For personal injury plaintiffs awaiting a settlement, choosing the right pre-settlement funding company is crucial. The ideal legal funding partner should offer fast relief, fair terms, and trustworthy service during a challenging time.

Express Legal Funding stands out as a top choice in the industry, offering several unique advantages that set it apart from other lawsuit loan providers.

In fact, Express Legal Funding was recently ranked the #1 best pre-settlement funding company in 2025 for its fast approvals, low rates, and unparalleled transparency.

This recognition highlights Express Legal Funding’s commitment to client success, from speedy, risk-free settlement cash advances to industry-leading honest practices.

Below are 10 compelling reasons why Express Legal Funding is the best lawsuit funding company for plaintiffs in need of financial support before their cases settle.

What makes Express Legal Funding the best choice for a pre-settlement loan?

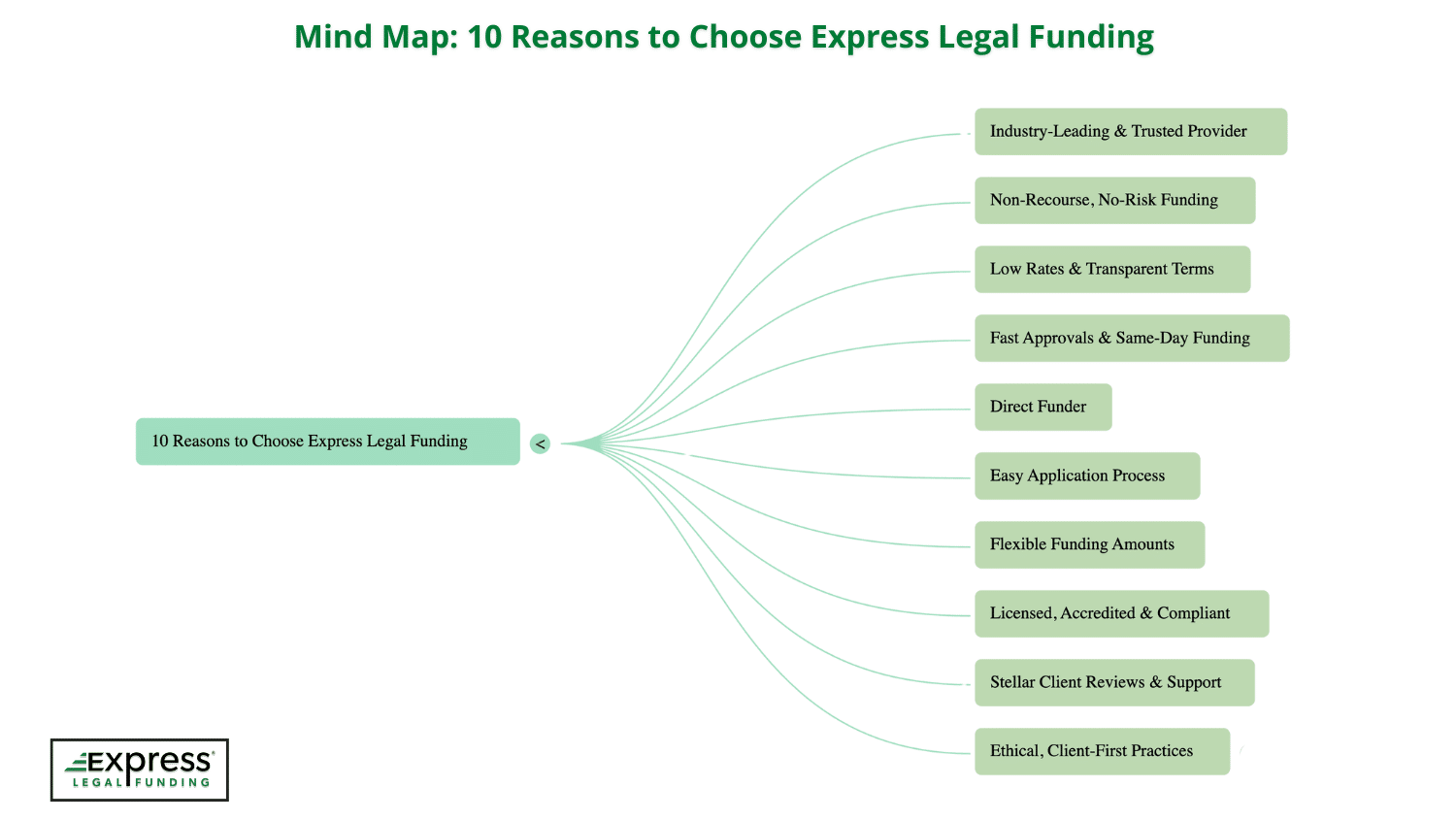

10 Reasons to Choose Express Legal Funding for Pre-Settlement Loans

- Industry-Leading & Trusted Provider (Ranked #1 in 2025)

- Non-Recourse, No-Risk Legal Funding (You Only Pay If You Win)

- Low Rates & Transparent Contract Terms (No Hidden Fees)

- Fast Approvals & Same-Day Pre-Settlement Funding for Plaintiffs

- Direct Funder with No Broker or Middleman

- Easy Application Process (No Hassle & No Credit Checks)

- Flexible Lawsuit Funding Amounts for a Wide Range of Cases

- Licensed, Accredited & Compliant (Your Case Is in Good Hands)

- Stellar Client Reviews & Customer Support

- Ethical, Client-First Practices

Mind Map: 10 Reasons to Choose Express Legal Funding

Next, we’ll walk you through a clear and comprehensive explanation of the top reasons to choose Express Legal Funding for a risk-free loan on your pending lawsuit.

1. Industry-Leading & Trusted Provider (Ranked #1 in 2025)

Express Legal Funding has earned a reputation as an industry leader in lawsuit funding, trusted by plaintiffs and attorneys nationwide.

The company is a nationally recognized legal funding provider founded in 2015 and based in Plano, Texas. Through years of reliable performance, it has grown into a top-tier service.

Ranked Best Pre-Settlement Funding Company in 2025

