Written by Aaron R. Winston

Last Updated: March 10, 2024 2:43pm CDT

Getting into a car crash can be one of the most devastating situations you can find yourself in, especially if the other car is larger than yours.

Despite the chaos a motor vehicle collision can unleash, they are remarkably widespread incidents on modern motorways.

Getting into an auto accident is significantly more likely now than when motor vehicles were first invented. This is primarily a byproduct of the sheer number of people worldwide who rely on motor vehicles to complete our commutes to and from our places of employment.

Unfortunately, the most significant contributor to these accidents is simple negligence born of impatience or disregard for driver safety.

Usually, someone is at fault for a car accident. Still, the biggest challenge is proving what happened and gathering evidence.

The original automobiles were very simplistic and could not even remotely reach the speeds modern cars do, let alone host the same technology and safety features.

Modern vehicles are equipped with state-of-the-art safety and luxury technology designed to make life simpler and more comfortable for car owners and their passengers.

The advancement of automobile technology is not standalone, as other vehicle types, such as aircraft, have seen significant (and significantly more) advances as well, of which they share many similarities.

Many motorists are unaware that one of the more well-known airplane safety and data recording devices has also been relevant to new vehicles since 2014: the “black box.”

A car’s black box data can play a crucial role in addressing an accident’s aftermath in ways that most motorists do not realize, which will be a significant focus of this article.

However, before we dive into the topic of car accidents and black box crash data, let’s start by discussing what a black box is, particularly in an airplane.

For purposes of clarity in this article, we’ll generally refer to the various types of vehicle data recorders under the commonly used “black box” term.

What Is a Black Box?

A black box refers to installed vehicle data recorders (i.e., in a plane or car). Generally, black box recording components have similar functions, which include the following names and acronyms:

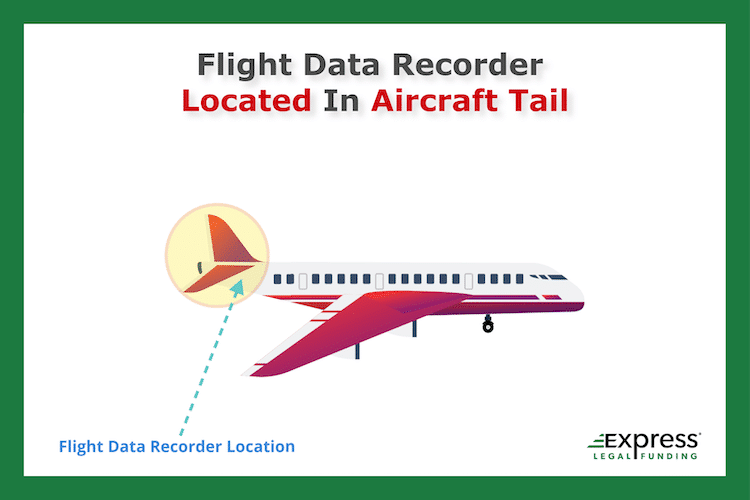

- Flight Data Recorder (FDR): The FDR is found in the tail of an airplane and stores flight data, such as altitude, altitude pressure, pedal-rudders, and the direction of aircraft.

- Cockpit Voice Recorder (CVR): The CVR is Attached to the flight data recorder and is responsible for recording sounds and pilot conversations from within the airplane cockpit.

- EDR (Event Data Recorders): These independent devices are typically found in modern vehicle control modules and capture and record data before, during, and after a crash. EDR data can include information about throttle activation, airbag systems, steering wheel angle, and other types of vehicle system data.

- ADR (Accident Data Recorder): These are similar to EDR’s. However, unlike event data recorders, ADR modules respond to inertial signals (i.e., gyroscopes that detect changes in a vehicle’s angular rate or sudden and drastic changes in force).

- TCU (Telematics Control Unit): These communicate data to external entities and are commonly found on fleet vehicles or emergency service vehicles.

- JDR (Journey Data Recorder): These are commonly used in commercial vehicles or fleet vehicles.

- VDR (Vehicle Data Recorder): This broadly encompasses vehicle recording devices, including but not limited to TCUs, JDRs, and EDRs.

- VDR (Voyage Data Recorder): Voyage Data Recorders can be used by all types of water-traveling vessels and are intended for accident investigation. The IMO requires passenger-carrying ships and ships weighing 3000 tons or more created on or after July 1, 2002, to have a voyage data recorder installed.

