Spinal injury lawsuit loans can be a financial lifeline for victims struggling with medical bills, lost income, and ongoing rehabilitation. These non-recourse advances give injured plaintiffs access to a portion of their future lawsuit settlement, without the pressure of monthly payments or credit checks.

But not every case qualifies. Legal funding companies carefully review each spinal cord injury lawsuit based on its legal strength and medical documentation. If key details are missing or liability is unclear, your application could be denied.

In this guide, we’ll break down:

- What a spinal injury lawsuit loan is

- Common reasons funding gets denied

- The types of spine injuries that typically qualify

- The role your attorney plays in the approval process

- How to improve your chances of getting approved

Whether you’re dealing with a herniated disc or a permanent spinal cord injury, understanding how this type of legal funding works is the first step to securing the support you need while your case moves forward.

What Is a Spinal Injury Lawsuit Loan?

A spinal injury lawsuit loan is a type of non-recourse legal funding available to people who’ve filed a personal injury lawsuit for a serious back or spinal cord injury. It provides fast access to cash while you wait for your case to settle, helping you cover urgent expenses like:

- Medical treatment and surgery

- Rent and utility bills

- Lost wages

- Every day living costs

Despite being called a “loan,” this isn’t traditional lending. You only repay the settlement advance if you win or settle your case—no credit check, income proof, or monthly payments required.

How Spinal Injury Legal Funding Works:

- Non-recourse: You pay nothing back if you lose your case.

- Fast approval: Get funded in as little as 24 hours after attorney cooperation.

- Risk-free: No upfront costs or hidden fees.

Approval Depends On:

- Severity of your spinal injury (e.g., herniated discs, spinal fusion, paralysis)

- Liability: Who caused your accident, and how clear the evidence is

- Strength of your lawsuit and potential settlement value

- Attorney cooperation with the funding company

Common Cases That Qualify:

- Car accidents that cause spinal cord trauma

- Slip and fall injuries to the back or neck

- Work-related spinal injuries

- Medical malpractice involving surgical errors or misdiagnosis

Can I Get a Lawsuit Loan for a Spinal Injury?

Yes, if you’re suing for a serious spinal injury and have a strong legal case, you may qualify for a non-recourse spinal injury lawsuit loan, even with no credit or job. Funding helps cover costs while you wait for a settlement.

👉 Pro Tip: If your spine injury lawsuit is eligible, you could qualify for $10,000 to $50,000 or more in pre-settlement funding. But even strong cases can get denied—keep reading to learn the seven reasons spinal injury lawsuit loans are rejected and how to boost your chances of approval.