In a 2025 review of legal funding companies, Express Legal Funding secured the #1 ranking with an outstanding score of 97/100 – the highest in the industry. This top ranking was based on critical factors like customer reviews, speed, transparency, and compliance, reflecting how well Express Legal Funding meets the needs of its clients.

Being ranked the best pre-settlement funding company is more than just a title – it speaks to Express Legal Funding’s proven track record.

Plaintiffs can take confidence in the fact that the company holds a stellar reputation (including a Better Business Bureau A+ accreditation) and hundreds of positive customer reviews attesting to its quality of service.

In short, Express Legal Funding is a trusted lawsuit loan partner that has already helped countless clients, setting the benchmark for excellence in the legal funding industry.

🟢 Ready to apply? Apply for Legal Funding Now.

2. Non-Recourse, No-Risk Legal Funding (You Only Pay If You Win)

One of the most important reasons to choose Express Legal Funding is its non-recourse funding structure. “Non-recourse” means that you only repay the advance if you win or settle your case – if your lawsuit fails, you owe nothing back.

Pre-Settlement Funding Is Not a Loan

This is not a traditional loan, but rather a risk-free cash advance on your expected settlement.

By removing the obligation to repay if the case doesn’t succeed, Express Legal Funding provides peace of mind and financial security during litigation.

Unlike a bank loan or credit card, pre-settlement funding requires no monthly payments and no debt burden placed on you.

Non-recourse Advances (No Repayment If You Lose)

Repayment comes only from the future settlement proceeds, so your personal assets and credit are never at risk. If the case unfortunately results in no recovery, you keep the funds with zero out-of-pocket cost.

This plaintiff-friendly approach makes Express Legal Funding a safer alternative to traditional loans, letting you focus on your recovery and legal fight without the fear of incurring debt you can’t repay.

In summary, Express Legal Funding’s non-recourse funding truly aligns with your interests – they only get paid if you do, which speaks to their confidence in your case and their commitment to helping clients, not burdening them.

