Frequently Asked Questions (FAQs) Directory

Find answers to the most common questions about legal funding, lawsuits, and repayment.

Lawsuit Loan FAQs

A lawsuit loan, also called a pre-settlement cash advance, is a form of legal funding that helps plaintiffs pay bills and expenses while waiting for their case to settle. Unlike traditional loans, they carry no personal liability because repayment only comes from your settlement or court judgment if you win. The process is simple: apply, your attorney provides case details, the funding company reviews your claim, and if approved, money is delivered—often within 24 hours.

Why Plaintiffs Turn to Lawsuit Loans for Financial Relief

Lawsuits can take months—or even years—to settle, leaving many plaintiffs burdened with daily expenses such as rent, medical bills, or household costs. This financial strain often forces people to consider low settlement offers simply because they cannot afford to wait.

Lawsuit loans, also known as pre-settlement funding, offer a solution. Despite the name, they are not traditional loans. Instead, they provide a cash advance on your future settlement that only needs to be repaid if your case is successful. If you lose, you owe nothing.

This type of funding is especially valuable in personal injury cases, including car accidents, slip and fall claims, medical malpractice, and wrongful death lawsuits. By giving plaintiffs access to funds now, lawsuit loans provide stability during long legal battles and allow attorneys the time they need to pursue fair compensation.

In this FAQ guide, we’ll break down what lawsuit loans are, how they work, who qualifies, their costs, and the protections available so you can make an informed decision.

Disclaimer: Although commonly referred to as “lawsuit loans”, these financial products are not loans in the traditional sense. They are non-recourse cash advances against your potential settlement or judgment. We use the term lawsuit loan throughout this page for accessibility and ease of understanding, but legally and financially, they are different from debt-based loans.

Definition & Basics of the Lawsuit Loan Process

What is a lawsuit loan?

A lawsuit loan is a non-recourse cash advance on your future settlement or court judgment. It gives plaintiffs access to money while their case is still ongoing. Unlike traditional financing, this money is not tied to your personal credit, job history, or income. Instead, approval is based on the strength of your case and the potential value of your claim.

For example, if you were injured in a car accident and your attorney is pursuing compensation, a legal funding company may advance you part of your expected settlement so you can cover bills, rent, or medical care during the lawsuit.

Is a lawsuit loan actually a loan?

Despite the name, a lawsuit loan is not a loan in the traditional sense. With a credit card or personal loan, you are responsible for repayment no matter what. Lawsuit loans work differently: repayment is conditional on a successful outcome. If your case fails, the advance does not need to be paid back.

This is based on state laws and court precedent.

This is why many providers, including Express Legal Funding, refer to them as pre-settlement funding or lawsuit cash advances, which more accurately describe the arrangement.

How do lawsuit loans work?

The lawsuit loan process is straightforward:

- Apply online or by phone.

- Case review: The funding company contacts your attorney for case details.

- Approval: If your case qualifies, you can receive money in as little as 24 hours.

- Repayment: Once your case settles, repayment is taken directly from your settlement proceeds.

This setup provides fast, risk-free access to funds for plaintiffs facing financial pressure.

Examples: How Lawsuit Loans Work in Real Life

Example: Car Accident Case

Martha was injured in a car accident and filed a personal injury lawsuit. While her attorney worked on the case, Maria’s medical bills and rent piled up. She applied for pre-settlement funding and, with her attorney’s cooperation, was approved for a $2,500 advance.

The money arrived the next day, allowing her to cover her living expenses while focusing on recovery. Months later, her attorney secured a settlement. Repayment was taken directly from the settlement proceeds, and Martha kept the remaining balance. If her case had been unsuccessful, she would have owed nothing.

Relevant guide: Can You Get a Loan on a Car Accident Settlement?

Example: Workplace Injury Case

James suffered a serious back injury while working at a construction site. His workers’ compensation claim was being disputed, and the case dragged on for months. Without income, James applied for pre-settlement funding and was approved for $4,000.

This money helped him cover rent and medical treatments until his case settled. When his attorney secured compensation, the advance was repaid directly from his award. If the case had been denied, James would not have owed anything.

Example: Medical Malpractice Case

Lisa filed a medical malpractice claim after a surgical error caused lasting complications. Her lawsuit was complex and expected to take years. Facing mounting medical bills, Lisa applied for pre-settlement funding. She was approved for a $10,000 advance, which covered therapy and household expenses.

Once her case concluded with a favorable settlement, repayment was deducted from her award. Had her case been unsuccessful, Lisa would have kept the funds without any obligation to repay.

These examples show how lawsuit loans provide practical, risk-free relief for plaintiffs who can’t afford to wait years for their case to resolve.

Lawsuit Loan Eligibility & Process

Who qualifies for lawsuit loans?

Not every plaintiff qualifies for a lawsuit loan. Approval depends on meeting a few key criteria:

- Active legal claim: You must have a lawsuit already filed in court or a legal claim under active attorney negotiation

- Attorney representation: You must be represented by a contingency fee attorney, since funding companies work directly with your lawyer to verify case details.

- Settlement potential: Your case must have clear settlement value, meaning there is a strong likelihood of compensation.

❌ Not eligible: Cases without legal representation or with uncertain liability usually do not qualify. Criminal cases, divorces, and child custody disputes are also not eligible.

What types of cases are eligible for lawsuit loans?

The most common types of cases that qualify for lawsuit loans include:

- Personal injury lawsuits: car accidents, truck accidents, slip and fall claims, and wrongful death cases.

- Medical malpractice: claims involving doctor or hospital negligence.

- Product liability: defective or dangerous products that cause injury.

- Civil rights and employment claims: wrongful termination, workplace discrimination, or harassment cases.

Because these cases often involve long legal battles and significant damages, they are good candidates for pre-settlement funding.

How do I apply for a lawsuit loan?

The lawsuit loan application process is designed to be simple and fast:

- Submit an application online or by phone in just a few minutes.

- Attorney cooperation: Express Legal Funding contacts your lawyer to gather details about your case, including liability, damages, and potential settlement value.

- Case review and approval: if your case meets the criteria, approval can happen within hours.

- Receive funds: most clients receive money in 24 hours or less after approval.

This streamlined pre-settlement funding process ensures plaintiffs can access the money they need quickly, without paperwork or credit checks.

Financial Terms of Lawsuit Loans

What are the costs and fees of lawsuit loans?

Lawsuit loans generally cost more than traditional bank loans because they are non-recourse and require no collateral. In these arrangements, the funding company assumes all the risk—if your case is unsuccessful, you owe nothing. To balance that risk, interest rates are typically higher than those for mortgages, credit cards, or personal loans, which always place repayment responsibility on the borrower.

Costs can vary significantly between providers. Some pre-settlement funding companies charge simple interest, which grows at a steady, predictable rate. Others use compound interest, which can make the payoff amount rise much faster over time. Before accepting funding, it’s crucial to understand which type of interest applies to your contract so you know the true cost of borrowing.

Example of Simple vs. Compound Interest for Lawsuit Loans

👉 Example: If you take a $3,000 advance with simple interest, you might owe $3,900 after a year. But with compounding, the payoff could be $4,500 or more over the same period.

You can see the difference in costs using our Lawsuit Loan Calculator.

At Express Legal Funding, we focus on transparent and affordable terms. You’ll know upfront how much the advance costs, with no hidden fees or surprise charges.

How is the lawsuit loan amount determined?

The amount you can receive from a lawsuit loan isn’t random. Lawsuit loan companies use an underwriting process that looks at several key factors, such as:

- Type of case: Serious injury cases usually qualify for higher advances than smaller disputes.

- Estimated settlement value: Larger expected payouts allow for larger funding.

- Insurance policy limits: The maximum available from the defendant’s insurer caps potential recovery.

- Attorney cooperation: The more details your lawyer provides, the easier it is to assess case strength.

Typical lawsuit loans range from $500 to $500,000, depending on the case. Plaintiffs should limit how much they borrow to what they need to cover essential living costs. Approved amounts are typically 10-20% of the full expected settlement. This prevents overborrowing and protects your final payout.

