If you’re struggling financially while waiting for your lawsuit to settle, pre-settlement funding can provide quick and reliable relief during that difficult period.

However, it’s important to understand the pros and cons of pre-settlement funding—while it can provide fast access to money for essential expenses, there are also costs and considerations involved.

Knowing both sides will help you make the best decision for your situation.

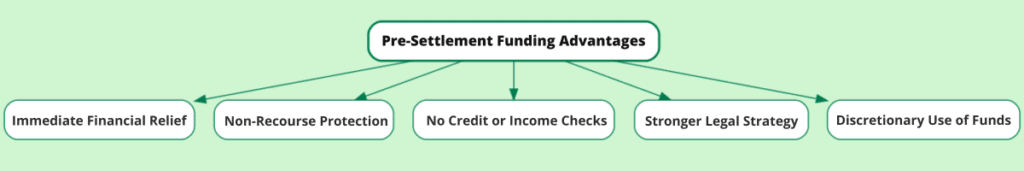

Pros and Cons of Pre-Settlement Funding Infographic

What Is Pre-Settlement Funding?

Pre-settlement funding is a type of cash advance against the expected outcome of a lawsuit. It is non-recourse, meaning repayment is only owed if the plaintiff wins or settles the case. Unlike loans, which are based on credit scores and income, pre-settlement funding approval depends on the strength of the case.

This option is commonly used by personal injury plaintiffs, such as those injured in car accidents, workplace incidents, or slip-and-fall cases. Because lawsuits can take months or years to resolve, pre-settlement funding is designed to help claimants pay for everyday expenses during the wait.

⚡ Ready to get pre-settlement funding? Apply online today and access cash fast.

How Pre-Settlement Funding Works

- Application: The plaintiff (or their attorney on their behalf) applies with a legal funding company.

- Attorney Cooperation: The company requests case details from the lawyer, including liability, damages, and insurance policy limits.

- Case Evaluation: Underwriters review the legal claim’s likelihood of success and potential settlement value.

- Approval & Advance: If approved, the plaintiff receives an offer amount and a funding contract. Once signed, they receive their lump sum cash payment (often within 24–48 hours).

- Repayment: If the case is successful, the funding company collects repayment directly from the settlement. If the case is lost, the plaintiff owes nothing.

👉 Want to dive deeper? Explore our full guide: What Is Legal Funding and How Does It Work?

Who Qualifies for Pre-Settlement Funding?

Most plaintiffs in personal injury and accident cases may qualify for pre-settlement funding if they have an attorney working on a contingency fee basis. Approval is based on the strength of the case, liability, damages, and available insurance coverage, not credit or income.

Plaintiffs without legal representation or cases with weak evidence or disputed liability typically will not qualify.

Pros and Cons of Pre-Settlement Funding

| Pro/Con | Details |

|---|---|

| ✅ Immediate Financial Relief | Provides fast access to cash—often within 24–48 hours—to cover rent, groceries, utilities, and medical bills while waiting for a lawsuit to settle. |

| ✅ Non-Recourse Protection | Repayment is only required if the case is successful. If the plaintiff loses, they owe nothing, shifting the risk to the funding company. |

| ✅ No Credit or Income Checks | Approval is based on the strength of the lawsuit, not credit history, employment status, or income, making it accessible for plaintiffs in financial hardship. |

| ✅ Stronger Legal Strategy | By reducing financial stress, funding allows plaintiffs to avoid lowball settlement offers and gives attorneys time to pursue maximum compensation. |

| ✅ Discretionary Use of Funds | Funds can be used for any expense—childcare, housing, medical treatment, transportation, or daily bills—offering flexibility during litigation. |

| ❌ High Costs | Fees and compounding charges are typically higher than traditional financing. A $5,000 advance can grow to $10,000+ if a case takes years to resolve. |

| ❌ Limited Eligibility | Only strong cases with clear liability, documented damages, and insurance coverage typically qualify, leaving some plaintiffs without access. |

| ❌ Attorney Involvement Required | Funding cannot proceed without lawyer cooperation, as case documents and updates are needed to evaluate risk and approve funding. |

| ❌ Lack of Loan Protections | Since it’s legally a non-recourse cash advance, standard lending regulations and consumer protections do not apply to funding contracts. |

| ❌ Risk of Over-Borrowing | Plaintiffs may be approved for more money than they need, which increases repayment amounts and reduces their final settlement share. |

Pros of Pre-Settlement Funding

Here’s a closer look at the benefits of pre-settlement funding in detail:

Pre-settlement funding can provide much-needed financial support while you wait for your case to resolve. Beyond quick access to cash, it offers unique protections and advantages that traditional loans cannot match.

