When you or a loved one are involved in a personal injury case, you challenge another party’s negligence to recover losses. Sometimes, personal injuries result from a genuine accident that could not have been avoided.

Other times, the injury directly resulted from someone else being careless and endangering others.

Unfortunately, these claims are one of the most common civil lawsuit processes in the United States since personal injuries are far too common.

Most of the time, personal injury lawsuits result in the negligent party providing a settlement to the victim hurt by their actions. This can happen as the legal system grants us the right to sue for the party’s negligence to seek financial compensation.

However, while the legal claim in hopes of a personal injury settlement requires substantial consideration of time and money, you must also consider the type of settlement itself.

When the idea of a settlement comes to mind, most people think of getting a settlement check that accounts for the entire sum the defendant owes you.

However, a settlement does not necessarily have to be a one-time payment and can instead be staggered into a series of payments over a set schedule. This is called a structured settlement, one of the lesser-known types of settlement in the legal world.

Most people opt for a large lump sum at the end of their case, as the total amount is not large enough to justify dividing it into smaller payments to be paid out to you over time.

Structured settlement vs. lump sum, which one should you choose? To answer that, we need to answer the questions of which is truly the superior settlement plan, and what are the pros and cons of each?

We will discuss that to help you better understand what your lump sum and structured settlement options can be within this article.

So continue reading to get more of the best facts from the helpful structured settlement blog post that does not make money from affiliate clicks to structured settlement company websites. More truth without unfair conflicts of interest.

What is a Structured Settlement?

Unlike the larger payment in a one-time lump sum settlement, a structured settlement works differently in that the total settlement amount is not automatically made available to you after your personal injury lawsuit ends.

By default, most claims end with a large payment being offered as the standard method for the defendant to pay the injuries and damages owed to you.

Insurance companies are apt to agree to a lump sum settlement payout as the total amount if it is not too much for them to pay you all at once.

However, the other choice is the structured settlement option, when you agree upon a payment plan with the defendant so they can compensate you without hurting their company’s bank account too much, all at once.

Structured settlements are agreed upon between you and the liable party or their insurance company during mediation when the settlement negotiations occur following the injury.

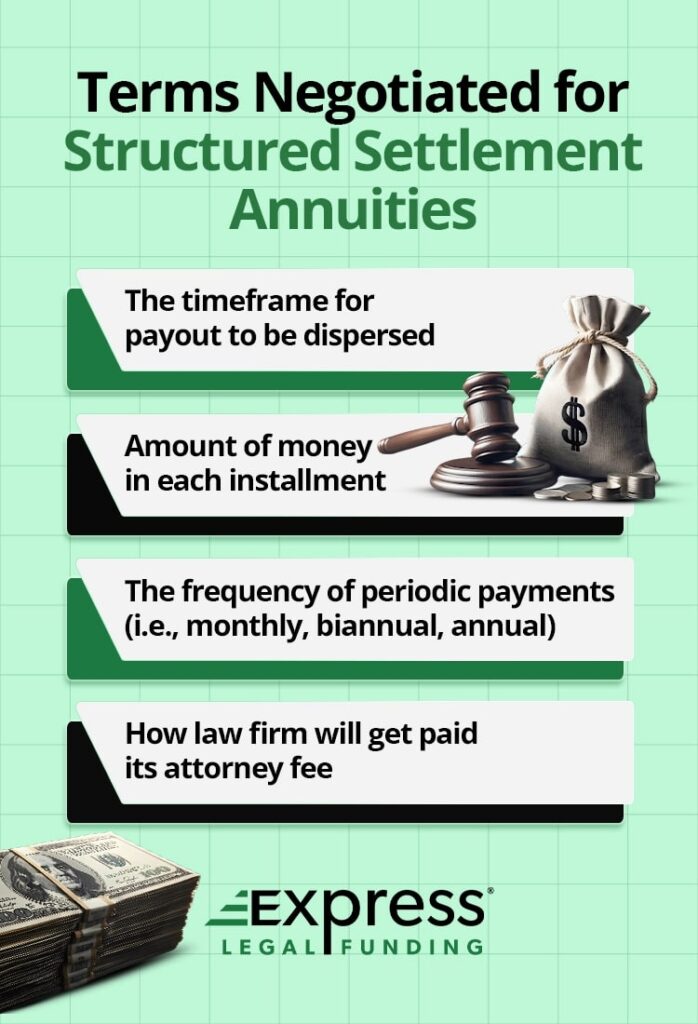

When negotiating your structured settlement, your personal injury lawyer can fight for most details.