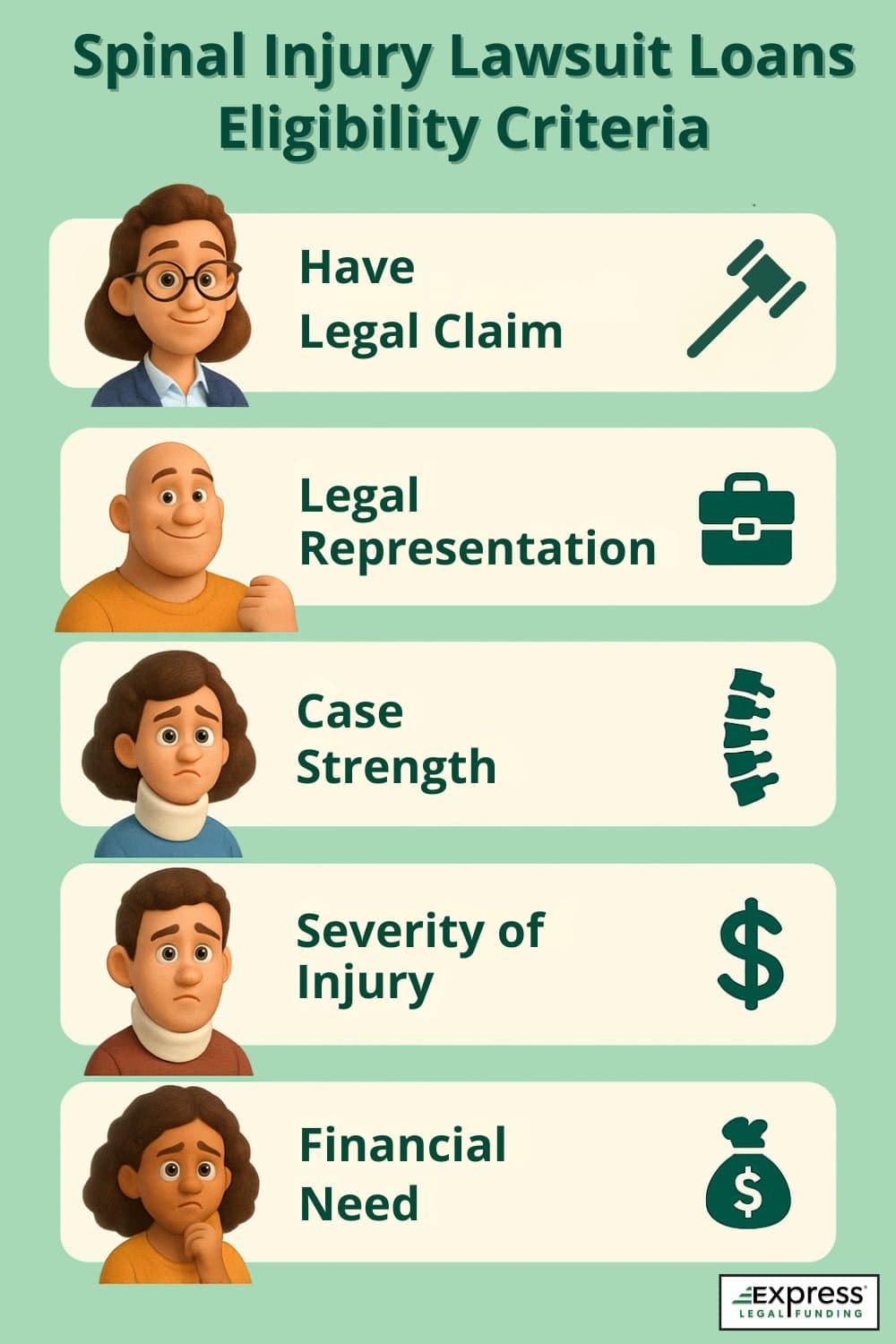

Basic Spinal Injury Lawsuit Loans Eligibility Criteria

Pre-settlement funding offers financial relief to spinal injury victims involved in ongoing lawsuits. To qualify, several key criteria must be met:

You’ve Filed a Lawsuit

Your claim must already be in litigation or nearing that stage. Filing a lawsuit signals that the dispute is formalized and has the potential to result in monetary compensation. Without an active claim, there is no expected recovery for a funding company to base an advance on.

Legal Representation

Victims must be represented by an attorney on a contingency basis (commonly called a “no-win, no-fee lawyer“). This proves that the case is actively pursued and that the plaintiff and attorney are determined to secure a favorable settlement. Legal representation is crucial as it validates the claim and facilitates communication with the funding company.

Case Strength and Settlement Potential

The strength of the case is a pivotal factor in determining eligibility. The case must have clear liability and strong evidence of damages, such as medical records, accident reports, and witness statements. Legal funding companies assess potential settlement value to ensure that the case can cover the funding amount and other expenses.

Severity of Injury

The spinal injury must be significant enough to warrant substantial medical intervention and long-term care. This includes injuries from accidents, medical malpractice, or other incidents where negligence is evident. The severity of the injury impacts the expected settlement value and the amount of funding that can be provided.

Financial Need

Because pre-settlement funding can be expensive, it’s best reserved for essential expenses. Applicants should demonstrate a clear and immediate financial need, such as difficulty paying for basic living costs, urgent medical bills, or lost income resulting from the injury. Legal funding is meant to ease financial pressure during the litigation process, helping injured plaintiffs stay afloat while they pursue a fair settlement.

Types of Spinal Injuries That Typically Qualify for Lawsuit Loans

Not all spinal injuries carry the same financial weight. Lawsuit loan providers evaluate each claim based on the injury’s severity, permanency, and long-term impact on quality of life.

The following conditions frequently qualify for pre-settlement legal funding due to their high treatment costs, ongoing care needs, and potential for substantial pain and suffering damages:

Cervical Spine Damage or Paralysis

Cervical spine injuries often result from catastrophic accidents, such as high-speed car crashes, workplace falls, or sports-related trauma. These injuries may involve vertebral fractures, nerve root compression, or complete paralysis, leading to loss of motor function and requiring long-term neurological care.

