If you’re involved in a lawsuit and waiting for a fair settlement, you may be struggling to pay bills or keep up with daily expenses. That’s where pre-settlement funding comes in—it’s a financial lifeline that can help you stay afloat while your case is ongoing.

At Express Legal Funding, one of the most common questions we hear from plaintiffs during the application process is:

How Much Pre-Settlement Funding Can I Get?

The short answer: Most legal funding companies will advance you 10% to 20% of your expected settlement value. So if your case is projected to settle for $100,000, you could qualify for $10,000 to $20,000 in funding, not the full amount, since attorney’s fees (typically 33%-40%) and other costs must also be paid from the settlement.

This guide breaks down everything you need to know about how much funding you can get for your case, what affects your approval amount, and how to get the most out of your legal funding application.

Quick Answer: Typical Pre-Settlement Funding Amounts

- Standard Range: 10%–20% of your anticipated settlement.

- Dollar Range: Between $500 and $2,000,000+, depending on your case and the funding provider.

- Repayment Terms: You only repay if you win or settle your case.

- Case-by-Case Basis: Your case type, damages, and liability all factor into your funding offer.

Keep in mind that while this funding isn’t based on your credit score or income, it’s still subject to an evaluation of your case’s strength and potential value.

👉 Try our free lawsuit loan calculator.

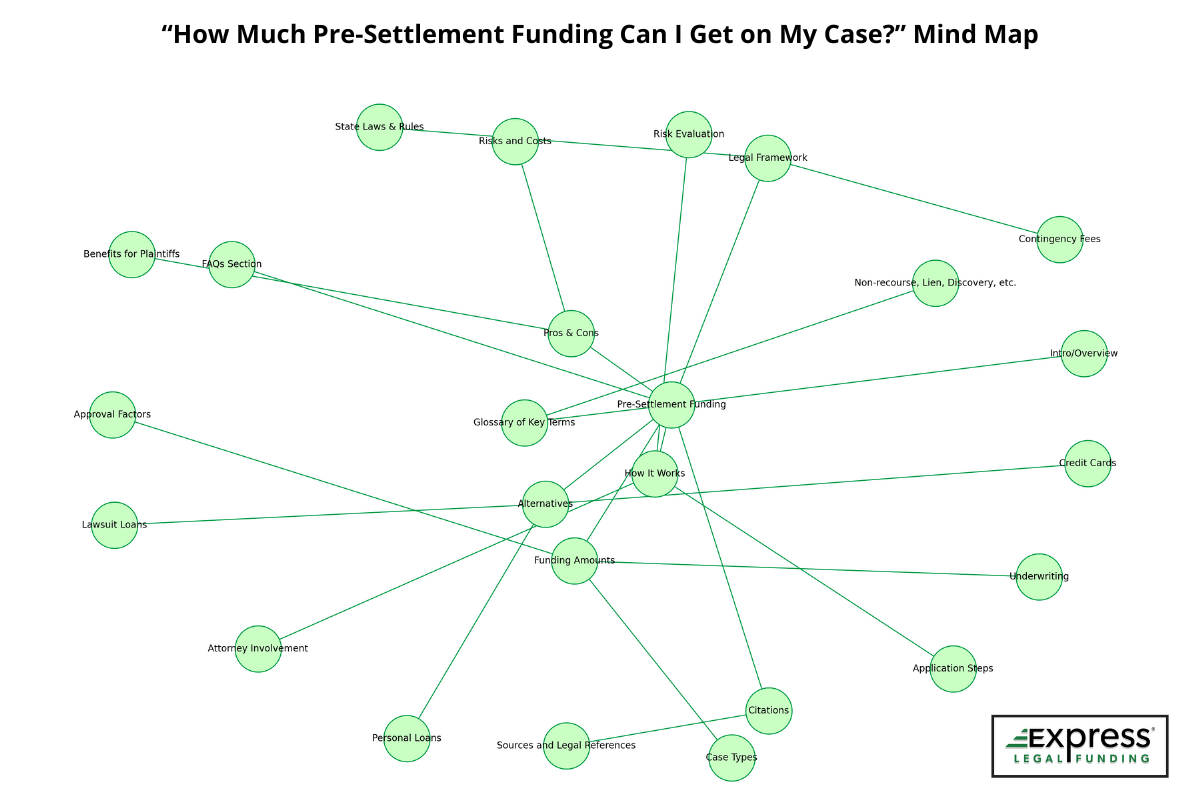

Mind Map: How Much Pre-Settlement Funding Can I Get on My Case?

