A car accident caused by another driver’s negligence can turn your life upside down in an instant. Medical bills pile up, lost wages create financial strain, and emotional distress takes a heavy toll — all while you’re left waiting months or even years for a fair settlement.

Understanding how car accident settlements are calculated is a crucial step toward regaining control over your recovery and financial future.

That’s why our editorial team at Express Legal Funding created a free Car Accident Settlement Calculator — a quick and easy tool designed to help you estimate your potential compensation and see what you might actually take home after paying for medical expenses, attorney fees, and case costs.

Calculate Your Car Accident Settlement Value

⬇️ Use our free car accident settlement calculator below to get a realistic estimate of your potential payout. See your projected take-home amount after attorney fees, case costs, and medical expenses — it only takes a minute!

Disclaimer: This calculator provides a general estimate for informational purposes only. Actual car accident settlement amounts vary based on the specific facts of each case, applicable state laws, insurance negotiations, and attorney evaluations. For personalized advice, consult with a licensed personal injury attorney.

What’s next? Now that you have your estimate, it’s important to understand how settlements are calculated — and the key factors that can influence the final payout you receive.

What Is a Car Accident Settlement and How Is It Calculated?

A car accident settlement is an agreement where the injured party receives compensation for damages without going to court. Settlements resolve personal injury claims efficiently, providing financial recovery for accident victims. Damages in settlements typically include:

- Economic Damages: Tangible costs like medical bills, lost income, and property damage.

- Non-Economic Damages: Intangible losses such as pain and suffering, emotional distress, and loss of enjoyment of life.

Settlements are crucial in personal injury law, helping victims move forward without the time and expense of litigation.

Key Factors That Impact Car Accident Settlement Amounts

Multiple factors can directly impact the value of your car accident settlement, influencing how much compensation you may ultimately recover.

Understanding these key elements can help you set realistic expectations and make better financial decisions throughout your claim process.

Economic Damages

🏥 Medical expenses, physical therapy costs, medications, and lost wages form the core of economic damages. These losses are typically straightforward to document and calculate, making them a major part of your settlement value.

Non-Economic Damages

Pain and suffering, emotional distress, and loss of companionship are harder to quantify but can substantially increase your settlement amount, particularly in cases involving serious or permanent injuries.

Liability and Comparative Fault

If you are partially responsible for causing the accident, your settlement amount could be reduced based on your share of fault. For example, if you are found 20% at fault, your total compensation may be reduced by 20% under comparative negligence laws.

Insurance Policies and Policy Limits

Auto insurance coverage plays a critical role in settlement negotiations. Even if your injuries are extensive, the at-fault driver’s policy limits may cap how much you can recover. Our calculator accounts for these limits when providing your estimated payout.

Nearly every state requires drivers to carry minimum auto insurance coverage, which sets the maximum payout available after an accident.

For example, both Texas and California currently require a minimum of $30,000 per person and $60,000 per accident for bodily injury liability.

Not sure what the insurance policy limits are in your case?

👉 Learn more in our guide: Are Insurance Policies Public Record? Access & Privacy Law

Litigation Status

⚖️ Filing a lawsuit can increase the potential value of your settlement because it signals a willingness to pursue full compensation. However, it typically raises your attorney’s contingency fee percentage due to the additional work involved in litigation.

Being aware of these key elements can help you set realistic expectations and make smarter decisions as you and your attorney move through the legal process.

How to Use the Car Accident Settlement Calculator

Using our calculator is simple. Here’s what you need to calculate your accident settlement estimate:

- Medical Expenses: Include all past medical costs and projected future treatment expenses related to your injuries.

- Lost Wages: Estimate the amount of income you have lost — and may continue to lose — because of your accident.

- Broken bones or surgery: Select whether you suffered any broken bones or required surgery due to your car accident injuries. These serious injuries can significantly increase your estimated settlement amount by qualifying for a higher pain and suffering multiplier.

- Insurance Policy Limits: Input the maximum payout available under the at-fault party’s insurance coverage.

- Lawsuit Filing Status: Select whether your attorney has filed a lawsuit. (This affects the applicable attorney contingency fee percentage.)

Once you input your case information, our calculator automatically adjusts for two key factors:

Policy Limit Caps

The calculator ensures your projected settlement amount does not exceed the available insurance coverage. This prevents unrealistic payout expectations.

Attorney Fee Changes

If your attorney has filed a lawsuit, the contingency fee typically increases — often from about 33⅓% to approximately 40% — to account for the additional legal work involved. Our calculator accounts for this adjustment automatically.