Because cervical spine trauma significantly increases the estimated settlement value and typically involves both economic and non-economic damages, it is one of the strongest candidates for non-recourse lawsuit funding.

Spinal Fusion or Decompression Surgeries

Serious spinal conditions, including herniated discs, lumbar instability, or degenerative disc disease, often necessitate invasive procedures like spinal fusion or spinal decompression surgery. These operations carry extensive recovery times and long-term implications, including reduced mobility and chronic pain.

Because of the high medical costs, rehabilitation requirements, and evidence of permanent impairment, cases involving spinal surgery are frequently eligible for legal funding advances.

Chronic Neurological Impairment or Functional Loss

Injuries resulting in radiculopathy, myelopathy, or ongoing neurological deficits often indicate significant spinal cord damage. These conditions can cause chronic pain, partial paralysis, or inability to work, requiring long-term pain management and therapy.

Since these injuries directly affect earning capacity and daily living, these cases usually justify larger lawsuit loan amounts, especially when supported by thorough medical records and Functional Capacity Evaluations (FCEs).

Top 7 Reasons Spinal Injury Lawsuit Loans Are Denied (and How to Avoid Them)

Even severe and medically documented spinal cord injury claims can be denied pre-settlement loans. Legal funding providers perform detailed risk assessments, and if critical elements are missing, they may reject the application.

Below are seven of the most common reasons why spinal injury victims may be denied lawsuit cash advances, including those involving herniated discs, paralysis, nerve impingement, or other catastrophic back and neck injuries.

1. Lack of Clear Liability

If it’s unclear who caused the injury or if you are partially or entirely at fault, funding companies will likely decline your application. Most funders avoid cases where liability is disputed, especially if there’s no police report, witness statement, or strong supporting evidence.

2. Insufficient Medical Evidence

Claims without thorough documentation, such as MRI results, surgical records, or consistent treatment notes, raise red flags. A diagnosis alone is rarely enough. Underwriters need to see a clear connection between the injury and the incident, supported by medical imaging and expert evaluation.

3. No Attorney or Uncooperative Legal Counsel

Funding cannot proceed without a licensed attorney who agrees to cooperate. If you’re self-represented or if your lawyer refuses to engage with the funding provider (e.g., won’t confirm case details or return documents), the application will be rejected.

4. Weak Damages or Limited Recovery Potential

Cases involving minor spinal sprains, soft tissue damage, or no permanent impairment often don’t qualify. Even if the injury is legitimate, funders need a case with enough projected settlement value to justify the advance.

5. Previous Legal Funding Exhausts the Case Value

If you’ve already taken out one or more legal funding advances, the remaining value of your potential settlement may not support an additional disbursement. Funders typically cap advances at a percentage of expected recovery, often 10–20%, to manage risk.

Learn more about the different values of spinal injury lawsuits in our guide: How Much Is a Spinal Cord Injury Lawsuit Settlement Worth?

6. Inconsistent or Incomplete Case File

If your attorney cannot provide a complete case file, including complaint filings, insurance correspondence, and medical records, the funder may not have enough information to evaluate risk. Cases with gaps in documentation are often placed on hold or denied outright.

7. Case Recently Dropped by Attorney

If a lawyer has withdrawn from your case, it signals a potential issue, such as a lack of evidence, low recovery potential, or client non-cooperation. Reputable legal funders will not underwrite cases without active legal counsel, and a withdrawal usually ends funding eligibility until new representation is secured.

If an attorney dropped your case, don’t wait to find new representation—legal deadlines still apply. Learn more in our guide: Statute of Limitations for Spinal Injury Lawsuits

How Much Can You Get from a Spinal Injury Lawsuit Loan?

For spinal injury victims seeking pre-settlement funding, understanding the typical amount available is essential for planning their financial strategy during the legal process.

How Lawsuit Loan Amounts Are Calculated for Spinal Injuries

Lawsuit loan providers typically advance 10% to 20% of your estimated case value, though this range can vary depending on several key factors. Unlike traditional loans, spinal injury lawsuit loans are based on the potential value of your legal claim, not your credit score or income.

To determine how much to advance, funding companies evaluate:

- Severity of the Injury: More serious spinal injuries, such as permanent paralysis or surgeries like spinal fusion, signal higher damages and increase your funding potential.

