🙅 If your pre-settlement loan application was denied, you’re not alone—and it doesn’t necessarily mean your case is weak. While these settlement advances aren’t based on credit scores or income, they are still subject to strict eligibility requirements.

Most denials occur due to legal, procedural, or case-specific factors that make the risk too high for lawsuit lenders. Understanding the most common reasons for rejection can help you fix the issue and reapply successfully.

In this guide, we’ll explain why pre-settlement loans get denied and what steps you can take to improve your chances of approval.

What Is a Pre-Settlement Loan and How Does It Work?

A pre-settlement loan—also known as lawsuit funding, legal funding, or a lawsuit cash advance—is a non-recourse financial advance provided to plaintiffs with pending legal claims. It gives you access to money now based on the expected value of your future settlement.

Unlike traditional loans, pre-settlement funding doesn’t require monthly payments, credit checks, or repayment if you lose your case. Because it’s non-recourse, repayment only comes from a successful settlement or court award. This makes it a valuable option for personal injury victims and other plaintiffs who need financial relief during a lengthy legal process.

Read our guide: Lawsuit Loans vs. Pre-Settlement Funding: 5 Key Differences

Disclaimer: For clarity and accessibility, the term loan is used throughout this article. However, pre-settlement loans are technically non-recourse cash advances, not traditional, credit-based loans. Approval is based on the merit of your legal case, not your creditworthiness.

Why Do Pre-Settlement Loans Get Denied?

Legal funding companies carefully assess risk before approving a pre-settlement loan. Since repayment only comes from a future settlement or court award, lenders must be confident that your case is likely to succeed—and that the expected payout will be large enough to cover the advance, your attorney’s fees, and any outstanding liens or medical bills.

If your application was denied, it likely didn’t meet the lender’s internal eligibility criteria or risk thresholds. This could be due to the stage of your case, insufficient documentation, or concerns about liability or potential recovery.

Below is a list of the most common reasons lawsuit loan applications are denied.

Top 10 Reasons Pre-Settlement Loans Are Denied

- You don’t have an attorney representing your case.

- Your case is too weak or considered too risky by the funder.

- The expected settlement value is too low to justify funding.

- You live in a state that restricts or prohibits legal funding.

- You’ve already received the maximum allowable amount based on your case value.

- Your attorney won’t cooperate with the funding company.

- Your case is too new or lacks sufficient documentation.

- Liability is unclear, disputed, or you’re partially at fault.

- You have outstanding liens or an active bankruptcy case.

- Your case type is ineligible or conflicts with the lender’s policy guidelines.

1. You Don’t Have an Attorney

Pre-settlement funding companies deny applications from plaintiffs who don’t have an attorney. Legal representation is a strict requirement because lenders rely on your attorney to validate the claim, share case updates, and coordinate repayment from any future settlement. Without a lawyer, funders view the case as too risky to support.

2. Your Case Is Too Weak or Risky

Lawsuit loan applications are often denied when the case appears too weak or uncertain to win. Legal funding companies evaluate the strength of your claim based on the defendant’s liability, available evidence, and expected damages. If your case lacks clear proof or has a low chance of settlement, funders are unlikely to take the risk.

For example, in a slip and fall case, if there’s eyewitness testimony claiming the plaintiff appeared to intentionally fall and no visible liquid or hazard was found on the floor, the perceived credibility of the claim is significantly weakened.

Even if the plaintiff was injured, the lack of liability evidence and the suggestion of fraud may lead funders to deny the application.

3. Your Expected Settlement Value Is Too Low

Pre-settlement loan requests are commonly denied when the expected settlement amount is too small. Most legal funding companies only approve cases with sufficient projected value—typically over $20,000—so there’s enough room to repay the advance after legal fees and liens. If your case is valued too low, it may not qualify for funding.

4. You Live in a State That Restricts Legal Funding

Some states prohibit or heavily regulate pre-settlement funding, leading to automatic loan denials. If you live in a state with restrictive laws, such as Arkansas, Colorado, Kentucky, or Tennessee, lawsuit loans may not be legally available.

Even if your case is strong, ethical legal funding companies won’t approve applications in jurisdictions where funding is not permitted.