What happens if I lose my case? Do I have to repay the lawsuit loan?

If your case is unsuccessful, you don’t have to repay the lawsuit loan. The legal funding company accepts the loss, which is why settlement advances are considered one of the safest financing options for plaintiffs.

Can I get more than one lawsuit loan during my case?

Yes, in many situations, you can apply for more than one lawsuit loan (also called a pre-settlement advance) while your case is pending. Approval for additional funding depends on how your case is progressing, the estimated settlement value, and how much you have already borrowed.

Each request requires attorney cooperation and a new case review to ensure the advance is reasonable and won’t deplete your future recovery.

Important: While multiple advances are possible, borrowing too much can significantly reduce your final settlement payout. It’s best to only request the amount you truly need to cover essential expenses.

Pros and Cons of Lawsuit Loans

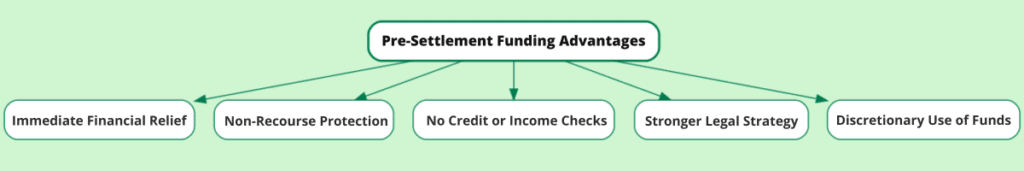

Before applying, it’s important to weigh both the benefits and drawbacks of lawsuit loans. Here are the main pros and cons:

Pros of Lawsuit Loans

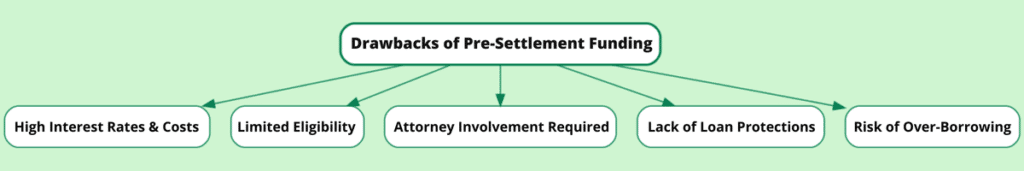

[ninja_tables id="22908"]Cons of Lawsuit Loans

[ninja_tables id="22909"]Lawsuit Loans vs. Traditional Loans vs. Credit Cards

While lawsuit loans are often compared to personal loans or credit cards, they work very differently. The key distinction is that repayment is tied to your settlement—not your income, credit score, or ability to make monthly payments. Here’s a side-by-side look:

[ninja_tables id="22910"]Why Lawsuit Loans Are Safer Than Traditional Loans

Unlike bank loans or credit cards, lawsuit loans and pre-settlement funding are non-recourse and carry no personal liability. That makes this type of legal funding a unique and safer option for plaintiffs who need fast, risk-free cash to cover living expenses while waiting for their case to resolve.

In addition to comparing lawsuit loans with traditional financing, it’s also important to understand other funding alternatives that may be available.

Alternatives to Lawsuit Loans and Legal Funding

While lawsuit settlement loans can be a lifeline, they aren’t the only option. Depending on your situation, you may want to consider these alternatives:

1. Personal Loans

- Offered by banks or credit unions.

- Require good credit, income verification, and repayment regardless of your case outcome.

- Lower interest rates than legal funding options, but carry full personal liability.

2. Credit Cards

- Quick access to funds if you have available credit.

- May be suitable for short-term expenses, as cardholders can avoid interest charges if the balance is repaid in full within the billing cycle.

- High APRs and compounding interest make them risky if balances carry over.

3. Borrowing from Friends or Family

- Flexible repayment terms, often interest-free.

- Avoids high costs but may create personal strain if repayment is delayed.

4. Payment Plans or Medical Liens

- Some doctors and providers offer treatment on a lien basis—payment is deferred until settlement.

- Reduces immediate financial pressure without borrowing cash.

5. Community or Government Assistance

- Programs may cover essentials like housing, utilities, or food.

- Nonprofit aid can sometimes offset urgent expenses without debt.

Read our full guide: 15 Alternatives to Lawsuit Loans

Are Lawsuit Loans Safe? Risks and Protections Explained

What does “non-recourse” mean for lawsuit loans?

Non-recourse funding means the lawsuit lender’s repayment rights are limited only to the settlement proceeds. If the case doesn’t end in compensation, you walk away without owing anything further. This structure shifts the financial risk from the plaintiff to the funding company.

Do lawsuit loans affect your credit score or credit report?

No, lawsuit loans do not affect your credit score or appear on your credit report. Unlike traditional lenders, legal funding companies do not perform hard or soft credit inquiries, and repayment isn’t reported to credit bureaus.

Approval is based solely on your case strength, not your financial history. This makes lawsuit loans (pre-settlement funding) accessible to plaintiffs who might not qualify for traditional financing.

Relevant read: Do Pre-Settlement Funding Companies Require Credit Checks?

Are lawsuit loans taxable income?

No, lawsuit loans are not taxable because they are not considered income. A lawsuit loan is a cash advance against your future settlement, not wages or earnings. Since repayment only comes from your case proceeds, the IRS does not treat the advance as taxable income.

However, the final lawsuit settlement itself may be taxable depending on the type of damages (for example, punitive damages are usually taxable, while compensation for physical injuries is not). Always consult a tax professional about your specific case.

Do consumer protections exist for lawsuit loans?

Yes. Several states, including Illinois, Ohio, Oklahoma, Missouri, and Utah, have enacted laws to regulate pre-settlement funding. These laws require companies to provide clear contracts, transparent fee disclosures, and limit unfair practices.

Even in states without specific regulations, reputable companies like Express Legal Funding go beyond the minimum. We follow legal funding industry best practices to make sure every client receives upfront, easy-to-understand terms—no hidden costs, no fine print surprises.

These protections ensure lawsuit loans remain a safe financial option for plaintiffs who need immediate relief while pursuing justice.

Attorney Role and Settlement Effects of Lawsuit Loans

Do I need my attorney’s approval to get a lawsuit loan?

Yes. Your attorney must participate in the process. Funding companies rely on your lawyer to provide case information and to sign off on the agreement. This protects you, since it ensures the loan terms are fair and that funding won’t interfere with your case. Without attorney cooperation, you cannot receive pre-settlement funding.

Relevant read: Can I Get Pre-Settlement Funding Without Attorney Consent?

How does a lawsuit loan affect my settlement?

Repayment is taken directly from your settlement check before you receive the remainder. This means your final payout will be smaller, but it can also give you more time and financial stability to pursue a larger settlement. For example, instead of accepting the first lowball offer, you may have the resources to hold out until your attorney negotiates a fair result.

What should I discuss with my lawyer before applying for a lawsuit loan?

Before moving forward with a lawsuit loan, it’s smart to have a detailed discussion with your attorney. Key points to cover include:

- Funding amount: How much do you actually need? Borrowing less helps you preserve more of your eventual settlement.

- State regulations: Lawsuit funding rules differ by state, so confirm what applies to your case.

- Repayment terms: Review how repayment will work and how it will affect your net recovery.

When your lawyer is involved early, a lawsuit loan can serve as a helpful financial tool instead of creating unnecessary strain.

Why is Express Legal Funding the best company for lawsuit loans?

Not all lawsuit loan companies are the same. Many operate as brokers, adding extra costs and confusing terms. At Express Legal Funding, we do things differently.

- Direct Lender Advantage: We are a direct funding company, not a broker. That means lower costs for you and no hidden middleman fees.

- Transparent Terms: From the start, you’ll know exactly what your funding will cost. We don’t use fine print or vague contracts. Our goal is to provide clarity, not confusion.

- Fast Approvals: We understand that plaintiffs often need money right away. That’s why we work with your attorney quickly and deliver funding in as little as 24 hours.