- Estimated Settlement Value: Funders review similar past verdicts and settlements to estimate how much your case may be worth.

- Liability and Case Strength: Strong, well-documented claims with clear liability are more likely to qualify for higher advances.

- Medical Documentation: Detailed records of treatment, diagnosis, prognosis, and ongoing care help justify larger funding amounts.

- Attorney Cooperation: A responsive and experienced attorney who supports the funding request can positively impact approval and loan size.

By understanding how these components influence your loan offer, you can better prepare for the application process and maximize the funding available for medical care, housing, and other urgent needs.

Typical Spinal Injury Lawsuit Loan Amounts Explained

Spinal injury lawsuit loan amounts vary widely, typically ranging from $5,000 to $100,000 or more, depending on the severity of the injury, the strength of your case, and the estimated settlement value.

These cash advances are designed to help plaintiffs borrow money on their pending lawsuit and cover urgent costs while waiting for a settlement.

Cases involving catastrophic spinal trauma, such as paralysis, cervical spine injuries, or herniated discs requiring spinal fusion surgery, tend to qualify for larger funding amounts. That’s because the long-term medical needs and the high likelihood of a significant settlement increase the funding company’s confidence in recovery.

On the other hand, lawsuits involving milder spinal injuries or limited documentation may only qualify for smaller advances, particularly if there are questions about liability or medical causation.

What’s the Average Spinal Injury Lawsuit Loan Amount?

For plaintiffs with active spinal injury lawsuits, pre-settlement cash advances typically range from $10,000 to $50,000. However, cases involving catastrophic injuries, such as paralysis, spinal fusion surgery, or permanent disability, may qualify for even higher funding amounts.

The specific amount you may be approved for depends on several key factors:

- Severity and documentation of medical injuries (e.g., MRI results, surgical reports, long-term care plans)

- Projected settlement value based on case type and jurisdiction

- Strength of liability evidence and clear attribution of fault

- Availability of insurance coverage and defendant assets

By understanding how these variables affect your eligibility and funding limits, you can set more realistic expectations, avoid overborrowing, and better manage critical expenses like medical bills, lost wages, rent, and household utilities while your lawsuit remains unresolved.

Staying informed empowers you to make confident, financially sound decisions as your spinal injury claim progresses through the legal system.

Documents Required for Spinal Injury Lawsuit Funding

Applying for a spinal injury lawsuit loan is generally straightforward, but submitting the right documentation is key to getting fast approval and maximizing the funding amount. Legal funding companies rely on case details and medical evidence to evaluate risk and determine how much money they can advance.

Below are the essential documents most legal funding providers require:

Attorney’s Contact Information

Legal funding cannot proceed without active attorney participation. Funder–attorney communication is crucial for:

- Verifying case details

- Confirming the lawsuit is active and viable

- Reviewing liability and settlement expectations

Having your attorney responsive and cooperative is a major factor in securing spinal injury lawsuit loans, as most funding companies require attorney participation, making it nearly impossible to get approved for pre-settlement funding without your lawyer’s consent or cooperation.

Case File Summary

A clear and comprehensive summary helps funders assess the lawsuit’s strength. This typically includes:

- Description of how the spinal injury occurred

- Legal basis for the claim (e.g., negligence, product liability)

- Estimated settlement value

- Key documents: police reports, complaint filings, insurance communications, and any photo or video evidence

Medical Records

Medical documentation proves the severity and long-term impact of the spinal injury. Important records include:

- Hospital admission notes and emergency care reports

- MRI, CT scan, and X-ray results

- Surgical reports (e.g., cervical spinal fusion, laminectomy)

- Physical therapy and rehabilitation records

- Disability evaluations or prognosis for permanent impairment

These records allow the funder to gauge both the economic and non-economic damages the case may recover.

Providing these documents upfront can speed up the funding process and help you qualify for a higher spinal injury lawsuit loan amount.

The Role of Medical Documentation: A Deeper Dive

When applying for pre-settlement funding in a spinal injury case, medical records aren’t just helpful—they’re critical. They serve as the backbone of your claim, giving legal funding underwriters a clear picture of the injury’s severity, treatment path, and long-term impact.

The more thorough and compelling your documentation, the higher your chances of qualifying for a substantial lawsuit loan.