5. You’ve Already Taken the Maximum Funding

Lawsuit funding companies typically cap advances at 10% to 20% of your case’s estimated value. If you’ve already received a prior pre-settlement loan or have substantial medical or legal liens, you may have reached your funding limit.

In that case, any new application is likely to be denied due to limited remaining recovery.

Want to know if you can get additional funding? Read our full guide: How Many Pre-Settlement Loans Can You Get?

6. Your Attorney Won’t Cooperate

If your attorney refuses to work with the funding company, your pre-settlement loan will likely be denied. Legal funding providers require your lawyer to supply case documents, verify case status, and sign the attorney acknowledgement section for the funding agreement. Without your attorney’s cooperation, lenders cannot process or approve the application.

In Practice: Some attorneys are hesitant to participate in legal funding due to concerns about repayment terms or how it might affect their client’s net settlement. This may lead them to refuse to sign the funding agreement or delay sending required documents. Even if your case qualifies, a lack of attorney cooperation can stop the process entirely.

Pro Tip: If this happens, talk openly with your lawyer to understand their concerns. Some funders are willing to work directly with your legal counsel to address ethical or logistical issues.

Relevant guide: Can I Get Pre-Settlement Funding Without Attorney Consent?

7. Your Case Is Too New or Lacks Documentation

Pre-settlement loan applications are often denied when there isn’t enough documentation to properly evaluate the case. Legal funding companies rely on case records to assess risk, and without sufficient evidence, they can’t determine whether your lawsuit is likely to succeed or result in a meaningful settlement.

If your claim is still in the early stages of pre-litigation, such as waiting for a police report, medical records, witness statements, or a formal complaint to be filed, funders may view your case as too undeveloped to support. Even if your injuries are severe, lenders need clear documentation to confirm liability, damages, and the extent of your losses.

For example, if you were injured in a rear-end car accident but haven’t yet sought medical treatment or filed a claim with the at-fault driver’s insurance, there’s no proof of damages or negligence on record. In such cases, legal funding companies will typically wait until more paperwork is available before reconsidering your application.

Pro Tip: The stronger your documentation, especially medical records and incident reports, the easier it is for underwriters to approve your request.

8. Liability Is Unclear or You’re Partially at Fault

Legal funding companies often deny applications when fault for the incident is disputed or shared. In states with comparative or contributory negligence laws, being even partially at fault can reduce or eliminate your settlement. If the liability isn’t clearly in your favor, lenders may see your case as too risky to fund.

For example, if you were injured in a slip-and-fall accident at a grocery store, but there’s surveillance footage showing you looking at your phone and not noticing a “Wet Floor” sign, or a witness claims you slipped on purpose, the funding company may question the strength of your liability claim. Even if you were legitimately injured, that uncertainty over fault can result in a denial.

9. You Have Outstanding Liens or Bankruptcy

Pre-settlement loan applications may be denied if you have significant liens or an active bankruptcy case. Legal funding companies evaluate your net recovery—what’s left after attorney fees, medical bills, owed child support, or tax liens. If those obligations are too high, or a bankruptcy court has a claim on your settlement, lenders may reject your request.

10. Case Type Isn’t Eligible or Lender Policy Conflicts

Some legal funding companies have restrictions on the types of cases they’ll approve for pre-settlement loans. If your claim involves medical malpractice, workers’ compensation, or a complex class action, it may fall outside a lender’s risk profile. Each funder sets its own guidelines, so eligibility can vary by provider.

Read our fully updated, in-depth guide to help you choose the right legal funding provider—especially if other companies have let you down: 10 Best Legal Funding Companies in 2025: Scores & Reviews