- Same-day Funding: We offer multiple same-day funding options, including same-day ACH and e-check for instant delivery.

- Risk-Free Guarantee: If you don’t win your case, you owe nothing. Period.

- Personal Injury Focus: Most of our clients are accident victims dealing with medical bills and lost wages. We’re experienced in helping people facing those exact challenges.

With Express Legal Funding, you can feel confident knowing you’re getting honest, affordable, and fast financial support while your attorney fights for the settlement you deserve. We’ve funded thousands of plaintiffs since 2015 and are BBB A+ accredited.

Additional Lawsuit Settlement Loan FAQs

Still have questions? Explore more of our detailed FAQ resources:

- Do I Need a Lawyer to Get Legal Funding?

- How Much Does Pre-Settlement Legal Funding Cost?

- Do I Have to Pay Taxes on Pre-Settlement Legal Funding?

- What Are the Pros and Cons of Pre-Settlement Funding?

Closing Thoughts on Lawsuit Loans and Pre-Settlement Funding

Waiting for a lawsuit to settle can feel like a financial battle of its own. Bills keep coming, medical expenses pile up, and daily living doesn’t pause for the legal process. A lawsuit loan—more accurately known as pre-settlement funding—offers a way to ease that stress. Because repayment is tied only to a successful settlement, this type of funding is both safe and risk-free.

Apply for a Risk-Free Lawsuit Loan Today

At Express Legal Funding, we make the process simple: you can apply in minutes, we review your case quickly, and you often receive cash in 24 hours or less once approved. With transparent terms and no hidden fees, you can focus on your case while we help with your immediate financial needs.

👉 Don’t wait for your case to drag on. Apply for a risk-free lawsuit loan online today and get the cash you need now. You can also apply by calling us at (888) 232-9223. Our helpful customer service team is available to answer your call anytime, 24/7.

Legal Funding Basics FAQs

Non-recourse legal funding is a risk-free cash advance provided to plaintiffs during ongoing litigation. It requires no collateral and is only repaid if the case results in a settlement or favorable judgment. If the lawsuit is unsuccessful, the plaintiff owes nothing, making it a safe and flexible financial solution for those awaiting compensation.

Overview of Non-Recourse Legal Funding

Non-recourse legal funding, also known as pre-settlement funding and sometimes referred to as a lawsuit loan, is a risk-free cash advance available to injured plaintiffs while they wait for their case to resolve.

This guide explains how it works, how it differs from a traditional loan, what types of cases qualify, and why Express Legal Funding is a trusted provider offering fast, transparent support with no repayment required if you lose your case.

How Non-Recourse Legal Funding Works

What is non-recourse legal funding for plaintiffs?

Non-recourse legal funding is a cash advance offered to plaintiffs in civil lawsuits, based on the anticipated value of their future settlement or judgment. It’s considered “non-recourse” because you only repay the funding if your case is successful, either through a settlement or court award. If you lose, you owe nothing.

How does non-recourse funding differ from recourse loans?

Non-recourse legal funding is fundamentally different from traditional (recourse) loans because it carries no personal repayment obligation. If you lose your case, you’re not required to repay the advance. In contrast, recourse loans hold you personally liable, meaning the lender can pursue your income, credit, or assets to collect the debt, regardless of the outcome of your case.

Why is it called 'non-recourse'?

The term “non-recourse” means the funding company cannot pursue you personally for repayment if your case is unsuccessful. Their only source of repayment is your future settlement or court award. If there’s no recovery, you owe nothing.

Is non-recourse legal funding considered a loan?

No. Legal funding is typically classified as a non-loan financial product or legal advance. This distinction means it isn’t subject to the same laws and interest rate caps that govern loans.

Key Terms in a Non-Recourse Funding Agreement

What are the legal terms involved in a non-recourse legal funding agreement?

A non-recourse legal funding agreement sets forth the official terms under which a plaintiff receives an advance on their expected settlement. The contract is designed to ensure transparency and legal clarity for all parties involved. Key provisions typically include:

- Funding amount: The specific dollar amount being advanced to you based on your case’s estimated value.

- Repayment terms: Clear instructions on how and when repayment occurs—usually only if and when you receive a monetary settlement or judgment.

- Fees and charges: A detailed breakdown of applicable funding rates, capped fees, and how charges accrue over time (e.g., fixed or compounding).

- No-repayment clause: A critical provision confirming that you owe nothing if your case is unsuccessful—this is what makes the funding non-recourse.

- Purchase Agreement: The core legal contract that outlines the sale of a portion of your future recovery to the funding company in exchange for the advance.

- Consumer Disclosure: A document summarizing the funding terms in plain language, including the total anticipated repayment amount and effective rate, designed to ensure you understand the cost of funding.

- Payment Instructions: Specifies how you wish to receive your funds (e.g., via ACH transfer, wire, e-check, or other method).

- Notice of Purchase and Assignment: A clause stating that the funding company has purchased a portion of your potential recovery, and that this assignment is acknowledged by you and your attorney.

- Irrevocable Letter of Direction: An authorization directing your attorney to repay the funding company directly from your settlement or judgment proceeds before disbursing any remaining funds to you.

- Attorney Acknowledgment: A signed statement from your attorney confirming their cooperation, agreement with the terms, and responsibility for handling repayment per the contract.

These components work together to ensure legal clarity, consumer protection, and ethical handling of funds throughout your case.

Learn more about the different types of legal funding in our guide: What Are the Types of Legal Funding?

Do I have to repay my non-recourse legal funding if I lose my case?

No. That’s the key benefit of non-recourse funding. You are not obligated to repay the advance if you do not win or settle the case.

Who Qualifies and How to Apply for Non-Recourse Legal Funding

Who qualifies for non-recourse legal funding?

To qualify for non-recourse legal funding, you must have a strong personal injury or civil lawsuit, be represented by a contingency fee attorney, and have a lawyer who is willing to cooperate with the funding company by providing case documents for review.

What types of cases are eligible for non-recourse legal funding?

Common case types that qualify for non-recourse legal funding include:

- Car accidents

- Slip and fall injuries

- Medical malpractice cases

- Wrongful death

- Workplace injuries

- Product liability lawsuits

Do I need an attorney to apply for legal funding?

You can apply for legal funding without an attorney, but you must have legal representation to be approved. Funding companies require your attorney’s cooperation to review your case and finalize the funding agreement.

Explore the importance of having a lawyer for pre-settlement funding further in our guide: Can I Get Pre-Settlement Funding Without Attorney Consent?

Can I be denied funding? If so, why?

Yes, legal funding can be denied for several reasons. Common factors include weak or disputed liability, a low expected settlement value, an attorney who is unwilling to cooperate, or excessive existing funding from other providers that limits remaining recovery.

Non-Recourse Funding Process and Repayment

How does the non-recourse legal funding process work?

The non-recourse legal funding process is fast and straightforward:

- Submit your application: Apply online or over the phone with basic case details.

- Attorney cooperation: Your lawyer provides case documents and confirms representation.

- Case evaluation: The funding company reviews your claim’s strength and estimated value.

- Approval and agreement: If approved, you’ll receive a funding agreement to sign.

- Receive your funds: Once finalized, funds are typically disbursed within 24 hours, often the same day.

How much money can I receive through legal funding?

The amount you can receive through legal funding depends on the estimated value of your case. Advances typically range from $500 to $500,000. Funding companies assess your projected settlement by evaluating damages, including medical expenses, lost wages, and pain and suffering, along with attorney fees, liens, and other case-related deductions.

Relevant guide: How Much Pre-Settlement Funding Can I Get on My Case?

When do I get my funds after approval?

Most clients receive their funds within 24 hours of approval—often the same day—through a secure ACH transfer, direct deposit, or e-check, depending on the method selected.

What happens if my case takes longer than expected?

If your case takes longer than expected, there’s no pressure to repay early—non-recourse legal funding is only repaid after your case settles. Your agreement remains valid for the duration of your lawsuit, though fees or charges may continue to accrue over time based on the terms outlined in your contract.