Most Impactful Types of Medical Documentation:

Each type of record plays a specific role in justifying your need for funding and projecting the potential settlement value:

- Diagnosis Reports: Include specific ICD-10 codes that clearly identify spinal cord trauma, fractures, disc herniation, or nerve compression.

- MRI or CT Imaging Results: These objective scans provide visual evidence of structural damage and are essential for establishing permanency or disability.

- Surgical Notes: Especially vital in cases involving spinal fusion, discectomy, or laminectomy. Detailed operative reports show the seriousness of the injury and the extent of medical intervention.

- Treatment Plan and Timeline: Documentation of ongoing physical therapy, pain management procedures, or spinal injections supports claims of continued impairment and medical costs.

- Disability Assessments: Functional Capacity Evaluations (FCEs), neurologist letters, or orthopedic assessments indicating reduced mobility or inability to work greatly strengthen your case and funding eligibility.

By submitting detailed medical documentation early in the process, you not only speed up your approval but also increase the potential loan amount based on the projected value of your claim.

Does Your Attorney Need to Be Involved to Get a Spinal Injury Lawsuit Loan?

Yes, attorney participation is mandatory for pre-settlement funding approval.

Your lawyer must agree to sign an acknowledgement of the funding and communicate with the funder during underwriting. Cooperation helps speed up approval, as delays typically occur when attorneys are unresponsive or unwilling to provide documents.

Funder-to-attorney collaboration is critical. Delays in approval are most often caused by lawyers who are unresponsive or unwilling to share necessary documentation. On the other hand, a cooperative attorney can significantly accelerate the process.

Why This Matters:

By ensuring your lawyer is on board and providing the following:

- Case file summaries

- Medical records

- Contact availability

You help present a complete and credible application. This not only increases your chances of securing spinal injury lawsuit funding but also helps ensure you receive the amount you truly need to manage medical bills, lost income, and day-to-day expenses during your recovery.

State-Specific Regulations for Spinal Injury Lawsuit Loans

Third-party litigation funding for consumers is legal in most U.S. states, but the rules governing it vary significantly depending on where you live.

Some states treat spinal injury lawsuit loans as regulated financial products, subject to interest rate caps, licensing, and disclosure requirements.

Others view them as non-recourse investments, imposing fewer restrictions and allowing greater flexibility in contract terms.

Key State Considerations:

- Colorado and Tennessee: These states have implemented caps on fees and interest rates for legal funding providers.

- New York: Lawsuit funding is permitted. Plaintiffs should ensure providers are transparent and follow fair practice guidelines.

- Arkansas and West Virginia: Legal funding is severely restricted and effectively prohibited. Residents may need to explore alternative forms of financial relief.

- California and Florida: Legal funding is allowed, and the state bars have published documents explaining the attorney’s permitted role.

Before applying, claimants should verify whether their state requires specific licensing, fee limits, or disclosures. Consulting a personal injury attorney familiar with local rules can help avoid non-compliant or exploitative arrangements.

Spinal Injury Lawsuit Loan Costs and Rates

Spinal injury lawsuit loans can offer vital financial relief, but it’s essential to understand how much they cost. Legal funding fees and interest rates vary by provider, and small differences can have a major impact over time, especially if your case takes a year or longer to settle.

Interest Rates

- Legal funding is not a traditional loan, but it still accrues fees or interest over time.

- Most lawsuit funding companies charge monthly compounding rates ranging from 2% to 4% per month.

- This translates to 24% to 60% annually, depending on how long your case takes to resolve.

Fee Types

Pre-settlement funding companies may charge different types of fees. In addition to interest, some funders may charge:

- Origination Fees: 5%–10% of the funded amount, deducted up front.

- Processing Fees: Flat charges for administrative tasks, usually $100–$300.

- Underwriting Fees: Sometimes hidden in the contract—ask for a full fee schedule.

- Broker Markup: If you apply through a legal funding broker, they may charge an additional fee not included in the base rate.

Example Spinal Injury Lawsuit Loan Cost Timeline

Let’s say you receive $10,000 in funding for a spinal cord injury lawsuit at a 3% monthly compounding rate, and your case settles in 12 months.