Medical Treatment and Hospital Lien Reductions

Our calculator assumes a 70% reduction in your total medical expenses to reflect typical lien negotiations with healthcare providers after a settlement.

In most cases, medical providers — particularly chiropractors and physical therapists — agree to reduce their outstanding bills to help facilitate settlement payouts.

By factoring in these potential reductions, the calculator provides a more realistic estimate of your potential final net recovery.

At the end, you’ll receive two important estimates:

- Estimated Gross Settlement Amount: The total value of your settlement before any deductions.

- Projected Final Net Payout: The amount you may take home after deducting attorney fees, case costs, and medical expenses.

Benefits of Using an Injury Settlement Calculator

While our Car Accident Settlement Calculator is specifically designed for motor vehicle accident claims, the benefits of using an injury settlement calculator apply broadly across many types of personal injury cases.

Understanding your potential compensation early on in your case gives you a significant advantage during the claims process.

Here’s how an injury settlement calculator can help:

Quick Estimation

Get a rough idea of your potential compensation in just minutes. A calculator provides fast insight without needing to schedule an attorney consultation first.

Better Settlement Negotiations

Knowing a realistic settlement range strengthens your negotiating position with insurance companies. You’ll be better equipped to recognize lowball offers and advocate for fair compensation.

Financial Planning

Knowing your projected recovery amount helps you anticipate medical costs, lost wages, and other future financial needs during your healing process.

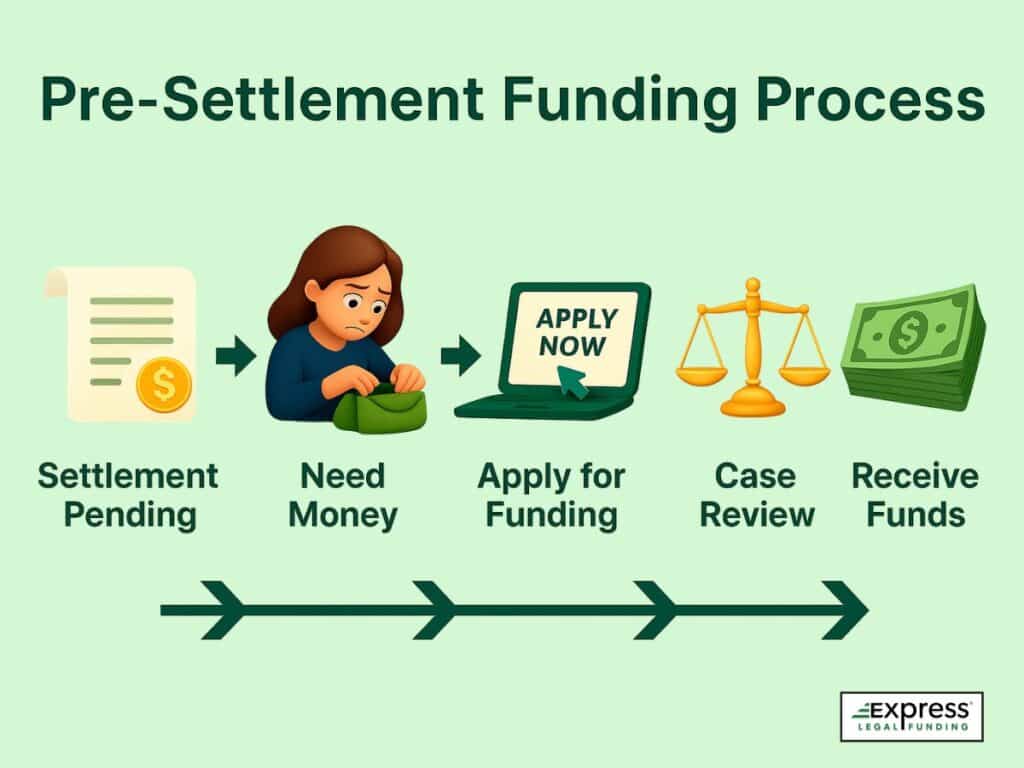

Pre-Settlement Funding Eligibility

A strong settlement estimate can also help determine if you qualify for pre-settlement funding, giving you access to financial relief while you wait for your case to conclude.

Limitations of Settlement Calculators

While injury settlement calculators are valuable tools for getting a rough estimate of your case’s worth, they are not perfect. Several real-world factors can affect the actual settlement you ultimately receive.

Future Medical Needs

Settlement calculators cannot predict future surgeries, long-term rehabilitation, or unexpected complications that could significantly increase your medical expenses.