Are there any upfront costs or fees?

No, reputable legal funding companies do not charge any upfront costs. There are no application fees, hidden charges, or credit checks required. Any fees associated with the funding are only repaid after your case settles or results in a successful judgment.

How are fees calculated on non-recourse legal funding?

Fees on non-recourse legal funding are usually calculated as either a fixed rate or a monthly compounding rate applied to the funded amount. The total cost depends on how long your case takes to resolve, so it's important to ask whether the fees are based on a simple interest model or compound over time.

Try our pre-settlement loan calculator

Do interest rates apply to my funding amount?

Yes, though they’re often not classified as traditional “interest” under state laws. Instead, these charges are typically labeled as funding fees or usage fees, which can vary significantly between providers. Rates vary widely, so review the terms carefully and choose a company that offers clear, transparent pricing.

Non-Recourse Legal Funding Benefits and Drawbacks

What are the benefits of choosing non-recourse funding?

Non-recourse legal funding provides several important advantages for plaintiffs during a pending lawsuit:

- No repayment if you lose: You owe nothing if your case doesn’t result in a settlement or award.

- Fast access to cash: Funds are often disbursed within 24 hours of approval.

- Covers essential living expenses: Helps you pay for rent, groceries, medical bills, and utilities.

- No credit impact: No credit checks are required, so it shouldn’t affect your credit score.

- Supports a stronger case outcome: Gives your attorney more time to negotiate a fair and full settlement without financial pressure.

Relevant read: What Are the Pros and Cons of Pre-Settlement Funding?

Are there risks involved for plaintiffs?

Non-recourse legal funding isn’t considered risky because you owe nothing if you lose your case. However, the advance and any applicable fees are deducted from your final settlement, which can reduce your net payout. Since you’re receiving part of your future settlement upfront, it’s important to borrow only what you need and fully understand the terms.

How does non-recourse funding help during long legal battles?

Non-recourse funding provides crucial financial support during prolonged lawsuits, helping plaintiffs pay for essentials like rent, food, and medical bills. By easing financial stress for plaintiffs, it prevents the need to settle early for less and gives your attorney the time and leverage to pursue the full value of your claim.

Legal Rights and Protections

Is non-recourse funding regulated by law?

Regulation and legality of non-recourse legal funding varies by state. Some states have specific laws or consumer protection regulations that govern the industry, while others do not regulate it at all. Because oversight differs, it’s essential to read your contract thoroughly and ask questions to ensure you understand the terms.

Can a legal funding company interfere in my case?

No, legal funding companies are not allowed to interfere with your case. They have no control over legal decisions, settlement negotiations, or your attorney’s strategy—those remain strictly between you and your lawyer.

What rights do I have under a non-recourse funding agreement?

When you enter into a non-recourse funding agreement, you’re entitled to several important rights designed to protect your interests:

- Right to clear disclosure of terms: You have the right to receive a transparent explanation of all fees, rates, and repayment conditions before signing.

- Right to cancel within a grace period: In many states, you can cancel the agreement without penalty within a specified time frame.

- Right to attorney-client confidentiality: Your legal funding arrangement does not waive your attorney-client privilege and, in some states, is specifically protected from discovery.

What should I look for in a legal funding company?

When choosing a legal funding provider, look for a company that prioritizes fairness, speed, and transparency. Key qualities include:

- Transparent terms: Clear, easy-to-understand contracts with no confusing language.

- Capped fees: Limits on how much the legal funding costs can grow over time.

- No hidden charges: All fees should be disclosed upfront—no surprises later.

- Fast turnaround: Quick application processing and same-day or next-day funding options.

- Excellent customer support: Responsive, knowledgeable staff to guide you through the process.

- Direct funding (not via brokers): Work with companies that fund cases directly to avoid extra markups or third-party delays.

Alternatives to Non-Recourse Legal Funding

If you're not ready to pursue legal funding or want to explore other financial options, here are some common alternatives to help cover expenses during a lawsuit:

- Personal savings: Using your own funds can help you avoid fees or repayment obligations.

- Friends or family: Borrowing from trusted individuals may provide flexible, interest-free support.

- Personal loans or credit cards: These options may be accessible but often involve interest, credit checks, and personal liability.

- Disability benefits or insurance payouts: If you're eligible, these can provide steady income during recovery.

- Crowdfunding platforms: Online fundraising through platforms like GoFundMe can help gather community support for urgent needs.

Relevant guide: 15 Alternatives to Lawsuit Loans

Is non-recourse legal funding the right choice for me?

If you're struggling financially while waiting for your personal injury or civil case to settle, non-recourse legal funding can be a smart solution. It provides fast, risk-free support with no repayment if you lose—making it a helpful tool when used responsibly and with a clear understanding of the terms.

How is Express Legal Funding different from other legal funding companies?

Express Legal Funding sets itself apart by providing honest, affordable, and risk-free non-recourse legal funding designed to protect your recovery. Here's what makes us different:

- Low, affordable rates: Our pricing is competitive and structured to help you keep more of your settlement.

- Capped origination fee: We limit the upfront cost to ensure your funding remains fair and manageable.

- Capped funding rate: Your rate won’t spiral over time—we set clear maximums to protect your payout.

- Direct funding—not through brokers: We fund your case directly, eliminating broker markups and delays.

- 100% risk-free guarantee: You owe nothing if your case doesn’t settle or win—no hidden conditions.

- No hidden fees: All terms are clearly disclosed upfront, with no surprise charges.

At Express Legal Funding, we prioritize transparency and fairness, so you get the financial support you need without compromising your future settlement.

See why Express Legal Funding ranked number one as the best legal funding company in 2025: 10 Best Legal Funding Companies in 2025

Final Thoughts on Non-Recourse Legal Funding

Non-recourse legal funding can be a valuable lifeline for plaintiffs facing financial hardship during a pending lawsuit. It offers risk-free access to cash when you need it most, without adding debt or requiring repayment if your case is unsuccessful.

As with any financial decision, it’s important to understand the terms, borrow only what you need, and choose a transparent, reputable funding company. When used wisely, non-recourse funding can help you stay afloat and give your attorney the time needed to pursue the fair settlement you deserve.

Apply Now for Non-Recourse Legal Funding

Are you waiting on a personal injury or civil lawsuit to settle and need fast financial support? Express Legal Funding can help you get the cash you need, risk-free and with no upfront costs.

Apply in Minutes

Simply complete the secure form below. Our team will review your application and contact your attorney for a quick case evaluation.

Yes, you need an attorney to qualify for legal funding. Pre-settlement funding companies, including Express Legal Funding, require that you have legal representation from a contingency-fee attorney. Without a lawyer, your application can’t be approved, as attorneys play a crucial role in verifying your case, ensuring legal compliance, and protecting your interests.

Before you can get approved for pre-settlement funding, one of the most important requirements is having a lawyer on your side. Legal funding companies won’t move forward with your application unless you're represented by an attorney who can verify your case details and ensure everything is handled ethically.

Here’s why having legal representation is essential for getting legal funding.

Why You Need a Lawyer to Get Legal Funding

Legal funding, also called pre-settlement funding or a lawsuit cash advance, is not a loan. It's a non-recourse financial agreement: you only repay if you win or settle your case.

Because of this structure, legal funding companies must evaluate your case’s strength, and that’s only possible with help from your attorney of record.

Legal Funding Requires a Contingency-Fee Attorney

To be eligible for legal funding:

- Your lawyer must work on a contingency fee basis (no win, no fee).

- The attorney must be actively involved in your lawsuit.

- They must agree to cooperate with the funding provider and verify case documentation.

This legal relationship ensures the funding company can accurately assess the risk and your likelihood of winning the case.

Relevant read: Pre-Settlement Funding: A Guide for Plaintiff Attorneys

Legal Funding Is Not a Traditional Loan

Legal funding is non-recourse, meaning repayment is only required if your case is successful. This differs from traditional loans and aligns with the contingency fee structure, where attorneys are paid based on the outcome of your case. This is why legal funding is often called a pre-settlement cash advance.

