💼 Is your attorney refusing to cooperate, but you urgently need money while waiting for your lawsuit to settle? Pre-settlement funding—often referred to as a lawsuit loan—can provide critical financial support during a lengthy legal process, helping cover essential living expenses, medical bills, and lost income.

Can You Get Pre-Settlement Funding Without Attorney Consent?

Typically, legal funding companies require your attorney’s participation to move forward with your application.

But what if your lawyer is unresponsive, unwilling to assist, or refuses to sign the necessary documents? Can you still get funding without their involvement—and if so, should you?

In this article, we explain whether it’s possible to get pre-settlement funding without attorney consent, explore the potential risks, and outline your options if you find yourself in this challenging situation.

What Is Pre-Settlement Funding, and Why Would You Avoid Attorney Involvement?

Pre-settlement funding is a cash advance provided to plaintiffs awaiting a lawsuit settlement. It helps cover urgent expenses like rent, medical bills, or lost wages during a legal case. The funds are repaid from the future settlement, and if the case is lost, the plaintiff typically owes nothing.

Think of pre-settlement funding as an early cash withdrawal from your future settlement. It can provide fast financial relief—but it comes with important terms, conditions, and, most importantly, a cost.

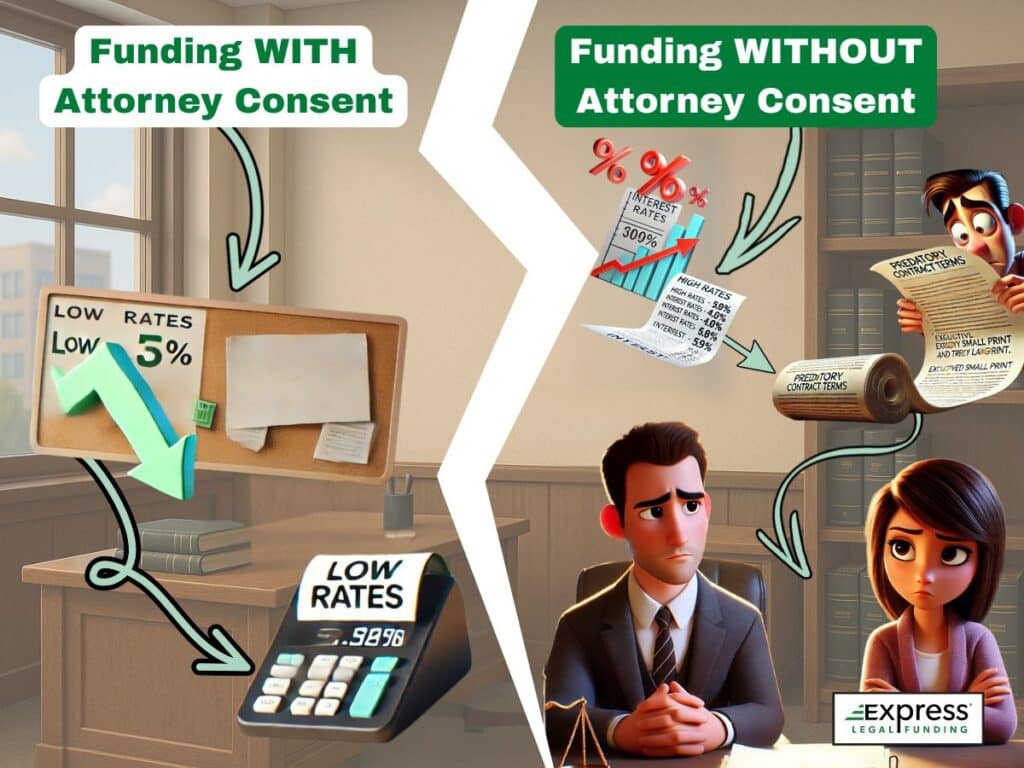

While it offers fast financial relief, pre-settlement funding comes with important conditions and fees. Some plaintiffs may consider bypassing attorney involvement to speed up approval, but this can increase risks, limit lender options, and weaken legal protection.

Why Plaintiffs Seek Pre-Settlement Funding Without Attorney Consent

While attorney participation is standard in most legal funding deals, plaintiffs might consider bypassing it in situations such as:

- 🙅♂️ Attorney Refusal: Their attorney won’t cooperate with funders.

- 🆘 Urgent Financial Needs: They’re in urgent need of money for rent, bills, or medical care.

- 📵 Breakdown in Communication: Sometimes, the client-lawyer relationship suffers due to poor communication or a lack of responsiveness. For example, a plaintiff might wait weeks without a reply after asking their attorney for help with legal funding paperwork, leaving them no choice but to seek financial solutions on their own.