Liability Disputes

If there are disagreements over who was at fault for the accident or how much fault each party bears, your settlement offer may be lower than initially estimated.

Jury Risks

If your case goes to trial, jury decisions can be highly unpredictable. Even strong cases sometimes yield lower awards based on how the jury interprets the evidence.

Negotiation Variations

Insurance adjusters negotiate settlements based on many factors that a calculator cannot capture, including company-specific policies, negotiation tactics, and the skill of your attorney.

General Estimate Only

While a settlement calculator offers a helpful ballpark figure, it is not a substitute for personalized legal advice from an experienced attorney who understands the nuances of your case and local laws.

Tips for Maximizing Your Settlement

Taking the right steps after your accident can significantly strengthen your personal injury claim and help you secure the highest possible settlement. Here are essential tips to maximize your compensation:

Document Everything

Keep detailed records of your medical treatments, diagnoses, wage losses, and property repairs. Thorough documentation strengthens your claim by providing clear, credible evidence of your damages.

Consult an Experienced Personal Injury Attorney

An experienced attorney can often negotiate a much higher settlement than you could achieve alone. Legal expertise also ensures that your rights are fully protected throughout the claims process.

Protect Your Right to Full Compensation

Each state has its own statute of limitations deadlines and comparative fault rules that can significantly impact your case. Failing to file your claim on time or misunderstanding how fault affects your case can severely limit your ability to recover compensation.

Be Cautious of Early Settlement Offers

Insurance companies often make low initial settlement offers in hopes that injured victims will settle quickly. Don’t rush into accepting a settlement without fully evaluating the value of your claim and future expenses.

How a Car Accident Loan Can Help While You Wait for a Fair Settlement

Even after building a strong case, personal injury settlements can take months or even years to finalize. In the meantime, accident victims and their families often face mounting bills, rent payments, and daily living expenses they can’t afford to delay.

Car accident loans, also known as pre-settlement funding, offer a risk-free way to access a portion of your expected settlement before your case resolves.

(Sometimes called “lawsuit loans,” though technically different, pre-settlement funding provides non-recourse advances based on the strength of your case.)

Read our guide: Can You Get a Loan on a Car Accident Settlement?

Here’s how pre-settlement funding can help:

No Credit Checks Required

Your eligibility is based solely on the strength of your car accident claim, not your credit history or employment status.

Non-Recourse Funding

If you lose your case, you owe nothing. Repayment is only required if you successfully win or settle your lawsuit — no personal liability attached.

That’s what makes pre-settlement funding truly risk-free for accident victims.

Fast Approvals and Rapid Access to Funds

Most applicants receive funding within 24 to 48 hours after approval, providing rapid access to cash when you need it most.

Using our free Car Accident Settlement Calculator to estimate your potential case value is the first step toward qualifying.

A strong settlement estimate can help speed up the approval process, giving you the financial relief you need while you wait for justice.

How Express Legal Funding Can Help After You Estimate Your Settlement

Estimating your potential settlement amount is a powerful first step. It gives you a clearer picture of your case’s realistic value and helps you make smarter financial decisions during the legal process.

However, even knowing what your case may be worth doesn’t solve the problem of immediate financial needs. Accident victims often face months of uncertainty before receiving any compensation, and that’s where Express Legal Funding steps in.

We offer pre-settlement funding based on the strength and estimated value of your car accident claim, helping you access the money you need while your case moves forward.

Key benefits of working with Express Legal Funding include:

No Credit Checks or Employment Verification

Your funding eligibility is determined entirely by your case strength, not your credit score or current employment status.

No Upfront Costs or Monthly Payments

There are no out-of-pocket expenses. Repayment only happens after your case settles successfully, and if you don’t win, you owe us nothing.

Fast, Risk-Free Cash Advances

Most of our clients receive funding within 24 hours of approval, giving you fast access to cash without adding financial pressure during your recovery.

By using our free Car Accident Settlement Calculator, you’re already taking the first step toward understanding your financial options — and preparing yourself to access the settlement funding you may need today.

Ready to Access Your Settlement Money Sooner? Apply for Pre-Settlement Funding

If you’re waiting for a car accident settlement and facing urgent financial needs, Express Legal Funding can help bridge the gap.

➡️ Apply for a car accident cash advance today and get the risk-free financial relief you need while your case moves forward. Approval is fast, risk-free, and based entirely on the strength of your case, not your credit history.

Why Trust Our Accident Settlement Calculator?