What Is the Black Box On a Plane?

The term “black box” is a singular noun that primarily refers to an airplane flight recorder (official name: a flight data recorder cockpit voice recorder) that is designed to be installed to record and store information and voice data from ongoing flights.

Government regulatory agencies require black boxes to be installed on all commercial aircraft vehicles for research and safety.

History of flight data recorder fact: The first flight data recorder was created in 1942 by Viejo Hietala, a Finnish aviation engineer, to record and store data during fighter aircraft test flights.

However, Australian inventor David Warren is largely credited for inventing the modern-day black box.

What Does a Black Box Do In a Plane?

Despite its concise two-syllable name, the function and monitoring purpose of black boxes installed on airplanes is not as straightforward as one might think. Black box flight data recorders (and cockpit voice recorders) are responsible for monitoring and recording all flight information, which includes the following example information:

- Types of Black Box Information and Recordings:

- Radio transmissions

- Sounds coming from the cockpit

- Airspeed

- Altitude (In aviation, altitude is the number of feet above sea level)

- Pressure altitude (In aviation, pressure altitude is used to calculate aircraft performance at high altitudes.)

- Heading (In aviation, heading is the longitudinal axis direction an aircraft is pointing. The calculation uses degrees.)

- Rudder-pedal position

If a plane crashes, the data gathered from the black box can be reviewed by the National Transportation Safety Board (NTSB) to determine the cause of the aircraft crash. NTSB safety specialists investigate all civil aviation accidents.

Does a Black Box Have a Beacon?

Yes, black boxes in airplanes have underwater detector beacons that begin to emit ultrasonic pings once the devices detect coming in contact with water. Other airplanes, ships, and submarine rescue vehicles can hear the submerged beacon’s ultrasonic sound.

What Color Is a Black Box On a Plane?

The black boxes on airplanes are not black, nor are they shaped like boxes. In fact, modern aircraft black boxes are actually colored a bright flame orange and are more cylindrical in shape (though there is a box installed next to the cylinder device).

Now that we have completed our overview of black boxes in airplanes, we can proceed with our in-depth guide about what is a car black box, how it detects accident events, and the types of data it records.

What Is a Black Box In a Car?

A black box in a car is an event data recorder (EDR) installed in cars and is tasked with recording various driving parameters. The information recorded by event data recorders (before, during, and after a crash event) helps investigators determine the cause of a collision and includes the following:

- Speed of car (How fast the driver was going.)

- Acceleration

- Engine RPM (revolutions per minute)

- Whether the driver’s seatbelt is fastened

- Airbag deployment

- Steering wheel angle

- Braking info

- Antilock brake activation status

- Front seat positions

- Size of occupant(s)

Do All Cars Have Event Data Recorders?

Yes, beginning on September 1, 2014, the National Highway Traffic Safety Administration (NHTSA) requires vehicle manufacturers to add event data recorders to all new cars.

NHTSA Requires Car Manufacturers To Install Event Data Recorders Since 2014

Event data recorders in cars can be essential to identifying critical information to determine how the collision occurred and who is at fault for causing the car accident.

The two-part question we will cover is: What data do motor vehicle data recorders focus on and why?

Why Do Cars Have Black Boxes?

The reason the U.S. government made it mandatory to have black boxes installed in motor vehicles is to reduce the number of future collisions by providing the recorded data to researchers working towards that goal.

As a result, these devices are designed to capture specific motor vehicle information within a particular timeframe relating to a car accident.

The main objective of motor vehicle black boxes is to help researchers looking to develop new safety features for vehicles. However, the car insurance industry has found a way to utilize the black boxes, and we’ll discuss that a little later.

What Do Car Black Boxes Record?

The car black box telemetry (telemetry is the process of automatically recording and transmitting the readings of an instrument) gathered by event data recorders focuses on the following crash data:

- The vehicle’s speed.

- The throttle’s position.

- Whether the brakes were applied.

- Airbag deployment and how/when the airbags deployed.

- Whether the seatbelts were secured.

- The steering angles.

There are other details the black box will monitor, but these rank among the most critical. That said, the information gathered by the data recorder is constant, and not all of it is relevant.