Our Experience With Clients Asking About Attorney Consent

Over the years, our team at Express Legal Funding has received countless inquiries from plaintiffs asking whether we require their attorney’s consent to provide pre-settlement funding. This is a common concern, especially for individuals facing economic hardship while dealing with attorneys who are unresponsive, unwilling to help, or slow to return calls.

Many of these clients come to us feeling unsure about their eligibility, particularly if they’re considering changing legal representation or don’t currently have an active attorney involved.

These situations are far from rare. With our direct experience assisting thousands of plaintiffs and law firms, we fully understand the urgency and frustration that can come with seeking financial help during a lawsuit.

Why Attorneys Are Usually Required for Legal Funding

In the pre-settlement funding industry, attorney cooperation is typically mandatory. Here’s why:

How Attorneys Support the Pre-Settlement Funding Process

Attorneys play a crucial role in helping legal funding companies evaluate and manage your application. Their involvement ensures transparency, compliance, and efficiency throughout the process. Here’s how they contribute:

- Case Verification: They confirm the strength and validity of your claim.

- Document Sharing: Attorneys provide essential case documents, including timelines and medical records.

- Case Status Updates: They provide regular updates on your case’s progress, allowing funders to reassess risk and make informed decisions, especially if you’re requesting additional rounds of pre-settlement loans.

- Lien Acknowledgment: They formally acknowledge the funding lien to ensure repayment from your settlement.

- Reviewing Terms: Attorneys help ensure that the funding agreement is fair, legal, and aligned with your best interests.

- Settlement Disbursement: After your case settles, your attorney facilitates repayment by disbursing the agreed amount from the settlement check owed to the funder.

This not only helps the funder evaluate your eligibility but also protects you, the client, from signing predatory agreements. Most reputable legal funding companies won’t proceed without your attorney’s participation, as it could create ethical and legal complications, including potential violations of attorney-client privilege.

Is It Possible to Get Legal Funding Without Attorney Consent?

Yes, it’s possible to get legal funding without attorney consent, but it depends on your state’s laws and the policies of the funding company. Some states require attorney acknowledgment by law, while others allow funders to work directly with plaintiffs. Most reputable legal funding companies still require attorney involvement to protect all parties and reduce risk.

State Regulations

Whether or not you can get pre-settlement funding without attorney consent depends on your state laws. Some jurisdictions are more lenient and may not explicitly prohibit funders from working directly with plaintiffs.

States With Laws Requiring Attorney Acknowledgment for Pre-Settlement Funding

- Illinois (Illinois Legal Funding Act, 815 ILCS 121)

- Ohio (Ohio Revised Code § 1349.55)

Pre-Settlement Lender Policies

Even in states where attorney consent isn’t legally required, a trustworthy legal funding company still mandates attorney involvement, as it follows industry best practices.

Those that don’t often charge higher rates or impose stricter terms to offset the added risk of proceeding without legal oversight.

Possible Exceptions to the Rule

There are a few case types and scenarios where attorney consent might not be strictly necessary:

- Small Claims, Probate Matters, or Minor Injury Cases

- Pro Se Litigants: Individuals representing themselves.

- Non-Traditional or Niche Funding Providers

These are uncommon exceptions, and they typically come with greater risks and less favorable terms.

