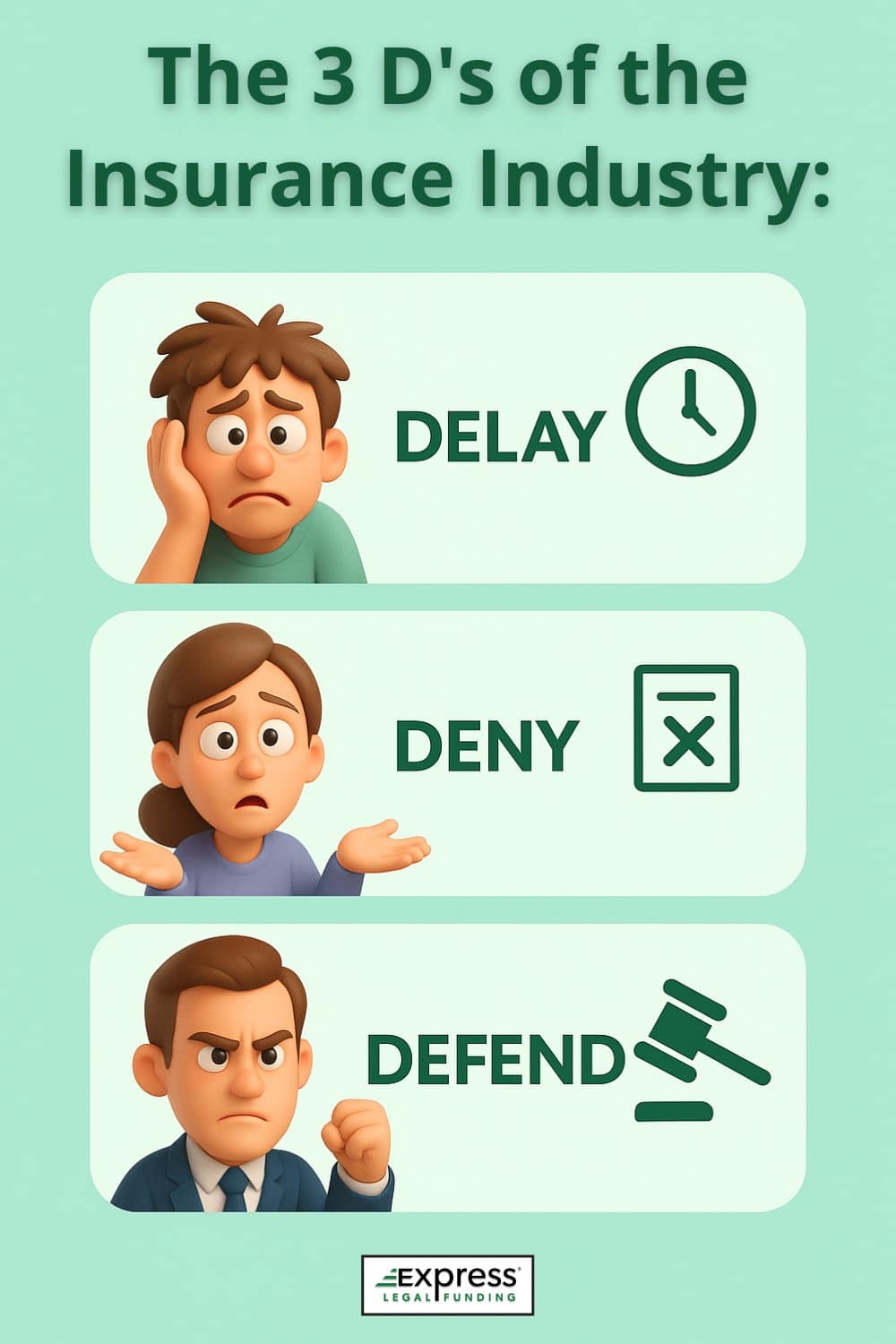

Understanding the 3 D’s of Insurance Claims: Delay, Deny, Defend

In the complex world of insurance claims, the “3 D’s” — Delay, Deny, Defend — serve as a strategic framework that many insurers use to manage and, at times, minimize payouts.