What Your Attorney Does During the Legal Funding Process

Your lawyer is essential at every step of securing legal funding:

1. Confirms Legal Representation

Verifies that you’re actively pursuing a valid claim with their help.

2. Shares Supporting Case Materials

Attorneys play a vital role in submitting necessary documents and communicating with legal funders. This includes sending police reports, medical records, demand letters, and other documents needed to assess your case.

3. Reviews and Approves the Funding Agreement

Your attorney evaluates the funding terms to ensure they’re fair, ethical, and in your best interest.

Can I Get Legal Funding Without a Lawyer?

No. Reputable legal funding companies do not work with unrepresented plaintiffs (also known as pro se litigants). Here’s why:

- Legal Barriers: Many states require attorney involvement for consumer legal funding.

- Risk of Misunderstanding: Without legal guidance, clients may not understand the terms or risks of getting legal funding.

- Underwriting Limitations: Funders can’t properly evaluate a case without legal insight.

Applying without an attorney poses risks, such as misunderstanding terms and lacking proper case evaluation.

Exception: Some limited non-litigation claims, such as certain probate or inheritance funding, may not require an attorney, but these are rare.

What If My Attorney Doesn’t Approve of Legal Funding?

Ultimately, attorney participation is voluntary. If your lawyer refuses to cooperate, you will not be able to receive funding from Express Legal Funding or any reputable provider, but it’s important to understand why they’re concerned and what your options are. Legal funding companies rely on attorney cooperation to move forward, so their disapproval can delay or prevent approval.

Relevant guide: Can My Lawyer Stop Me From Getting Pre-settlement Funding?

Common Reasons an Attorney May Say No to Legal Funding or Lawsuit Loans

Your lawyer might reject a funding request due to:

- Ethical concerns: They may worry about high interest rates or repayment terms that could harm your financial recovery.

- Firm policies: Some law firms avoid third-party funding arrangements altogether to avoid conflicts of interest or administrative burdens.

- Impact on settlement strategy: Attorneys may believe funding could discourage you from accepting a fair settlement offer or complicate lien negotiations.

What You Can Do Next

If your attorney declines to cooperate with a legal funding request, here are steps you can take:

- Start a conversation: Ask your attorney to explain their specific concerns and whether they’d support funding with revised terms.

- Negotiate better terms: Reach out to the funding company to see if they’ll adjust the offer to satisfy your attorney’s standards.

- Explore alternatives: Consider other forms of financial help, such as personal loans, hardship grants, or connecting with a different law firm if appropriate.

Pro Tip: Legal funding is most successful when your attorney is fully on board. If you're working with Express Legal Funding, we’re happy to collaborate directly with your lawyer to answer their questions, address concerns, and provide transparent terms that meet ethical standards.

How to Apply for Legal Funding With an Attorney

- Hire a Contingency-Fee Attorney: Choose a lawyer who agrees to work on your case and supports legal funding.

- Apply with Express Legal Funding: Complete the online application form or call our team directly.

- Attorney Case Review: We contact your attorney to request case documentation and confirmation of representation.

- Approval and Agreement: If approved, both you and your attorney will receive and sign your portions of the funding contract.

- Receive Funds: Get your lawsuit cash advance, often within 24 hours of approval.

Can I Apply for Legal Funding Before Hiring a Lawyer?

Yes, you can begin the legal funding inquiry process before hiring a lawyer, but you won’t be approved until you retain legal counsel. Most legal funding companies, including Express Legal Funding, require your attorney’s active involvement to evaluate your case and move forward with approval.

[ninja_tables id="21910"]FAQs About Needing a Lawyer to Get Legal Funding

Do pre-settlement funding companies require my lawyer to sign anything?

Yes. Reputable pre-settlement funding companies typically require your attorney to sign a confirmation of representation and lien agreement known as an "Attorney Acknowledgment". This signed document verifies that your lawyer is actively handling your case and agrees to cooperate by sharing case information and ensuring repayment from the future settlement proceeds.

Without this signed cooperation, your funding application cannot be approved.

Relevant guide: Can I Get Pre-Settlement Funding Without Attorney Consent?

Can I switch attorneys to one who supports legal funding?

Yes, but it's a decision that should be made cautiously. While switching to an attorney who supports legal funding is possible, it's generally best to maintain continuity with your current lawyer whenever possible. Changing representation can delay your case and may not always be in your best interest.

We recommend first discussing your concerns openly with your attorney to explore potential solutions before considering a switch.

What if I already applied and didn’t have a lawyer?

Your application cannot be approved without legal representation. Legal funding companies require an attorney to verify your case details and participate in the approval process. If you applied without a lawyer, you’ll need to hire one before your application can proceed.

Once you have legal representation, you can reapply. If you need help finding an attorney, many legal funding companies, like Express Legal Funding, can offer referrals to qualified lawyers in your area.

Have More Questions About Legal Funding and Attorney Involvement?

If you're wondering whether your case qualifies for funding or need help finding an attorney:

- 📞 Call Express Legal Funding Toll-Free at (888) 232-9223

- 📝 Apply Online for Legal Funding

No, pre-settlement funding does not require monthly payments. Unlike traditional loans, repayment is only made from the settlement proceeds once your case is resolved. This means you can access funds without the stress of monthly bills, allowing you to focus on your legal proceedings without financial pressure.

Pre-settlement funding is a financial service designed to provide plaintiffs with cash advances against their expected settlement.

Unlike traditional loans, pre-settlement funding is non-recourse, meaning there are no monthly payments, no credit checks, and no personal liability if the case is lost.

This page answers common questions about repayment and monthly obligations associated with pre-settlement funding.

Do I Have to Make Monthly Payments on a Pre-Settlement Funding Advance?

No, you do not have to make monthly payments on a pre-settlement funding advance.

Pre-settlement funding is non-recourse, meaning repayment is only required if the plaintiff wins or settles their case. The funds are repaid directly from the settlement, not out of pocket. This ensures no monthly bills and no financial pressure during your lawsuit.

FAQs About Monthly Payments and Pre-Settlement Funding

What Happens If My Case Is Unsuccessful?

Pre-settlement funding is non-recourse, which means you are not required to repay the settlement advance if your case is lost. There is no personal liability and no risk of owing money if you do not receive compensation. This makes legal funding a safer financial option during a lawsuit.

Is Pre-Settlement Funding a Loan?

No, pre-settlement funding is not a traditional loan. It is a non-recourse cash advance based on the potential value of your lawsuit. Unlike personal or payday loans, it is not classified as debt, and you are not required to make monthly payments or repay the funds out of pocket.

Instead, repayment is contingent on a successful outcome, meaning you only repay the advance if your case settles or you win. The repayment comes directly from your settlement proceeds. If you lose, you owe nothing.

This unique structure provides financial relief without the burden of traditional loan obligations, making it a risk-free option frequently used by personal injury plaintiffs who need help covering living expenses, medical costs, and lost wages while their cases are still pending.

Read our step-by-step guide on getting a pre-settlement advance while your lawsuit is pending: Can I Get a Loan on a Pending Lawsuit?

Is a Credit Check Required for Pre-Settlement Funding?

No, credit checks are typically not required for pre-settlement funding. Approval is based on the strength of your case—not your credit history—making this type of legal funding accessible to plaintiffs with poor credit. This provides critical financial relief during a lawsuit, even for those facing financial hardship.

How Is My Pre-Settlement Funding Amount Calculated?

The amount of pre-settlement funding you can receive depends on the expected value of your case and the risk involved. Key factors include the strength of your legal claim, the severity of your injuries, available insurance coverage, and how likely you are to win or settle successfully.

How Long Does Pre-Settlement Funding Take to Arrive?

Pre-settlement funding is typically available within 24 to 48 hours after your application is approved.

Here’s a typical timeline:

- Apply: Submit a short application online or over the phone.

- Attorney Verification: The funding company contacts your lawyer to confirm case details.