Summary Table: Why Pre-Settlement Loans Get Denied

| Reason for Denial | Explanation |

|---|---|

| No Attorney Representation | Legal funding companies require you to have an attorney. Without legal representation, your application is automatically denied. |

| Case Is Too Weak or Risky | If your claim lacks evidence or has a low chance of winning, funding companies won’t take the risk. |

| Settlement Value Too Low | Cases valued under $20,000 may not qualify, as there may not be enough to cover the advance and legal costs. |

| State Restrictions on Legal Funding | States like Arkansas, Kentucky, and Tennessee limit or "ban" legal funding, leading to automatic denials. |

| You’ve Reached the Funding Limit | Funders typically cap loans at 10–20% of your case value. If you've already received funding, you may not be eligible for more. |

| Attorney Won’t Cooperate | If your lawyer refuses to share documents or sign the funding agreement, the application can’t proceed. |

| Case Is Too New or Missing Documentation | Early-stage claims without police reports or medical records are often denied due to lack of evaluable information. |

| Liability Is Disputed or Shared | If you’re partially at fault or liability is unclear, lenders may view your case as too risky. |

| Outstanding Liens or Bankruptcy | Active bankruptcy or unpaid liens (e.g., child support or tax debts) can reduce your net recovery and disqualify you. |

| Ineligible Case Type or Internal Policy | Some funders exclude case types like medical malpractice or workers’ comp. due to internal underwriting guidelines or restrictions from their financial backers. |

What to Do If Your Pre-Settlement Loan Is Denied (Step-by-Step Guide)

Getting denied for a pre-settlement loan doesn’t mean you’re out of options. In many cases, denials are based on temporary issues—like missing documents, an early-stage claim, or limited cooperation from your attorney. Here’s what you can do to improve your chances of approval on a future application:

- Find out why you were denied: Ask the funding company or your attorney for a clear explanation. Understanding the exact reason can help you take targeted action.

- Strengthen your case documentation: Gather all relevant records, such as medical reports, accident photos, or police reports. The more evidence you provide, the better.

- Continue medical treatment and follow your lawyer’s advice: Staying consistent with care and legal guidance shows you’re serious about your case.

- Resolve outstanding liens or legal issues: If you have a child support lien, IRS debt, or an active bankruptcy case, try to address these obligations before reapplying. Unresolved legal or financial claims can reduce your potential recovery and lead to another denial.

- Wait until your case progresses: Sometimes, time is the solution. Once your claim is more developed or closer to settlement, lenders may reconsider.

Pro Tip: You can reapply with the same lender—or try another that may have more flexible approval standards.

🟢 Apply for a pre-settlement advance with Express Legal Funding. Approvals are quick!

