Every year, millions of car accidents across the United States result in personal injury claims, and many victims face long settlement timelines that can stretch for months or even years—often causing significant financial stress.

Medical bills add up quickly, vehicle repair costs become unavoidable, and lost wages can make it difficult to keep up with everyday expenses after a serious crash. When income slows down but expenses continue, the financial pressure can feel overwhelming.

Because lawsuits and insurance negotiations take time, compensation often arrives later than expected. This delay leads many injured individuals to ask an important question: Can You Get a Loan for Car Accident Settlement while waiting for your case to resolve?

The answer is yes. A car accident settlement loan—also known as pre-settlement funding—is a financial solution that allows injured plaintiffs to access a portion of their expected compensation before their case concludes. It offers fast, risk-free cash relief, helping accident victims stay financially stable during the legal process.

In this guide, we’ll break down how car accident settlement loans work, who qualifies, what to expect from the process, and how to decide whether it’s the right option for your situation.

Can You Get a Loan on a Car Accident Settlement?

Yes — injured plaintiffs can access money before their case settles through pre-settlement funding.

Rather than waiting months (or years) for a lawsuit to resolve, funding companies advance a portion of your expected settlement. Approval is based primarily on the strength and value of your case — not your credit score, employment status, or income history.

Because this is non-recourse funding, repayment only happens if you win or settle your case successfully. If you don’t recover compensation, you typically owe nothing.

The amount you qualify for depends on factors like liability, insurance coverage, and projected settlement value.

Disclaimer: While commonly referred to as “loans,” car accident settlement loans are technically non-recourse cash advances on car accident claims, not traditional loans. We use the term “loan” throughout this article for clarity and accessibility, as it reflects how most plaintiffs search for and discuss these types of funding.

What Is a Car Accident Settlement Loan?

A car accident settlement loan—also known as pre-settlement funding—is a settlement cash advance given to plaintiffs who have a pending personal injury lawsuit. It’s not a traditional loan. Instead, repayment is only required if you successfully settle or win your case.

🟢 Ready to apply for fast financial relief today? Apply for a Car Accident Loan!

Why Plaintiffs Use Car Accident Settlement Loan?

- Cover Immediate Living Expenses: Pay for essentials like rent, groceries, and utilities while waiting for your case to settle.

- Afford Medical Care Without Delay: Access funds for hospital bills, physical therapy, medications, and other injury-related treatments.

- Avoid Pressure to Settle Early: Prevent financial hardship from forcing you into accepting a lowball settlement offer.

- Support Long-Term Recovery: Focus on healing and allow your attorney the time needed to negotiate the best possible outcome.

- Bridge the Gap Between Injury and Compensation: Maintain financial stability without relying on high-interest credit cards or personal loans.

Who Qualifies for a Car Accident Settlement Loan?

To be eligible for a car accident settlement loan, you generally must meet the following criteria:

- You have an active personal injury claim resulting from a car accident.

- You are represented by an attorney working on a contingency fee basis (you don’t pay unless you win).

- Your case shows clear evidence of liability and damages, such as police reports, medical records, and insurance documentation.

Note: You don’t need a good credit score, steady income, or employment history—approval is based solely on the strength and recoverability of your case.