Factors That Determine How Much Pre-Settlement Funding You Can Get

Every case is different, and legal funding companies use several criteria to decide how much money they can safely advance to you. While most plaintiffs receive 10% to 20% of their estimated settlement value, the exact amount depends on the following key factors:

1. Estimated Settlement Value

The larger your projected settlement, the more funding you may qualify for. Underwriters assess your case’s potential value based on:

- The severity of your injuries and economic losses

- Similar verdicts or settlements from past cases

- The strength of your legal claim and evidence

- The potential for punitive or non-economic damages

Funders typically make a conservative estimate to ensure there’s enough room to cover attorney fees, liens, and funding repayment, while still leaving you with a meaningful payout.

2. Type of Case

Certain case types tend to result in higher settlements or judgments, making them more attractive for funding. These include:

- Serious car, truck, or motorcycle accidents

- Medical malpractice cases

- Birth injury claims

- Premises liability (e.g., slip and falls with lasting injuries)

- Wrongful death or catastrophic personal injury lawsuits

- Product liability and mass tort claims

- Police misconduct lawsuits involving officers who were criminally convicted

- Employment, whistleblower, or civil rights violations with strong documentation

The more serious the injuries and damages in the case, the higher the potential funding amount, especially if liability is well-established.

3. Strength of Evidence

Clear, compelling evidence significantly boosts your funding eligibility. This includes:

- Police or accident reports

- Medical records and diagnoses

- Witness statements

- Photographs or video evidence

- Documentation of lost wages or economic damages

Funders want to see that your case has strong legal merit and a high likelihood of success.

4. Insurance Policy Limits

Legal funding companies also consider how much insurance coverage is available. If the defendant has only a minimal liability policy, the settlement ceiling may be relatively low, regardless of how severe your injuries are.

Conversely, accident cases involving commercial vehicles or corporate defendants often come with higher policy limits, increasing potential funding.

5. State Laws and Regulatory Limits

In some states, your eligibility for legal funding—and how much you can receive—is affected by state laws that regulate pre-settlement advances.

One clear example is Illinois, where the Consumer Legal Funding Act limits how much principal a plaintiff can owe to a legal funding company (or its affiliates). The law states that:

“No licensee shall permit an obligor to owe the licensee, an agent of the licensee, or an affiliate… an aggregate principal amount in excess of $100,000, unless permitted by rule.”

In plain terms, this means that $100,000 is the maximum amount you can receive in total principal advances from any one provider, even if your case is worth significantly more and would otherwise justify a higher settlement advance under the typical 10–20% range.

This cap applies only to the principal, not to interest, fees, or other charges.

Other states may have similar rules that set:

- Maximum or minimum funding amounts

- Licensing requirements

- Limits on interest rates or fees

- Disclosure standards for consumer protection

These laws can impact how much you’re approved for and whether legal funding is even available in your state. A reputable funder will review these limitations with you during the application process to ensure full compliance.

🏆 Read Our Newly Updated Guide: Top 10 Legal Funding Companies of 2025, Ranked by Scores and Real Expert Reviews

6. Legal Representation

To qualify for funding, you must be represented by an attorney on a contingency fee basis (no-win, no-pay). Funders also evaluate:

- Your attorney’s track record and experience with similar cases

- How responsive and cooperative the attorney is during the underwriting process

- Whether the law firm is known to take cases to trial or settle early

A strong, engaged attorney can help you qualify for a larger advance by showing that your case is being taken seriously.

Relevant read: Can I Get Pre-Settlement Funding Without Attorney Consent?

7. Stage of the Case and Timing of the Application

The point at which you apply for funding in the life of your case can directly affect how much you’re approved to receive.

In the early stages of a lawsuit, funders are more cautious because there are still many unknowns, such as unresolved liability, limited medical records, or pending investigations. As a result, funding offers may be smaller until more documentation becomes available and the case matures.