- Case Review: Underwriters evaluate your case’s strength and estimated value.

- Funding Sent: Once approved, funds are usually sent via direct deposit or e-check the same day.

What Can I Use Pre-Settlement Funds For?

Pre-settlement funds offer flexibility and can be used for various urgent personal expenses, including:

- Medical Bills: Covering treatment costs and healthcare needs.

- Living Expenses: Paying for rent, mortgage, utilities, and groceries.

- Transportation: Managing travel costs related to your case or daily needs.

- Childcare: Ensuring care for children while you focus on your legal proceedings.

This flexibility allows you to address immediate financial needs without restrictions, providing peace of mind during the legal process.

What Are the Fees Associated with Pre-Settlement Funding?

The fees and rates for pre-settlement funding vary depending on the provider.

Some companies charge a flat fee, while others use compound interest that increases over time. Because of these differences, it's essential to review your contract carefully.

A reputable legal funding company will clearly disclose all costs upfront. There should be no hidden fees. Make sure you fully understand how the fees work and how much you may owe if your case takes months or even years to settle. Transparency and clarity in the terms help protect your settlement and avoid surprises later.

Will My Attorney or the Defendant Know About My Funding?

Your attorney will be involved in the legal funding process, but the defendant is typically not made aware of your pre-settlement funding.

The funding company will contact your attorney to verify key case details and assist with the approval process. While attorney consent and participation are required, your funding agreement is generally kept confidential and does not need to be shared with the opposing party.

Disclosure is only necessary in rare cases if ordered by the court, meaning your legal strategy and settlement negotiations are usually unaffected.

For a deeper look at attorney involvement in legal funding, read: Do I Need a Lawyer to Get Legal Funding?

Key Takeaways About Monthly Payments and Legal Funding

- No monthly payments

- Repay only if you win

- No credit check required

- Use funds however you need

- Fast access to cash

Ready to Apply for Pre-Settlement Funding?

Express Legal Funding offers fast, risk-free financial support with no monthly payments required. Get the cash you need now, so you can focus on your recovery while your lawyer fights for a fair settlement.

Apply Today:

- Phone: (888) 232-9223

- Apply Now – Complete our quick and easy application form to get started.

Most clients receive funding in as little as 24 hours after approval. There are no upfront fees, no credit checks, and no repayment unless you win.

Legal funding is a non-recourse cash advance that allows plaintiffs with pending legal claims to access part of their expected settlement or court award before the case is resolved. Repayment is only required if the plaintiff wins or settles, making it a risk-free financial solution during litigation.

Legal funding is a non-recourse cash advance that allows plaintiffs involved in lawsuits to access part of their expected settlement before the case resolves, with no repayment obligations if the case is lost.

Unlike traditional loans, legal funding places a monetary lien on the case itself rather than on the plaintiff, making it a beneficial option for individuals with bad credit.

Express Legal Funding is a trusted provider of pre-settlement funding, ensuring plaintiffs don’t repay unless they win. In this guide, we explain how legal funding works, who qualifies, and what to expect, empowering you to make informed financial decisions during litigation.

What Is Legal Funding and Who Is It For?

Legal funding (also known as pre-settlement funding, lawsuit loans, or legal cash advances) is a type of financial support provided to plaintiffs during an active lawsuit. It gives injured or wronged individuals immediate cash to cover essential expenses—like rent, groceries, or medical bills—while they wait for a fair settlement.

Non-loan Legal Financing

Unlike traditional loans, pre-settlement funding is:

- Non-recourse: You only repay if you win.

- Based on case strength: Not your credit score or employment history.

- Risk-free: If you lose, you owe nothing.

Other Common Names for Legal Funding

- Pre-settlement funding

- Lawsuit loans (often used inaccurately)

- Settlement cash advance

- Lawsuit advance

- Plaintiff funding

How Does Legal Funding Work Step-by-Step?

Legal funding is designed to be fast, risk-free, and easy for plaintiffs who need immediate financial relief while pursuing a lawsuit. Here’s how the process works:

Step 1: Apply Online or by Phone

Submit a simple application with basic details about your case, your injuries or claims, and your attorney’s contact information. There’s no credit check, employment verification, or upfront cost to apply.

Step 2: Case Evaluation by Legal Funding Company

Express Legal Funding reviews your case by speaking directly with your attorney. We assess the strength of your claim, liability, and potential settlement value to determine funding eligibility. This review is based entirely on the merits of your lawsuit, not your financial background.

Step 3: Fast Approval and Cash Advance Disbursement

If approved, you’ll receive a pre-settlement advance agreement to review and sign. Once completed, you can receive your cash advance within 24 to 48 hours—often the same day. Funding amounts typically range from $500 to $500,000, depending on your case.

Step 4: Repayment Only If You Win or Settle

There are no monthly payments on legal funding. Repayment is made directly from your future settlement or court award. If you lose your case, you owe nothing—because lawsuit advances are non-recourse, meaning there is no personal liability or obligation to repay.

🟢 Ready to apply for fast, affordable pre-settlement funding from a trusted industry leader?

Apply now with Express Legal Funding and get the cash you need—risk-free.

What Is a Non-Recourse Purchase Agreement?

A non-recourse purchase agreement is the legal contract that makes pre-settlement legal funding possible. Instead of giving you a loan, the funding company purchases a portion of your future settlement or judgment, meaning you only repay if you win or settle your case.

If your case is unsuccessful, you owe nothing back, and the company absorbs the loss. This non-recourse structure protects plaintiffs from debt during an already financially stressful time and is what separates lawsuit settlement funding from traditional personal loans.

Key Features of a Non-Recourse Legal Funding Agreement:

- No Personal Liability: You’re never required to repay out of pocket—even if you lose.

- No Credit Checks: Your credit score is never affected or pulled.

- Risk-Free for Plaintiffs: The financial risk is fully shifted to the pre-settlement funding provider.

- Payment Comes from Your Settlement: Repayment for the lawsuit cash advance is required only if your case wins or settles.

This structure allows plaintiffs to pursue fair compensation without being pressured into early settlements just to cover living expenses.

How to Qualify for Legal Funding?

Legal funding is available to plaintiffs with pending lawsuits who need financial support before their case settles. Approval depends on the strength of your legal claim, not your credit score or income.

To qualify for legal funding, you must:

- Have a valid, pending lawsuit: Most commonly, personal injury claims such as car accidents, slip and fall cases, medical malpractice, wrongful death, or civil rights violations.

- Be represented by a licensed attorney: Your lawyer must be working on a contingency fee basis and willing to cooperate with the funding process.

- Have a strong case with merit: Your claim must have a high chance of settling or winning, with clear liability and damages that support a future payout.

Unlike traditional loans, legal funding does not require a credit check, proof of employment, or personal collateral. If your case qualifies, you can receive a non-recourse cash advance and owe nothing back if you lose.

What Role Does My Attorney Play in Legal Funding?

Your attorney plays a crucial role in the legal funding approval process, serving as both a case verifier and a liaison between you and the funding company.

Key responsibilities of your attorney include:

- Providing essential case documents: Your attorney shares case details, medical records, and legal filings to help the funder evaluate the strength of your claim.

- Reviewing and signing the funding agreement: Your attorney must review and sign the contract to confirm that the terms are fair and legally compliant and to accept responsibility for disbursing repayment from your settlement once the case concludes.

- Coordinating repayment after settlement: Once your case settles, your attorney works directly with the provider to repay the advance from the case proceeds.

Learn how your attorney plays a key role in the legal funding process in our guide: Do I Need a Lawyer to Get Legal Funding?

Important Fact: Legal funding cannot move forward without your lawyer's active cooperation. You must have a lawyer who is willing to share case details and sign the funding agreement for your application to be approved.

This collaboration ensures the funding process is smooth, transparent, and aligned with your best legal interests.

What Are the Benefits of Getting Legal Funding?

Legal funding offers plaintiffs critical financial support while their lawsuit is still pending, without adding personal financial risk or monthly debt.