The information that matters in an official investigation is the telemetry recorded approximately 20 seconds before, during, and after the collision.

Get Court Order Subpoena For Vehicle Black Box Data

Following an auto accident, this information can be retrieved from one or more of the vehicles involved in the accident through a court order subpoena, which should be available to be retrieved long as the cars were manufactured after 2014.

This black box data can help insurance investigators, personal injury law firms, and accident reconstruction experts identify the party responsible for the accident.

Next, let’s dig into some of the other most common ways these black boxes can affect you and your car accident claim.

General Concept: How Are Car Insurance Rates Calculated?

In addition to an insured car’s value, car insurance companies adjust their rates according to their clients’ driving habits. They all increase the premiums (monthly payments for insurance) for policyholders who cause car accidents as a way to compensate for the increased odds of future collisions.

As is well-known and frustrating for parents, teenage boys are charged a high car insurance premium as compared to middle-aged drivers.

Reckless driving habits indicate a higher chance of subsequent collisions, including a higher probability of future losses from car accident claims, making car insurance coverage more expensive for the policyholder.

Do Car Insurance Rates Go Up After a Claim?

Yes, car insurance rates increase after filing a claim. That is why, immediately following a car wreck, some people may attempt to circumvent the process by offering to pay on the spot for repairs.

In this example, the driver who caused the accident seeks to avoid the accident going on their official driving record, which, if reported, would cause their car insurance rate to go up.

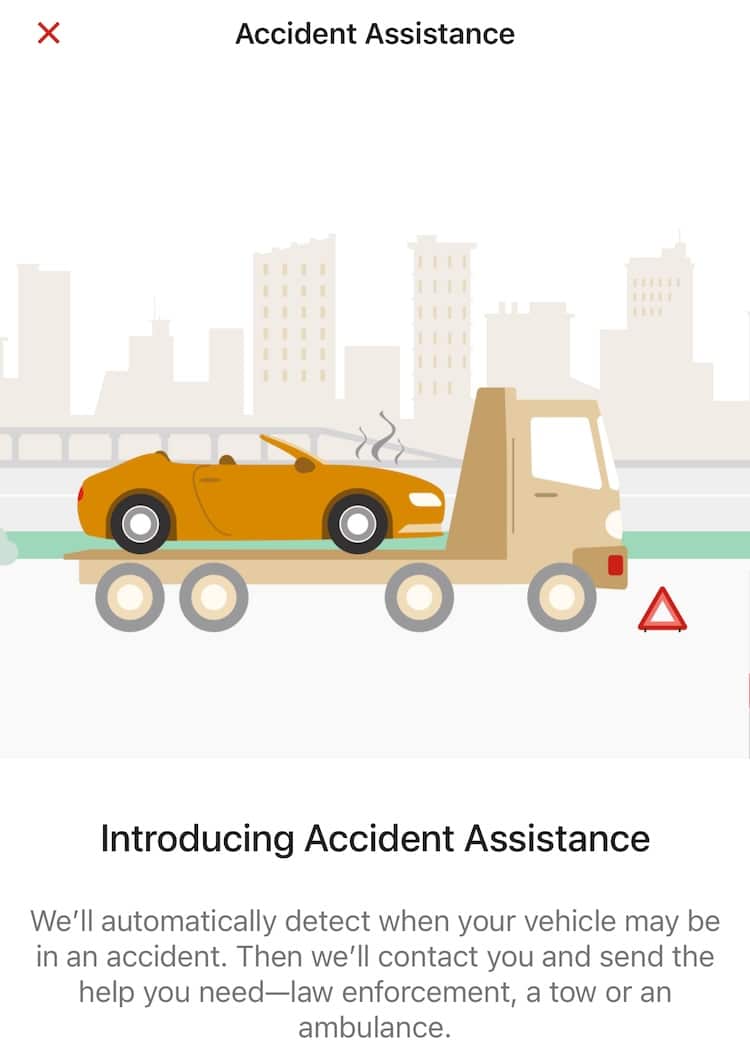

Insurance companies have significantly counteracted this loophole by offering what is known as usage-based car insurance, which involves drivers installing black boxes to detect what type of driving led up to the car wreck.

What Is Usage-Based Car Insurance?