3. Low Rates & Transparent Contract Terms (No Hidden Fees)

Another major reason Express Legal Funding stands out is its commitment to low costs and full transparency. Legal funding fees can vary widely, and some less reputable companies burden plaintiffs with sky-high interest or surprise charges.

Express Legal Funding takes the opposite approach: it offers one of the lowest rate structures in the industry and no hidden fees.

All terms are disclosed upfront in plain language, so you know exactly what you will owe if your case succeeds.

Read our guide: How Much Does Pre-Settlement Legal Funding Cost?

No Hidden Fees: Low Rates with Transparent Pricing

You won’t be hit with unexpected processing fees, application fees, delivery fees, or other sneaky charges – what you see is what you get.

Importantly, Express Legal Funding offers a capped-fee and pricing structure, which means the cost to you does not snowball over time.

Many lawsuit loan providers charge compounding interest with no caps that accumulates month after month, potentially tripling or even quadrupling what you owe if your case drags on.

In contrast, Express Legal Funding’s funding fees are non-recurring and capped, protecting you from excessive costs.

This transparent, plaintiff-friendly rate policy ensures that you keep more of your eventual settlement.

As a direct result of these low, honest rates, Express Legal Funding was noted for its “affordability and transparency” – a key factor in being ranked the #1 lawsuit funding option.

In short, when you choose Express Legal Funding, you can trust that you’re getting a fair deal. The company prides itself on being upfront about pricing, so you can make an informed decision without any unpleasant surprises down the line.

Saving money on fees means more of your settlement remains in your pocket, fulfilling the very purpose of pre-settlement funding: to help you financially, not hurt you.

Try our lawsuit loan calculator to estimate your costs.

4. Fast Approvals & Same-Day Pre-Settlement Funding for Plaintiffs

When you’re facing mounting bills and urgent expenses, speed matters. Express Legal Funding recognizes this and provides fast approvals and lightning-quick funding, often in as little as 24 hours after approval.

The company has a streamlined intake and underwriting process that can review your application quickly (sometimes within the same day), coordinate with your attorney, and get you cash as soon as possible.

Many clients even receive their funds the same day approval is granted, which is a lifesaver if you need money immediately for rent, medical bills, or other necessities.

Get Lawsuit Funding Fast—Often Within 24 Hours of Approval

Express Legal Funding’s efficient turnaround times are a huge advantage over slower alternatives. Lawsuits can take months or years to conclude, but with Express Legal Funding, you won’t have to wait that long to access a portion of your expected settlement.

The moment your funding is approved, the disbursement process kicks into high gear – often via ACH wire transfer or overnight delivery at no extra cost (Express Legal Funding even provides free delivery of funds).

This rapid funding means you can stay financially afloat during litigation, avoiding desperate choices like settling your case too early for too little.

Clients frequently praise how quick and hassle-free the funding process is with Express Legal Funding. In urgent situations, having a reliable partner that can put money in your hands within a day can make all the difference.

With Express Legal Funding, you get the cash you need when you need it, helping you pay your bills and support your family while your attorney fights for the full value of your case.

5. Direct Funder with No Broker or Middleman

Express Legal Funding operates as a direct funder, which is a crucial benefit for clients. This means that when you apply with Express Legal Funding, you are dealing directly with the funding company that is providing your cash advance, not through any brokers or middlemen.

Why does this matter?

Using a legal funding broker or referral service can tack on additional fees or delays, since brokers often charge commissions and have to shop your case around to actual funding companies.

Those extra layers increase the cost of funding (and cut into your settlement) for no added benefit.

Industry experts advise plaintiffs to “steer clear of brokers” because it’s an unnecessary cost that lowers the total amount you receive.

Apply Directly: No Legal Funding Brokers or Middleman Fees

By bypassing intermediaries, Express Legal Funding eliminates those added fees and inefficiencies.

You get a better deal financially because there’s no middleman taking a cut – savings which Express Legal Funding passes directly to you in the form of lower rates.

