What Is Litigation Finance and How Does It Work?

Litigation finance — also called lawsuit funding, legal funding, or third-party litigation funding — is a non-recourse financial arrangement in which a litigation funder pays for some or all legal costs in exchange for an agreed share of any settlement or court award.

These agreements are typically non-recourse, meaning repayment is only required if the plaintiff wins or reaches a settlement. If the case is lost, the plaintiff owes nothing to the funder.

Although the term litigation finance is often used to describe funding for corporate lawsuits, it operates in two main markets, which differ greatly. These include:

- Consumer legal funding: Provides individual plaintiffs with immediate cash while their case is pending (commonly in personal injury cases).

- Commercial litigation finance: Supplies capital to businesses or law firms to pursue high-value disputes, typically involving complex litigation, such as intellectual property enforcement claims.

While Express Legal Funding specializes in consumer legal funding — also called pre-settlement funding or lawsuit loans — this guide explains both types so you can see how litigation finance works, what it costs, and whether it’s the right option for your situation.

💡 Need funding now? You may be able to get approved and funded in as little as 24 hours with Express Legal Funding. Apply today for pre-settlement funding to cover essential expenses while your case is pending.

History of Litigation Finance

Modern litigation finance has deep historical roots in medieval England, where strict legal doctrines—maintenance, champerty, and barratry—were designed to prevent wealthy individuals from manipulating the court system for personal gain.

These rules prohibited third parties from funding lawsuits in exchange for a share of the proceeds and, in doing so, also blocked legitimate arrangements that could have helped claimants pursue valid cases.

By the late 20th century, countries such as Australia and the United Kingdom began dismantling these restrictions, paving the way for modern litigation funding. By the early 2000s, the practice had spread to Canada and other common-law jurisdictions.

In the United States, litigation finance started gaining significant traction around 2010, supported by increased acceptance among courts, law firms, and corporate clients. Today, it is a multi-billion-dollar global industry, with established consumer and commercial markets and growing regulatory oversight.

Maintenance, Champerty, and Barratry: Historical Barriers That Still Matter

The medieval doctrines of champerty and maintenance once acted as barriers to litigation finance, and in some U.S. states, their influence still determines whether a legal funding contract is enforceable.

- Maintenance: Providing improper support for another person’s lawsuit without a legitimate interest in the case. Under the feudal system, powerful lords and royal officials often funded lawsuits to influence outcomes or harass rivals, sometimes maintaining “private armies of lawyers” to pursue their own agendas.

- Champerty: A specific form of maintenance in which a third party funds a lawsuit in return for a share of the recovery. This is the restriction most relevant to modern legal funding debates.

- Barratry: The repeated instigation of frivolous lawsuits for personal profit.

While these doctrines were intended to protect judicial integrity, they also prevented plaintiffs with strong cases from accessing much-needed financial resources. Many jurisdictions—particularly Australia, the UK, and parts of Canada—abolished or reformed these laws, enabling the growth of modern litigation finance.

Why This Matters Today

In the United States, champerty laws vary widely by state. Some still enforce strict prohibitions, while others allow third-party legal funding under defined regulatory frameworks and disclosure requirements. If a funding agreement violates state champerty rules, a court can declare it void.

For plaintiffs, law firms, and litigation funders, understanding the local legal landscape is essential before moving forward with any litigation finance arrangement.

Types of Litigation Finance

Litigation finance generally falls into two main categories: consumer legal funding and commercial litigation finance.

Both operate on a non-recourse basis—meaning repayment is only required if the case wins or settles—but they differ greatly in scale, purpose, and cost structure.

Relevant read: What Are the Types of Legal Funding?

Consumer Legal Funding

Also called pre-settlement funding or a lawsuit cash advance, consumer legal funding gives individual plaintiffs, such as a car accident victim pursuing a personal injury claim, immediate access to cash while their case is pending.

- Purpose: Helps plaintiffs cover essential living expenses such as rent, utilities, groceries, and medical bills during the often lengthy legal process.

- Typical case types: Car accidents, slip-and-fall injuries, workplace accidents, medical malpractice, and other personal injury claims.

- Repayment: Required only if the case is won or settled. The amount owed includes the principal advanced plus agreed fees and interest, all under a non-recourse agreement—meaning no repayment is required if the case is lost.

How Consumer Legal Funding Works: Video Guide

In the video below, we break down the consumer legal funding process in a straightforward and informative way.

Commercial Litigation Finance

Commercial litigation finance provides businesses, law firms, or other entities involved in high-value disputes with the capital needed to cover the high costs of pursuing a lawsuit.