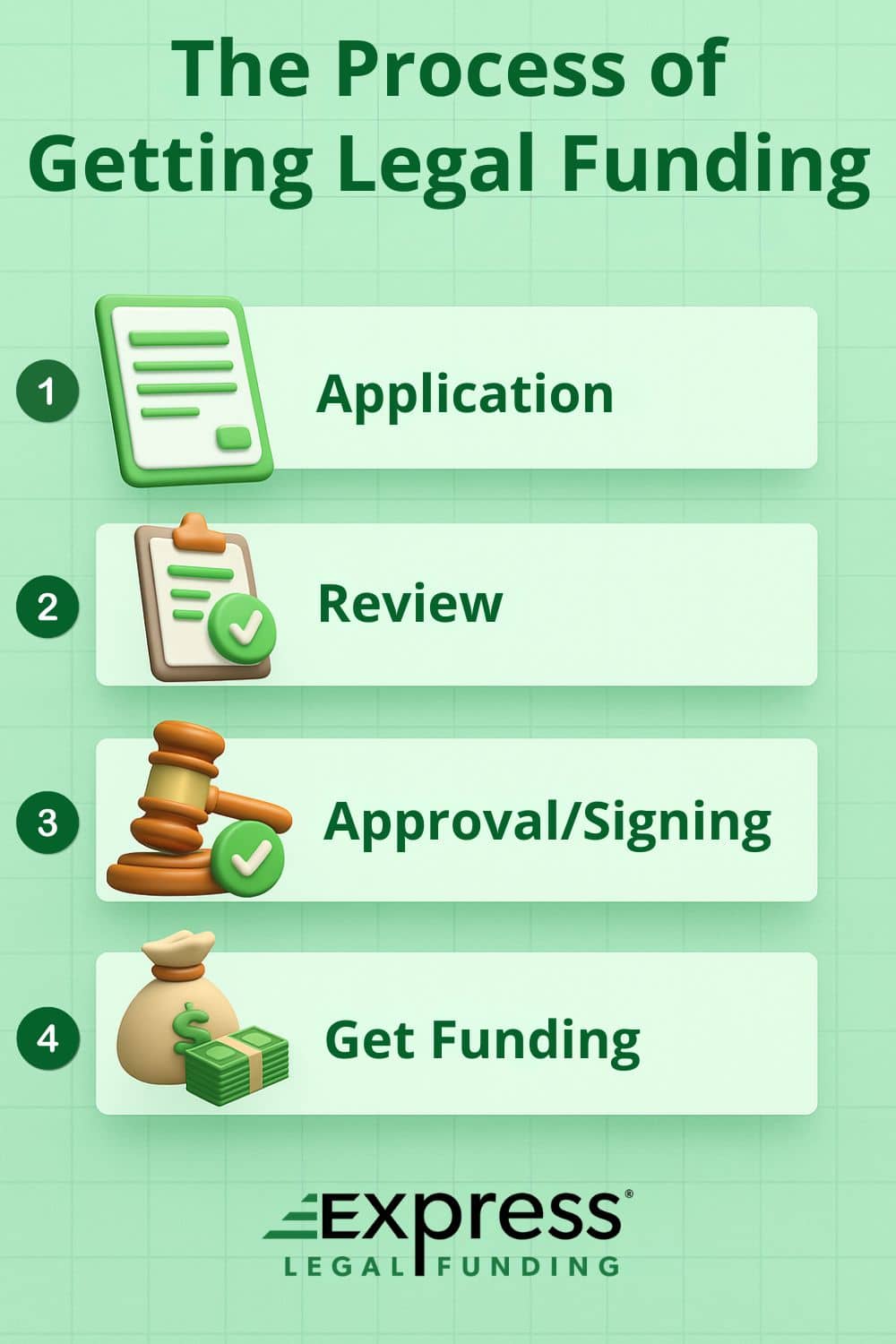

The Process of Obtaining a Car Accident Settlement Loan

Getting a loan on a car accident settlement is typically fast and straightforward. Here’s how it works:

- Application: Complete a brief application online or over the phone. No credit check or income verification is required.

- Case Review: The funding company contacts your attorney to review key details like liability, damages, and insurance coverage.

- Approval and Offer: If your case qualifies, you’ll receive a funding offer based on the estimated value of your settlement.

- Funding Disbursement: Once the agreement is signed, funds are deposited directly into your account, usually within 24 to 48 hours.

Pro Tip: Always consult your attorney before accepting a settlement loan to ensure it aligns with your legal strategy and financial needs.

Benefits of Car Accident Settlement Loans

Car accident settlement loans provide several key advantages for injured plaintiffs facing financial stress:

- Immediate Access to Cash: Get the funds you need right away to cover essentials like rent, groceries, medical bills, and transportation.

- Non-Recourse Protection: You only repay the advance if you win or settle your case—no repayment is required if you lose.

- No Credit Check Required: Approval is based on your case’s strength, not your credit score, income, or employment history.

- Stronger Negotiation Power: With financial pressure off your shoulders, your attorney has more time to negotiate a fair settlement rather than settling early for less.

Risks and Considerations of Car Accident Settlement Loans

While settlement loans can be a lifeline for many plaintiffs, it’s important to understand the potential downsides before applying:

- High Interest Rates and Fees: Legal funding can become expensive, especially if your case takes months or years to resolve. Costs may accumulate quickly over time.

- Reduced Final Payout: A portion of your eventual settlement will be used to repay the advance, which can significantly reduce how much money you take home.

