Looking for a reliable lawsuit loan calculator to estimate your total cost before applying?

Free Lawsuit Loan Calculator

Use this free lawsuit loan calculator from Express Legal Funding to instantly calculate how much your pre-settlement funding might cost—no email or personal info required.

The tool is fast, anonymous, and designed to help you avoid hidden fees, inflated payoffs, and misleading terms. Our legal funding is 100% risk-free and non-recourse, so you only repay if you win or settle your case.

This lawsuit loan calculator is ideal for personal injury plaintiffs and accident victims who need money now but want to make informed financial decisions. Estimate your total repayment upfront and choose the best legal funding offer with confidence.

Certified Accuracy: The lawsuit loan calculator on this page has been verified by Legal Funders for Actually Fair Funding (LFAFF) to ensure fair and transparent funding estimates.

Ready to try it out?

👉 Skip to the Lawsuit Loan Calculator to estimate your pre-settlement funding costs now.

What Is a Lawsuit Loan Calculator?

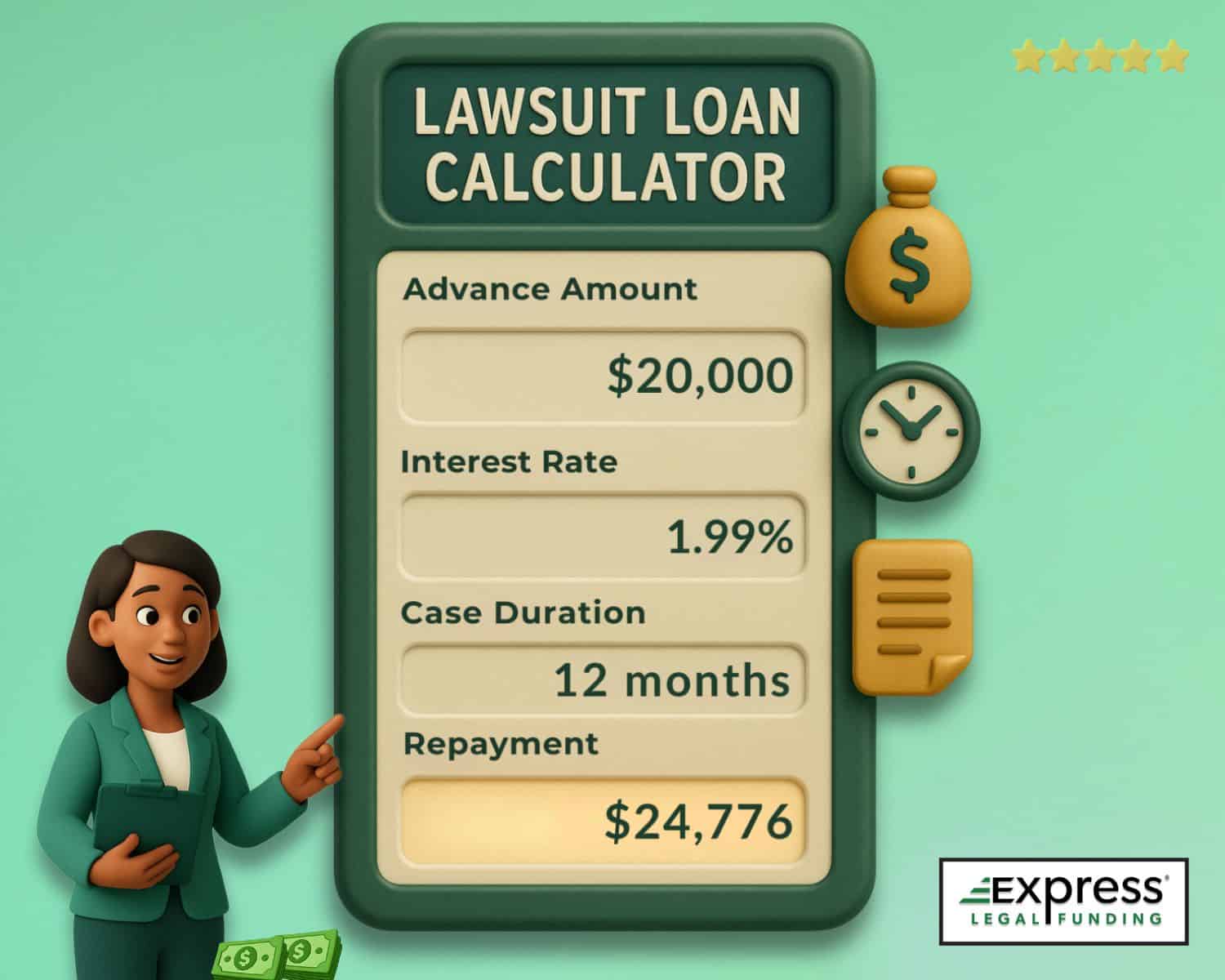

A lawsuit loan calculator is a financial tool that estimates your total repayment (also called ‘payoff’) based on your advance amount, interest rate, loan duration, and any fees. It helps plaintiffs understand how much they’ll owe at settlement before applying for pre-settlement funding.