- Purpose: Covers substantial legal costs without draining operational capital, allowing companies to pursue meritorious claims.

- Typical case types: Breach of contract, intellectual property (patent or trademark infringement), antitrust claims, international arbitration, construction disputes, and shareholder litigation.

- Repayment: Required only if the case is successful. Terms often involve higher pricing due to longer timelines, larger commitments, and higher risk, and may include tiered returns or multiples of the funded amount.

Commercial Litigation Funding and Arbitration

Because many high-value commercial disputes are resolved outside of traditional courts, arbitration often plays a central role in how litigation finance agreements are structured.

In the context of commercial litigation funding, arbitration can shape both the funding process and the potential outcomes for claimants and funders.

From a litigation funder’s perspective, arbitration presents unique considerations:

- Confidentiality: Arbitration proceedings are typically private, which can limit public information about case progress but also protect sensitive business details.

- Enforcement: Arbitration awards may require recognition and enforcement in multiple jurisdictions, particularly in international disputes, which can affect collection risk.

- Procedural Control: In some arbitrations, the tribunal may have discretion over whether to allow third-party funding and may require disclosure of the funding arrangement to all parties.

Funders also expect the claimant and their legal counsel to maintain a fiduciary duty to act in the best interests of the case. This includes making strategic decisions that maximize recovery without being unduly influenced by settlement pressure or funding terms.

A breach of this duty can create conflicts between the claimant, counsel, and funder, and may lead to disputes over control or repayment.

Key takeaway: Arbitration clauses and fiduciary obligations are central to structuring commercial litigation funding agreements. These factors not only affect case strategy but can also influence the pricing, risk assessment, and financial outcomes discussed later in this guide.

What is the difference between commercial litigation finance and consumer legal funding?

While both commercial litigation finance and consumer legal funding offer non-recourse funding for legal claims, the two operate in very different markets with distinct costs, risks, and funding structures.

Commercial litigation finance typically involves larger capital commitments, higher risk, and longer timelines, which translate to more expensive pricing and deeper involvement from the funder in case strategy.

In contrast, consumer legal funding is designed for speed, affordability, and minimal interference, giving plaintiffs the cash flow they need without surrendering control of their case.

The table below outlines these key differences so you can quickly understand why consumer legal funding is often the faster, more affordable choice for plaintiffs who need immediate financial relief.

Key Differences: Consumer vs. Commercial Litigation Finance

| Factor | Consumer Legal Funding | Commercial Litigation Finance |

|---|---|---|

| Typical case types | Personal injury claims (car accidents, slip-and-fall, workplace injuries) | Large-scale disputes (breach of contract, IP, antitrust, international arbitration) |

| Funding size | Smaller amounts to cover living expenses or limited legal costs | Often millions of dollars to fund complex, multi-year litigation |

| Case duration | Months to 1–2 years on average | Several years; often includes appeals or cross-border enforcement |

| Risk profile | Moderate — based on clear liability and insurance coverage | High — complex legal issues, uncertain jurisdictions, and enforcement risks |

| Cost structure | Principal advanced plus fees and interest (non-recourse). On average, repayment in successful cases equals ~20%–30% of the settlement. | Often higher pricing. May involve tiered returns, multiples of the amount funded (e.g., 3–5x), and additional fees. |

| Repayment obligation | Only if the case wins or settles | Only if the case wins or settles |

| Influence on strategy | No influence — funders have no role in case direction; all legal decisions remain between the plaintiff and their attorney | Funders may have in-house attorneys who provide input on litigation strategy, settlement decisions, and case direction to protect their investment |

| Why pricing differs | Smaller advances, shorter timelines, lower overall risk | Larger capital commitments, longer timelines, greater uncertainty |

What is the purpose of litigation finance?

The purpose of litigation finance is to provide funding for legal claims so plaintiffs and law firms can pursue strong cases without paying the full cost upfront. This non-recourse funding:

- Levels the playing field against better-funded opponents.

- Supports access to justice for parties with limited resources.

- Ensures cases are decided on merit rather than financial limitations.

Allows for case monetization, enabling claimants to unlock value from their legal claims before resolution.