- State-Specific Legal Restrictions: Some states have specific regulations—or outright bans—on pre-settlement funding. Rates, terms, and availability may vary depending on your location.

- Client Expectations May Shift: Receiving too much money upfront can sometimes cause plaintiffs to hold out for unrealistically high settlement amounts, even when their attorney provides sound legal guidance. It’s important to stay grounded in the actual value of your case and trust the advice of your legal team.

Wondering how much your case is realistically worth? Try out our Car Accident Settlement Calculator. It’s free!

In-Depth Examples of Car Accident Settlement Loans

To better understand how car accident settlement loans work in real-life situations, consider these two examples of plaintiffs who turned to pre-settlement funding during difficult times:

Jane’s Story – A Single Mother Facing Medical Debt:

Jane, a single mother, was seriously injured in a chain reaction collision. Unable to work and overwhelmed by growing medical bills and everyday expenses, she faced the possibility of settling her case early, just to stay afloat. After speaking with her attorney, Jane applied for a car accident settlement loan.

The funds helped her pay for critical medical treatment and cover her rent and utilities. With the immediate financial pressure relieved, Jane was able to hold out for a fair settlement without compromising her recovery or her legal rights.

Tom’s Story – A Freelancer Struggling After a Car Crash:

Tom, a freelance graphic designer, suffered severe whiplash and a wrist injury in a side-impact collision. His injuries prevented him from meeting client deadlines, which caused his income to vanish overnight. With no savings and bills piling up, Tom applied for pre-settlement funding.

The advance gave him the breathing room to heal and allowed his attorney to negotiate without the urgency of financial hardship driving the timeline.

These stories highlight how legal funding can serve as a lifeline for injured plaintiffs, helping them bridge the financial gap between injury and compensation.

Choosing a trustworthy legal funding company that works closely with your attorney and offers clear, fair terms is essential to making the most of this financial resource.

Real-world experiences like Jane’s and Tom’s show how settlement loans can empower plaintiffs to protect both their finances and their legal outcomes.

Comparing Car Accident Settlement Loans to Other Financial Options

Here’s how settlement loans compare:

Comparison of Financial Options for Car Accident Victims

| Financial Option | Pros | Cons |

|---|---|---|

| Settlement Loans | No credit check, repay only if you win | High rates can reduce settlement proceeds |

| Personal Loans | Lower rates if you have good credit | Require credit check and steady income |

| Credit Cards | Quick access to funds | High interest if not paid quickly |

| Family or Friends Loan | May be low or no interest | Can strain personal relationships |

Read our complete guide for more options: 15 Alternatives to Lawsuit Loans.

How to Choose the Right Car Accident Loan Company

Not all legal funding providers are created equal. To protect yourself and get the best possible outcome, look for these key qualities when choosing a car accident settlement loan company:

- Transparent Fees and Terms: Choose a company that offers clear, upfront contracts with no hidden fees, compounding interest traps, or vague language. You should know exactly what you’ll owe before signing.

- Strong Reputation and Reviews: Look for providers with positive client testimonials, high ratings, and endorsements from attorneys who have worked with them. A history of trustworthiness matters.

- Attorney Collaboration: A reliable funding company will communicate directly and professionally with your attorney, respecting their time and ensuring the funding process doesn’t disrupt your legal strategy.

- Competitive and Fair Rates: Don’t accept the first offer you receive. Compare funding amounts, fees, and terms across multiple companies to make sure you’re getting a fair deal.

Pro Tip: If a company pressures you to sign quickly or avoids answering questions, that’s a red flag. Reputable legal funders put transparency and your best interests first.

📘 To learn more about your lawyer’s role in the pre-settlement funding process, read our guide: Can I Get Pre-Settlement Funding Without Attorney Consent?