This isn’t just speculation. A CNN investigative report revealed that State Farm and Allstate—two of the largest U.S. insurers—adopted this exact strategy in the mid-1990s, based on recommendations from consulting firm McKinsey & Company.

The strategy encouraged insurers to deliberately stall, deny, and defend against legitimate claims, particularly low-impact soft-tissue injuries, to increase profits and discourage claimants from pursuing full compensation.

Delay: Wearing Down the Policyholder

The first “D,” Delay, involves tactics already discussed, such as excessive documentation requests and prolonged communication gaps, which can wear down claimants’ resolve and patience.

Deny: Technicalities and Ambiguities

Once a claim has been sufficiently delayed, insurers may move to the second “D,” Deny. This step often involves finding technicalities or ambiguities within the policy language to justify a denial, leaving policyholders scrambling to prove their case.

Denials can be based on seemingly minor discrepancies or interpretations that favor the insurer, further complicating the claimant’s path to resolution.

Defend: Legal Pressure and Intimidation

If a policyholder persists and challenges the denial, the insurer may resort to the third “D,” Defend.

This involves preparing for potential legal battles, where insurers leverage their resources and legal expertise to defend their decision, often intimidating claimants into accepting less favorable settlements.

Understanding the 3 D’s is crucial for policyholders, as it provides insight into the systematic approach insurers may take to protect their financial interests.

By being aware of these tactics, claimants can better prepare themselves to counteract each stage, ensuring they remain steadfast in their pursuit of fair compensation. This knowledge empowers policyholders to navigate the claims process with resilience and determination, ultimately securing the resolution they deserve.

Satirical Look at Insurance Delay and Denial Tactics

Want a satirical—but surprisingly accurate—take on how insurance companies delay and deny claims? This video highlights the frustrating tactics policyholders often face, with a humorous twist that hits close to home.

Real Examples of Insurance Company Delay Tactics

Real-world examples of insurance company delay tactics reveal how difficult and emotionally exhausting the claims process can be for policyholders. At Express Legal Funding, we see these stalling strategies play out daily across a wide range of cases.

The following four examples highlight common delay behaviors across different types of insurance claims, demonstrating why staying informed, persistent, and proactive is essential.

Example 1: Delaying Roof Repairs After a Storm

Consider the case of a homeowner who filed a claim after a severe storm damaged their roof.

Despite submitting all required documentation promptly, the insurer repeatedly requested additional evidence, such as detailed weather reports and contractor estimates, dragging the process out for months.

This “documentation shuffle” left the homeowner in limbo, unable to proceed with necessary repairs.

Example 2: Car Accident Victim Left Waiting

In another case, a car accident victim became trapped in the insurer’s “waiting game,” enduring weeks without responses to their inquiries or updates on the claim’s progress. The prolonged silence not only stalled their settlement but also intensified the emotional and financial stress during an already challenging recovery period.

Example 3: Small Business Fire Damage Claim

A third example involves a small business owner whose claim for fire damage was subjected to an “investigation stall,” with the insurer conducting an exhaustive review of the business’s financial records, ostensibly to verify the claim’s legitimacy.

This prolonged scrutiny delayed the payout, hindering the business’s ability to recover and resume operations.

These examples highlight the real impact of delay tactics, underscoring the importance of being proactive and informed.

By understanding these strategies, policyholders can better navigate the claims process, advocating effectively for the resolution they deserve and minimizing the frustration and financial strain caused by such delays.

Legal Recourse: How to Fight Back Against Delay Tactics

When faced with persistent delay tactics from insurance companies, policyholders may find that legal recourse becomes a necessary step in securing the compensation they deserve. Understanding your rights and the legal avenues available can transform a seemingly uphill battle into a more manageable process.