Unlike traditional loans, lawsuit loans are non-recourse, meaning you only repay if you win or settle your case.

Calculate Your Total Lawsuit Loan Repayment

This lawsuit loan calculator helps you make informed decisions by showing the potential cost of legal funding before you apply.

Ready to apply for an advance on your settlement?

Apply Online for Pre-Settlement Funding

What Are Lawsuit Loans and How Do They Help Personal Injury Plaintiffs?

A lawsuit loan—also known as pre-settlement funding—is a form of financial support provided to plaintiffs with ongoing legal claims. Unlike traditional loans, lawsuit loans are non-recourse, meaning you only repay the advance if you win or settle your case.

Injured plaintiffs often face serious financial pressure while their cases are still pending. Medical bills, lost wages, and daily living expenses can quickly pile up, especially when a lawsuit takes months or even years to resolve. Without access to income, many plaintiffs struggle to stay afloat.

Pre-settlement funding provides immediate cash to cover essential costs, allowing plaintiffs to focus on recovery and their legal case without the added burden of financial stress. This can be critical to maintaining stability and ensuring they don’t feel forced into accepting a lowball settlement.

It’s important to understand that lawsuit loans come with higher interest rates than traditional loans due to the risk taken by the funding company. That’s why using a tool like the Lawsuit Loan Calculator is so valuable—it helps you estimate potential repayment amounts before applying, ensuring you make an informed decision.

Relevant read: What Is a Lawsuit Loan & How Does the Process Work?

How a Pre-Settlement Loan Calculator Works to Estimate Your Total Repayment

A lawsuit loan calculator works by estimating the total payoff amount based on four key factors:

- Advance Amount: The initial funding you receive (e.g., $3,000, $10,000, or $15,000).

- Monthly Interest Rate: Typically ranges from 2% to 4%, applied as either simple or compound interest.

- Time Until Settlement: The number of months your case is expected to remain active (e.g., 6, 12, 18, or 24 months).

- Fees: Additional costs like origination fees, processing, or underwriting fees.