It also means a faster, smoother process: decisions come quicker when the same company evaluates and funds your case, rather than waiting on third parties.

Communication is clearer, too, since you work with Express Legal Funding’s team from start to finish, ensuring everyone is on the same page about terms and expectations.

In short, Express Legal Funding is the source of the funds, and this direct-funding model sets it apart.

Many competitors, by contrast, either are brokers or rely on broker networks (for example, some well-known providers have hidden broker fees built into their rates).

With Express Legal Funding, you can rest easy knowing you’re getting a straightforward, no-middleman transaction. The result is less cost, less hassle, and often a quicker approval for you.

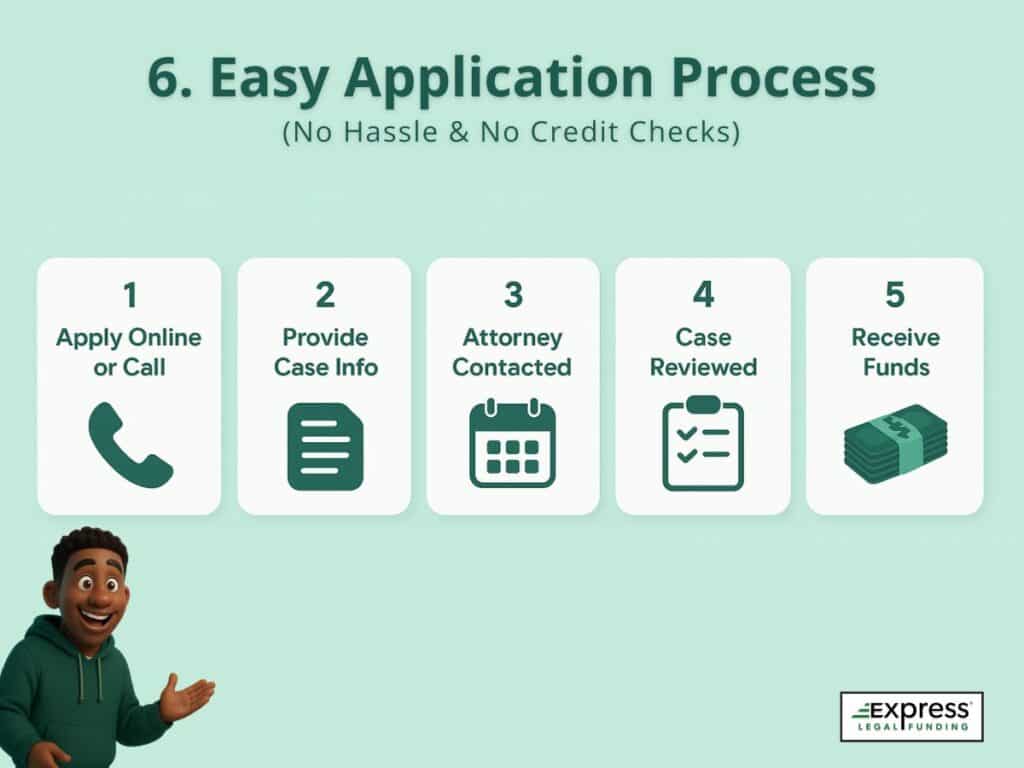

6. Easy Application Process (No Hassle & No Credit Checks)

Applying for pre-settlement funding with Express Legal Funding is simple and stress-free, especially compared to traditional loans. The company offers an easy application process that can be started online through a short form or over the phone, whichever is more convenient for you.

There are no lengthy paperwork requirements and no application fees. Once you provide basic information about your case and attorney, Express Legal Funding swiftly handles the rest – they will reach out to your lawyer to gather case details and assess the potential settlement value.

This due diligence is thorough but quick, ensuring you get a fair advance offer without jumping through hoops.

Learn more: Do I Need a Lawyer to Get Legal Funding?

Simple, Hassle-Free Application—No Credit Check Required

Importantly, no credit check is required to qualify for funding from Express Legal Funding (or most reputable legal funding companies).

