If you’ve already received legal funding for your lawsuit, you might be wondering if you can qualify for another advance. The short answer is yes—many plaintiffs receive more than one pre settlement loan as their case progresses.

Can You Get Multiple Pre Settlement Loans?

Yes. There is no legal limit to the number of pre-settlement loans you can receive. However, funding companies will typically only approve another advance if your case still has enough remaining settlement value to support it. Each new request is evaluated based on updated case information, damages, and how much has already been advanced.

Relevant read: How Much Pre Settlement Funding Can I Get on My Case?

How Getting More Than One Pre Settlement Loan Works

What Is a Pre Settlement Loan?

A pre settlement loan—also known as legal funding or a lawsuit cash advance—is a form of non-recourse funding provided to plaintiffs involved in active lawsuits. Unlike traditional loans, these advances are only repaid if you win or settle your case.

Disclaimer: While commonly referred to as “pre settlement loans,” these transactions are typically not classified as loans in most states; the term “loan” is used here for accessibility and ease of understanding.

The purpose of pre-settlement funding is to help injured plaintiffs cover essential expenses while they wait for their lawsuit to resolve. This includes rent, utilities, groceries, and transportation costs—especially helpful during times when they’re unable to work due to the injuries caused by someone else’s negligence.

Pre-settlement loans are commonly used in litigation involving personal injury, car accidents, employment discrimination, and product liability claims.

How Pre Settlement Loans Support Personal Injury Plaintiffs

Pre settlement loans are especially helpful in personal injury lawsuits, where plaintiffs often find themselves out of work and under financial pressure due to rising medical expenses.

Many applicants are accident victims who are pursuing compensation for damages, including:

- Lost wages

- Medical expenses

- Pain and suffering

In these situations, lawsuit funding provides plaintiffs with critical financial support, helping them stay afloat and avoid feeling pressured to accept an early, lowball settlement offer from the insurance company.

To determine how much funding to offer, legal funding underwriters evaluate the anticipated damages, insurance policy limits, and overall strength of the case. Their goal is to ensure the amount advanced is both reasonable and low-risk—avoiding overfunding that could reduce the plaintiff’s potential recovery at settlement.

⏳ Waiting for your personal injury lawsuit, but need money now? 💵 Apply for a Personal Injury Loan today!

How Many Pre Settlement Loans Can You Get?

You can receive more than one pre settlement loan during the course of your lawsuit.

Each time you request a new advance, the funding company will reassess your case to determine if there’s enough remaining settlement value to justify additional funding. That includes reviewing your damages, case progression, and how much you’ve already been advanced.

Real-World Example: Express Legal Funding Clients Often Receive Multiple Advances

At Express Legal Funding, it’s common for clients to request and receive more than one lawsuit cash advance.

In fact, the average client receives 1.69 advances per case. This demonstrates the company’s flexible approach to lawsuit funding and its commitment to helping clients meet their financial needs throughout the litigation process.

As a case progresses—especially when new updates increase the expected settlement value—a client may qualify for a second or even third round of funding.

Client Testimonial: How Multiple Pre Settlement Loans Helped Edward Stay Afloat

“Thank you for always helping. You’ve been a true blessing. Melissa is amazing—so kind, supportive, and always there when I needed her.”

— Edward C.

What Determines If You Qualify for Additional Lawsuit Funding?

Whether or not you qualify for more lawsuit funding depends on a variety of factors, including:

- The strength and current stage of your litigation

- The total amount of damages being claimed (e.g., medical bills, lost income, pain and suffering)

- How much has already been advanced

- The estimated value of your future settlement

- Attorney cooperation and updates on your case status

Legal funding companies look to ensure there’s enough remaining value in the case to appropriately issue more funds without jeopardizing your potential recovery.

Understanding the Contract Terms When Accepting Multiple Lawsuit Advances

It’s important to review the pre-settlement funding contract carefully, especially if you plan to request multiple advances. Key clauses to pay attention to include:

- Whether the agreement allows for future advances: This clause specifies if you’re eligible to request additional funding under the same agreement or if new approval is required each time.