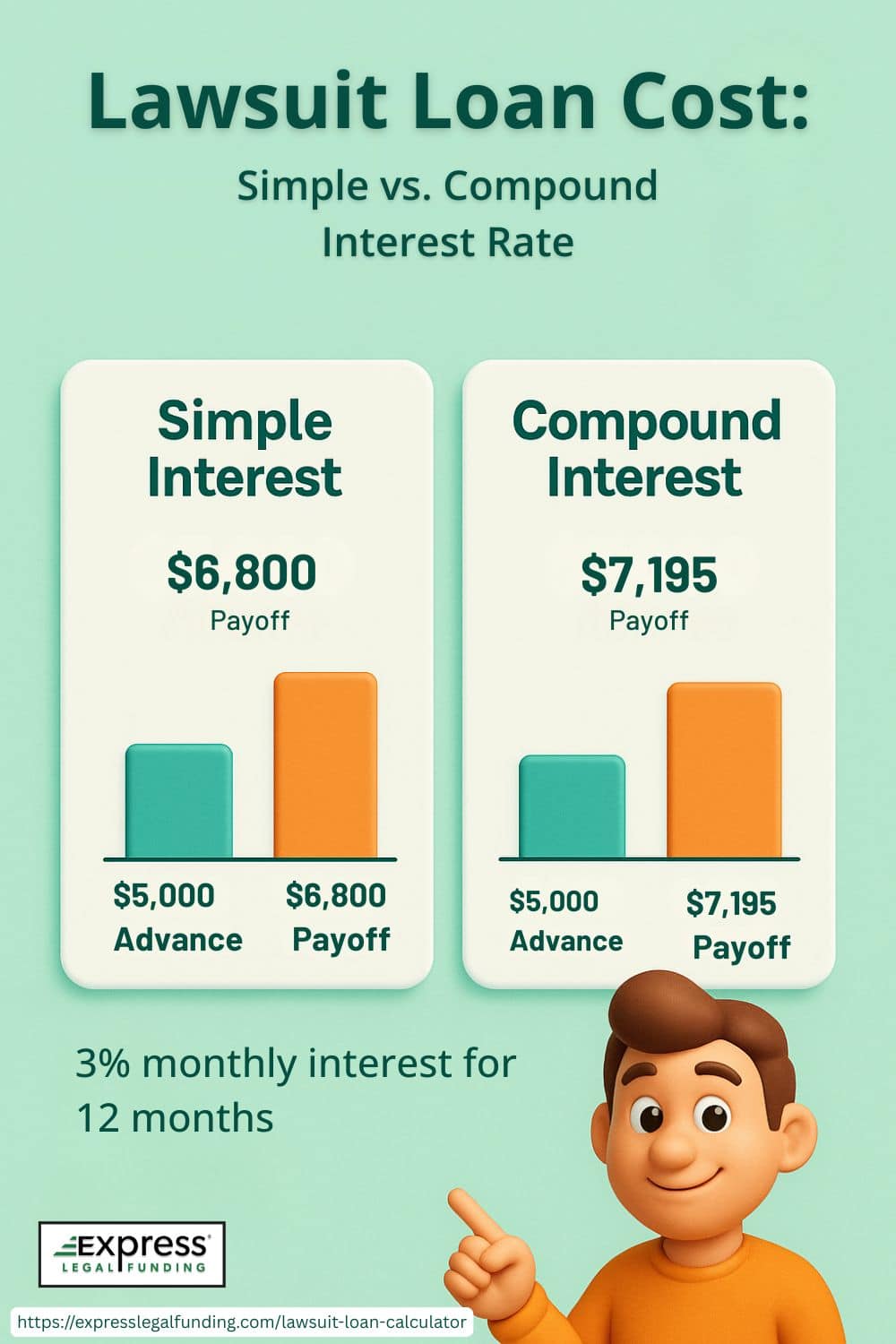

The calculator uses these inputs to estimate your final repayment amount, showing how much you’ll owe when your case resolves. For example, with a $5,000 advance at 3% monthly compound interest over 12 months, the payoff could reach or exceed $7,000 depending on duration.

The most helpful lawsuit loan calculators also allow you to compare simple vs. compound interest to help you understand the difference in cost.

Compound interest is calculated monthly by applying the interest rate to the updated balance, which includes previously accrued interest. This results in a higher payoff over time, especially in longer cases

By using a lawsuit loan calculator before you apply, you can preview your potential repayment, avoid surprises, and choose a provider with fair terms.

How to Use Express Legal Funding’s Lawsuit Loan Calculator (Step-by-Step Instructions)