Usage-based car insurance is a type of auto coverage that allows car insurance companies to collect real-time driving data from automotive telematic devices (black box) to determine car insurance premium costs. This car insurance black box information includes the following:

Data Collected By Automotive Teleonomics:

- Location

- Distance traveled

- Braking

- Turning/cornering

- Speed

- Acceleration

- Phone use (i.e., texting and driving)

Usage-Based Car Insurance Discounts

Over the last few years, usage-based car insurance has become increasingly popular due to its ease of setup and allowing for lower insurance premium rates. These discounts are made possible by covered drivers installing a specialized black box provided by their insurance company to track their driving.

Still, it is essential to be aware that a big part of usage-based insurance is how it can be used as a marketing tool to get customers to choose one company over its competition.

The image below is a screenshot of an actual policyholder’s State Farm car insurance dashboard. It demonstrates how the black box beacons are a relatively misleading marketing gimmick.

Instead of State Farm reducing the discount, it chooses to add surcharges. That way, Start Farm can show larger discount amounts while offsetting the savings with surcharges.

Do Insurance Companies Check Black Boxes?

Yes, insurance companies check black boxes in cars. Specifically, the real-time telemetry data gathered by the usage-based car insurance black boxes provides more than just resources that can be used to determine who is at fault in an accident.

These device devices can be installed by the covered drivers themselves and track their driving behavior with the incentive being discounted cost of premiums.

They are an unprecedented resource for motor vehicle insurance companies and agencies worldwide.

Examples of How Usage-Based Car Insurance Works

So, as an example, if the black box information indicates that you drove a significant amount of mileage and exhibited reckless driving behavior (such as hard breaking and speeding) over an extended period of time, your car insurance premium is likely to increase.

In contrast, if the telematic device you installed in your car shows that you have been doing a good job driving safely, your insurance premiums should be reduced, as you are upholding your basic duty of care.

What Are the Pros and Cons of Usage-Based Car Insurance?

Ultimately, usage-based insurance black boxes are double-edged swords that can either make or break your insurance premium, correlating to how safe you drive with definite pros and cons, which include the following:

Usage-Based Car Insurance Pros and Cons:

- Pro: If you are a safe driver, you will receive a more significant discount.

- Pro: Telematic data is objective. It fights against stereotype profiling, which insurance companies previously had to rely on to mitigate their risk, which means demographics such as younger drivers can now demonstrate they consistently practice safe driving habits, which facilitates their not being unfairly subject to higher rates.

- Con: Drivers who remain accident-free even though they drive recklessly may see increased premiums due to the black-box sharing of this driving data. This risk of these cost-increasing penalties is not associated with traditional car insurance, as that data is not tracked.

Specifically concerning car accidents, most insurance companies have integrated usage-based insurance that analyzes your black box whenever a claim is made.

This way, they can definitively determine whether you were taking every precaution to prevent the incident, and leads us to our next question about using black box information as evidence in a car accident. - Con: Drivers may have privacy concerns, as the real-time tracking functionality of usage-based car insurance inherently encroaches upon the policyholder and their occupants’ privacies.

Help or Hindrance: Are Black Boxes Beneficial?

Dealing with a car crash can be difficult enough without the fear of increased insurance premiums. In some ways, black boxes are beneficial, and in others, they are a hindrance to you and can make your situation more complicated.

The question of the hour is: What are the pros and cons of motor vehicle data recorders regarding evidence in a car accident lawsuit?

Black Box Data is Evidence

By taking legal action, you can receive compensation for your injuries and loss when you are a victim of a car accident due to another driver’s fault.

However, it will take evidence to do so, which is why having access to black box records can be a difference maker in your effort to identify the liable party in an accident.

Gathering evidence and proving fault is easier said than done, especially if there is some confusion surrounding who struck whom and whether someone was driving negligently.

The car’s black box can determine whether the other party was going over the speed limit when the accident occurred.

Evidence In Personal Injury Lawsuits

If you decide to file a personal injury claim against the other party, your attorney may be able to request a subpoena for the black box data from their car.

Whether or not the data from the defendant’s vehicle benefits your claim will vary depending on the case’s facts (if you caused the crash, the black box information will hurt your claim).

Nevertheless, the information from your vehicle’s black box can be instrumental in proving details that would typically be very difficult for law enforcement and attorneys to verify as evidence.