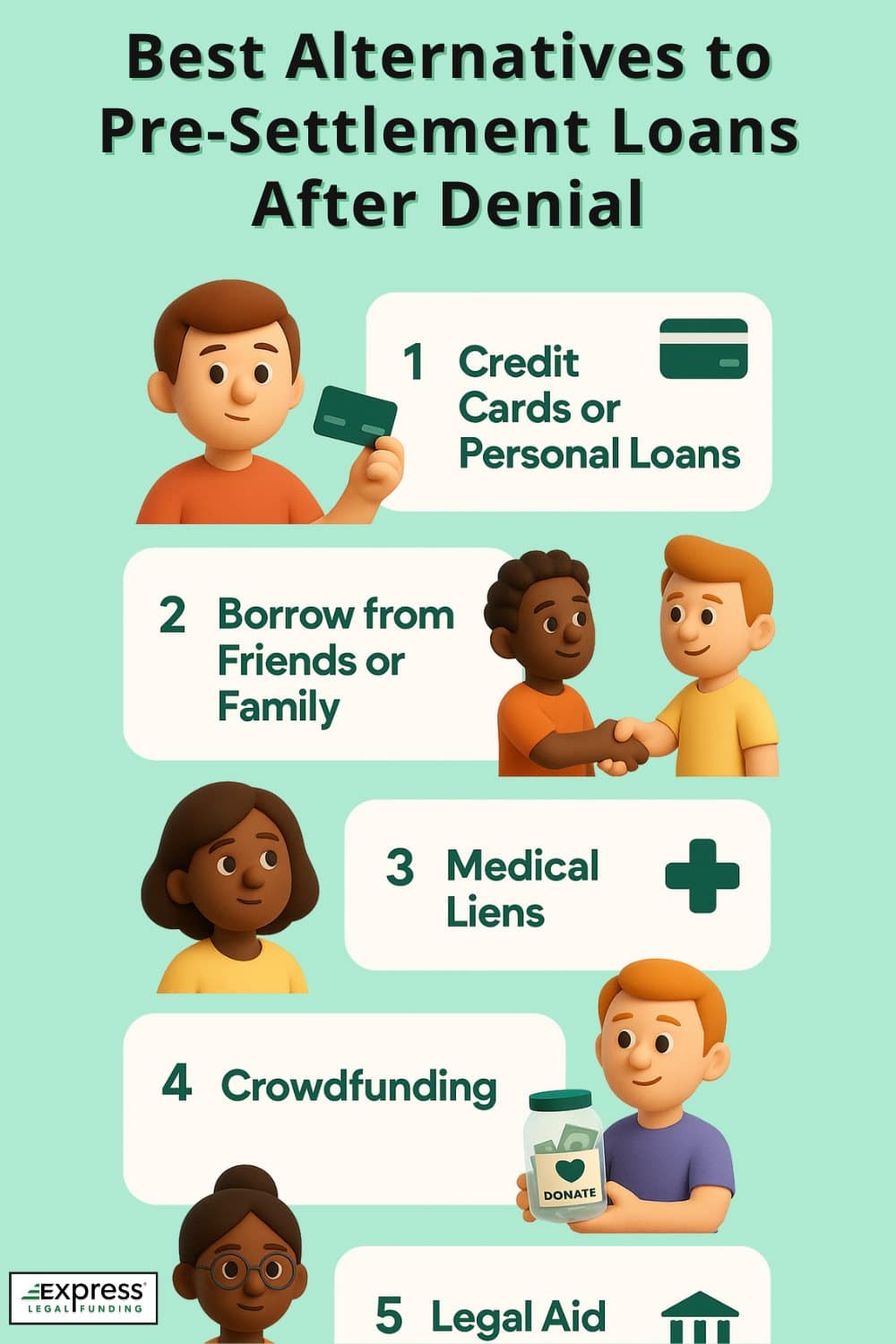

Best Alternatives to Pre-Settlement Loans After a Denial

If your lawsuit loan application is denied, there are still other ways to get financial support while your case is pending. Consider these alternative funding options:

- Personal loans or credit cards: These offer fast access to cash but come with repayment obligations and interest—unlike non-recourse legal funding.

- Borrow from friends or family: While not always ideal, this option can help bridge the gap without formal approval requirements.

- Medical provider liens or treatment on contingency: Some healthcare providers may agree to delay payment until your case settles by using a letter of protection (LOP)—a legal agreement that ensures they’ll be paid from your future settlement, especially common in personal injury claims.

- Crowdfunding platforms: Sites like GoFundMe allow you to raise money from your community to help cover bills and living expenses.

- Legal aid or local nonprofit programs: Depending on your situation, you may qualify for emergency financial help or legal assistance through nonprofit organizations.

Pro Tip: While these alternatives can provide short-term relief, always consult your attorney before making financial decisions tied to your lawsuit.

Explore your alternative financial options further in our guide: 15 Alternatives to Lawsuit Loans: Pros, Cons, & How to Apply

Pre-Settlement Loan Denial FAQs: Common Questions Answered

Can I get a pre-settlement loan without a lawyer?

No, you must have an attorney to qualify for a pre-settlement loan. Legal funding companies require an attorney to verify your case, provide documentation, and handle repayment from your settlement. Applications without legal representation are automatically denied.

Does my credit score affect my pre-settlement loan application?

No, your credit score does not affect eligibility for legal funding. Pre-settlement loans are based on the strength and value of your lawsuit—not your credit history, income, or employment status.

Can I reapply for a lawsuit loan after being denied?

Yes, you can reapply after a denial—especially if you’ve fixed the issue that caused it. Common reasons to reapply include added documentation, case progress, or attorney cooperation. Some lenders even encourage resubmission once your case matures.

How long should I wait to reapply after a denial?

You can reapply for legal funding as soon as your case status changes or the reason for denial is resolved. This may include completing medical treatment, securing more documentation, or getting attorney cooperation. Some plaintiffs reapply in a few weeks, while others wait until their case has significantly progressed.