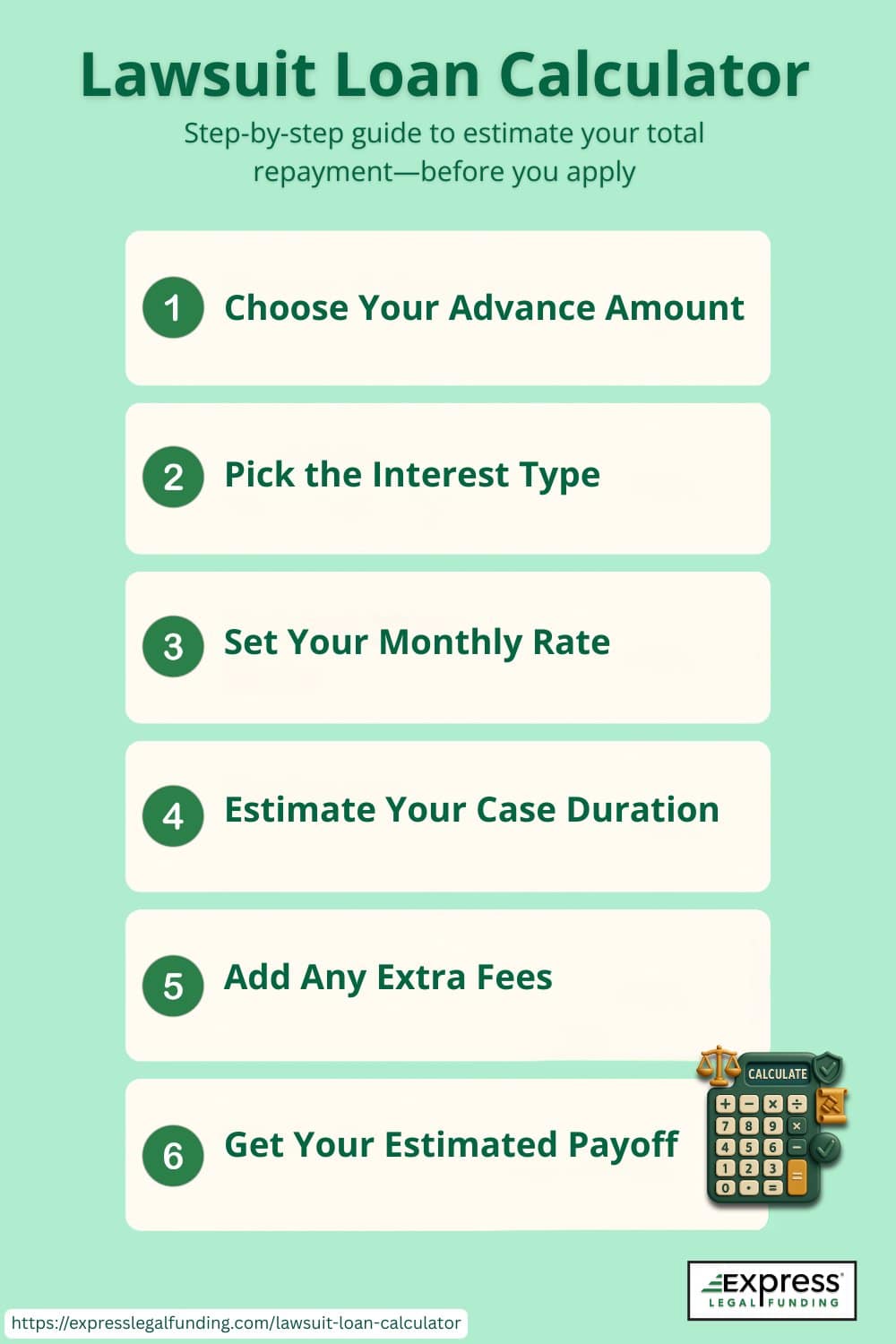

Using our lawsuit loan calculator is easy and only takes a few seconds. Follow these steps to estimate your total payoff cost:

- Enter Your Advance Amount – Type in how much funding you need (e.g., $3,000).

- Choose an Interest Type – Select between simple or compound interest, depending on what applies.

- Set the Monthly Interest Rate – Use the dropdown or input field to select your estimated rate (typically 2%–4%).

- Estimate the Duration of Your Case – Select how many months you expect until settlement (e.g., 12 months). You can ask your attorney for an estimate.

- Add Any Additional Fees – If known, include origination or processing fees.

- View Your Results – Instantly see your estimated total repayment amount and cost breakdown.

Pro Tip: Use the calculator to test different durations and interest types so you can make the most informed decision before applying.

No Email Required — Instant Lawsuit Loan Cost Results

Our lawsuit loan calculator is 100% free to use and doesn’t ask for your email or personal information. Get an instant estimate of your total payoff without signing up or submitting a form.

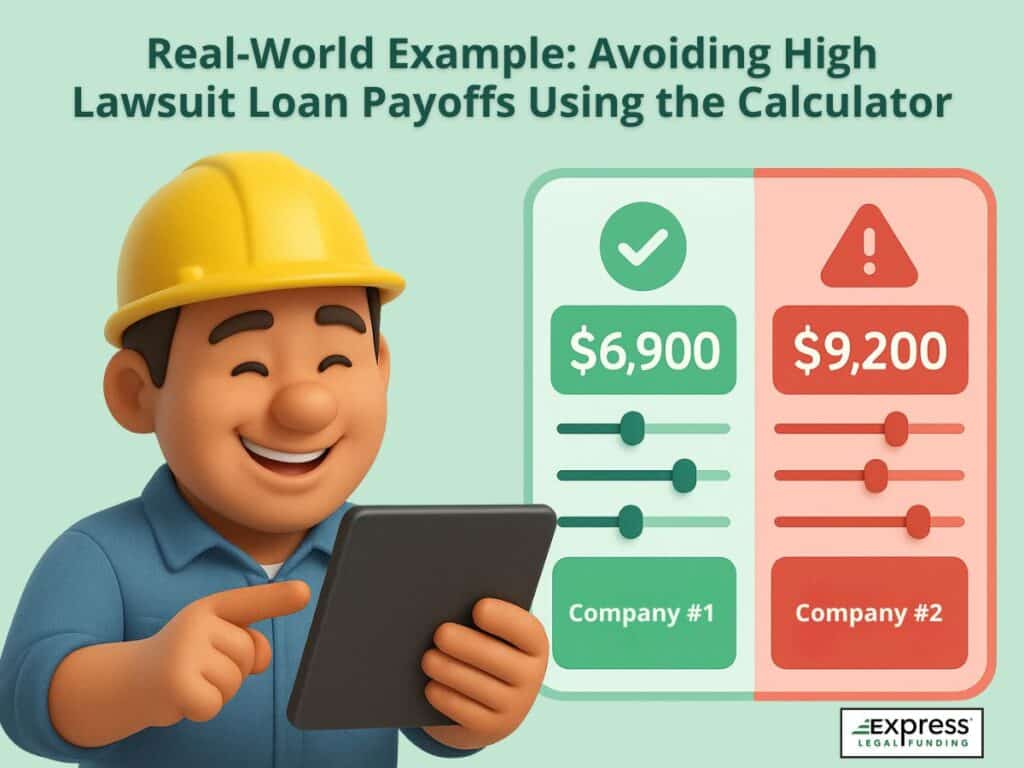

Real-World Example: Avoiding High Lawsuit Loan Payoffs Using the Calculator

José, an oilfield worker from Texas, was seriously injured in a car accident and couldn’t return to work. Facing mounting medical bills and rent, he needed a $5,000 lawsuit loan to stay financially afloat. His lawyer estimated the case would settle in approximately 12 months.