Terms of Structured Settlement Negotiations:

- The timeframe for your payout to be dispersed

- The frequency of your periodic payments (weekly, bi-weekly, or monthly payments. In some cases, bi-monthly, bi-annually, annually)

- The sum expected for each installment

- Will it be a structured settlement annuity

- How your law firm will receive its attorney fee and get repaid for case expenses

The level of control over a structured settlement can allow you to dictate how the series of regular payments will be set up to ensure you continue to receive your total settlement. You must keep the settlement amount in mind when negotiations are underway.

For example, let us say that the case settles for $800,000.00 to compensate for all injuries, damages, and lost property from the incident. From there, you may be able to influence how much the defendant has to pay and how often.

So, if the defendant has eight years to pay off the balance, they would be paying a sum of $100,000.00 a year. If they pay monthly, that means a check of approximately $8,333.33 a month.

However, the longer it takes to pay off the settlement sum, the more complicated the calculations become as inflation, interest rates, and other financial details should be factored in.

Larger settlement amounts are more common in significant injuries or wrongful death cases. High-value cases, especially when the settlement payout is to be paid out to a minor(under 18), tend to be more beneficial over time, serving as a future source of income for you and your family. In some cases, it’s enough to cover college tuition. More on that later, though.

Before negotiating a structured settlement, you should consider speaking with an attorney and financial planner who can help you weigh the pros and cons of a structured settlement annuity versus a lump sum payment.

When negotiating a structured settlement, you create a structured payment plan from which you can draw within the period of time you require.

However, a structured settlement also benefits the defendant by ensuring they have the time to gather the settlement funds to pay their debts and by spreading the regular payments over time. In a sense, it is like you financed them with a payment plan.

What Are The Benefits of Structured Settlements?

Structured settlement payouts might seem a disadvantage since you have to wait to get all the money you are owed. However, many reasons make a structured settlement ideal for closing your claim.

However, using a structured settlement could be a very niche one. For the most part, a structured settlement is best when the money you have to gain would be better put to use as a long-term income stream throughout your lifetime.

Structured settlements can benefit a case where the overall compensation exceeds $150,000.00 total. When settling a large lawsuit like this, you are dealing with a significant sum of money that can be better used over the long rather than the short term.

When you are dealing with substantial sums, a structured settlement offers the advantage of staggering the payments and preventing you from spending the money too quickly.

Accepting a structured settlement means you will only receive a portion of the settlement in each increment so that you can stem any reckless spending habits.

In most cases, people who are given large sums of money all at once are compelled to spend it rapidly. It can feel like winning the lottery. While this response is common and understandable, it is not helpful.

Quickly spending your lump sum settlement can backfire heavily since the funds are vital for essential costs down the line and are gone when you need them most. Settlements are provided to help you recover from your losses and the pain you suffered.

Furthermore, you are not as likely to spend the money before you truly need to by staggering the payments. In addition to keeping your finances stable, you can negotiate a structured settlement on a significant sum, which can continue to be paid out to your heirs should you pass away before the settlement is fully paid.

This contingency means that the settlement will remain a valuable and vital source of income for your family when you can no longer provide for them.

The payments are tax-free and will continue until the total balance is paid so that not one dime is lost. A structured settlement is an excellent way to turn your injury claim into an investment for your future and your family.

Another minor advantage of a structured settlement has to do with its tax benefits and the exact tax codes of your state. While settlement money for personal injury cases is tax-free, you will still have to pay taxes on the interest of the money you have in your structured annuity or profit from your investments.

While a lump sum would have every dollar placed into your account immediately, a structured settlement keeps the amount in your bank more manageable.

However, there will be situations where a structured settlement will not be an effective financial instrument. This brings us to the question of what makes a lump sum settlement a good decision.

Can I Change My Annuity to a Lump Sum Payment?

Some of you might be wondering if you can start with a structured annuity settlement and switch to a lump sum payment down the line or vice-versa. The answer is “no,” as once a settlement agreement is reached, it cannot be renegotiated.

However, you can cash out on the settlement annuity through a 3rd party. This is when a company buys your structured settlement from you for a single, one-time payment.

Meaning they are paying you for the right to receive the rest of your settlement payments.

Selling a structured settlement is a serious matter and should not be your first choice when you need extra money.

In the long run, you will receive a lot less of the total settlement money you would have received if you stayed patient for your regular payments to complete.

However, life does not operate on a schedule and is never a straight path. So in all likelihood, sudden expenses are bound to crop up between your structured settlement payments.

Disadvantages of Selling a Structured Settlement

If such an expense arises and you cannot wait for the next installment of your settlement to come through, a structured settlement purchasing company might be your best option.

Still, it should be more of a last resort. This is a situation where you would want your personal injury attorney to push for a lump sum settlement.

Unfortunately, you cannot force the defendant’s insurance company to agree to a lump sum settlement. The closest option is to seek a factoring company to purchase some installments so you can get your settlement money now.