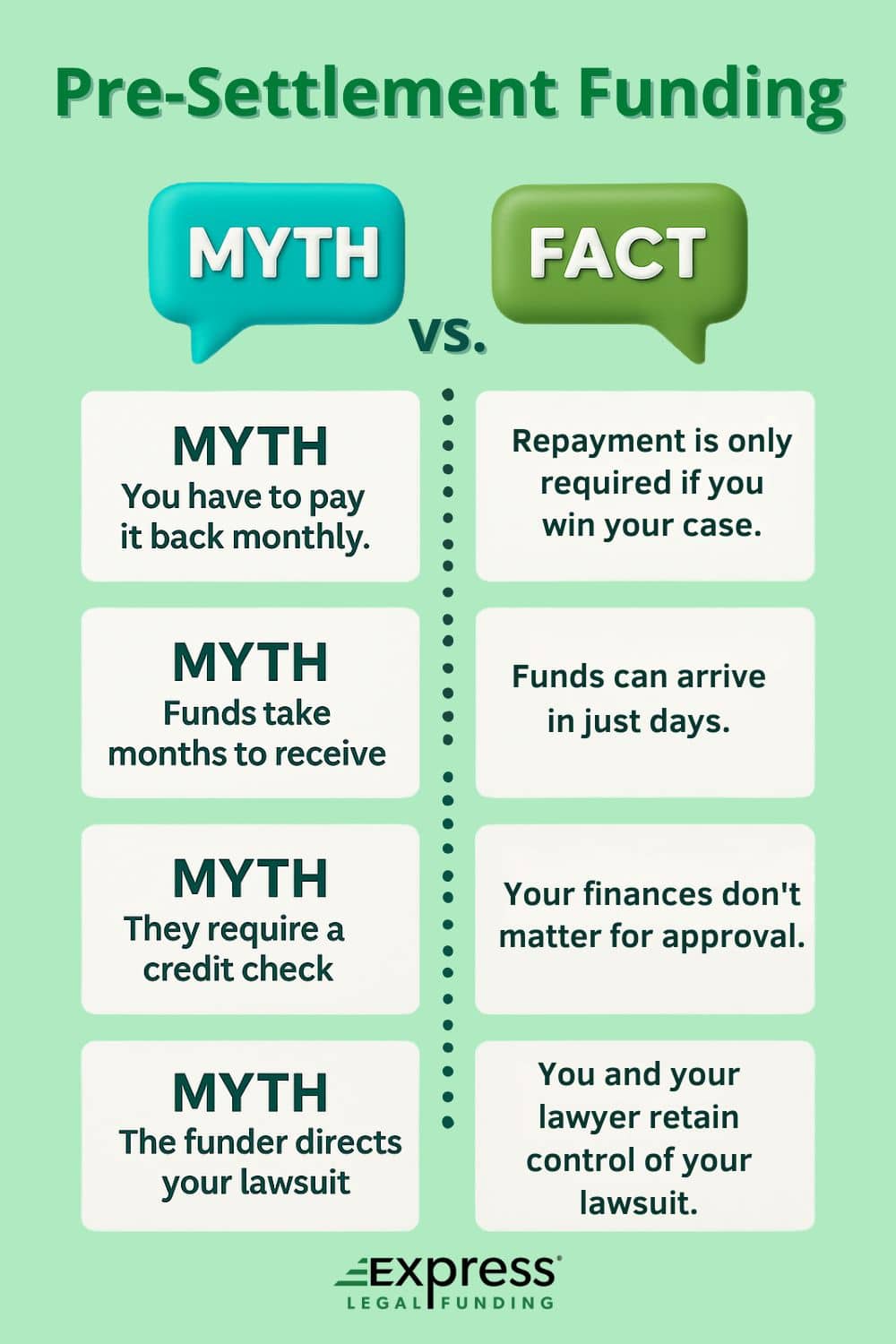

Common Myths and Misconceptions About Car Accident Settlement Loans

Myth 1: They Are Like Regular Loans

Fact: Settlement loans are non-recourse, meaning you only repay if you win or settle your case. If you lose, you owe nothing.

Myth 2: They Hurt Your Credit

Fact: Legal funding does not affect your credit score at all. There are no credit checks, and repayment isn’t reported to credit bureaus.

Myth 3: Funding Takes Weeks

Fact: Most plaintiffs receive funds within 24 to 48 hours of approval, depending on how quickly their attorney submits the case details and signs the Attorney Acknowledgement section.

Myth 4: Funding Companies Control Your Case

Fact: Your lawsuit remains entirely under the control of you and your attorney. Reputable legal funding companies do not influence legal strategy, negotiations, or case decisions. They won’t tell you when to settle, whether to accept an offer, or if you should proceed to trial. Their role is to provide financial support—not legal direction.

Myth 5: You Can Borrow Unlimited Amounts

Fact: Advances are typically capped at 10% to 20% of your estimated settlement, to reduce risk and protect your final payout..