Express Legal Funding Lawsuit Loan Calculator Cost Estimate:

He used Express Legal Funding’s calculator to estimate his potential cost:

- Advance: $5,000

- Rate: 3% monthly, simple interest

- Duration: 12 months

- Fees: $100

👉 Estimated Payoff: $6,900

Another provider offered him a similar lawsuit loan, but with 5% compound interest and a $300 fee. His estimated total repayment there was over $9,200, almost double what he borrowed.

Thanks to the lawsuit loan calculator, José chose the lower-cost, transparent option and avoided over $2,000 in extra costs.

Lawsuit Loan Calculator

Use this free lawsuit loan calculator to estimate how much your pre-settlement funding will cost.

This calculator provides general cost estimates only. It is not an offer of funding or an advertisement of rates. See full disclaimer below.

Haven’t applied yet? This lawsuit loan calculator offers a helpful estimate, but your actual funding terms may vary based on your case and the provider you choose.

For the most accurate results, compare your estimate with real quotes from legal funding companies, and always request a full cost breakdown before signing any agreement.

🟢 Apply Online for Pre-Settlement Legal Funding. We make it quick and easy!

Lawsuit Loan Cost Examples by Interest Type and Duration

Here are sample scenarios based on a $5,000 advance at typical monthly interest rates to help you better understand how a lawsuit loan calculator estimates your payoff amount.

Example 1: Simple Interest Lawsuit Loan Repayment Estimates – 3% per Month (Based on a $5,000 Advance)

| Duration (Months) | Interest Owed | Total Payoff |

|---|---|---|

| 6 months | $900 | $5,900 |

| 12 months | $1,800 | $6,800 |

| 18 months | $2,700 | $7,700 |

| 24 months | $3,600 | $8,600 |

Formula:

- Simple Interest = Principal × Rate × Time

- $5,000 × 0.03 × 12 = $1,800 in interest (12-month example)

Example 2: Compound Interest Lawsuit Loan Repayment Estimates – 3% per Month (Based on a $5,000 Advance)

| Duration (Months) | Interest Owed | Total Payoff |

|---|---|---|

| 6 months | $955 | $5,955 |

| 12 months | $2,195 | $7,195 |

| 18 months | $3,694 | $8,694 |

| 24 months | $5,477 | $10,477 |

Formula:

- Compound Interest = Principal × (1 + Rate)^Time − Principal

- $5,000 × (1.03)^12 − $5,000 ≈ $2,195 in interest

Expert Tip: Always check if the provider uses simple or compound interest, and whether a repayment cap (e.g., 2x your funding amount) applies. This can make a huge difference in how much of your settlement you keep.

Repayment Caps Explained: How to Avoid Unlimited Payoffs on Lawsuit Loans

A repayment cap limits how much you’ll owe, regardless of how long your case takes. For example, a two-times (2x) cap on a $5,000 advance means you’ll never pay more than $10,000—no matter the case duration. Not all providers offer this, so always ask if a cap applies.

Comparing Pre-Settlement Loan Offers: Use Calculator Results to Spot the Best Deal

Once you’ve used a lawsuit loan calculator to estimate your total payoff, the next step is to compare providers to find the best terms. Here’s what to look for:

- Monthly Interest Rate: Lower is better. Some providers offer 2%–3%, while others may charge 4% or more.

- Interest Type: Confirm whether the provider uses simple or compound interest—compound interest grows faster and can significantly increase your repayment.

- Fees: Watch for hidden costs like application, processing, or underwriting fees.

- Repayment Caps: Some companies cap your total repayment (e.g., at 2x the advance), protecting you if your case takes years to resolve.

- Funding Transparency: Reputable legal funders clearly explain how your payoff grows over time and what terms apply.

Tip: Use your lawsuit loan calculator results as a benchmark. If a provider’s offer costs much higher than your estimated payoff using the advertised interest rate, ask for a breakdown of all fees or shop elsewhere.

By comparing lawsuit loan providers with your calculator results in hand, you can avoid predatory contracts and choose the most affordable pre-settlement funding option.