On the other hand, if your case is further along, such as after discovery, depositions, or nearing trial, funders have more information to evaluate and may be willing to give you a larger percentage of your projected settlement.

It’s also important to remember that legal funding typically accrues interest over time. So the earlier you receive an advance, the longer that interest will have to accumulate.

Borrowing from your lawsuit too much, too soon, could significantly reduce your final payout once the case is resolved.

To minimize costs, many plaintiffs choose to take a smaller advance early on and wait to request more funding if their case strengthens or takes longer to settle than expected.

8. Prior Advances or Existing Liens

If you’ve already received pre-settlement funding from another company or have medical or legal liens attached to your case, that can reduce how much additional funding you can receive.

Legal funding companies won’t overfund a case beyond what they expect will be recoverable from the final settlement. If too much has already been advanced, you may be denied further funding or offered a smaller amount.

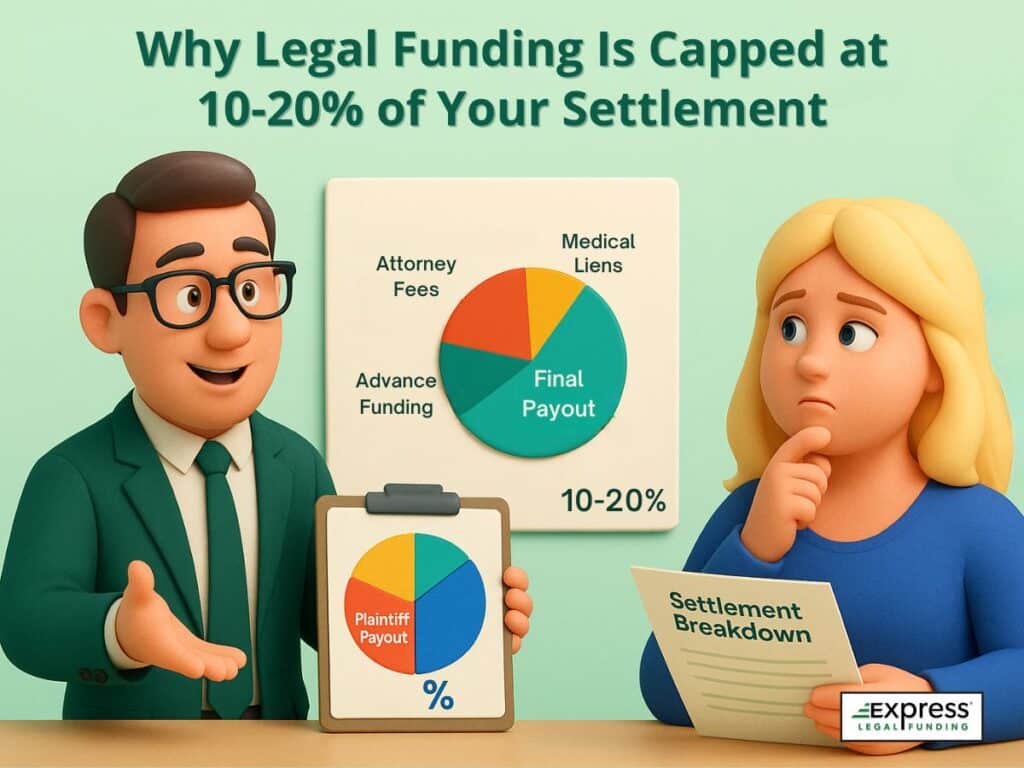

Why Is Pre-Settlement Funding Limited to 10–20% of Your Settlement?

Pre-settlement funding is typically capped at 10% to 20% of your expected settlement value. This limit exists to protect both you and the funding company, ensuring you’re not overburdened with repayment and that your case can still cover other required expenses.

Why You Can’t Access the Full Settlement Upfront

While it might seem reasonable to want the entire value of your settlement in advance, especially if you’re in financial distress, pre-settlement funding is structured with important safeguards:

1. Your Final Settlement Might Be Lower Than Expected

Lawsuits are unpredictable. Even strong cases can settle for less than initially estimated. If a funder advances too much and your case underperforms, there may not be enough left to cover attorney’s fees, liens, interest, and your own recovery.