Conclusion: Should You Get a Car Accident Settlement Loan?

Car accident settlement loans offer a lifeline for plaintiffs facing financial hardship after an accident. With non-recourse protection and fast access to cash, they can ease the burden while awaiting a fair settlement.

However, it’s critical to understand the costs, work with a reputable funding company, and involve your attorney in every step of the decision.

By approaching settlement funding strategically, you can protect your financial future while fighting for the compensation you deserve.

Ready to Get Started? Get Pre-Settlement Cash for Your Car Accident Case Today!

At Express Legal Funding, we’ve helped thousands of injury victims get fast, risk-free financial relief while waiting on their car accident settlements. As a licensed and trusted legal funding company, we work directly with your attorney to ensure a smooth, transparent process—with no credit checks, upfront fees, or repayment if you lose.

Apply today to see how much funding you qualify for. Our experienced team is here to answer your questions and help you regain financial control—because you deserve support while your case is pending, not just after it ends.

Apply With Express Legal Funding for a Loan on Your Car Accident Settlement

FAQs About Getting a Loan on a Car Accident Settlement

In this section, we answer some of the most frequently asked questions about car accident settlement loans—including those that often lack clear or accurate information elsewhere online.

Our goal is to provide reliable, well-researched answers that help you make informed financial decisions, while highlighting key facts you won’t easily find outside of expresslegalfunding.com.

Can I get a loan if my car accident case hasn’t gone to court yet?

Yes, you can qualify for a car accident settlement loan even if your case hasn’t gone to court. As long as you have filed a claim and are represented by an attorney, funding companies can evaluate your case based on liability and potential damages.

How soon can you get a car accident settlement loan after an accident?

You can typically apply for a car accident settlement loan within days or weeks after the accident, as soon as you’ve filed a personal injury claim and hired an attorney. Once your attorney provides your case details, funding can be approved and disbursed in as little as 24 to 48 hours. The earlier your case is organized and documented, the faster the process moves.

How fast can I get a car accident loan after a car accident?

Most plaintiffs can receive a car accident settlement loan within 24 to 48 hours after their application is approved. Funding speed depends on how quickly your attorney submits your case details for review.

How much can I borrow from a car accident settlement loan?

Most legal funding companies will advance 10% to 20% of your estimated settlement value. For example, if your case is valued at $30,000, you may qualify for an advance between $3,000 and $6,000.

The exact amount may also depend on how far along your case is:

- Early-stage cases typically qualify for funding closer to 10%, due to uncertainty.

- Cases near settlement may be eligible for funding closer to 20%, as liability and damages are clearer.

Funding amounts vary based on case strength, insurance limits, and your attorney’s cooperation.

Do I need a good credit score to qualify for a settlement loan?

No, car accident settlement loans do not require a credit check. Approval is based on your case strength, not your financial history or employment status.

Can I get more than one car accident settlement loan if my case takes longer than expected?

Yes, you may be able to receive more than one pre-settlement loan if your case value increases or new developments improve your chances of winning. However, this depends on your case and provider approval.

Will getting a car accident settlement loan affect my lawsuit?

No, taking out a car accident settlement loan will not negatively impact your lawsuit. Legal funding is structured to work alongside your attorney’s efforts and does not interfere with your legal strategy, case timeline, or settlement negotiations. Your attorney remains fully in control of the case, and funding companies cannot influence its outcome or direction.

Can my attorney charge extra if I get a car accident settlement loan?

Yes, technically, your attorney may charge a reasonable fee if your request for a settlement loan requires them to perform extra legal work outside their standard contingency agreement, such as reviewing complex funding contracts or negotiating terms with the lender.

However, in most cases, attorneys do not charge additional fees and simply cooperate by providing case documents and disbursing repayment from your settlement. It’s best to ask your lawyer upfront about any potential costs related to pre-settlement funding.

Can the defense or insurance company find out that I got a settlement loan?

In most cases, the opposing party is not informed of your settlement loan. Pre-settlement funding is a private agreement between you, your attorney, and the funding company. However, if your case proceeds to trial, some courts may require disclosure depending on jurisdictional rules.

Notably, in Missouri, consumer legal funding contracts are not discoverable in litigation, providing an added layer of confidentiality and protection.

What happens if I lose my case after taking a car accident loan?

If you lose your case, you do not have to repay the car accident settlement loan. These loans are non-recourse, which means repayment is only required if you win or reach a settlement.

