One of the most common types of legal proceedings is personal injury claims. These injury claims can be filed in all 50 states and are for when you suffer an injury due to another party’s actions. Everything from car accidents to slip and fall cases.

However, For most people, the goal in mind is to physically recover and win or settle for the most money possible.

Those two goals go hand in hand, as the recovery process from your wounds inflicted by this negligence or intent greatly determines the compensation you can expect to claim and settle for from the liable party.

This usually involves negotiations with the defendant’s insurance company. However, depending on the state or if the other driver was uninsured, that is not always the case.

You may need to file a claim against and eventually sue your own insurance company on your PIP insurance policy or uninsured motorist coverage.

These are the general textbook ideas for most parties you would sue for money in car accident cases.

Personal injury lawyers want your job as the plaintiff to listen to your doctors and stay focused on your hopefully large recovery at the end of your case.

That plus not lying about the case details is where your attorney-client relationship job will begin and end.

In some cases, that is not where it ends. The accident victims must worry about the repercussions of filing a successful claim and getting a large settlement for their injuries and damages.

They must worry about losing their access to free healthcare through Medicaid.

Their pursual of a successful claim can put them in a very financially harrowing that can cost them much more than the settlement or trial award amount they won. It can cost them their free Medicaid healthcare benefits and more.

Many of those who do not have access to private health insurance rely on government health insurance programs to provide them access to the healthcare they need.

This article will explain how a personal injury settlement can affect your Medicaid services and what you can do not to lose the government health insurance program.

Medicaid And Personal Injury Claim Settlements

As mentioned above, one of the most well-known public health insurance programs is Medicaid, which has been offered for years.

To be more exact, Medicaid was passed into law alongside the other widely known government healthcare program, Medicare, in 1965.

Like all government benefit programs, Medicaid is still(in many ways) a work in progress and very far from perfect.

Still, many people rely on Medicaid coverage for all their health insurance needs since they cannot afford a private policy with the typical independent broker and insurance agency setup.

The high cost of privatized health and minimal coverage of medical treatment are what make Medicaid so valuable and why it is vital to take action to not violate Medicaid laws and lose Medicaid coverage.

This should be a concern if you are a Medicaid beneficiary who was in an accident that requires you to file a personal injury claim. So let’s start out by answering some FAQs:

What is Medicaid?

If Medicaid services do not actively cover you now, you might wonder what it is and why it matters.

Medicaid, as previously mentioned, is a public healthcare program created by the United States government to provide coverage for individuals unable to secure a private policy. Over 80 million Americans are enrolled in the program.

The Medicaid program is not typical health insurance but offers low-cost healthcare for low-income individuals. In many cases, Medicaid waives the entire cost of the treatment and allows these individuals to enjoy free healthcare.

However, Medicaid is also highly particular about what services and treatments it will cover.

While the federal government funds Medicaid, it falls to the different states to manage the particulars of their programs(Including CHIP, Children’s Health Insurance Program).

As a result, Medicaid programs are often found under other names depending on your state. Regardless of the state or its name, the function of Medicaid is universal across the country.

Because enrolling in Medicaid gives specific individuals coverage for the cost of future medical expenses, the program is very selective. The savings add up quickly, as the US spent over $671 billion on Medicaid and CHIP in 2020 alone.

Medicaid is for Low-Income Individuals

So when applying for Medicaid, you will learn that many factors exclude individuals from qualifying, as the guidelines render Medicaid being unnecessary for them. A lack of financial resources is rarely enough.

The issue is that “unnecessary” is a subjective concept left to the government’s discretion and, in reality, the social security administration employee handling your case.

A slight change in your financial status can quickly alter your eligibility for Medicaid coverage. It is crucial to learn and understand the Medicaid eligibility criteria to ensure you preserve and protect your coverage throughout your treatment and possibly the rest of your lifetime.

The eligibility criteria are usually the same regardless of the state where you apply.