- The fee or interest structure, particularly for compounded funding: It’s important to understand how fees or interest will accumulate over time, especially if the funding compounds monthly, quarterly, or bi-annually.

- Penalties or limitations for early resolution or default: This outlines any financial consequences or restrictions if your case settles quickly or if you fail to meet the contract terms.

- Lien management and whether a new contract or amendment is required for each advance: This details how liens are handled and whether a new contract must be signed for each additional advance.

Most companies require a new or amended contract for every round of funding, which your attorney must sign and approve to ensure all legal and ethical obligations are met.

How Does the Process Work for Getting Another Advance on Your Lawsuit Settlement?

Here’s how the process typically works if you need another lawsuit cash advance:

- Contact your original funder or reach out to a new legal funding company.

- Your attorney submits updated case information, such as new medical records or settlement negotiations.

- The funding company re-evaluates your case, focusing on outstanding damages and prior advances.

- If the case still has sufficient value, a new funding offer is issued, usually within 24–48 hours.

Are There Risks to Taking Multiple Pre Settlement Loans?

While pre-settlement funding can be incredibly helpful, taking multiple advances can come with certain risks:

- Reduced final payout: Since pre settlement funding is an advance on your expected settlement, receiving more funds means a larger portion of your recovery will go toward repaying those advances.

- Increased fees: Multiple advances may compound interest or increase the overall cost of the funding.

- Overfunding: If you borrow too much money, there may not be enough left from your case to repay everyone involved.

- Attorney resistance: Some attorneys may be reluctant to approve further funding if they feel it puts your recovery at risk.

That’s why it’s important to have a transparent conversation with both your legal funding company and your attorney before taking additional advances.

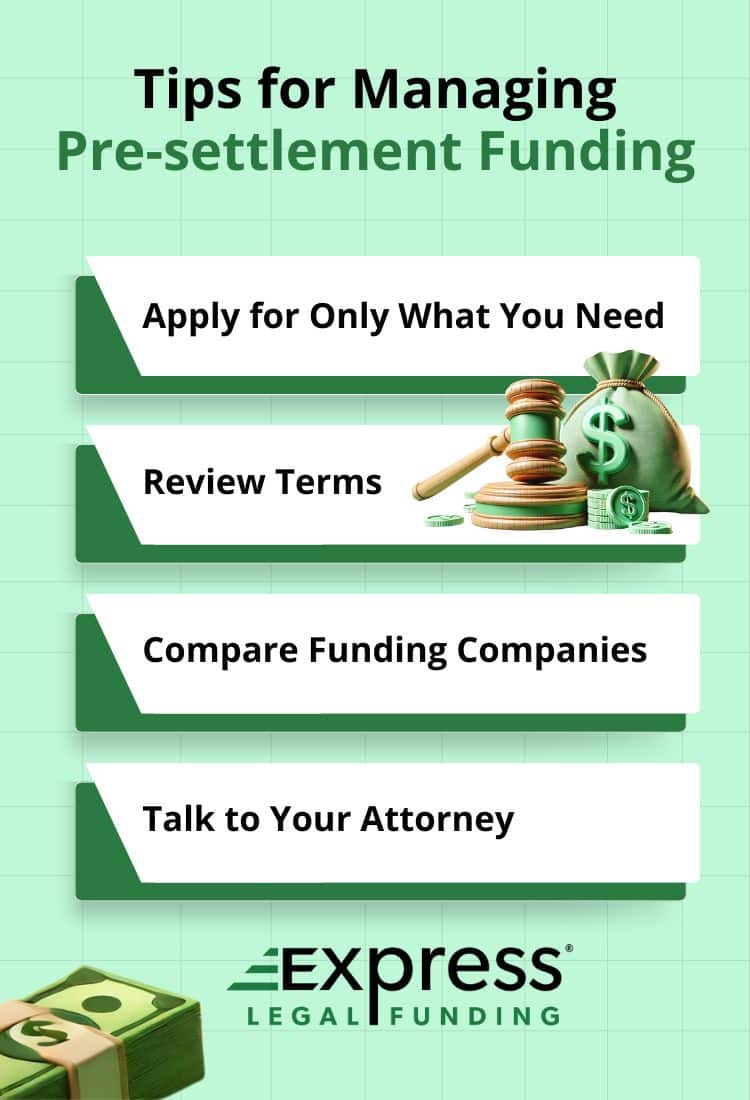

Tips for Managing Multiple Pre Settlement Fundings

If you’re considering or already have more than one pre settlement advance, here are some practical tips to help you manage them wisely:

- Keep Detailed Records: Track the amount, date, and terms of each advance, including contract copies and payoff statements.