2. Other Expenses Must Be Paid First

Before you receive any portion of your settlement, the following are typically deducted:

- Your attorney’s contingency fee (usually 33%–40%)

- Medical liens and treatment costs

- Court filing fees, expert witness costs, and case-related expenses

- Any other outstanding obligations tied to your claim, such as tax liens or overdue child support payments

3. The Cost of Funding Is Also a Factor

Another key reason you can’t receive 100% upfront is that legal funding isn’t free. It includes:

- Interest charges (simple or compound, depending on the funder)

- Origination or processing fees

- Repayment obligations are based only on what’s advanced, not the entire settlement

These costs are deducted from your share of the settlement, so the more money you’re advanced, the more you’ll need to repay. If the entire settlement were advanced upfront, there wouldn’t be enough left over to cover interest and fees, let alone leave money for you to take home at the end of the case.

Example Scenario

Let’s say your expected settlement is $100,000, and you receive $15,000 of pre-settlement funding. Here’s a realistic breakdown:

- Attorney’s Fee (33%) = $33,000

- Medical Liens & Court Costs = $15,000

- Legal Funding Advance (15%) = $15,000

- Accrued Interest & Fees on Legal Funding (7.5%) = $7,500

- Your Final Take-Home Amount = $29,500

But if the funder had advanced $80,000 instead:

- After subtracting the attorney’s fee, liens, and high-interest charges,

- You could be left with nothing, or even owe money.

Can You Receive Multiple Pre-Settlement Advances?

Yes, it’s possible to receive more than one pre-settlement advance, as long as your case still has sufficient remaining value. Many plaintiffs apply for additional rounds of funding when their case takes longer than expected or new developments increase the potential settlement amount.

Here’s how the process typically works:

- Each new request triggers a fresh case review. The funding company will re-evaluate your case by contacting your attorney and reviewing updated documentation.

- The underwriters check how much of your case’s value is still unfunded. They assess any prior advances, attorney fees, liens, and projected case value to determine what’s safely available for a second or third advance.

- You may qualify for more if your case has progressed or strengthened. For example, if discovery has concluded or a trial date is set, your case may appear more stable, leading to a higher advance amount.

Important: Some companies allow “stacking,” where multiple funders issue advances on the same case. This can create confusion, excessive fees, or reduced take-home value. Ethical legal funding providers typically require full payoff of any existing advances before issuing new funding. Always ask about a company’s policy before applying again.

If you think your case has increased in value or you simply need additional support, speak with your attorney and consider applying for a second round—but do so carefully and with full transparency.

Relevant read: What Is a Pre-Settlement Funding Buyout?