At Express Legal Funding, we often encourage applicants to reapply in 30 days if their denial was based on timing—such as a case being too new or lacking documentation. Our underwriters frequently approve applicants who were previously denied once more information becomes available or the case advances.

Can I switch legal funding companies after being denied?

Yes, you can apply with a different legal funding company after being denied. Each company has its own underwriting criteria, case type preferences, and risk tolerance. If one lender denies your application, another may approve it—especially if your case progresses or you provide new documentation. Always consult your attorney before switching.

Can my attorney stop me from getting a lawsuit loan?

Your attorney can’t stop you from applying for a lawsuit loan, but they can prevent approval by not cooperating. Legal funding companies need your attorney to sign documents and confirm case details. If your lawyer refuses, your application can’t be processed.

Relevant guide: Can My Lawyer Stop Me From Getting Pre-settlement Funding?

Final Thoughts: Don’t Give Up After Denial. You May Still Qualify for Legal Funding

Being denied for a pre-settlement loan can be frustrating, but it doesn’t mean your case lacks merit. Most denials are due to timing, documentation issues, or eligibility criteria—not the strength of your lawsuit. By understanding why your application was rejected and taking steps to address those issues, you may still qualify for funding later.

Remember: Legal funding companies assess risk carefully, but many offer second reviews once your case progresses.

Need a Second Opinion? Express Legal Funding Can Help

If another legal funding company denied your application for a pre-settlement loan, don’t give up. At Express Legal Funding, we specialize in helping plaintiffs get approved—even after other lenders say no with fast pre-settlement funding buyouts. Our team takes a fresh look at your case, and we never charge fees to apply or review your claim.

We’ve helped thousands of injured clients secure fast, affordable pre-settlement cash advances, even in difficult situations.

Contact us today for a free, no-obligation case evaluation, and see how much funding you could qualify for based on your updated case status.

Apply for a Pre-Settlement Loan With Express Legal Funding

Glossary of Key Terms in This Article

- Pre-settlement loan (also called lawsuit funding, legal funding, or a lawsuit cash advance): A type of financial advance offered to plaintiffs involved in active legal claims. It’s based on the anticipated value of a future settlement or court award and does not require repayment unless the plaintiff wins the case.

- Non-recourse: A funding arrangement where repayment is only required if the plaintiff successfully recovers compensation. If the case is lost, the plaintiff owes nothing back.

- Plaintiff: The individual or party who files a lawsuit, seeking compensation or relief from the opposing party.

- Settlement: A mutual agreement reached between both sides in a legal dispute, often resolving the matter without going to trial.

- Court award: A sum of money granted to the plaintiff by a judge or jury following a trial verdict.

- Legal representation: The act of being represented by an attorney during a legal matter.

- Liability: Legal accountability for causing harm, injury, or damage to another party.

- Damages: The monetary compensation sought or awarded to a plaintiff for losses or injuries suffered.

- Expected settlement value: The projected amount of money a case is likely to resolve for, typically estimated by attorneys or funding companies.

- Funding cap: The upper limit on how much pre-settlement funding a company will provide for a case, generally expressed as a percentage of the estimated settlement amount.

- Attorney acknowledgement: A part of the funding agreement that requires the plaintiff’s attorney to confirm case details and agree to cooperate with the funding provider.

- Documentation: All relevant materials used to support a legal case, including police reports, medical records, witness statements, and photographs.

- Pre-litigation: The phase before a lawsuit is officially filed in court, where parties may negotiate or prepare their case.

- Comparative negligence: A legal concept where the plaintiff’s compensation may be reduced based on their share of fault in the incident.

- Contributory negligence: A more rigid legal rule (used in some states) where if the plaintiff is found to be even slightly at fault, they may be denied any compensation.

- Lien: A legal claim placed on a plaintiff’s future settlement or court award to ensure repayment of debts like medical bills, taxes, or child support.

- Bankruptcy: A legal procedure for individuals or businesses who can’t repay debts. An ongoing bankruptcy case can impact a plaintiff’s eligibility for pre-settlement funding.

- Underwriting criteria: The set of rules and risk factors a legal funding company uses to assess whether to approve a funding application.