Your personal credit score, employment status, and financial history are not factors in approval – the strength of your legal case is what matters.

This is a huge relief for plaintiffs who may have damaged credit or no income due to their injuries. As one industry source notes, with lawsuit funding, “you don’t have to worry about a credit check as you would with traditional loan applications”.

Express Legal Funding will never ask you for pay stubs, bank statements, or collateral. If you have a pending claim with merit and attorney representation, you can qualify for a lawsuit cash advance, regardless of your credit or finances.

The overall experience of applying is very user-friendly. Clients often highlight how “quick and hassle-free” the application and approval process with Express Legal Funding can be.

The team at Express Legal Funding also keeps applicants comfortable by maintaining a no-pressure approach.

You’ll get your questions answered and time to consider the offer, rather than aggressive sales tactics. (Heavy pressure is a red flag with some lenders, and something you won’t encounter at Express Legal Funding.)

Express Legal Funding Portal: Track Your Application Faster Anytime, 24/7

Express Legal Funding enhances your experience with its custom-built online Portal and mobile app, designed for convenience and transparency.

With 24/7 access, you can easily track your funding application status in real-time, receive updates, securely upload documents, and communicate with the team—right from your phone or computer.

Express Legal Funding Portal – Now available on the iOS App Store and Google Play Store

From start to finish, Express Legal Funding makes the funding process straightforward, transparent, and convenient, so you can get the money you need without added stress.

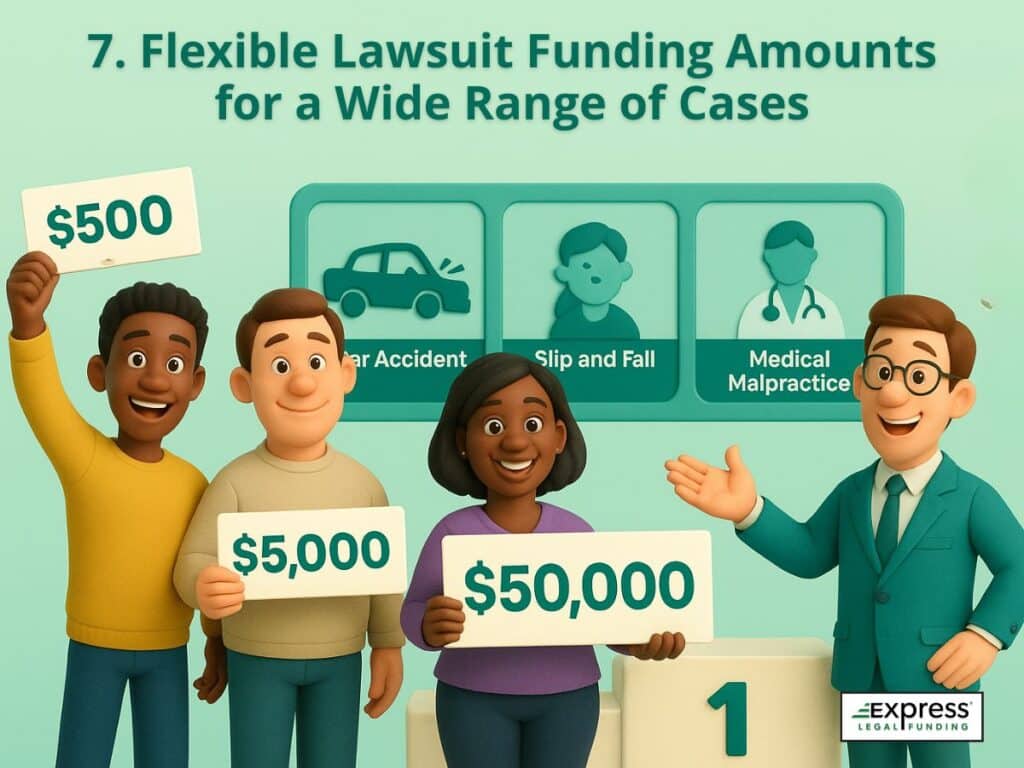

7. Flexible Lawsuit Funding Amounts for a Wide Range of Cases

Every lawsuit is different, and Express Legal Funding is equipped to handle that. Whether you need just a small advance to hold you over or a large sum to cover extensive costs, Express Legal Funding offers flexible funding amounts tailored to your case.