Our free Car Accident Settlement Calculator was created by the legal funding professionals at Express Legal Funding, who have years of real-world experience helping accident victims understand the financial side of personal injury claims.

The tool is built to reflect actual settlement factors, including medical bills, lost wages, insurance policy limits, and pain and suffering multipliers — the same key elements insurance companies and attorneys consider during negotiations.

While no calculator can guarantee an exact settlement amount, ours is designed to give you a realistic estimate based on common industry practices.

Final Thoughts on Using a Car Accident Settlement Calculator

Estimating your settlement amount is only the beginning.

➡️ Use our free Car Accident Settlement Calculator today to understand your potential recovery. If you need cash before your case concludes, reach out to Express Legal Funding for fast, risk-free financial help.

FAQs About Car Accident Settlements and Calculators

Yes, you can. Most states follow comparative negligence rules, which allow you to recover compensation even if you were partially at fault for the accident.

However, your settlement will likely be reduced based on your share of fault. For example, if you are found 20% responsible, your total compensation would typically be reduced by 20%.

If the at-fault driver has no insurance, you may still recover compensation through your own uninsured motorist (UM) coverage if you carry it. Without UM coverage, you may have to pursue a personal injury lawsuit against the uninsured driver directly, although collecting payment can be difficult if they lack personal assets.

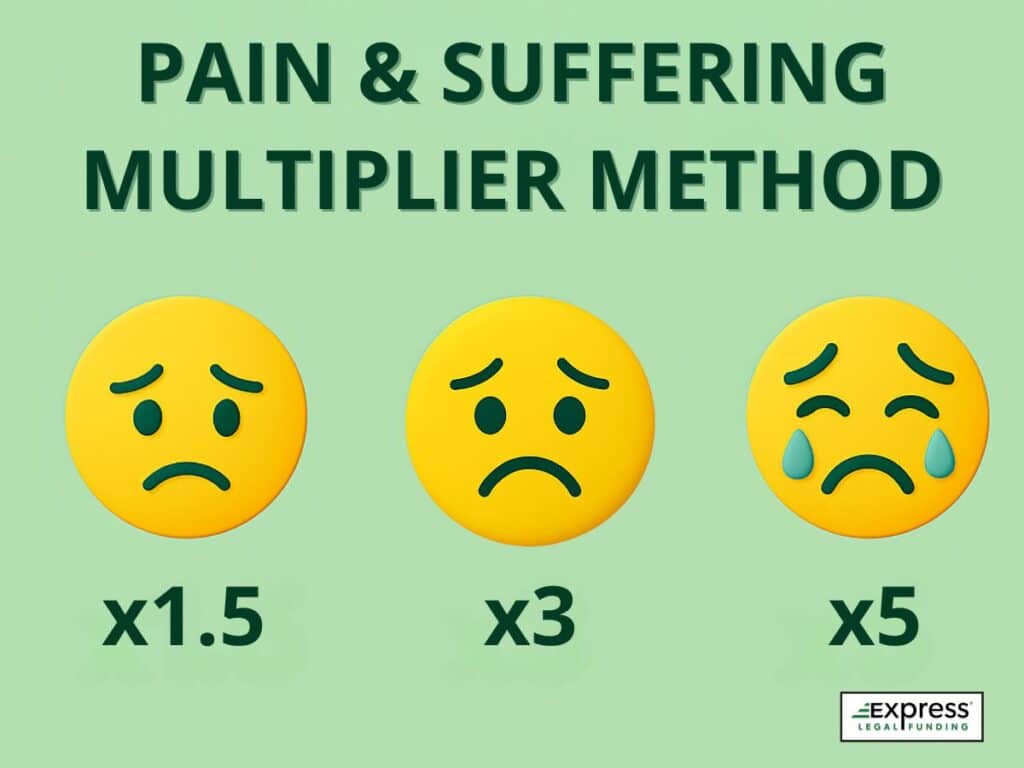

To calculate a car accident settlement amount, add up your economic damages (such as medical expenses, lost wages, and property damage) and non-economic damages (like pain and suffering). Often, a “multiplier method” is used by insurance adjusters: your total medical bills and lost wages are multiplied by a number between 1.5 and 5, depending on the severity of your injuries.

Pain and suffering compensation varies widely based on the severity of your injuries. Insurance adjusters often use a “multiplier method,” multiplying your medical expenses by a number between 1.5 and 5 to estimate non-economic damages. Serious or permanent injuries typically qualify for higher multipliers, resulting in a larger settlement for pain and suffering.