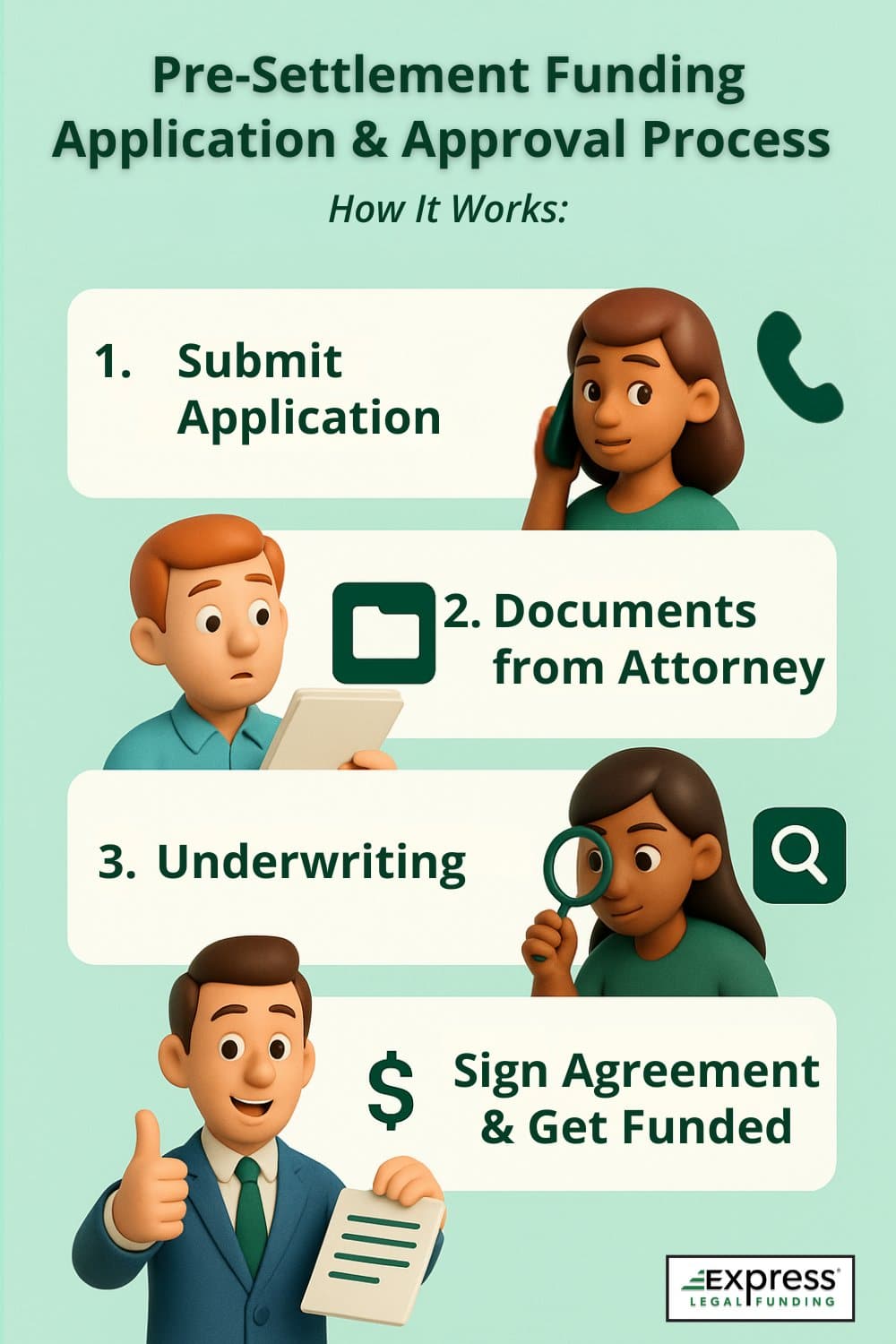

How the Application and Approval Process Works

Applying for pre-settlement funding is typically a quick and straightforward process. Most legal funding companies aim to make it as stress-free as possible, especially for plaintiffs already dealing with injuries and financial strain.

While timelines can vary slightly by provider, the general process involves the following four key steps:

Step 1: Submit Your Application Online or by Phone

The process begins when you apply, either through an online form or by speaking with a representative. The initial application is short and typically requires:

- Your full name and contact information

- The name of your attorney and their law firm

- The type of case you have (e.g., auto accident, slip and fall)

- The date the incident occurred

- A brief summary of your injuries and current financial needs (optional but helpful)

There’s no application fee, and most companies will not run a credit check. Your eligibility is based on your case, not your income or financial history.

Step 2: Case Review and Attorney Collaboration

Once your application is submitted, the funding company will contact your attorney to begin the case evaluation process. This step is essential and often determines how quickly your application moves forward.

The funder will request:

- Accident or incident reports

- Medical records and treatment summaries

- Insurance policy details and claim status

- A legal case summary prepared by your attorney

Your attorney must confirm they represent you on a contingency basis and cooperate by supplying documentation. Most reputable funding companies won’t proceed without attorney participation.

Step 3: Underwriting and Funding Decision

Once the required documents are received, the company’s underwriters review your case to determine the risk and value. They assess:

- The strength of liability and whether fault is clear

- The severity and permanency of your injuries

- The estimated settlement or trial value

- Available insurance policy limits

- The likelihood of a successful outcome

Based on these factors, they determine whether to approve your funding request and how much they’re willing to advance. Most companies offer between 10% and 20% of your estimated net settlement amount at the time of application.

Step 4: Sign the Agreement and Get Funded

If approved, you’ll receive a funding agreement outlining the terms, including:

- The advance amount

- The fee structure and interest rate (simple or compound)

- Repayment terms (only if your case is successful)

- Any additional costs or provisions

Once you and your attorney sign the agreement, the funds are disbursed—often within 24 to 48 hours. Payment is typically made via direct deposit, check, or wire transfer.