Flexible Pre-Settlement Funding Amounts

Plaintiffs can obtain anywhere from $500 up to $500,000 in pre-settlement funding, depending on the specifics of the claim and its potential value. This wide range is much more accommodating than some funding companies that might cap advances at lower amounts.

It ensures that if you have a very serious case with significant damages (for example, a catastrophic injury or wrongful death claim), you could access a substantial portion of your expected settlement now, when you need it most.

On the other hand, if you just require a smaller amount to cover immediate bills, Express Legal Funding can provide that too without pushing you to over-borrow.

Many Types of Civil Lawsuit Cases Qualify

Not only are the funding amounts flexible, but Express Legal Funding also supports a broad spectrum of case types. This is important because some lawsuit loan companies only fund certain cases or specialize in one niche.

Express Legal Funding, however, helps plaintiffs across most personal injury and civil litigation cases, including auto accidents, slip-and-fall injuries, medical malpractice, product liability, workers’ compensation, employment disputes, and more.

Express Legal Funding helps plaintiffs across a wide range of personal injury and civil litigation cases, including:

- Auto accidents – car, truck, motorcycle, pedestrian, and rideshare-related claims

- Slip and fall injuries – premises liability cases at stores, restaurants, or private properties

- Medical malpractice cases – negligence by doctors, surgeons, nurses, or healthcare providers

- Product liability – injuries caused by defective or dangerous products, tools, or medications

- Workers’ compensation claims – on-the-job injuries and occupational illness disputes

- Employment disputes – wrongful termination, workplace discrimination, and unpaid wages

- Nursing home abuse or neglect – elder care cases involving physical or emotional harm

- Wrongful death lawsuits – filed on behalf of deceased loved ones due to negligence

- Construction accidents – scaffolding falls, equipment failures, or OSHA violations

- Assault and negligent security cases – injury claims involving preventable criminal acts

- Sexual abuse lawsuits – including institutional abuse cases like Maclaren Hall and other survivor claims against churches, schools, and foster care systems

In practice, this means whatever your claim – if you need a cash advance for a car accident injury, a workplace injury, a wrongful termination, or even a nursing home abuse case – there’s a good chance Express Legal Funding can provide financial support while you pursue justice.

The company’s funding experts evaluate each case on its merits, and as long as you have a valid claim with an attorney working on contingency (no-win, no-fee), you are eligible to apply.

This versatility in both advance size and case type makes Express Legal Funding a one-stop solution for plaintiffs seeking pre-settlement funding. You won’t be turned away just because your case is a bit different or because you need a larger-than-average advance.

Express Legal Funding is confident in handling everything from routine accident claims to complex litigation. The bottom line is, they give you the flexibility to borrow what you need, when you need it, for virtually any qualifying lawsuit.

Learn more in our guide: How Much Pre-Settlement Funding Can I Get on My Case?

8. Licensed, Accredited & Compliant (Your Case Is in Good Hands)

When evaluating legal funding companies, it’s important to choose one that operates with integrity and in compliance with all laws and regulations.

Express Legal Funding excels here: the company is fully licensed to operate in multiple states and follows all applicable legal guidelines for non-recourse funding.

Licensed and Compliant Contracts

Different states have various rules for lawsuit funding, and Express Legal Funding only does business where it’s permitted and vetted, giving you confidence that your funding contract will be enforceable and fair. (By contrast, some outfits operate without proper licensing, which can put plaintiffs at risk.)

In states like Texas, California, Oklahoma, Missouri, and Florida, where Express Legal Funding is active, it has met the regulatory requirements to assist consumers with cash advances on their settlements.

This commitment to playing by the rules reflects Express Legal Funding’s professionalism and reliability.