Top Benefits of Legal Funding:

- Immediate cash when you need it most: Use funds to cover rent, medical bills, groceries, or other urgent living expenses during your case.

- No credit checks or monthly payments: Approval is based on your case, not your credit score, income, or employment status.

- Zero risk if you lose: Legal funding is non-recourse, so you owe nothing if your case doesn’t settle or win.

- Reduces pressure to settle early: Financial relief gives your attorney time to fight for the full value of your claim instead of accepting a lowball settlement.

- Peace of mind during stressful litigation: Focus on recovery and legal strategy while your immediate financial needs are covered.

What Are the Drawbacks of Legal Funding?

Legal funding provides fast, risk-free financial relief, but like any financial tool, it comes with trade-offs that plaintiffs should carefully consider before applying.

Potential Drawbacks to Keep in Mind:

- Reduces your final settlement payout: Legal funding is repaid from your case proceeds. The more you borrow, the less you’ll keep after attorney fees and other costs are deducted.

- Costs can increase over time: Legal funding agreements have interest. The longer your case takes to resolve, the more you may owe.

- A good credit score won’t lower your rate or improve approval chances: Legal funding is based solely on your case strength, not your creditworthiness.

- Approval is not guaranteed: Cases with unclear liability, minimal damages, or poor documentation may not qualify for funding.

Pro Tip: Always have your attorney review the funding agreement and make sure you understand all terms before accepting an offer.

Explore this relevant guide about the benefits and drawbacks of legal funding: What Are the Pros and Cons of Pre-Settlement Funding?

What Types of Cases Qualify for Legal Funding?

Legal funding is available for a wide range of civil lawsuits, especially those with strong liability and the potential for a monetary settlement. The most common qualifying case types include:

- Car accidents and personal injury claims – Including motorcycle, truck, pedestrian, and rideshare accidents.

- Slip and fall (premises liability) – Injuries caused by hazardous property conditions or negligent maintenance.

- Medical malpractice – Cases involving surgical errors, misdiagnosis, or negligent care by healthcare providers.

- Workplace or construction accidents – When third-party negligence causes injury on the job.

- Wrongful death claims – Filed by surviving family members seeking compensation after a preventable fatality.

- Employment discrimination or retaliation – Including wrongful termination, harassment, and wage disputes.

- Product liability or defective medical device lawsuits – Claims against manufacturers for dangerous or faulty products.

Frequently Asked Questions About Legal Funding (Answered by Industry Experts)

Is legal funding a loan?

No. Legal funding is not a loan; it's a non-recourse cash advance tied to your lawsuit. You only repay if you win or settle your case, and you owe nothing if you lose.

How much legal funding can I receive?

The amount of legal funding most plaintiffs qualify for is 10% to 20% of their anticipated settlement value. At Express Legal Funding, advances range from $500 to $500,000, depending on your case strength.

How fast can I get legal funding?

If your attorney responds quickly, you may receive funding within 24 to 48 hours of applying. Express Legal Funding uses a streamlined process to ensure fast approvals.

Do I need my attorney’s approval?

Yes. Your attorney must review and sign the funding agreement for your application to proceed. Legal funding cannot be finalized without your lawyer’s cooperation.

Learn more in our detailed guide: Can I Get Pre-Settlement Funding Without Attorney Consent?

What happens if I lose my case?

You owe nothing. Because lawsuit cash advances are non-recourse, you keep the money with no repayment required if your case is unsuccessful.

Is Legal Funding Taxable Income?

No, legal funding is generally not considered taxable income. Because of its non-recourse structure, the IRS does not count it as part of your gross income, so you typically don’t need to report it on your tax return.

Learn more about the taxation status of legal funding in our guide: Do I Have to Pay Taxes on Pre-Settlement Legal Funding?

Is Legal Funding Safe and Regulated?

Yes—legal funding is safe when provided by a reputable company like Express Legal Funding. We prioritize transparency, consumer protection, and full compliance with all applicable laws.

Here’s what makes our legal funding safe:

- Clear, easy-to-read contracts with no hidden terms

- Transparent pricing—no confusing interest structures or heavily compounding interest

- No upfront fees or surprise charges

- 100% non-recourse funding—you only repay if you win

- Compliance with state-specific pre-settlement funding regulations

Plaintiff financing is largely regulated at the state level, and rules vary by jurisdiction. These may include requirements for disclosures, fee caps, and attorney involvement.

At Express Legal Funding, we not only meet but often exceed these standards, advocating for stronger legal protections for plaintiffs nationwide.

Why Plaintiffs Choose and Trust Express Legal Funding

Express Legal Funding stands out as a trusted, plaintiff-first provider of risk-free settlement advances. Here’s why thousands of injured claimants choose us:

- Direct Funder (Not a Broker): We fund cases in-house, so you get faster approvals, lower fees, and more money in your pocket.

- Zero Risk If You Lose: Our guaranteed pre-settlement funding is 100% non-recourse—no repayment is required unless you win or settle.

- No Credit Checks or Upfront Fees: Approval is based solely on your case, not your credit or income.

- Transparent Terms: Our easy-to-read contracts include flat pricing and no hidden fees or heavily compounding interest.

- Top-Rated and Trusted: We’re proud to have an A+ rating with the Better Business Bureau and a track record of helping plaintiffs across the country.

How to Apply for Legal Funding Today

If you're struggling financially while your lawsuit is pending, Express Legal Funding can help you access fast, risk-free cash without any upfront costs or credit checks. Applying is quick, confidential, and entirely obligation-free.

Here’s how to get started:

- Step 1: Call us or apply online in just minutes

- Step 2: We’ll review your case with your attorney

- Step 3: If approved, receive funding in as little as 24 hours

You only repay if you win or settle—otherwise, you owe nothing.

📞 Call us now at (888) 232-9223 or apply online to see how much you qualify for.

Learn More About Legal Funding From These Helpful Resources

Pre-settlement legal funding typically costs 2% to 4% per month. The total repayment depends on the case type, duration, and whether the interest is simple or compounding. Choosing a provider with capped rates and transparent terms, like Express Legal Funding, can help reduce costs and protect more of your settlement.

Waiting for a legal settlement can take months—or even years. That’s why many people turn to legal funding, also known as lawsuit loans, to help pay bills while their case is ongoing. But one of the first questions they ask is:

“How Much Will Pre-Settlement Legal Funding Cost Me?”

The exact cost of legal funding depends on several factors, including the provider you choose, the details of your case, and how long it takes to reach a settlement.

This guide breaks down typical legal funding rates, explains how repayment works, and shows you how to avoid hidden fees and paying too much.

Disclaimer: All rates, fees, and repayment examples provided are for illustrative purposes only and do not constitute a guarantee, offer, or commitment to fund. Actual terms may vary based on individual case details, applicable state laws, and underwriting approval.

Please review your agreement carefully before accepting any funding.

What Is Legal Funding?

Legal funding is a cash advance provided to plaintiffs with active legal claims. It is not a traditional loan. Instead, it’s classified as non-recourse funding, which means:

- You only repay the advance if you win or settle your case.

- If you lose, you owe nothing—there is no personal liability.

- Approval is based on the strength of your case, not your credit score or employment history.

Legal funding helps plaintiffs cover essential living expenses during long legal battles without taking on personal debt.

Types of Legal Funding

The most common types of legal funding include:

- Pre-settlement funding: Given while your case is still open.

- Post-settlement funding: Offered after your case is won but before the payout is received.

- Medical lien funding: Pays medical bills upfront in exchange for repayment from your settlement.

How Legal Funding Costs Are Calculated

The cost of legal funding isn't one-size-fits-all. Funding companies evaluate several factors to determine your rates and repayment terms. Understanding what drives these costs can help you compare offers and avoid overpaying.

Here are the main factors that influence how much legal funding will cost:

1. Type of Case

Not all cases carry the same risk. Common examples include:

- Car accidents with clear liability may receive lower rates.

- Medical malpractice or product liability cases often involve more uncertainty and higher costs.