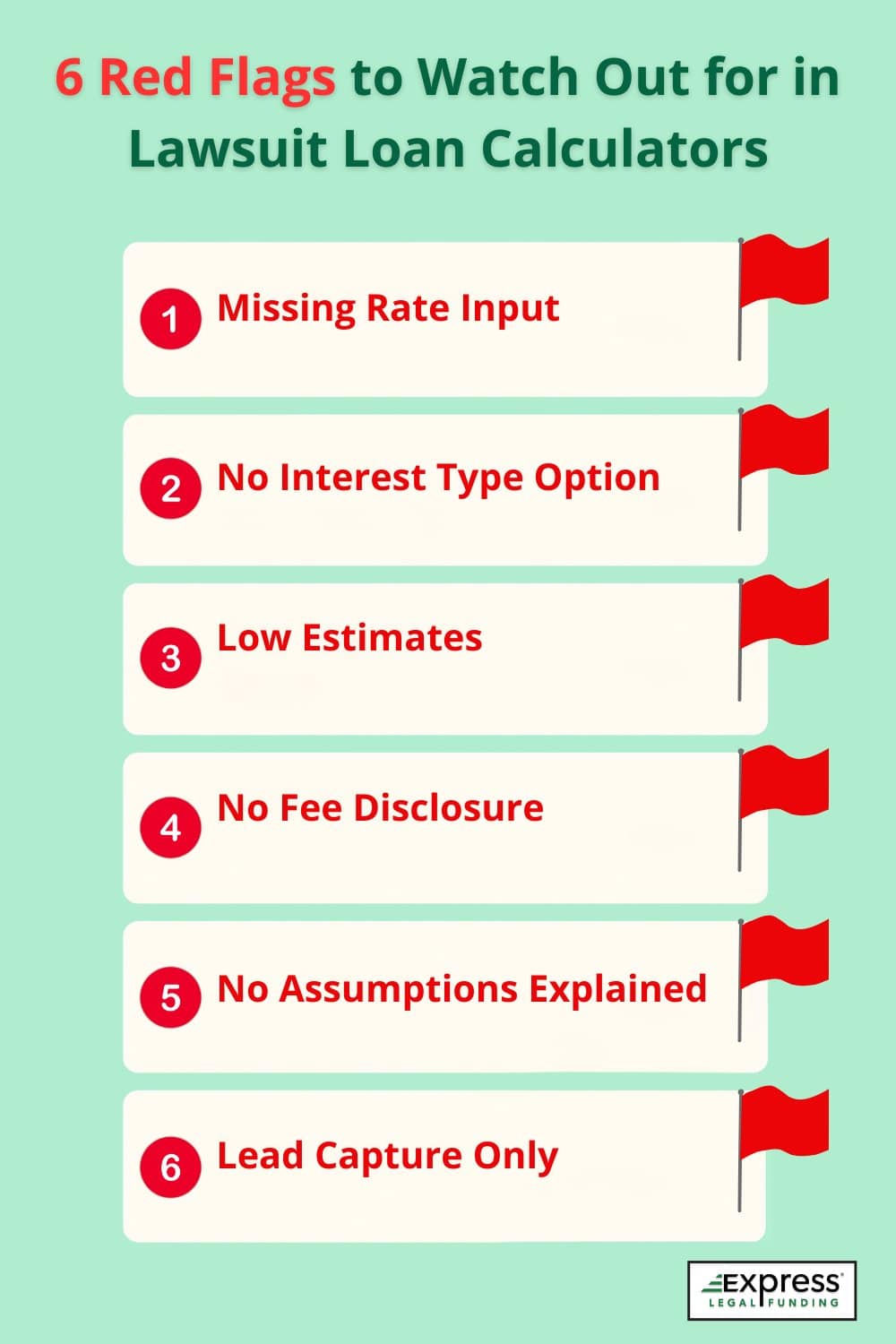

6 Red Flags to Watch Out for in Lawsuit Loan Calculators

While a lawsuit loan calculator is a helpful tool, not all calculators, or the companies behind them, are created equal. Some tools are designed more for marketing than accuracy, and others may lead you into expensive or unclear funding agreements.

🚩 Here are common red flags to watch for:

1. Missing or Hidden Interest Rate Inputs

If a lawsuit loan calculator doesn’t let you input or adjust the interest rate, it likely won’t provide a realistic cost estimate. Always look for calculators that are transparent about rates and let you enter your own.

2. No Option to Choose Interest Type (Simple vs. Compound)

A calculator that only assumes simple interest may dramatically understate your actual cost, especially if the provider charges compound interest, which grows faster over time.

3. Unrealistically Low Payoff Estimates

Some calculators are designed to underestimate the total payoff to make the loan appear cheaper than it really is. If the results seem too good to be true, request a written quote or ask how the numbers were calculated.

4. No Mention of Fees

Be wary of tools that ignore:

- Origination or processing fees

- Monthly service charges

- Repayment caps (or lack thereof)

These hidden terms can increase your cost dramatically and should be factored into the estimate.