To qualify for coverage, you must be a citizen of the United States of America and a permanent resident of the state in which you apply.

You also need to lack insurance coverage and be in a low-income bracket per the country’s financial climate. However, one of these few other circumstances must apply to you to be eligible for Medicaid. These include:

Medicaid Eligibility Criteria:

- Being pregnant.

- Being the custodial parent or legal guardian of a child under 18.

- Have a disability or be responsible for a family member with a disability.

- Be at least 65 years old (for similar Medicare programs.)

If you meet these criteria, the chances of being approved for Medicaid coverage are relatively high.

However, the predominant factor is your current financial situation.

Medicaid was designed to benefit those who are financially unable to fund a health insurance plan on their own or have access through their employer, which in many ways is the same as paying on their own as it is often deducted from their paycheck.

This stringent criterion could cause your Medicaid coverage to be rescinded if your financial situation improves within a certain margin, which in many ways is unrealistic and counterproductive.

It can basically punish Medicaid patients for working their way out of economically dire situations for fear of losing health insurance.

For those without disabilities, the Medicaid office determines your financial eligibility by assessing what is known as your countable assets.

If these assets fall below a certain threshold, your eligibility for Medicaid improves. The Medicaid office could rescind your eligibility if your countable assets exceed that threshold.

What Are Countable Assets?

When you apply for government-funded financial assistance, it has to be because you do not have the assets to pay for care services yourself. When you request coverage, the Medicaid office will assess your financial resources via your countable assets to determine if you are genuinely in need of their aid.

A countable asset is a term used for any assets that can count against the asset limit used to determine who qualifies for assistance.

Your countable assets include (but are not limited to):

- Liquid Funds

- SSI (Supplemental Security Income)

- SSDI (Social Security Disability Insurance)

- Bank Accounts

- Real Estate

- Stocks

- Bonds

- Mutual Funds

Your countable assets and their monetary worth are compared to the national poverty line to determine where you rank. Your placement on the poverty line is the main factor in determining whether you qualify for Medicaid services.

Federal Poverty Line Determines Eligibility

Your annual and monthly earnings and the number of people in your home help identify where you sit on the Federal Poverty Line. That placement is used to determine eligibility for Medicaid and Medicare benefits. Your monthly income must not exceed $2,000.00, though the specific number varies by state.

You cannot own any property that exceeds a similar value, usually within the $2,000 to $3,000 range. This restriction only applies to non-essential property such as collectibles, artwork, electronics, etc.

Essentials such as your residence, vehicle, or other items you need to survive do not count against the asset limit for Medicaid.

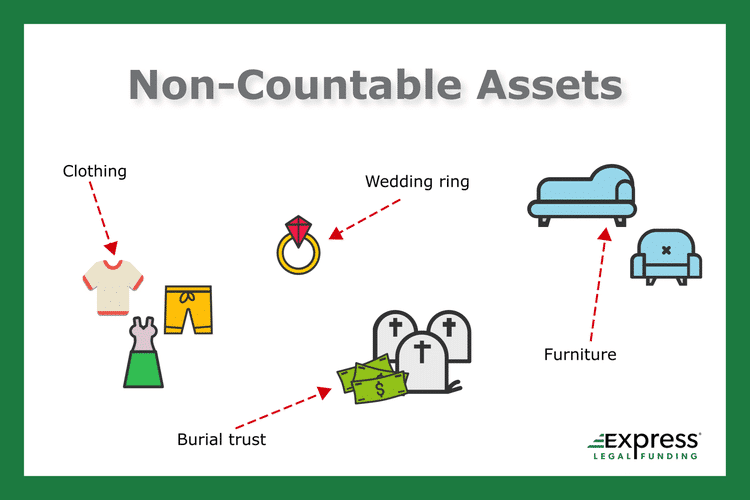

Non-Countable Assets Do Not Count Against You

The other assets are identified as “non-countable,” which the Medicaid offices will not hold against the asset limits.