BBB Accredited Legal Funding Company With A+ Rating

Moreover, Express Legal Funding carries a strong Better Business Bureau accreditation with an A+ rating. The A+ BBB rating is a testament to the company’s trustworthiness and customer service quality. It indicates that it has a proven record of addressing any client concerns and upholding high standards of transparency and honesty.

In independent evaluations, factors like state licensure and BBB standing are key indicators of a legal funding company’s legitimacy, and Express Legal Funding scores top marks on both.

Choosing a licensed and accredited funder means you’re choosing safety and peace of mind. With Express Legal Funding, you know you are dealing with a reputable firm that has been recognized by consumer watchdogs and industry analysts alike.

The company’s years of experience and compliance-focused approach ensure your transaction is secure and above board. In summary, Express Legal Funding’s credentials (state licenses, BBB A+ accreditation, and over a decade in business) show that your case – and your money – will be in good hands with a legitimate, respected company.

9. Stellar Client Reviews & Customer Support

Nothing speaks louder than the voice of actual clients, and Express Legal Funding shines in this respect as well. The company has amassed hundreds of positive reviews from plaintiffs who have used its services, reflecting a high level of customer satisfaction.

Top-Rated: Hundreds of 5-Star Reviews

On TrustPilot and Google, Express Legal Funding is highly reviewed by clients, with an overwhelming majority awarding 5-star ratings and praising their experience.

In fact, Express Legal Funding maintains a near-perfect customer rating, and less than 3% of its reviews are 1-star (a remarkably low figure).

Such consistency in positive feedback indicates that it not only meets but often exceeds client expectations.

So, what do customers love about Express Legal Funding?

Outstanding Client Support and Personalized Customer Service

According to client feedback, key praises include the company’s low rates, quick funding, and transparent terms. Many clients highlight the professionalism and compassion of the Express Legal Funding team, noting that they felt genuinely cared for during a stressful time.

This is crucial because seeking a lawsuit cash advance can be an emotional decision – you’re likely under financial and personal strain.

Having a supportive, understanding funding partner can make the process much easier. Its staff are often commended for excellent customer service, guiding clients through each step of the funding process and answering questions patiently.

Beyond anecdotes, the strong word-of-mouth is backed by formal recognition: as mentioned earlier, Express Legal Funding was rated the #1 legal funding company in 2025, which factored in its customer reviews and reputation.

Knowing that so many other plaintiffs have had a great experience provides added peace of mind that you, too, will be treated well.

With Express Legal Funding, you’re not just getting a check – you’re getting a team that will support you through the funding process with respect, responsiveness, and empathy.

High customer ratings and testimonials serve as proof that the company delivers on its promises and truly helps its clients when they need it most.

10. Ethical, Client-First Practices

Finally, one of the most compelling reasons to choose Express Legal Funding is the company’s unwavering commitment to ethical, client-first practices.

Unfortunately, the lawsuit lending industry has its share of bad actors – some companies engage in predatory tactics, charge exorbitant fees, or pressure vulnerable clients into bad deals.

Ethical Legal Funding That Puts Plaintiffs First

Express Legal Funding has taken a very different path by building its business around fairness, honesty, and the well-being of the client.

The company adheres to strict ethical funding guidelines: for example, the company’s underwriters carefully evaluate each case to ensure plaintiffs do not borrow more than necessary, preventing excessive debt.

The goal is to provide a financial lifeline, not to create another financial burden.

Express Legal Funding also prides itself on transparency and honesty at every step. All terms and rates are clearly explained (no fine-print tricks), and the team makes sure you understand the agreement before you sign.

If you have questions, they will be answered thoroughly – there’s no evasiveness or high-pressure sales pitch.

Express Legal Funding fosters a no-pressure environment; you won’t be rushed into a decision. This approach aligns with expert advice, since “you shouldn’t feel pressured to make a quick decision” when seeking a lawsuit loan.

They give you the information and time you need to decide what’s best for you.

By avoiding predatory lending practices and putting the client’s interests first, Express Legal Funding has earned a reputation for integrity and reliability.