5. No Disclaimer or Explanation of Assumptions

Trustworthy lawsuit loan calculators explain how results are calculated, including:

- Interest formulas used

- Default rate assumptions

- Fee structures (if applicable)

If there’s no explanation or fine print, the results may be misleading.

6. The Calculator Is Just a Lead Capture Form

If the tool only asks for your contact info without showing any results, it’s likely just a way to generate leads, not a genuine calculator. You should see real numbers, not just a “we’ll call you” screen.

Pro Tip: Always compare the calculator’s results with at least one other provider’s offer. When in doubt, ask for the full repayment schedule or payoff estimate in writing before signing anything.

How Express Legal Funding Keeps Your Costs Low

At Express Legal Funding, we understand that lawsuit cash advances are more than just financial tools—they’re lifelines for plaintiffs under pressure.

That’s why we’re committed to offering transparent, affordable, and risk-free legal funding solutions that put your interests first.

Here’s how we help you keep your lawsuit loan costs as low as possible:

Low Monthly Rates

We offer some of the most competitive monthly rates in the industry, often lower than traditional lawsuit loan companies. And unlike brokers or intermediaries, we fund cases directly—no middleman markups.

Read our guide: Legal Funding Brokers vs Lawsuit Loan Company: How to Choose?

Low Interest Rates-That Never Increase

Unlike many funding companies, which use highly compounding interest and large flat fees, which can cause your payoff to balloon over time, our contracts include a single interest rate that never increases over time. That means your cost grows but doesn’t leap.

Real Client Feedback: Transparent Rates That Make a Difference

Don’t just take our word for it. Here’s what one of our satisfied clients had to say. Myasia D. left a 5-star Google review praising our fair pricing and personalized support:

They really worked with me and fought hard for my funding. I appreciate Express Legal Funding so much! Plus, the interest cost is very reasonable!

Myasia D., 5-star Google Review

Her experience reflects what we strive for: honest rates, client-first service, and no surprises. That’s what sets us apart in the lawsuit funding industry.

No Upfront Fees or Hidden Charges

You’ll never pay:

- Application fees

- Underwriting fees

- Out-of-pocket costs

- E-signature fees

The amount you’re approved for is what you receive—no deductions or surprises.

Clear Repayment Terms

Our funding agreements are written in plain language with easy-to-understand payoff schedules. You’ll always know:

- What you owe

- When interest accrues

- How your costs are calculated

We prioritize honesty and transparency at every step.

Risk-Free Guarantee

If you don’t win or settle your case, you owe us nothing. That’s the power of non-recourse legal funding. You can use the cash to cover essential expenses while your attorney fights for a fair settlement, without worrying about falling into debt.

Explore our guide about Guaranteed Pre-Settlement Funding

Want to See How Much You Could Save with a Lawsuit Loan From Express Legal Funding?

Try our free lawsuit loan calculator to estimate your cost, and see why more plaintiffs choose Express Legal Funding for peace of mind and fair pre-settlement funding pricing.

Lawsuit Loan Calculator FAQs

How much does a lawsuit loan cost?

The cost of a lawsuit loan varies based on the following factors:

- Advance Amount: The amount of money you borrow from your pending lawsuit (e.g., $1,000 or $5,000).

- Monthly Interest Rate: Typically between 2% and 4%.

- Interest Type:

- Simple interest grows at a steady rate.

- Compound interest increases faster over time.

- Loan Duration: The longer your case takes, the more interest adds up.

- Fees: Most companies charge fees like origination or processing fees, while others do not.

Tip: Use our free lawsuit loan calculator to estimate your total repayment upfront. It helps you understand true costs and compare offers before you apply.

How Much Can I Get for a Lawsuit Loan?

The amount you can receive depends on the estimated value of your case. Legal funding companies typically offer 10% to 20% of your potential settlement as a non-recourse cash advance. For example, if your case is expected to settle for $50,000, you might qualify for $5,000 to $10,000 in funding.

Your attorney’s cooperation, case strength, and liability details also play a role in determining your advance.

Learn more about how much you may qualify for in our guide: How Much Pre-Settlement Funding Can I Get on My Case?

What’s the difference between simple and compound interest on lawsuit loans?

With a lawsuit loan, simple interest means you’re charged a fixed percentage each month based only on the original funding amount. The total cost grows at a steady, predictable rate, making it easier to understand and plan for.

Compound interest, however, causes your lawsuit loan balance to grow faster. Each month, interest is added to the balance, and then new interest is charged on that updated amount. The longer your case lasts, the more expensive the payoff can become.

On average, simple interest lawsuit loans are generally more affordable for plaintiffs.

Can I use a lawsuit loan calculator to compare providers?

Yes, a lawsuit loan calculator is a valuable tool for comparing funding offers from different legal funding companies. It helps you estimate the total cost of each provider’s offer so you can make an informed decision before committing.