These non-countable assets are generally identified because they are too significant to be sold or sacrificed for any reason.

This includes more than your needing them for the basic cost of living like your home and vehicle, which are part of the non-countable assets category.

You should keep a few other items in mind—your personal belongings such as clothing, furniture, burial trusts, and even wedding rings.

Medicaid Non-Countable Assets [Infographic]

Regardless of the value of these items, they cannot be held against your asset limit, compelling you to sell them when you apply for Medicaid.

Any finances or property that put you above the Federal Poverty Line disqualify you from receiving Medicaid benefits.

This is done to prevent system abuse that might deprive other, more needy candidates and significantly increase the country’s deficit.

However, the qualifiers are very strict and do not account for personal circumstances very well.

For example, you might be put over the line by something you are unable or unwilling to part with, even if it elevates you by a relatively small amount.

This situation brings us to the question of how your injury settlement affects your Medicaid eligibility.

Do Personal Injury Settlements Affect Medicaid?

The question that brought you here or at the very least got you to continue to read the article is likely to learn more about a result of an impending personal injury claim you sustained while considering or covered by Medicaid. The short answer to the question of whether your personal injury settlement can cause you to lose Medicaid is:

Yes, getting money through a personal injury settlement or court award can cause you to lose your Medicaid benefits and incur Medicaid liens you will owe to the SSI and Medicaid office.

A personal injury settlement or a reward from a verdict is designed to give you the financial resources to pay for your medical care costs from treating your injuries following an accident.

When the defendant is responsible for your injuries, their insurance company is liable to be on the hook for financing the settlement or the court verdict award amount.

However, some auto accidents result in emotional or property damage, allowing you to receive compensation with additional funds in the settlement amount for “pain and suffering.”

While there is no guaranteed settlement sum in any personal injury claim, there is an average.

Average Personal Injury Settlement

A personal injury settlement averages about $60,000.00, which is not an insignificant sum: when finances are tight, a settlement like this could be an incredible windfall for you and your family.

However, the settlement could prove detrimental to your goals if you rely on Medicaid’s care or plan to apply for the free government benefits.

So much so that it can make your settlement not worth it even when it is a larger settlement amount you get to keep.

Medicaid’s strict eligibility requirements are meant to safeguard you from being unable to treat medical issues when you cannot afford health insurance.

Unfortunately, it is a bureaucratic system, and little consideration is made for those who are locked out by those requirements and still need assistance.

Any sum added to your list of countable assets runs the risk of putting you over the edge of Medicaid’s eligibility requirements.

Are Personal Injury Settlements Countable Assets?

Unfortunately, when it comes to personal injury claims, personal injury settlements are considered countable assets and are not exempt from Medicaid’s asset limits.

Therefore, while a personal injury settlement is not guaranteed to affect your Medicaid eligibility and reimbursement, more considerable sums can put you over the Federal Poverty Line and invalidate your free benefits, which you do not want.

This can quickly render your settlement a bittersweet victory since your windfall has jeopardized your Medicaid healthcare benefits.

The reality is that there are very few exemptions to what the Medicaid system will not hold against your asset limits.

Both the Medicaid and Social Security offices will almost certainly disqualify you from receiving benefits if it is enough to elevate you over the Federal Poverty Line.

To make matters worse, after losing your health benefits, Medicaid can still take your personal injury settlement.

The Medicaid office can justify it by saying you did not qualify as a Medicaid recipient after receiving your personal injury claims settlement. Meaning you were getting free healthcare benefits after you no longer were eligible.

This outcome might give you concerns about seeking a personal injury claim even when you are legally entitled to seek damages and have a strong case.

However, there are options for those seeking a settlement without compromising their Medicaid eligibility.

Unfortunately, large personal injury settlement checks do not rank among them.

How to Protect Your Medicaid Benefits From a Personal Injury Settlement?

While it might seem like pursuing a personal injury settlement while attempting to maintain your Medicaid benefits is a tall order, it is not impossible.