In many cases, clients receive their funds the same day the contract is finalized, especially if their attorney responds quickly.

Example Scenarios: How Much Pre-Settlement Funding Can You Get?

The amount of pre-settlement funding you may qualify for depends on the projected value of your case. While funding companies typically offer between 10% and 20% of your expected settlement, the actual dollar amount can vary based on case type, liability, damages, and available insurance coverage.

Here are some general examples to give you a better idea of what to expect:

- Minor Car Accident: A case with soft-tissue injuries and minimal vehicle damage may settle for around $25,000. Based on that value, you could be approved for $2,500 to $5,000 in pre-settlement funding.

- Severe Slip and Fall: If a fall results in broken bones or surgery, your case might be worth $75,000. In that situation, the advance amount could range from $7,500 to $15,000.

- Medical Malpractice Claim: Serious malpractice cases involving long-term injury or misdiagnosis can reach $500,000 or more. Depending on the evaluation, funding offers may fall between $50,000 and $100,000.

- Truck Accident Resulting in Death or Permanent Injury: Catastrophic cases involving commercial vehicles often carry high policy limits and can settle for $1 million or more. Plaintiffs in these serious personal injury cases might be eligible for $100,000 to $200,000 or more, depending on available coverage and liability.

These figures are estimates and are meant for illustrative purposes. Your actual funding amount will depend on the specific facts of your case, including the strength of the evidence, the defendant’s insurance coverage, and any existing liens or prior advances.

Keep in mind that funding companies limit how much they advance to ensure that there’s enough left to cover your attorney’s contingency fee, typically 33% to 40%, as well as medical liens and other costs. This approach helps protect your ability to receive a meaningful portion of the settlement once your case is resolved.

What Happens If I Lose My Case?

If your case is unsuccessful, you owe nothing.

That’s the defining feature of pre-settlement funding—it’s a non-recourse advance, not a loan. This means:

- You only repay if your case results in a settlement or judgment in your favor.

- If you lose your case, you keep the money you received—no repayment is required.

- There are no monthly payments, no interest accumulation after a loss, and no impact on your credit score.

Because of this structure, pre-settlement funding is often referred to as a “lawsuit cash advance” rather than a traditional loan. It shifts the financial risk away from the plaintiff and onto the funding company. That’s why reputable funders carefully evaluate each case before offering an advance—to ensure they’re supporting strong, winnable claims.

This risk-free model gives plaintiffs peace of mind during one of the most difficult periods in their lives.

Tips for Getting Approved for the Highest Amount

If you’re considering pre-settlement funding, there are several steps you can take to help maximize your approval amount and improve the overall experience:

1. Understand the Value of Your Case

Ask your attorney for a realistic estimate of your case’s potential settlement value. Knowing what your case may be worth—and how liability and damages are likely to be viewed—can help you set realistic expectations and give the funder confidence in your claim.

🧮 Use our free Car Accident Settlement Calculator to estimate your potential case value.

2. Maintain Strong Communication with Your Lawyer

Delays in attorney communication are one of the most common reasons for funding slowdowns. Make sure your attorney knows you’re applying for legal funding and is prepared to cooperate with the funder’s requests. Timely responses can lead to faster approvals and potentially higher offers.

3. Be Transparent About Existing Advances or Liens

If you’ve received prior funding or have liens on your settlement, disclose them up front. Failing to do so can delay or even jeopardize your new application. Funders need a clear picture of your case’s remaining value before approving an additional advance.

4. Choose a Reputable Legal Funding Company

Not all legal funding providers operate with the same standards. Look for companies that:

- Offer clear, written terms with no hidden fees

- Cap funding at a reasonable percentage of your expected settlement

- Use simple or non-compounding interest structures

- Have a strong reputation for transparency and fairness

Working with a trustworthy legal funding company helps ensure you’re getting a fair deal—and that your advance won’t leave you with little or nothing once your case is resolved.