From non-recourse terms that safeguard you if you lose your case to the freedom of using funds however you need, these benefits can make a real difference in both your personal finances and legal strategy.

Immediate Financial Relief

Pre-settlement funding provides fast access to cash when plaintiffs need it most. Lawsuits can drag on for months or even years, leaving injured victims struggling to cover daily costs. With a pre-settlement advance, funds are typically available within 24–48 hours after approval.

This quick turnaround helps plaintiffs pay rent, groceries, utilities, and medical bills without falling behind financially during the legal process.

Non-Recourse Protection (No Repayment If You Lose)

One of the biggest benefits of pre-settlement funding is that it is non-recourse, meaning repayment is only required if the case is successful. If the lawsuit is lost, the plaintiff owes nothing. This unique structure shifts the financial risk to the funding company, not the injured party.

Unlike traditional loans, where borrowers are personally responsible for repayment, pre-settlement funding provides peace of mind and financial security during uncertain litigation without the risk.

Learn more in this relevant guide: What Is Non-Recourse Legal Funding?

No Credit or Income Checks

Eligibility for pre-settlement funding is based on the strength and value of the case, not personal finances. Plaintiffs with poor credit, limited income, or no employment history can still qualify since the funding decision depends on liability, damages, and insurance coverage.

This makes it an attractive option for accident victims who may already be facing financial hardship and cannot qualify for traditional financing options. Plus, it has no negative impact on credit scores.

Relevant guide: Do Pre-Settlement Funding Companies Require Credit Checks?

Stronger Legal Strategy

Financial stress often forces plaintiffs to accept lowball settlement offers just to pay their bills. Pre-settlement funding allows claimants to maintain stability while their attorney fights for the maximum compensation their case deserves.

With living expenses covered, plaintiffs can avoid settling too early and instead give their lawyer the time needed to gather evidence, negotiate effectively, or even prepare for trial if necessary. This increases the likelihood of a fair and full settlement.

Discretionary Use of Funds

Once approved, plaintiffs have full control over how the money is spent. Unlike certain financial products that restrict use, pre-settlement funding can be applied to any expense the plaintiff chooses—whether it’s childcare, housing, medical treatment, transportation, or household bills.

This flexibility ensures that the settlement advance supports the plaintiff’s most urgent needs, providing both convenience and peace of mind.

Cons of Pre-Settlement Funding

Here’s a closer look at the drawbacks of pre-settlement funding in detail:

While pre-settlement funding can offer valuable financial relief, it also comes with important trade-offs that claimants should consider. High interest rates and fees can reduce the portion of your eventual settlement. Eligibility is often limited, and attorney participation is mandatory, which may slow down the process.

Unlike traditional loans, these advances lack certain consumer protections, and there is always the risk of borrowing more than you truly need.

High Interest Rates and Costs

The most significant disadvantage of pre-settlement funding is its expense compared to traditional financing options. Legal funding companies charge fees for the risk they assume, and those fees are typically higher than those of credit cards, personal loans, or bank financing.

In addition, many contracts use monthly or compounding rates, which means the longer a case lasts, the more the repayment grows.

For example, a $5,000 advance could end up costing $10,000 or more if the lawsuit takes years to resolve. This can leave plaintiffs with a much smaller share of their settlement than they expected.

Relevant read: How Much Does Pre-Settlement Legal Funding Cost?

Limited Eligibility

Not every lawsuit qualifies for pre-settlement funding. Companies usually only approve cases with clear liability, strong damages, and an insurance policy available for recovery. Cases that involve disputed fault, minimal medical treatment, or uncertain damages may be denied.

This means that even if a plaintiff urgently needs money, approval is not guaranteed.

The strict requirements can make funding unavailable to plaintiffs with weaker or more complex cases.

Attorney Involvement Required

Pre-settlement funding cannot proceed without the active cooperation of the plaintiff’s attorney. The legal funding company will request case documents, liability assessments, and updates to evaluate risk. If an attorney refuses to work with the funder or is slow to provide documents, the approval process may be delayed—or denied altogether.

This can frustrate plaintiffs who need immediate cash but must rely on their lawyer to complete the legal funding process.

Lack of Consumer Loan Protections

Since pre-settlement funding is legally classified as a non-recourse cash advance and not a traditional loan, many standard consumer lending protections do not apply. Regulations that govern interest rates, loan disclosures, or predatory lending may not extend to lawsuit funding agreements.