They pay you a portion of the sum of the total installments you sell to them, and when the insurance companies would send your payment, the money goes to the company that bought your settlement. The money was already the company’s because they already purchased the payment from you.

However, these companies are challenging to use since you need a judge’s approval to retain their services. Typically, it takes weeks to get your lump sum payment from the company that purchases structured settlement.

That’s why the “Get Cash Now” is not accurate, especially with needing a judge’s approval, and can take seven weeks.

So if your case is still ongoing and you need a small amount of money now to get you by to pay for essential services or expenses, legal funding can be a good option since your getting approved is based on the current value of your case.

What Are The Benefits of a Lump Sum Settlement?

Unlike a structured settlement, a lump sum settlement has the defendant’s insurance company cut you a single check for the total amount you are owed. This option is far more common since so few personal injury claims warrant a staggered payment plan.

For the most part, personal injury claims are meant to pay off the immediate damages and medical costs with some allowance for pain and suffering. This means they seldom exceed the $150,000.00 value, for which a structured settlement is more effective.

However, even when the claim does exceed this amount, sometimes a lump sum is what you need.

When you face a legal battle, expenses tend to pile up. You often will find that most of your settlement ends up paying off these dues so you can return to your life as it was.

It will be rare for the costs of your accident to equal or exceed the amount of your settlement since the main point of the settlement is to compensate you for these costs and losses.

However, there will be situations where you will need more of your settlement as soon as possible to make sure your utility and medical bills are paid before they negatively impact you. In these cases, a lump sum is in your best interest.

When the costs associated with your case are too significant to put off, requesting a lump sum settlement will allow you to pay them off as soon as possible.

This can protect you in the long run since unpaid balances harm your standing in the eyes of the law.

So, a lump sum payout can be highly beneficial when you need money as fast as possible to pay off your debts. In some cases, the settlement also helps you replace essential property like a car you might have lost in the accident.

Lump sums are standard, but their general use is limited and does not offer the same longevity as a structured settlement. However, lump sums can be just what you need for your specific needs.

Which Type of Settlement Payout Should You Choose?

Now we come to the question that has brought you to this article. Should you opt for a structured settlement or a lump sum?

Unfortunately, the answer is not as straightforward, with one being superior to the other.

The reality is that you should make the decision based on the circumstances surrounding your claim. You will need to factor in how much you are receiving and how much you have in costs. These variables directly impact the value of a lump sum or structured settlement.

Unless you have high costs that need to be paid off, these funds are best used to try and serve as a long-term windfall for you and your family. If you are only set to receive a reasonable settlement, $150,000.00 or lower, a lump sum is probably in your best interest.

The moderate settlement will have less long-term value and is best used to pay off your legal and medical expenses so you can keep what remains for a later date. However, a structured settlement is potentially more valuable if the compensation exceeds this value.

In short, the decision should be a matter of your financial needs from the close of the case onward and how much money you stand to gain.

Aside from that, the different settlement types have no real advantage. The best course of action is to not view the settlement as a sudden influx of money and more as an investment to handle any costs that might crop up.

However, no matter your settlement amount, you still have to account for the costs that arise during your claim. Otherwise, you might find yourself drowning in expenses before seeing a dime of the settlement.

Your Case: Structured Settlement vs. Lump Sums

Personal injury claims are civil lawsuits meant to help us recover from the harm inflicted by another party’s negligence or misconduct. However, they are far from the simplest form of legal proceedings.

A great deal of financial and emotional stress can arise during a personal injury claim due to the costs and injuries they accompany. So the settlement method you opt into needs to be able to help you get through this turmoil.

Whether you choose a lump sum or structured settlement, it needs to be able to provide you with the financial resources necessary to address your expenses at the end of your case.

Unfortunately, the cost of living does not simply stop because you face a legal battle and are in the midst of negotiating your claim.

The reality is that you are expected to fulfill your day-to-day financial obligations regardless of your circumstances or current situation.

When you are in a legal battle, these obligations often worsen as you work to pay for your medical treatment and other sudden costs. It can be easy to lose yourself in a sea of unexpected bills while the case is still underway.

Fortunately, we at Express Legal Funding can help. As We previously mentioned, the benefit of how legal funding services can provide a better solution to you than waiting for factoring companies to buy your settlement.

We can offer you a lawsuit cash advance so you can get money now to pay for your bills that cannot wait, like rent and electricity.

A significant benefit is that the cash funds advanced to you on your case are risk-free. We only expect repayment from a portion of your potential settlement or court award.

So, if you don’t win or settle your case, the funds are yours to keep. In a sense, you still won the pre-settlement funding. So, if you need financial assistance, contact us for a free consultation to learn more about how lawsuit funding on your case may be the best choice for you.