Pre-Settlement Funding vs. Traditional Loans: Key Differences

Although pre-settlement funding is sometimes referred to as a “lawsuit loan,” it differs significantly from traditional loans in how it works, what it requires, and what it offers. Understanding these differences can help you decide which option, if any, is right for your financial needs during a pending lawsuit.

1. Approval Requirements

- Pre-settlement funding approval is based on the strength and value of your legal case, not your credit score or income. You must have an attorney and a qualifying claim, but there’s no need to submit financial documents, bank statements, or proof of employment.

- Traditional loans, on the other hand, require strong credit history, verifiable income, and often collateral, making them inaccessible to many injured plaintiffs.

2. Repayment Terms

- Pre-settlement funding is non-recourse, meaning you only repay if you win or settle your case. If your lawsuit is unsuccessful, you owe nothing.

- With a traditional loan, repayment is mandatory—regardless of the outcome of your case—and missing payments could lead to collections or credit damage.

3. Monthly Payments

- Lawsuit advances have no monthly payments. Repayment is made in one lump sum directly from your settlement.

- Traditional loans require regular monthly installments, which can be difficult to manage if you’re unable to work due to injury.

4. Credit and Financial History

- Pre-settlement funding does not require a credit check and will not affect your credit score. It’s accessible even if you have poor or limited credit.

- Traditional loans involve a hard credit inquiry and may be denied if your debt-to-income ratio is high or your score falls below a certain threshold.

5. Speed of Access

- Once approved, pre-settlement funding is often disbursed within 24 to 48 hours—sometimes even the same day.

- Traditional loans can take several days or weeks to process, especially when applying through banks or credit unions.

6. Approval Amounts

- Legal funding companies typically offer between 10% and 20% of your expected settlement value, depending on case strength and available insurance coverage.

- Traditional lenders extend credit based on your credit limit, income, and debt load, which may qualify you for higher amounts but also come with greater financial risk and long-term repayment obligations.

Alternatives to Pre-Settlement Funding

If you weren’t approved for enough legal funding to cover your expenses, or if pre-settlement funding isn’t the right fit for your situation, there are other financial options to help you bridge the gap while your case is pending:

1. Personal Loans

- Available from banks or credit unions.

- Require good credit and income verification.

- Must be repaid monthly—whether you win or lose your case.

2. Credit Card Cash Advances or Payday Loans

- Fast and convenient, but carry high interest rates.

- Could affect your credit utilization and score.

3. Borrowing from Friends or Family

- May be interest-free, but can strain personal relationships.

- No underwriting process, but informal.

4. Crowdfunding

- Platforms like GoFundMe allow you to raise donations.

- May not generate enough unless your story goes viral.

5. Negotiate with Creditors

- Most creditors are open to negotiating payment plans.

- Have to make payments.

Important Note: These options typically don’t offer the same protection as non-recourse legal funding—if you borrow from a lender or credit card, you’re still responsible regardless of your case’s outcome.

Explore more options: 15 Alternatives to Lawsuit Loans with Pros, Cons, and Application Tips

FAQs About How Much Legal Funding You Can Get

How many pre-settlement advances can I receive?

There’s no legal limit to how many pre-settlement advances you can get. However, funding companies will cap the total amount based on your case’s estimated value to avoid overfunding. You may be eligible for multiple advances as long as enough settlement value remains.

Can I accept less than the full pre-settlement advance amount offered?

Yes, you’re not required to take the full amount you’re approved for. Many plaintiffs choose to accept a smaller portion to minimize interest costs and maximize how much they keep from their final settlement. Taking only what you need can help preserve more of your recovery.

How quickly can I get pre-settlement funding?

In most cases, funding decisions are made within 24 hours after the legal funding company receives your case information from your attorney. Once approved and the contract is signed by all parties, the funds are usually sent to you within 24 to 48 hours, often on the same day.

What interest rates do legal funding companies charge?

Interest rates can vary significantly between providers. Some legal funding companies charge simple interest at a fixed rate, while others use monthly compounding interest, typically ranging from 2% to 4% per month.

These rates determine how much additional money you’ll owe beyond the initial advance. Because costs can add up quickly, it’s important to review all terms carefully before signing a funding agreement.

Is the money I receive from pre-settlement funding taxable?