For example, without black box data, you don’t have to worry about the insurance adjuster not accepting your statement that your seatbelt was fastened during the event of an accident (as long as the police report or emergency room notes do not say otherwise.) and that you were exercising proper safety precautions.

Still, insurance companies can’t track certain reckless driving behaviors, such as driving straight through a flashing red light or wearing headphones while driving.

The Seatbelt Defense

However, in some states, if the crash data retrieval shows you weren’t wearing your seatbelt at the time of the crash, the amount of compensation you can receive for your claim could suffer even if the car wreck itself was caused by another driver due to the legal concept of comparative negligence.

What Is Comparative Negligence?

Comparative negligence is a legal argument used to assign blame and can act as a defense to reduce the liability of the at-fault driver. The evidence of your not buckling up can be a factor in several states.

The comparative negligence concept for car accidents: You put your health at an increased risk by not wearing a seatbelt, which is negligence, and, therefore, the other driver is less liable for your injuries, which can hurt your potential compensation amount.

Proportionate Responsibility Statute In Texas:

In Texas, based on the proportionate responsibility statute, if a jury determines you are at more than 50% at fault for causing your injuries through nonuse of a seatbelt, you will be barred from any recovery (no compensation for your loss).

What Is an Example of Comparative Negligence?

The unfastened seatbelt defense is a classic example of comparative negligence that demonstrates how black boxes can be a hindrance to a car accident victim’s claim and is why insurance can gain valuable insight and evidence to use against you, which helps them do their job of saving their employer money by lowering the fair settlement amount they payout.

Further backing of how the black box data can be a powerful defense is that it will always be impartial and be matter-of-fact evidence.

This means that, unlike witnesses, the stored info can’t be swayed by sympathy, which hurts you since sympathetic victims tend to fare better with juries and bolster court awards, which means the insurance adjusters will be more apt to risk going to trial.

Additionally, nuanced misinterpretations can jeopardize your claim if the black box shows you or the other driver violated road laws.

For instance, if the insurance company uses the black box data to allege you caused the car accident on purpose, it would negate the insurance company’s liability.

Schedule a Free Consultation With a Personal Injury Lawyer

Black box data that is not helpful in backing up your side of the story does not automatically mean your case stands no chance and that you should give up, and that is a critical reason why scheduling a free consultation and seeking legal advice from a personal injury attorney can be beyond critical.

The fact is that lawsuits are rarely straightforward, so if you can prove your actions were justified and the other party is still at fault, you may have a viable case against the individual who caused the accident.

Ultimately, black boxes will help or hinder you, depending on the circumstances you find yourself in. They are usually a viable resource when filing an official claim against any defendant.

In contrast, if you are at fault for causing the car accident, the telematic black box data can be evidence that works against you, the defendant.

Car Accident Lawsuits: What Do You Stand to Gain?

Getting involved in a car crash can be detrimental to you and your vehicle since the impact causes significant damage to both. These collisions can range from minor fender benders to massive crashes that total your car and theirs. Despite the potential damage to your vehicle, the most pressing issue is always the harm to your body caused by the impact.

Car crashes almost always cause injury and symptoms (i.e., whiplash or tinnitus ringing in ears). However, the severity and grade of those injuries are influenced by the vehicles’ velocity and force of the impact.

It is important to note that these accident injuries might not always be apparent at first, so you should always visit the emergency room immediately after the accident to ensure there is no significant damage.

Seeking medical attention is crucial and will help determine the treatment you need to recover.

Medical Treatment After Personal Injury Auto Accident

The problem is that these car accident related medical treatments are far from being known as affordable and will often set you back tens of thousands of dollars if the accident and the resulting injuries are severe enough.

Unfortunately, the expense associated with medical care in the United States is nothing short of staggering and can easily send solvent people into severe financial debt.

Part of the concern with such accidents is that the injuries will strain the financial resources at your disposal, especially given the continued deterioration of our economy.

Being forced to pay for your own medical treatment that is only necessary because of someone else’s negligence could easily be considered unfair.

Fortunately, the American civil court system and its laws agree and empower people in most states (twelve are no-fault PIP states – Personal Injury Protection insurance) to file personal injury claims against the other party to recover the financial losses.

Cost of Medical Treatment Impact Personal Injury Settlements

The potential settlements associated with these claims act as the legal solution to prevent us from paying for our medical treatment out-of-pocket and make it the responsibility of the liable driver and their insurance company.