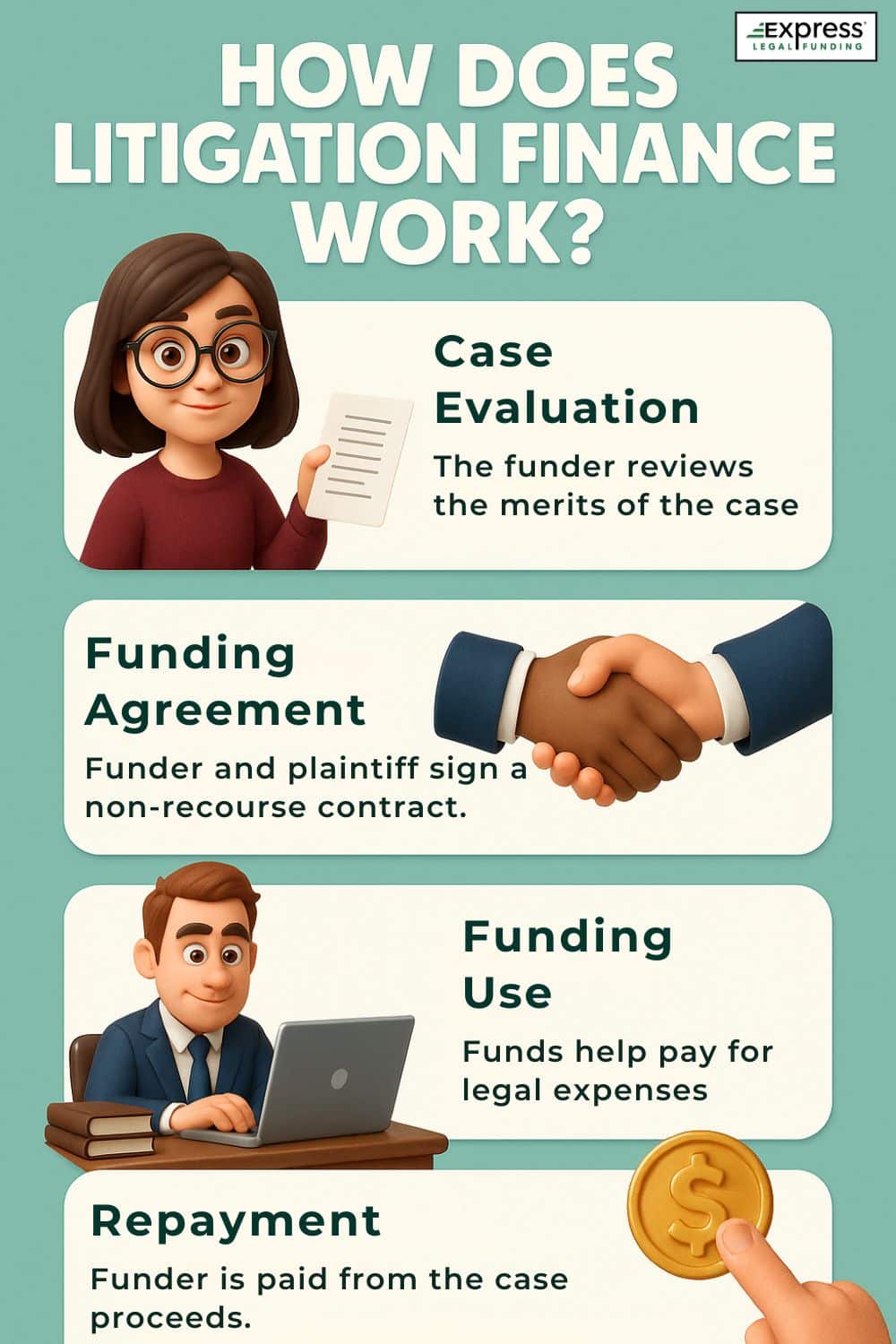

How Does Litigation Finance Work?

Litigation finance generally follows four main steps. While the structure is similar for consumer and commercial cases, the process, complexity, and timeline vary greatly between them.

Step 1 – Case Evaluation

The litigation funder performs in-depth due diligence to assess the case’s likelihood of success. This includes reviewing legal precedent, damages models, the applicable jurisdiction, potential recovery amount, and the enforceability and collectability of any judgment.

In commercial litigation, this stage is more intensive and may take weeks or even months due to complex legal issues, multiple jurisdictions, and detailed financial analysis.

Step 2 – Funding Agreement

If the case is approved, the parties sign a non-recourse contract outlining the funding amount, repayment structure, and agreed percentage of recovery or set multiplier. Because the agreement is non-recourse, repayment is only required if the case results in a settlement or favorable judgment.

Step 3 – Funding Use

Funds are provided upfront. In consumer legal funding, the money typically covers essential living expenses—such as rent, utilities, and medical bills—or limited case-related costs.

In commercial litigation finance, funding often supports substantial expenses like attorney fees, expert witnesses, document discovery, and trial preparation.

Step 4 – Repayment & Oversight

If the case is successful, the funder is paid directly from the settlement or judgment before the remaining proceeds go to the plaintiff or law firm.