What happens if my car accident settlement is less than the loan amount?

If your final settlement is less than the total amount you borrowed, your attorney will first deduct their legal fees, and the remaining funds will be applied toward repaying the funding company.

Because car accident settlement loans are non-recourse, you won’t owe anything beyond your settlement. In most cases, any remaining balance is forgiven under the terms of your agreement.

Although this outcome may feel disappointing, it’s generally considered fair—you already received a portion of your future settlement at a time when you needed it most, helping you cover urgent expenses like rent, medical bills, or lost wages.

Even if your case settles for less than expected, you still gained financial support without incurring traditional debt or damaging your credit.

Do car accident settlement loans affect your credit or show up on your credit report?

No, car accident settlement loans do not appear on your credit report and have no impact on your credit score. Since they are non-recourse advances, not traditional loans, they are not reported to credit bureaus and do not involve credit checks or monthly payments. This makes them a safe option for plaintiffs with poor credit or those looking to avoid new debt.

Can I use a car accident settlement loan to pay medical bills?

Yes, many car accident victims use their settlement loans to cover urgent medical expenses such as hospital bills, surgery, physical therapy, medication, and diagnostic tests. Pre-settlement funding provides fast access to cash while you’re waiting for your case to settle, helping you get the treatment you need without financial delays.

Can I get a car accident settlement loan if the other driver is uninsured?

Yes, you may still qualify for a settlement loan even if the at-fault driver doesn’t have insurance. If your attorney is pursuing compensation through uninsured/underinsured motorist (UM/UIM) coverage, another liable party, or your own no-fault insurance policy (in states with personal injury protection, or PIP), you could still be eligible for funding.

Pre-settlement loan approval is based on the strength and recoverability of your case, not solely on the other driver’s insurance status.

Is lawsuit funding available for rear-end car accidents?

Yes, rear-end collisions are one of the most common car accident case types eligible for pre-settlement funding. As long as fault is established, there is insurance coverage, and you’re working with a lawyer, you may qualify.

What alternatives are there for car accident settlement loans?

Alternatives to car accident settlement loans include applying for traditional personal loans, using credit cards, borrowing from friends or family, or negotiating payment plans with medical providers. Each option has different risks and approval requirements.

How can I find the best car accident settlement loan company?

To find the best car accident settlement loan company, look for a provider that offers transparent pricing, positive client reviews, strong attorney partnerships, and competitive advance rates. Make sure the company clearly explains all costs before you sign.

Does Express Legal Funding provide loans on car accident cases?

Yes, Express Legal Funding specializes in providing pre-settlement funding for car accident claims. In fact, nearly two-thirds of the advances issued by the company are for clients involved in car accident lawsuits.

If you’re waiting on a settlement and need fast financial relief, Express Legal Funding can help you access a portion of your expected compensation, risk-free and with no credit check required.

👉 Call us 24/7 at (888) 232-9223 or apply online for legal funding now. It’s free, fast, and always risk-free.

Glossary of Key Terms in This Article

- Pre-settlement funding: A financial option, also called a settlement cash advance or car accident settlement loan, that allows plaintiffs to access a portion of their anticipated compensation before their case is resolved.

- Non-recourse cash advance: A form of legal funding where repayment is only required if the plaintiff successfully settles or wins the case. If the case is lost, the plaintiff owes nothing to the funding provider.

- Car accident settlement loan: A commonly used term for pre-settlement funding offered specifically to individuals pursuing compensation for injuries sustained in car accidents.

- Plaintiff: The party who initiates a lawsuit against another, typically in pursuit of a personal injury claim stemming from a car accident.

- Contingency fee basis: A legal fee structure where attorneys are paid a percentage of the settlement or award only if the case results in a successful outcome.

- Liability: The legal obligation of a party found to be at fault for causing injuries or damages in a car accident.

- Damages: The total losses incurred by the plaintiff due to the accident, which may include medical expenses, lost income, emotional distress, and pain and suffering.

- Attorney Acknowledgement: A required step in the legal funding process in which the plaintiff’s attorney signs and confirms the funding documentation.

- Interest rates and fees: The charges that apply to a car accident settlement loan, which may accumulate over time and impact the plaintiff’s final recovery amount.

- Estimated settlement value: The predicted monetary compensation a plaintiff is likely to receive from their car accident claim, used to assess funding eligibility.