Step 1: Document Everything

The first step is to meticulously document every interaction with the insurer, including phone calls, emails, and letters, as this evidence can be crucial if legal action becomes necessary.

Step 2: Consult a Claims Attorney

Consulting with an attorney who specializes in insurance claims can provide invaluable guidance, helping you understand the nuances of your policy and the legal obligations of the insurer.

In some cases, a strongly worded letter from a lawyer can prompt the insurer to expedite the claims process, as they may wish to avoid the costs and publicity of a legal battle.

Step 3: File a Complaint or Lawsuit

If these initial steps do not yield results, filing a complaint with your state’s insurance department can apply additional pressure on the insurer to act in good faith. In more severe cases, pursuing litigation may be the best course of action.

While this can be a lengthy and costly process, it can also lead to a fair settlement or judgment in your favor.

By taking these steps, policyholders can effectively counteract delay tactics, ensuring that they are not left at the mercy of an unresponsive insurer. This proactive approach not only helps in resolving the current claim but also sets a precedent for fair treatment in future interactions.

How to Speed Up an Insurance Claim

Speeding up an insurance claim requires a strategic approach that combines preparation, persistence, and effective communication.

Submit a Complete, Well-Organized Claim

The first step is to ensure that all documentation is complete and organized before submitting your claim. This includes gathering evidence such as photos, receipts, and any relevant reports that support your case.

By presenting a comprehensive and well-documented claim, you reduce the chances of insurers requesting additional information, which can delay the process. Next, maintain regular communication with your insurance adjuster.

Follow Up Regularly and Keep Records

Set reminders to follow up on your claim status and keep detailed records of all interactions, including dates, times, and the content of conversations. This not only keeps your claim on their radar but also demonstrates your commitment to resolving the issue promptly.

If you encounter delays, consider escalating the matter by contacting a supervisor or filing a formal complaint with the insurer.

Use Technology and Online Portals

Leveraging technology can also be beneficial. Many insurers offer online portals where you can track your claim’s progress and communicate directly with adjusters.

Escalate When Necessary

If these efforts do not yield results, seeking assistance from a consumer advocacy group or consulting with an attorney may be necessary.

By taking these proactive steps, policyholders can effectively navigate the claims process, minimizing delays and ensuring they receive the compensation they deserve in a timely manner. This approach not only addresses immediate concerns but also establishes a foundation for smoother interactions in future claims.

Final Thoughts: Don’t Let Insurance Delay Tactics Win

Insurance company delay tactics are designed to frustrate claimants, wear down their resolve, and reduce payouts. But knowing how these strategies work—and how to respond—can help you take back control.

Stay organized, document every interaction, and don’t hesitate to seek guidance. Whether it’s from a legal professional or a consumer advocacy group, expert advice can be key to protecting your rights and securing the compensation you deserve.

Understanding your policy and recognizing unjust delays empowers you to challenge bad faith practices and move your claim forward. Every proactive step not only brings you closer to resolution but also pushes for greater accountability in the insurance industry.

Frequently Asked Questions About Delayed Insurance Claims

Why is my insurance claim taking so long to process?

Insurance companies often delay claims to reduce payouts and protect profits. Common reasons include repeated requests for documentation, extended investigations, and tactics designed to pressure you into accepting a lower settlement. These delays are strategic and not always justified—especially if your paperwork is complete.

What can I do if my insurer is ignoring my claim?

Begin by documenting every interaction—including calls, emails, letters, and missed responses. Follow up regularly and escalate the issue by requesting a supervisor. If you continue to be ignored, consider filing a complaint with your state’s insurance department and consult a bad faith insurance attorney to explore legal action and protect your rights.

Is it legal for insurance companies to delay claims?

Yes—to a point. Insurers are allowed to delay claims while conducting a reasonable investigation. However, excessive or unjustified delays may violate bad faith insurance laws. If your insurer is stalling without a valid reason, you may have the legal right to challenge the delay and seek additional compensation through a bad faith lawsuit.

What is an insurance claim denial letter?