Both consumer and commercial legal funders may request periodic updates on case progress, key court decisions, or settlement discussions to monitor their investment risk. If the case is lost, the plaintiff owes the funder nothing.

Timeline Overview:

- Consumer cases: Funding is often provided within 24–48 hours after the funder receives necessary documentation from your attorney.

- Commercial cases: The process can take weeks to several months, reflecting the more extensive due diligence, evidence review, and complex negotiations involved.

Litigation Finance Costs

Consumer Legal Funding Pricing

In most cases, the cost of consumer legal funding is based on the principal amount advanced plus fees and interest, all under a non-recourse agreement, meaning repayment is only required if you win or settle your case.

While exact repayment amounts depend on factors like case duration and contract terms, successful cases often see total repayment equal to about 20%–30% of the settlement amount.

Shorter timelines typically result in lower costs, while cases lasting a year or more can accumulate higher interest and fees.

Commercial Litigation Finance Pricing

The cost of commercial litigation funding is significantly higher on a per-dollar-funded basis compared to consumer funding. This is due to larger capital commitments, greater case complexity, and longer timelines, often several years. Funders face extended capital tie-up and higher risk, which is reflected in their pricing.

Agreements may include tiered returns, multiples of the funded amount (e.g., 3–5x), and additional fees. The longer the dispute continues, the higher the funder’s return percentage will be.

Market Conditions and Cost Impact

Recent industry trends have made securing funding more competitive. According to Westfleet Advisors’ 2024 report, U.S. litigation finance funders committed $2.3 billion to new deals last year — a 16% drop from 2023 and nearly 30% below 2022 levels.

While the 42 active funders in the survey maintained a combined $16.1 billion in assets under management, tighter capital availability has led to more selective underwriting and slower approvals, particularly in higher-risk commercial matters.

Key takeaway: Commercial litigation finance is more expensive because funders take on greater financial risk and commit substantial capital for extended periods. In the current tight market, these cost differences between consumer and commercial funding are even more pronounced. Consumer legal funding remains generally faster, smaller in scale, and more affordable for individual plaintiffs.

Litigation Finance Cost Examples

Understanding how repayment works in both consumer legal funding and commercial litigation finance can help you compare costs, timelines, and potential returns. Below are two real-world-style scenarios.

Example 1 – Consumer legal funding

A personal injury plaintiff awaiting a car accident settlement receives $10,000 in pre-settlement funding to help pay rent, utilities, and medical bills while the case is pending.

- Case duration: 12 months

- Repayment terms: Principal plus agreed fees and interest, all under a non-recourse agreement (no repayment if the case is lost).

- Outcome: The case settles for $125,000. The total repayment to the funder is $15,850, which equals about 12.7% of the gross settlement. After paying attorney fees and medical liens, the plaintiff is expected to net between $40,000 and $60,000 in final proceeds.

🔍 Explore our interactive lawsuit loan calculator

Example 2 – Commercial litigation finance

A technology company files a patent infringement lawsuit against a well-funded competitor and obtains $3 million in commercial litigation funding to pay for attorney fees, expert witnesses, and technical analysis.

- Case duration: 4 years, including appeals

- Repayment terms: Non-recourse agreement with a tiered return — the funder receives 4x the funded amount if the case is successful.

- Outcome: The case settles for $25 million. The litigation funder is repaid $12 million from the recovery, illustrating the higher cost per dollar funded caused by the long duration, elevated risk, and substantial capital tie-up. After paying legal fees and other expenses, the company retains the remaining settlement proceeds.

Why Choose Express Legal Funding?

- Fast, affordable funding: Get approved quickly with transparent, competitive rates designed to keep more of your settlement in your pocket.

- 100% non-recourse: You owe nothing if you lose your case — no hidden fees, no surprise charges.

- Trusted nationwide: We’ve helped clients across the U.S. access the financial support they need while their cases are pending.

Relevant read: 10 Reasons to Choose Express Legal Funding

Why would someone need third-party litigation funding?

Someone would need third-party litigation funding if they have a strong legal case but lack the money to cover attorney fees, expert witnesses, court costs, or living expenses during the lawsuit. It helps individuals, businesses, and law firms manage cash flow, share risk, and pursue claims without tying up their own capital.

Does litigation finance affect settlement negotiations?

Yes, litigation finance can influence settlement negotiations, often in a positive way. For consumer plaintiffs, it can indirectly strengthen their position by easing financial pressure, allowing them to reject lowball offers and hold out for fair compensation.

In commercial cases, however, funders may have direct input on settlement decisions to protect their investment, adding an extra layer of consideration to the negotiation process.

Litigation Finance Pros and Cons: Is It Worth It?