- Communicate With Your Attorney: Always inform your lawyer before applying for additional funding. Their cooperation is required, and they can help avoid overfunding.

- Understand the True Cost: Review the interest rates, fees, and how charges compound over time. Ask for a full payoff estimate.

- Avoid Stacking Funders Without a Buyout: Whenever possible, work with companies that will pay off your prior advance to avoid multiple liens on your settlement.

- Don’t Borrow More Than You Need: Only request what’s necessary to cover living expenses or urgent bills during your lawsuit. Overfunding reduces your potential recovery.

Proper management helps ensure you get the financial support you need—without compromising your case outcome.

Should You Use More Than One Legal Funding Company?

Yes, you can use more than one legal funding company, but it should be done carefully with proper oversight and documentation to avoid stacking liens, increased costs, and potential complications with your attorney and settlement.

You might need to use a different legal funding company if:

- Your current provider won’t offer additional funding

- You’re offered better terms or a higher amount by another funder

- The original funder is unresponsive or slow

- You’re looking to refinance an expensive advance

Here are some important things to know:

- Some companies will buy out your previous advance, rolling the balance into a new contract.

- Others may stack their lien on top of the existing one, which increases the total amount deducted from your settlement.

- Attorney cooperation is essential. They must verify all active liens and ensure contracts are properly recorded.

- Always keep clear records of all contracts, payoff amounts, and communication between funders and your legal team.

Switching or combining funders can work in your favor—but only if handled correctly.

FAQs About Multiple Pre-Settlement Loans

Yes, you can get a second lawsuit loan from a different legal funding company as long as you qualify and your attorney consents. Some companies specialize in buying out prior advances, which means they pay off your existing lien and issue a new funding agreement. Always consult your attorney before switching or adding funders to ensure all liens are disclosed and properly managed.

Yes, your lawyer must approve each additional pre-settlement loan. Legal funding companies require attorney cooperation to verify the status of your case, confirm any new damages or developments, and ensure the funding complies with ethical and legal guidelines. Without your attorney’s consent, additional funding cannot be issued.

Yes, you can be denied additional pre-settlement funding after receiving a prior advance. Legal funding companies reassess your case each time, and if your expected damages are too low, your case is close to settling, or there are existing liens, your request may be declined. Attorney cooperation is also required for approval.

If you lose your case, you don’t have to repay any of the pre-settlement advances—even if you received multiple rounds of funding. Pre-settlement funding is non-recourse, meaning you only repay if you win or settle. The funding company assumes the risk, not you.

Conclusion: Can You Get More Than One Pre-Settlement Loan?

Getting more than one pre-settlement loan is not only possible—it’s common, particularly in personal injury litigation, where cases can take months or even years to resolve.

Companies like Express Legal Funding help plaintiffs navigate the financial challenges of litigation by offering multiple advances based on updated evaluations and expected damages.

As always, read every contract carefully and work closely with your attorney to ensure you’re making the best decisions for your long-term outcome.

📞 Get More Legal Funding from a Trusted Source

If you’ve already received a lawsuit cash advance and need more support, Express Legal Funding is here to help. With fast approvals, transparent terms, and no-risk funding, we make it easy to get the financial relief you need—again.

- ✅ Already funded once? You may still qualify.

- 📲 Call now at (888) 232-9223 or apply online to see how much more you can get.

- ⚖️ Let your attorney keep fighting your case while you stay financially strong.

Don’t wait. Get the cash you need today—before your case settles. Benefit from our top-rated service and low rates.