Here’s what repayment would look like:

Spinal Injury Lawsuit Loan Cost Breakdown (12-Month Example)

| Time Period | Months Elapsed | Estimated Balance Owed |

|---|---|---|

| Initial Advance | 0 months | $10,000.00 |

| Quarter 1 | 1–3 months | $10,927.27 |

| Quarter 2 | 4–6 months | $11,940.52 |

| Quarter 3 | 7–9 months | $13,047.73 |

| Quarter 4 | 10–12 months | $14,257.61 |

(This illustrative example assumes no other fees and full repayment from settlement funds.)

Risks to Watch For

Before signing a lawsuit loan agreement, watch out for:

- No Cap on Repayment: Without a repayment cap, interest can balloon if your case takes years to settle.

- Lack of Transparency: Contracts that don’t clearly disclose repayment terms, interest calculations, or total cost under different timelines.

- Non-Negotiable Terms: If the provider refuses to discuss or explain the pricing, it’s a red flag.

- Early Repayment Traps: Some providers still charge full interest blocks even if you repay early.

Pro Tip: Always ask for a full amortization schedule before agreeing to any lawsuit loan. This will help you visualize what you’ll owe at 6, 12, 18, or 24 months—and help avoid unpleasant surprises when your case settles.

Frequently Asked Questions About Spinal Injury Lawsuit Loans

How much can I get for a spinal injury settlement loan?

Most plaintiffs receive 10% to 20% of their estimated settlement in pre-settlement funding. The exact amount you can get depends on factors such as case type, injury severity, liability strength, and available insurance limits.

Are there specific states where pre-settlement funding is available?

Yes, spinal injury pre-settlement funding is available in many U.S. states, especially high-demand regions like Texas, Florida, Georgia, and Michigan. Other eligible states include Alabama, Arizona, Louisiana, Mississippi, Missouri, New Mexico, Oklahoma, Pennsylvania, and Virginia.

Keep in mind that some states may regulate funding terms or limit available amounts. Check your local consumer legal funding laws before applying.

What is the typical lawsuit loan amount for spinal injury cases?

Most spinal injury plaintiffs qualify for pre-settlement funding amounts ranging from $5,000 to $100,000, depending on the severity of the injury, expected case value, and length of recovery. Cases involving permanent disability or paralysis may receive higher advances due to their long-term impact and higher settlement potential.

What happens if I lose my spinal cord injury lawsuit?

If you lose your case, you don’t have to repay the money. Spinal injury pre-settlement funding is non-recourse, which means you only repay the advance if you win or settle your lawsuit. There’s no personal liability or out-of-pocket risk if your claim doesn’t succeed.

How quickly can I get my spinal injury lawsuit funding?

Once you’re approved, you can receive your spinal injury pre-settlement funds in as little as 24 hours. Most funding companies offer fast disbursement by direct deposit, with other options like overnight checks or wire transfers available based on your preference.

Can I use my spinal injury pre-settlement funds for any purpose?

Yes, you can use the funds for nearly any personal need, including rent, utilities, groceries, medical treatment, or lost income while your case is pending. However, you generally can’t use the money to pay legal fees or costs directly related to pursuing your lawsuit, as most funding companies prohibit that use.

Conclusion: How Your Spinal Injury Affects Lawsuit Loan Approval

Not all spinal injuries carry the same legal weight when it comes to lawsuit loan approval. The type, location, and severity of your spinal injury—whether it’s a herniated disc, spinal fusion, or permanent paralysis—play a critical role in determining how much pre-settlement funding you can qualify for.

Injuries involving the cervical, thoracic, lumbar, or sacral spine each present unique medical challenges and legal considerations, all of which impact your case’s potential value.

Legal funding companies evaluate more than just your diagnosis. They assess long-term implications like disability, loss of income, ongoing care needs, and how clearly the injury was caused by someone else’s negligence. That’s why detailed medical records and clear evidence of liability are essential.

No two spinal injury cases are the same. Whether your injury results in limited mobility or lifelong care, working with experienced attorneys and healthcare providers is key to building a strong claim.

With the right documentation and support, you improve your chances of funding approval and ensure any cash advance reflects the true legal and financial weight of your injury.

Apply Now for a Spinal Injury Lawsuit Loan with Express Legal Funding

Suffering a spinal injury can be physically, emotionally, and financially overwhelming, especially when your lawsuit is still pending. At Express Legal Funding, we understand how quickly the costs add up: hospital bills, physical therapy, mobility aids, and lost income can place an enormous burden on you and your family.

That’s where we come in.