Litigation finance can be a valuable tool for plaintiffs, law firms, and businesses, but it’s not without trade-offs. Here’s a clear breakdown of the main advantages and disadvantages so you can decide whether it’s the right option for your case.

Pros of Litigation Finance

- Levels the playing field: Gives plaintiffs and businesses the resources to take on well-funded opponents.

- Access to justice: Enables strong cases to proceed even when the claimant lacks the funds to pay legal costs upfront.

- Risk transfer: The funder assumes the financial risk if the case is lost, with no repayment required in non-recourse agreements.

- Cash flow stability: Helps law firms and businesses manage cash flow while pursuing lengthy cases.

- Stronger settlement leverage: Allows plaintiffs to wait for fair offers instead of accepting low settlements due to financial pressure.

Cons of Litigation Finance

- Reduced net recovery: The funder’s share is deducted from the settlement or judgment, lowering the claimant’s final amount.

- Disclosure requirements: Some courts and arbitration panels require the third-party case funding arrangement to be disclosed.

- Complex agreements: Terms vary significantly; independent legal review is essential before signing.

- Perception risks: Opposing counsel may try to use the funding as a tactical disadvantage in litigation.

- Commercial case influence: In some high-value commercial disputes, funders may have a say in litigation strategy or settlement decisions to protect their investment.

Is litigation finance worth it?

Litigation finance can be worth it if you have a strong legal case but lack the funds to pursue it. It allows you to cover legal costs without risking your own money, since repayment is only required if you win or settle.

However, the trade-off is that the funder’s share will reduce your final recovery, so it’s important to weigh the potential benefits against the cost and terms of the agreement.

Alternatives to Litigation Finance

If litigation finance isn’t the right fit, plaintiffs and businesses have several other options to cover legal costs:

- Contingency fee arrangements: Attorneys receive a percentage of the recovery instead of an upfront payment or billing clients an hourly rate.

- Corporate lines of credit: Traditional financing available to businesses with sufficient creditworthiness.

- After-the-event (ATE) insurance: Covers adverse cost risks if the case is lost.

- Self-funding: Using personal or business reserves to pay legal expenses directly.

Is litigation finance legal and how is it regulated?

Yes — litigation finance is legal in most U.S. states and widely used internationally. However, rules vary by jurisdiction. Some states still have champerty laws or other restrictions, and certain courts or arbitration panels require disclosure of funding arrangements.

State-Level Regulation of Litigation Finance

- Nevada: Requires commercial funders to register and comply with disclosure rules under Nevada Revised Statutes Chapter 604C.

- Maine: Enacted the Legal Funding Practices (Title 9-A, Article 12), which limits certain contract terms and requires clear disclosures in consumer legal funding agreements.

Federal-Level Trends Addressing Litigation Finance:

Lawmakers have periodically introduced bills to increase transparency in third-party litigation funding, especially in commercial cases. Notable examples include:

- Litigation Funding Transparency Act of 2021

- Protecting Our Courts from Foreign Manipulation Act of 2023

A key motivating factor for these federal proposals is the fear of foreign influence in U.S. litigation, with China frequently cited in congressional hearings and reports as a potential source of strategic litigation financing.

Global & U.S. Best Practices and Guidelines for Third-Party Litigation Funding:

- The American Bar Association (ABA) has issued best practice guidelines for third-party litigation funding arrangements.

- The International Council for Commercial Arbitration (ICCA) promotes transparency and disclosure in arbitration funding.

Key takeaway: Commercial litigation finance is more directly impacted by these regulatory trends due to its higher case values and frequent cross-border elements, while consumer legal funding is primarily regulated at the state level.

Related FAQs and Guides

- What is non-recourse legal funding?

- Do I need a lawyer to get legal funding?

- How much does pre-settlement legal funding cost?

Litigation Finance: Key Takeaways and Final Thoughts

Litigation finance — whether consumer or commercial — can be a vital tool for plaintiffs and businesses to pursue strong legal claims without taking on additional debt. At Express Legal Funding, we help personal injury and accident victims nationwide access fast, affordable, and 100% non-recourse funding while their cases are pending.

By understanding the litigation finance landscape, you can make informed decisions about whether funding is right for you and avoid settling too soon because of financial pressure.

Get Legal Funding Fast: Apply Now and Stay in the Fight for Your Full Compensation

If you need money now to cover essential expenses while waiting for your settlement, don’t delay. Apply today, and you could get funded in as little as 24 hours after approval, giving you the financial strength to keep fighting for the compensation you deserve.

Call us at (888) 232-9223 or apply online today to get started with pre-settlement funding.