The more predictable the case outcome, the more favorable the pricing may be.

2. Estimated Case Value

Larger expected settlements usually qualify for higher funding amounts. However:

- Higher case value can reduce perceived risk, lowering your rate.

- But higher funding requests may result in larger total repayment amounts over time.

3. Time Until Case Resolution

Legal funding accrues costs over time, so the longer your case takes to settle, the more fees and interest can accumulate, especially if compounding interest is involved.

Tip: Choose a trustworthy legal funding provider with non-compounding interest and capped repayment terms to reduce long-term costs.

4. Risk Assessment

Funding is non-recourse, meaning you don’t repay unless you win. So, the more risk your case presents, the more a provider may charge to offset that risk.

Factors that raise the risk include:

- Unclear liability

- Incomplete medical records

- Delayed or disputed treatment

Legal funding companies use different ways to charge for their services. Some charge monthly interest, while others use flat fees. The next section explains how each method works and how it affects what you’ll pay back.

What Fees Do Pre-Settlement Funding Companies Charge?

Pre-settlement funding companies often apply a range of fees when offering cash advances on pending lawsuits, and these charges can vary widely depending on the provider and case specifics. Common fee types include:

- Monthly interest rates: Typically 2% to 4%, charged as simple or compounding interest

- Application or processing fees: Sometimes deducted from the upfront advance

- Underwriting or administrative costs: Additional fees for reviewing the case

- Broker markups: Extra charges if the provider uses a third-party broker instead of direct funding

Explore the Guide: Legal Funding Brokers vs. Lawsuit Loan Companies - Learn the differences

Tip: Always ask whether fees are deducted from your advance and if there's a cap on total interest to avoid paying more than expected.

[ninja_tables id="22291"]Why Choose Express Legal Funding Instead of Other Companies?

- No Upfront or Hidden Fees: Transparent terms with zero surprise charges.

- Capped Fees: Fees are capped to help protect your settlement.

- Free Delivery of Funds: No extra charge to receive your money.

- Free, No-Obligation Case Review: Fast approval process without any risk.

- 100% Risk-Free Guarantee: You only repay if you win or settle your case—no win, no repayment.

Simple vs. Compound Interest Rates: What It Means for You

Simple Interest:

- Based only on the amount you borrow.

- Easier to predict.

- Lower total repayment.

Compound Interest:

- Interest is charged on both the amount you borrowed and the interest already added.

- Costs grow faster the longer your case takes.

- Can double or triple your repayment.

Express Legal Funding only uses low interest rates with optional caps to protect your settlement.

Examples: How Much You Might Repay for the Cost of Pre-Settlement Funding

Here are real-world examples to show how much legal funding can cost depending on the provider:

[ninja_tables id="22292"]What This Means:

Even a small monthly compounding interest rate (3%) can double or triple the total repayment amount if your case takes a year or more to resolve. That’s why it's crucial to ask about:

- Whether the rate is compounding or flat

- Whether there’s a cap on total repayment

Why Simple Interest Matters:

- Simple interest is calculated only on the original funding amount, not on the interest that’s already added.

- This keeps your repayment amount predictable and fair, especially for longer cases.

Real Example: How Much Did Emily Repay on Her Legal Funding?

Emily was injured in a rear-end car accident and couldn’t work while waiting for her case to settle. She applied for legal funding to help cover her rent and groceries.

- Settlement Advance Amount: $5,000

- Repayment Type: Simple interest (3% monthly, capped after 24 months)

- Case Duration: 18 months

When Emily’s case finally settled, her attorney paid back $7,800 from her settlement, covering the original funding amount and interest. Thanks to the company’s non-compounding and capped fee model, she avoided the ballooning costs that many other providers would have charged.

💡 Had she chosen a provider using monthly compounding interest, her repayment could have exceeded $9,000.

Are There Upfront or Hidden Fees?

Yes, some pre-settlement funding companies add extra fees that aren’t always obvious at first. These hidden costs can significantly increase your total repayment, sometimes by hundreds or even thousands of dollars.

Common hidden or upfront fees may include:

- Application or processing fees

- Underwriting or administrative fees

- Broker markups (especially if the provider is not a direct funder)

- “Compliance” or “setup” charges

- Servicing and maintenance fees

- Electronic document storage fees

Tip: Always request a clear breakdown of all fees before signing. Look for companies that offer transparent, no-fee funding, like Express Legal Funding.

Watch Out for Upfront Deductions

Some legal funding companies may deduct fees directly from your advance, meaning you receive less money upfront than what you were approved for. Worse, you may still be charged interest on the full funded amount, including the portion you never actually received.

These upfront deductions can include:

- Application fees

- Processing or underwriting fees

- Broker or referral markups

- Delivery fees

Tip: Always ask whether the advance amount listed is net or gross and whether any fees are taken out before the funds are disbursed.

Are There Any Hidden Fees with Express Legal Funding?

No, there are absolutely no hidden fees with Express Legal Funding. Transparency is one of the core principles that sets us apart and is widely recognized by both clients and attorneys.

Express Legal Funding has no upfront fees or hidden costs. Every term is clearly explained in your agreement before you sign—there are no application fees, no surprise charges, and no out-of-pocket costs. You only pay if you win your case, and because our pre-settlement funding is non-recourse, you owe nothing if you lose.

How Does Repayment Work for Legal Funding?

Repayment is simple. Here’s how it works:

- Your case settles.

- Your lawyer receives the settlement check.

- The funding amount + agreed fees and interest are repaid from the settlement to the legal funding company.

- You get the rest of the money.

Legal funding has no monthly payments, no credit reporting, and no debt collection. If you lose your case, you owe nothing.

Can I Estimate My Legal Funding Cost?

Yes, you can estimate potential costs using a legal funding calculator or by reviewing a sample repayment table like the one below.

Please note: these examples are for illustration purposes only and do not represent an offer or pricing from Express Legal Funding. Actual rates, funding amounts, and eligibility are determined on a case-by-case basis and may vary depending on your case details and applicable state laws.

[ninja_tables id="22294"]This helps you:

- Understand how long-term cases affect repayment

- Compare offers from different companies

- Avoid overpaying for short-term cash relief

Want a free cost estimate for your legal funding? Contact us, and we’ll show you exactly what you’ll owe—before you commit.

What to Look for in a Legal Funding Company

Not all lawsuit funding companies are created equal. Here’s what to check:

- Transparent contracts

- Low interest rates

- No hidden fees

- Capped repayment options

- Direct funding (not a broker)

- Attorney-friendly process

Watch out for:

- Complex or unclear terms

- Pushy salespeople

- Promises of “guaranteed funding” with no case review

- Unregulated or offshore companies

Risks to Consider

While legal funding offers financial relief, it’s important to understand the trade-offs:

Risks:

- Less money left after your case settles

- High rates from some providers

- Longer cases can cost more if there’s no fee cap

How to Minimize Risk:

- Only borrow what you need

- Read the contract closely

- Ask about caps and interest types

- Get your attorney’s input

Read our 2025 legal funding company comparison guide to find and choose the best pre-settlement funding provider for your needs.

How to Apply for Legal Funding

At Express Legal Funding, getting started is quick and free:

Legal Funding Process Steps

- Apply online or call us for a free review.

- We contact your attorney to confirm your case details.

- Our team reviews your case and makes an offer.

- You sign the contract.

- We send the money, often the same day your contract is signed.

There’s no cost to apply and no obligation to accept.

Final Thoughts: Is Legal Funding Worth the Cost?

Legal funding helps injured plaintiffs access the cash when they need it most. But it’s crucial to understand the costs and choose a trustworthy provider.

By working with Express Legal Funding, you can:

- Avoid excessive fees

- Get simple, capped pricing

- Non-recourse funding: Only pay if you win

Apply With Express Legal Funding Today

Get the financial help you need. Apply for legal funding online or call us at 888-232-9223 to speak with a team member today.

Still have questions? Contact us for a free, no-pressure quote and find out how much you qualify for.