We offer pre-settlement funding—a risk-free cash advance designed to help injured plaintiffs cover essential expenses while their spinal injury case moves through the legal process. This is not a traditional loan. You only repay us if you win or settle your case. If you don’t recover any compensation, you owe us nothing.

With Express Legal Funding, you can:

- ✅ Pay rent, utilities, groceries, and urgent living expenses

- ✅ Cover medical costs like surgery, rehab, or spine-related equipment

- ✅ Avoid the pressure of accepting a lowball insurance offer

Whether your spinal injury involves the cervical, thoracic, lumbar, or sacral region, we tailor your funding amount to match the severity of your injury and the strength of your legal case. Our team works directly with your attorney for fast, seamless approvals—often in under 24 hours.

Apply Now or Call (888) 232-9223 to Get Started

Let Express Legal Funding help you stay financially stable while you pursue the full and fair compensation you deserve.

Glossary of Key Terms in This Article

- Amortization Schedule: A breakdown of scheduled loan payments over time, outlining how much of each payment goes toward interest and principal. In the context of lawsuit loans, it can illustrate how the loan balance increases over time due to interest accumulation.

- Cervical Spine: The top section of the spine located in the neck. Damage to this area can result in serious neurological issues, including paralysis.

- Compounding Interest: Interest that is calculated not just on the original loan amount but also on any previously accrued interest. With lawsuit advances, this means the cost can grow rapidly month to month.

- Contingency Fee Arrangement (No-Win, No-Fee): A payment structure where a lawyer only receives compensation if they win or settle the case. If the case is lost, no legal fees are owed. This is often required for lawsuit funding eligibility.

- Economic Damages: Measurable financial losses resulting from an injury, such as medical expenses, missed wages, and the cost of ongoing care.

- Functional Capacity Evaluation (FCE): A medical assessment used to evaluate an individual’s physical abilities after an injury, typically to determine work-readiness and daily activity capacity.

- Herniated Disc: A medical condition where the inner gel-like portion of a spinal disc pushes through its outer shell, potentially leading to discomfort, weakness, or numbness.

- ICD-10 Codes: A diagnostic coding system (International Classification of Diseases, 10th Edition) used by healthcare professionals to document injuries, including those affecting the spine.

- Liability: A legal term for being at fault or responsible for causing harm. When liability is clearly established in a case, it can strengthen eligibility for legal funding.

- Laminectomy: A type of back surgery where part of a vertebra, called the lamina, is removed to relieve pressure on the spinal cord or surrounding nerves.

- Lumbar Instability: A condition in the lower back where the vertebrae move abnormally, often causing chronic pain and sometimes requiring surgical correction.

- Myelopathy: A disorder resulting from compression of the spinal cord, which can cause numbness, coordination problems, and muscle weakness.

- Non-Economic Damages: Losses that don’t have a clear dollar value, such as emotional pain, reduced quality of life, and loss of companionship.

- Non-Recourse Legal Funding: A cash advance provided during a lawsuit where repayment is only required if the case results in a favorable outcome (e.g., settlement or win).

- Origination Fees: Fees charged upfront by funding companies or lenders to process and approve a new advance or loan.

- Personal Injury Claim: A civil action brought by someone injured due to another party’s negligence or misconduct, seeking compensation for losses.

- Pre-Settlement Funding (Lawsuit Cash Advance): Financial support offered to plaintiffs before their cases are resolved, giving them early access to potential settlement funds.

- Radiculopathy: A condition caused by nerve compression in the spine, often leading to shooting pain, tingling, or muscle weakness along the affected nerve path.

- Sacral Spine: The bottom section of the spinal column, composed of the sacrum, which is fused with the pelvis.

- Spinal Decompression Surgery: A surgical method to relieve pressure on nerves or the spinal cord, commonly involving the removal of parts of bone or disc material.

- Spinal Fusion: A surgical technique where two or more spinal vertebrae are permanently joined to stabilize the spine and reduce movement-related pain.

- Thoracic Spine: The central portion of the spine, located between the cervical (neck) and lumbar (lower back) regions.

- Underwriting Fees: Charges associated with evaluating the risk of providing legal funding, which may sometimes be embedded in fine print.

Citations:

AAPC. (n.d.). M43.26 – Spondylolisthesis, lumbar region. https://www.aapc.com/codes/icd-10-codes/M43.26