Ensuring your victory and financial recovery is where evidence, such as the black boxes in cars, comes in.

You can use the unimpeachable stored data to help you prove the other driver is responsible for causing the collision and, therefore, needs to compensate you for your injuries and damages.

Closing Statements About Black Boxes

While it is easy to associate black boxes with airplanes, they are more widespread than that, and there is likely one installed in your car.

These devices can enhance your odds of proving your claim that the other party was the negligent at-fault driver, but they might also expose negligence on your part.

The key is for you to tell the truth from the beginning to ensure no information is revealed that might draw your honesty into question.

Unfortunately, the black box does nothing to help you overcome the financial strain of the unexpected costs people inherently have to deal with after an accident, which is why someone needs to file a personal injury claim (or any lawsuit seeking compensation) in the first place.

However the good news is that resources can be made available to help you keep your head above water financially.

Pre-settlement Funding For Auto Accident Claims

We at Express Legal Funding know how difficult it can be to maintain your quality of life in the event of an accident, as you are suddenly hit with medical expenses and require car repairs that can’t wait until after you get compensated via a settlement or court award from your pending lawsuit.

This very and all too common situation is where we can come in to help car accident victims by providing a financial product commonly referred to as pre-settlement legal funding (or lawsuit loans, which in most states is an inaccurate term).

This type of non-recourse advance funding is unique in that it is not a loan.

Rather, as a legal funding company, we can advance your funds, with our repayment contingent upon your case’s potential proceeds (i.e., a settlement).

It works as a buyer/seller agreement, as we are purchasing a stake of your claim, which means we get paid when you settle or win and have to pay nothing when you go to court but unfortunately lose (have no financial recovery).

So, if you need money now and not just later when your case ends to help with crucial costs, such as food, car repairs, or rent, call us to learn more and apply for legal cash funding help.

We are here to help injured victims while they wait for their accident claim to proceed, which often means they need financial assistance more than ever.

Call us or apply online for lawsuit funding anytime 24/7. We make the initial application process easy and quick. A few minutes, never hours, done fast! We’re Express Legal Funding.

About the Author

Aaron Winston is the Strategy Director of Express Legal Funding. As "The Legal Funding Expert," Aaron has more than ten years of experience in the consumer finance industry. Most of which was as a consultant to a top financial advisory firm, managing 400+ million USD in client wealth. He is recognized as an expert author and researcher across multiple SEO industries.

Aaron Winston earned his title "The Legal Funding Expert" through authoritative articles and blog posts about legal funding. He specializes in expert content writing for pre-settlement funding and law firm blogs.

Each month, tens of thousands of web visitors read his articles and posts. Aaron's thoroughly researched guides are among the most-read lawsuit funding articles over the past year.

As Strategy Director of Express Legal Funding, Aaron has devoted thousands of hours to advocating for the consumer. His "it factor" is that he is a tireless and inventive thought leader who has made great strides by conveying his legal knowledge and diverse expertise to the public. More clients and lawyers understand the facts about pre-settlement funding because of Aaron's legal and financial service SEO mastery.

Aaron Winston is the author of A Word For The Wise. A Warning For The Stupid. Canons of Conduct, which is a book in poetry format. It consists of 35 unique canons. The book was published in 2023.

He keeps an academic approach to business that improves the consumer's well-being. In early 2022, Aaron gained the Search Engine Optimization and the Google Ads LinkedIn skills assessment badges. He placed in the top 5% of those who took the SEO skills test assessment.

Aaron's company slogans and lawsuit funding company name are registered trademarks of the United States Patent and Trademark Office. He has gained positive notoriety via interviews and case studies, which are a byproduct of his successes. Aaron R. Winston was featured in a smith.ai interview (2021) and a company growth case study (2022).

In 2023, Aaron and Express Legal Funding received accolades in a leading SEO author case study performed by the leading professionals at WordLift. The in-depth data presented in the pre-settlement funding SEO case study demonstrate why Aaron Winston maintains a high-author E-E-A-T. His original writing and helpful content continue to achieve unprecedented success and stand in their own class.

Aaron was born in Lubbock, TX, where he spent the first eight years of his life. Aaron attended Akiba Academy of Dallas, TX.