An insurance claim denial letter is a formal notice from your insurance company explaining why your claim has been partially or fully denied. It typically includes the denial reason, references to specific policy provisions, and your right to appeal.

If the explanation is vague or unjustified, it may signal bad faith, and you should consider seeking legal advice.

How long should it take to process an insurance claim?

Most straightforward insurance claims should be processed within 30 days, depending on your state’s laws and the complexity of the case. However, some insurers may take longer—especially if they use delay tactics. If your claim drags beyond this window without a valid explanation, it may be time to escalate.

Can I sue my insurance company for delaying my claim?

Yes. If your insurer is unreasonably delaying your claim without valid justification, it may constitute bad faith. You can sue for damages, and in some cases, recover compensation beyond the original claim amount—such as legal fees, emotional distress, or punitive damages.

Speak with a bad faith insurance attorney to determine if your case qualifies for legal action.

What are the 3 D’s of insurance?

The “3 D’s of insurance” refer to Delay, Deny, and Defend—a strategy some insurance companies use to minimize claim payouts:

- Delay: Slow communication and claim processing to frustrate policyholders.

- Deny: Reject claims using technicalities or vague policy language.

- Defend: Fight claims in court to discourage legal challenges.

This tactic, exposed in investigative reports, is designed to pressure claimants into settling for less—or giving up entirely.

What are signs my insurance company is stalling my claim?

Common signs of stalling include repeated requests for documents you’ve already submitted, unexplained delays in communication, vague updates like “your claim is under review,” and frequent changes in claims adjusters. These tactics may be used to frustrate you into accepting a low settlement or abandoning your claim altogether.

Need Help With a Delayed Insurance Claim? Here’s What to Do

If you’re facing unexplained delays, repeated document requests, or vague updates like “your claim is under review,” you’re not alone. Many policyholders and car accident victims experience the same insurance company delay tactics outlined above—often resulting in financial stress while waiting for their settlement.

Don’t Let Insurance Delay Tactics Dictate Your Compensation

- Talk to a Legal Expert: If you suspect bad faith or intentional delays, consult a personal injury attorney (for accident claims) or a bad faith insurance lawyer (for policyholder disputes). These legal professionals can review your case, explain your rights, and help you take action to recover the compensation you’re entitled to.

- Explore Pre-Settlement Funding: Don’t let financial stress pressure you into accepting a lowball offer. Fight back with pre-settlement funding from Express Legal Funding—a fast, risk-free way to access cash for medical bills, rent, groceries, and other essential expenses while your claim is still pending. It’s not a loan, and you only repay if you win or settle your case. Learn more by watching Express Legal Funding’s official commercial.

👉 Need fast cash while waiting on your claim? Apply for pre-settlement funding today and get the support you need to move forward with confidence.

Glossary of Key Terms in This Article

- Bad Faith Insurance: Refers to dishonest or unfair conduct by an insurance provider, such as unreasonably delaying or denying valid claims, which breaches their obligation to treat policyholders fairly.

- Claim Reserves: Money that insurers allocate specifically to pay for anticipated claim settlements, ensuring they can meet future liabilities.

- Documentation Shuffle: A tactic where insurers stall progress by continuously asking for more documents, often ones already submitted or unnecessary, to burden the claimant and prolong the process.

- Investigation Stalls: When an insurance company unnecessarily drags out the claims investigation process, often claiming they need more time to validate the claim, despite having sufficient details.

- Policyholder: An individual or organization that owns an insurance policy and is entitled to coverage under its provisions.

- Pre-settlement Funding: A type of financial advance offered to plaintiffs while their lawsuit is ongoing, typically with repayment only required if they win or reach a settlement—also known as non-recourse funding.

- The 3 D’s: An informal term describing a common insurance strategy to reduce payouts by: Delaying claims, Denying coverage, and Defending against lawsuits aggressively.

- Waiting Game: A form of passive delay where insurers keep claimants in limbo with limited updates or vague responses, causing uncertainty and frustration.