The company’s ethical stance is evident in its policies: non-recourse funding (protecting clients who lose their cases), capped low rates, no hidden fees, and responsive customer support are all practices that put the client’s welfare at the forefront.

This ethical foundation is a core reason Express Legal Funding is trusted by attorneys and plaintiffs alike, so you can feel confident that you’re working with a funding company that values your recovery and success over its own profit.

Their client-first philosophy means they succeed only when you do, and they genuinely want to help you get justice on your terms.

Conclusion: The Best Choice for Pre-Settlement Funding

When you consider all these factors together, it’s clear why Express Legal Funding is the best choice for plaintiffs seeking pre-settlement funding. The company combines all the top traits you should look for – speed, affordability, transparency, trustworthiness, and compassion – into one outstanding service.

By prioritizing quick relief, fair pricing, and ethical practices, Express Legal Funding empowers you to focus on your recovery and legal battle without financial fear.

Each of the 10 reasons above underscores the same conclusion: Express Legal Funding puts the plaintiff’s needs first and has set a new standard for what a lawsuit loan company should be.

Why Choosing the Right Lawsuit Loan Company Matters

In the stressful period between filing a lawsuit and receiving a settlement, Express Legal Funding provides a lifeline.

With this partner on your side, you can pay your bills, keep your life stable, and give your attorney the time needed to fight for maximum compensation – all without risking additional debt or falling prey to predatory lenders.

It’s no wonder Express Legal Funding is ranked #1 and is so highly recommended by its clients. If you need a lawsuit cash advance, choosing Express Legal Funding means choosing a secure, cost-effective, and client-focused solution.

With their help, you can stay financially afloat and strongly pursue justice, confident that you’ve entrusted your needs to the very best in the business.

Ready to Take the Next Step? Apply With Express Legal Funding Today

If you or a loved one is facing financial stress while waiting on a personal injury or civil case to settle, don’t wait any longer to get the support you need.

Express Legal Funding makes the process fast, risk-free, and affordable—so you can regain control of your finances and focus on healing while your attorney fights for justice.

- Apply in minutes – No credit check, no upfront fees

- Same-day approval and funding are often available, depending on contract signing time and attorney responsiveness.

- Only repay if you win your case – No-risk legal funding

- Trusted by plaintiffs and attorneys nationwide

Get started now and join the thousands of clients who’ve trusted Express Legal Funding for reliable pre-settlement cash advances.

Pre-Settlement Funding Application Intake

Frequently Asked Questions About Express Legal Funding

Is Express Legal Funding a reputable lawsuit loan company?

Yes, Express Legal Funding is a trusted and licensed legal funding company with an A+ BBB rating and hundreds of 5-star reviews. It was ranked the #1 best pre-settlement funding provider in 2025 for its transparency, low rates, and client-first practices.

How fast can I get pre-settlement funding from Express Legal Funding?

Most approved clients receive their pre-settlement cash advance within 24 hours. Express Legal Funding offers same-day funding in many cases, depending on attorney response times and case review.

Do I need good credit to qualify for legal funding?

No. Express Legal Funding does not require a credit check, employment verification, or collateral. Your eligibility is based on your legal case’s strength, not your personal finances or credit score.

What types of cases does Express Legal Funding support?

Express Legal Funding provides pre-settlement funding for most personal injury and civil cases, including:

- Car accidents

- Slip and fall

- Medical malpractice

- Workers’ compensation (with third-party liability)

- Employment disputes

- Nursing home abuse

- Wrongful death claims

What makes Express Legal Funding different from other lawsuit loan companies?

Express Legal Funding stands out for being a direct funder, not a broker, offering non-recourse funding, capped low fees, and transparent terms. Clients only repay if they win their case—there are no hidden costs or high interest rates to worry about.

How much pre-settlement funding can I receive?

You can receive anywhere from $500 to $500,000, depending on your case’s potential value. Express Legal Funding customizes funding amounts based on your needs and the strength of your legal claim.