No, pre-settlement funding is generally not considered taxable income because it’s classified as a non-recourse advance, not earned income. However, since tax laws can vary by jurisdiction and case type, it’s wise to consult a tax professional to ensure compliance with your specific situation.

What to Know Before You Apply for Pre-Settlement Funding

Pre-settlement funding can be a valuable financial tool for plaintiffs struggling to make ends meet while their case is pending.

By providing early access to a portion of your expected settlement, typically 10% to 20% of the estimated case value, it helps level the playing field and allows you to pursue the full value of your claim without being forced to succumb to insurance delay tactics and accepting a lowball settlement.

Still, legal funding isn’t one-size-fits-all. Before you apply, make sure you understand the terms and choose a funding company that prioritizes transparency and fairness.

If you’re considering a pre-settlement advance:

- Work with a reputable, direct pre-settlement funding provider—avoid legal funding brokers or companies with unclear fee structures.

- Talk to your attorney early in the process to ensure they’re prepared to share case details and support your application.

- Borrow only what you truly need to cover urgent expenses, such as rent, groceries, medical care, or utilities. Smaller advances cost less in the long run and preserve more of your final settlement.

Why Choose Express Legal Funding?

At Express Legal Funding, we’re committed to helping plaintiffs access fast, fair, and affordable financial support while they wait for their case to resolve. Our non-recourse lawsuit cash advances are designed to ease your financial burden, without adding risk, hidden fees, or monthly payments.

With over 200 five-star reviews, our reputation is built on transparency, speed, and putting clients first.

Here’s what sets us apart from traditional loan companies:

- No win? No repayment. You only pay us back if you win or settle your case successfully.

- No hidden fees. We believe in full transparency—what you see is what you get.

- No credit checks. Approval is based on your case, not your credit score or income.

- Fast access to funds. Apply for $500 to $500,000, and receive funding within 24-48 hours of approval.

🎯 Whether you need help covering bills, rent, groceries, or medical expenses, we’re here to provide financial peace of mind while your attorney fights for the compensation you deserve.

Apply for Pre-Settlement Funding to See How Much You Qualify For

Apply for legal funding online or call us toll-free today at (888) 232-9223 to find out how much you can qualify for—there’s no cost or obligation.

Glossary of Key Terms in This Article

- Pre-settlement funding: A financial advance offered to plaintiffs involved in ongoing litigation, providing access to a portion of their potential settlement before the case concludes.

- Non-recourse advance: A form of legal funding that only requires repayment if the case results in a successful outcome (through a win or settlement); if the plaintiff loses, no repayment is owed.

- Estimated settlement value: The projected monetary value a case may settle for, based on elements such as the extent of injuries, quality of evidence, and applicable insurance coverage.

- Contingency fee basis: A legal payment structure where the attorney’s fee is a percentage of the recovered settlement or award, payable only upon a successful case outcome.

- Underwriting: The evaluation process legal funding companies use to assess the strength, risk, and potential value of a legal claim before approving an advance.

- Lien: A legal right or claim placed on a portion of a settlement or judgment to ensure repayment of a debt, such as medical expenses or prior funding.

- Principal: The original sum of money provided as a pre-settlement advance, not including any added interest or fees.

- Interest charges: The accrued cost of borrowing legal funding, typically calculated using a simple or compound interest method over time.

- Origination/Processing fees: Charges imposed by the funding provider for setting up and handling the application and advance process.

- Stacking: The practice of obtaining multiple pre-settlement advances from different funders on the same case, often discouraged by reputable funding companies.

- Discovery: The litigation stage, where both parties exchange information, documents, and evidence prior to trial.

- Deposition: An out-of-court session in which a witness provides sworn testimony under oath, recorded for later use.

- Judgment: The final ruling or decision issued by a court resolving a legal dispute.

- Settlement: A negotiated resolution between parties in a legal case, typically reached without proceeding to trial.

- Liability: The legal obligation or fault assigned to a party for causing injury or harm.

- Damages: Financial compensation sought by the plaintiff for losses or injuries sustained as a result of the defendant’s actions.

Citations:

Illinois General Assembly. Consumer Legal Funding Act, 815 ILCS 121. https://www.ilga.gov/legislation/ilcs/ilcs3.asp?ActID=4309&ChapterID=67