When comparing lawsuit loan providers, use the calculator to evaluate:

- Monthly interest rates (e.g., 2% vs. 4%)

- Interest type (simple vs. compound)

- Payoff amounts over different case durations

- Additional fees (such as processing or origination)

- Repayment caps, if any (e.g., 2x or 3x the advance)

By calculating and comparing potential legal funding payoffs side by side, you can choose the provider that offers the most transparent and affordable terms.

Do all lawsuit loan companies offer repayment caps?

No, not all lawsuit loan companies include repayment caps in their contracts. Some providers set a maximum limit—often 2x or 2.5x the original funded amount—so your total repayment won’t exceed that cap, no matter how long your case lasts. Others offer no cap at all, which means your payoff can continue growing with each month of interest.

Always check whether a repayment cap is part of the agreement. If it’s not included, consider asking the provider to add one—some will agree, especially if you request it upfront.

A repayment cap can be a powerful safeguard, helping you keep more of your final settlement and avoid excessive costs in the event of long delays.

What is a flat-fee lawsuit loan?

A flat-fee lawsuit loan charges one fixed repayment amount for your advance, regardless of how long your case lasts. For instance, you might receive $5,000 but be required to repay $25,000, whether your case settles in 3 months or 3 years.

While this may sound simple, flat-fee loans often mask extremely high costs with no real benefit for early case resolution.

How accurate is a lawsuit loan calculator?

A lawsuit loan calculator provides a useful estimate, but it’s not 100% exact. Accuracy depends on how closely the calculator matches the actual terms of your funding offer, including:

- Interest rate (e.g., 3% monthly)

- Interest type (simple vs. compound)

- Case duration

- Fees and repayment caps

To get the most accurate result, use a calculator that lets you input these details and compare them to the written terms from the provider. Always verify your estimated payoff before signing any agreement.

What happens if my case takes longer than expected?

If your lawsuit takes longer to settle than anticipated, the cost of your lawsuit loan will likely increase, especially if your funding agreement charges monthly interest. The longer your case remains active, the more interest accrues, which raises your total repayment amount.

That’s why it’s important to use a lawsuit loan calculator to estimate both short-term and long-term payoff scenarios. This helps you understand how time impacts your final cost and ensures you’re prepared, even if your case extends beyond initial expectations.

Are lawsuit loans non-recourse?

Yes, lawsuit loans—also known as pre-settlement funding—are non-recourse. This means you only have to repay the advance if you win or settle your case. If you lose, you owe nothing: no out-of-pocket repayment, no collections, and no impact on your credit.

This structure makes pre-settlement funding a low-risk option for plaintiffs needing financial help during litigation.

Relevant read: Do I Have to Repay Pre-Settlement Funding If I Lose My Case?

How Is Express Legal Funding Different?

At Express Legal Funding, we believe legal funding should be clear, fair, and plaintiff-focused—not inflated with hidden fees or confusing contracts.

That’s why we do things differently:

- Transparent Pricing: We use straightforward, interest-based terms—not inflated flat fees.

- Low Monthly Rates: Our competitive rates help you keep more of your future settlement.

- No Hidden Fees: No application, delivery, or surprise charges—what you see is what you get.

- Risk-Free Guarantee: You only repay if you win or settle your case. If you lose, you owe nothing.

With Express Legal Funding, you’ll always know what you’re paying, why, and when. It’s lawsuit funding done the right way—honest, affordable, and designed to protect plaintiffs.

Read why so many plaintiffs trust Express Legal Funding for lawsuit loans in our guide:

10 Reasons to Choose Express Legal Funding

Ready to Apply for a Lawsuit Loan?

If you’re waiting on a legal settlement and need fast financial relief, Express Legal Funding can help bridge the gap. We provide low-cost, non-recourse pre-settlement funding with no hidden fees, no credit checks, and no repayment unless you win or settle your case.

Use the lawsuit loan calculator above to estimate your cost, then take the next step toward financial peace of mind.

Apply Today—Get Cash for Your Lawsuit in as Little as 24 Hours After Approval

Complete the quick form below to apply now. Our team will quickly review your case details and reach out to your attorney to expedite the approval process. We fund many case types.

📄 Free Application | 🔒 Risk-Free – No Repayment If You Lose | 💸 Fast, Direct Funding—The Power of Express Legal Funding

Disclaimer: For Informational Purposes Only

The lawsuit loan calculator provided on this page is for general informational and illustrative purposes only. It is not intended to advertise specific rates, terms, or conditions, nor does it constitute a formal offer of funding from Express Legal Funding or any of its partners.

Actual approval amounts, rates, and repayment terms will vary based on the specifics of your case and are subject to final review and agreement. Use of this calculator does not create a client relationship, and the results should not be relied upon as financial, legal, or lending advice.