It will take some additional planning and expert help. Mainly, it becomes a matter of how that money gets used after winning your claim.

Even though a personal injury settlement is a countable asset, it only becomes such if it is transferred into your bank accounts for you to use immediately. So the first step is seeking legal advice from an attorney.

The most affordable way to start is by consulting with your personal injury attorney on the situation.

They can discuss your circumstances with you and then help you know what steps to take next to ensure you find the best way to reallocate your settlement funds in a way that will not jeopardize your Medicaid benefits.

Most likely, they can help you know what other types of legal or financial professionals specialize in this.

Self-Settled Special Needs Trusts

While we cannot speak to the specifics of your case, there are law firms that are experts in guiding clients through creating a special needs trust and often specialize in annuities and life insurance.

These trusts are usually designed for individuals with compromised mental faculties or without the legal capacity to manage significant funds.

However, in a personal injury case, these self-settled special needs trusts can be created to store the funds awarded by the claim, preventing you from accessing them freely and all at once.

This can make all the difference in how it impacts your Medicaid and Medicare eligibility since you no longer have control over the settlement funds or trial award.

When a special needs trust is created for a personal injury settlement, it keeps the control of the finances out of the victim’s hands and preserves it for a single purpose. It puts systems and guidelines in place.

For example, initially, the rule for the funds to only be withdrawn to pay for the medical expenses incurred in the accident, so they are never officially transferred into your control.

Since the funds are no longer a gained asset and are sent to the medical providers that already had medical liens placed on them, you’d be spending the funds anyway.

People may use other “more creative” methods to preserve their benefits, but they usually cause more problems than they solve. Less savory individuals might recommend illicitly siphoning the funds and transferring them into non-countable assets.

Still, the last thing you want to do is attempt to hide your income or break the law.

The Medicaid and Supplemental Security Income(SSI) programs can demand reimbursement in lesser scenarios.

So it does not pay cut corners and bend the law. Plus, you would have to trust the people doing these less-than-trustworthy business deals.

There are perfectly legal options to set your settlement funds aside and only draw from those funds as needed.

The point of the settlement is to help you recover your quality of life, and setting up a self-settled special needs trust is how you can keep that going.

Trusting your legal counsel and opting into a trust is the safest way to preserve your Medicaid benefits while still being able to use your settlement to pay for your medical treatments and even future expenses for decades to come.

However, there will rarely be a perfect solution, and you might find that Medicaid’s strict requirements can still be somewhat limiting.

Closing Statements on Whether Medicaid Can Take Your Personal Injury Settlement

Debating with the Medicaid office can be a challenge, especially since they move slowly and are not always willing to accept new applications.

Given the strict requirements, any payments you receive, including personal injury settlements, can put you over the Federal Poverty Line and risk losing your Medicaid benefits.

While your attorney might be able to help you avoid this by establishing the trust, you will have a difficult time convincing the Medicaid or Social Security office to maintain your benefits when you go a single dollar over the asset limit.

This is especially true at the Social Security Administration office, where each claims specialist has the decision power to take away your benefits.

While Medicaid might try to take away your benefits if you did nothing, your legal resources and financial planner will do everything they can to preserve your benefits without costing you your settlement for years to come.

It can be more than worth it, even if you incur additional attorney fees, as one Medicaid lien can cost you much more, and that would be after they take your benefits.

That would be the epitome of adding insult to injury.

We at Express Legal Funding strive to offer our pre-settlement funding services in the most optimal way possible for our clients.

So from time to time, that means advising injured victims not to receive funding even if they need to use it to pay off medical bills and make payments on rent and electricity bills.

However, with our lawsuit funding service, we can advance people the funds they need to use for the cost of essential services, and we only get repaid if you settle or win your case.

That’s what makes it no risk to you. So, feel free to read more of our peer-reviewed blog and website and give us a call anytime for a free consultation and legal funding case review.