As a result, contracts can be harder for consumers to challenge if the terms feel unclear or unfair. This makes it especially important for plaintiffs to read the contract carefully and ask their attorney to review the terms before signing.

Risk of Over-Borrowing

Because pre-settlement funding is based on the projected value of a case, some plaintiffs may be approved for more money than they truly need.

Taking a larger advance can feel helpful in the moment, but it increases the repayment amount and can dramatically reduce the net settlement a plaintiff keeps.

For this reason, many attorneys recommend borrowing only the minimum necessary to cover essential living expenses.

Ultimately, pre-settlement funding can be a valuable tool for some plaintiffs, but it should be used carefully and only after weighing these pros and cons with your attorney.

Wondering how much pre-settlement funding you qualify for and where to draw the line? Explore our guide: How Much Pre-Settlement Funding Can I Get on My Case?

Example of Pre-Settlement Funding Costs

Suppose a plaintiff is advanced $10,000 on a case expected to settle for $50,000. If the case resolves quickly, repayment might total $12,500.

But if the case takes two years, compounding fees could push repayment to $20,000 or more. That leaves the plaintiff with much less from their final settlement.

This illustrates why legal funding can be both a lifeline and a costly option depending on timing.

Attorney and Court Perspectives on Pre-Settlement Funding

Attorney Perspectives

Many lawyers view pre-settlement funding as a valuable tool to ease financial pressure on clients during lengthy cases. By helping plaintiffs cover essential expenses, funding can prevent them from settling too early. At the same time, attorneys often warn clients about the high costs and potential impact on final recovery, usually advising that they borrow only what is truly necessary.

Court Perspectives

Most courts permit pre-settlement funding because it is classified as a non-recourse cash advance rather than a loan. Still, some jurisdictions have raised concerns about high rates and limited consumer protections, leading to debates over tighter regulations and new statutes. These discussions emphasize the importance of clear, transparent contracts to safeguard plaintiffs.

Alternatives to Pre-Settlement Funding

While pre-settlement funding can be a lifeline, it’s often a last-resort solution. Alternatives include:

- Personal Loans: Lower interest rates, but require credit checks and income verification.

- Credit Cards: Useful for short-term expenses but risky if balances aren’t repaid quickly.

- Borrow from Family or Friends: Can provide interest-free help, but may strain relationships.

- Community Assistance Programs: Some nonprofits and state agencies offer aid for housing, utilities, or medical bills.

Discover more alternatives in this in-depth guide: 15 Alternatives to Lawsuit Loans: Pros, Cons, & How to Apply

Is pre-settlement funding worth it?

Pre-settlement funding can be worth it for plaintiffs who need immediate financial relief and have limited alternatives, since repayment is only required if the case is won. However, because fees can reduce the final settlement, it should be used carefully and only for essential expenses.

When does pre-settlement funding make sense?

Pre-settlement funding may be appropriate if:

- You face urgent expenses like rent or medical bills.

- You have no other affordable financial options.

- Your attorney believes your case has strong settlement potential.

- You understand the costs and are comfortable with how much you’ll owe if you win.

If you have other sources of funding or savings, it’s often better to exhaust those first before turning to legal funding.

How long does pre-settlement funding take?

Most pre-settlement funding applications are processed quickly, with approval and funding typically completed within 24 to 48 hours once the attorney provides case information to the funding company. In some situations, plaintiffs may receive cash the same day after their attorney submits the necessary documents.

Bottom Line: Advantages and Disadvantages of Pre-Settlement Funding

Pre-settlement funding offers fast, risk-free cash for plaintiffs waiting on a settlement, but the costs can take a large portion of the final recovery. For some, it is a necessary tool to stay afloat during a long lawsuit. For others, the high rates may outweigh the benefits.

The key is to weigh your financial needs against the potential reduction in your payout and review all terms with your attorney before signing.

Express Legal Funding: Affordable, Transparent Pre-Settlement Lawsuit Funding

At Express Legal Funding, we provide fast, risk-free cash advances to help plaintiffs cover essential living expenses while their case is pending. Our process is simple, transparent, and affordable—unlike lawsuit loan companies that often charge excessive fees.

By offering direct funding at lower rates, we help you keep more of your settlement while still getting the financial relief you need now.

Discover why Express Legal Funding is the trusted choice in our guide: 10 Reasons to Choose Express Legal Funding

Get Pre-Settlement Funding Fast — Apply Online in Minutes

At Express Legal Funding, we make the process simple, transparent, and risk-free. Apply now to cover your essential expenses while your case is pending. Approval is based on the strength of your case—not your credit or income.