Factors that can lower a settlement include shared fault for the accident, low insurance policy limits, delays in seeking medical treatment, pre-existing medical conditions, weak evidence, and inconsistent statements. Insurance companies use these issues to dispute or reduce the amount they are willing to pay in a car accident claim.

To get the most accurate estimate, you’ll need key details such as your medical expenses, lost wages, property damage costs, the at-fault driver’s insurance policy limits, and whether your attorney has filed a lawsuit.

Several expenses are typically deducted from a car accident settlement before you receive your final payout, including attorney contingency fees, case costs and filing fees, outstanding medical bills and hospital liens, and pre-settlement funding repayment (if applicable).

These deductions are calculated prior to disbursement and determine the final net settlement amount you ultimately take home once your case is resolved.

Settlement calculators provide general estimates based on common personal injury valuation methods. However, every case is unique. Factors like medical complications, disputed liability, and insurance negotiation tactics can cause actual settlement amounts to vary from the calculator’s estimate.

Filing a lawsuit can increase your potential settlement, but it also usually increases your attorney’s contingency fee percentage. Many attorneys raise their fee from around 33⅓% to 40% after a lawsuit is filed to account for the additional time and effort involved in litigation.

You are not legally required to hire a lawyer to settle your car accident claim. However, working with an experienced personal injury attorney can significantly increase your chances of securing a fair settlement, especially if your case involves serious injuries, disputed liability, or negotiations with insurance companies.

Yes. Even if your injuries are severe, the at-fault driver’s insurance policy limits can cap the maximum amount you can recover. Unless there’s additional coverage or personal assets to pursue, policy limits often define the highest possible settlement.

The time it takes to receive a car accident settlement can vary widely depending on the complexity of the case. Simple claims with clear liability and minor injuries may settle within a few months. However, cases involving serious injuries, disputed fault, or extensive negotiations can take one to two years — or even longer — to fully resolve.

If a lawsuit is filed, the settlement process typically takes additional time due to court schedules and discovery procedures.

Yes, you can. With pre-settlement funding, you can access a portion of your expected car accident settlement before your case officially resolves. Express Legal Funding offers fast, risk-free lawsuit cash advances to help cover your living expenses while you wait.

You only have to repay the advance if you successfully win or settle your case — if you don’t recover compensation, you owe nothing.

Glossary of Key Terms in This Article

- Car Accident Settlement: A legal agreement reached between an injured individual and the at-fault party (or their insurer) to resolve a personal injury claim. It typically involves financial compensation and avoids the need for a court trial.

- Economic Damages: Measurable financial losses that result from a car crash. These include expenses such as hospital bills, lost earnings, car repairs, and physical therapy costs.

- Non-Economic Damages: Compensation for intangible losses after an accident, like physical pain, emotional suffering, mental anguish, or reduced quality of life, which are not easily assigned a fixed dollar amount.

- Comparative Fault (Comparative Negligence): A legal concept used when both parties share blame for an accident. A plaintiff’s compensation is reduced based on the percentage of fault assigned to them.

- Insurance Policy Limits: The highest amount an insurance company agrees to pay for a particular type of claim. These limits can affect how much compensation a victim may ultimately receive from a policy.

- Litigation Status: Indicates whether a legal case has officially been filed in court regarding a car accident claim. This status can influence how aggressively both sides negotiate and how legal fees are structured.

- Medical Lien: A formal claim from a doctor or medical facility against part of a personal injury settlement, ensuring they are paid back for services provided during treatment.

- Multiplier Method: A calculation used to estimate pain and suffering damages. It involves multiplying the total economic damages (like medical costs) by a number, usually between 1.5 and 5, based on injury severity.

- Pre-Settlement Funding (Lawsuit Loan / Legal Funding): An upfront cash advance available to plaintiffs involved in active personal injury cases. It’s classified as non-recourse, meaning repayment is only required if the case resolves favorably.

- Non-Recourse Funding: A financial advance where repayment is limited to funds recovered from a settlement or verdict. If the case is lost, the plaintiff keeps the money and owes nothing.

- Contingency Fee: A common attorney payment model where the lawyer receives a percentage of the final settlement or award. If the case doesn’t succeed, the attorney isn’t paid a fee.

- Statute of Limitations: A legal deadline that defines how long a person has to file a lawsuit after an incident. If the time limit expires, the injured party may lose the right to pursue a claim.

- Uninsured Motorist (UM) Coverage: An optional type of car insurance that provides protection if you’re injured by a driver who has no insurance. It helps cover costs like medical treatment and lost wages.