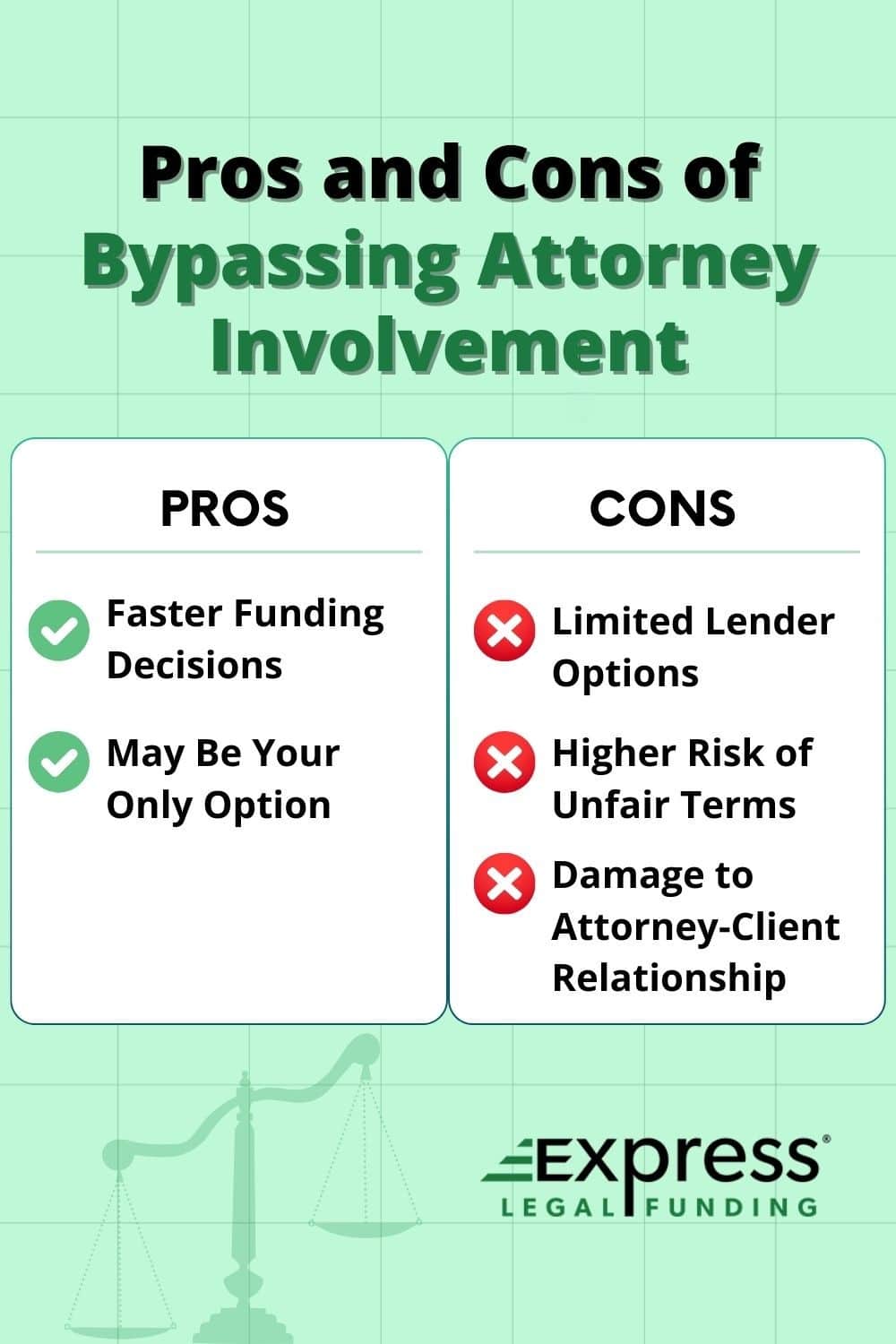

Pros and Cons of Bypassing Attorney Involvement

While it may be tempting to skip the attorney, it’s important to weigh the potential upsides and serious downsides.

Pros

- Faster Funding Decisions: No need to wait for attorney response.

- May Be Your Only Option: Especially if you’re in conflict with your attorney about whether you should get pre-settlement funding.

Cons

- Limited Lender Options: Fewer companies are willing to fund without a lawyer’s input.

- Higher Risk of Unfair Terms: No legal review could mean predatory contracts.

- Damage to Attorney-Client Relationship: Moving forward without their consent may cause friction or even lead to case abandonment.

Pros and Cons of Getting Pre-Settlement Funding Without Attorney Consent

| ✅ Pros of Bypassing Attorney Consent | ❌ Cons of Bypassing Attorney Consent |

|---|---|

| Faster approval without attorney delays | Fewer lawsuit lenders willing to approve funding |

| Often the only choice when facing an uncooperative attorney or preparing to change law firms | Greater risk of unfair or predatory contract terms |

| Can provide urgent financial relief in emergencies | Can damage your attorney-client relationship or result in withdrawal |

Real-World Example: When No Attorney Means Higher Costs

Some smaller legal funding companies that don’t require attorney acknowledgment have developed a reputation for offering contracts with extremely unfavorable terms.

For example, one such niche funder is known to approve plaintiffs for just $5,000 in pre-settlement funding, yet the repayment amount due at settlement skyrockets to $35,000 or more—even if the case only takes a few months to resolve.

Without an attorney reviewing the agreement or pushing back on the fees, the client is left vulnerable to compounding charges, unclear interest structures, and little room to negotiate.

This kind of contract structure is often considered predatory, as it takes advantage of plaintiffs in urgent need who may not fully understand the long-term cost of the funding.

How to Apply for Pre-Settlement Funding Without Your Attorney’s Consent

If you’re determined to proceed without your lawyer’s help, here’s what the process typically looks like:

- Research Non-Traditional Funders: Look for companies that explicitly state they offer funding without attorney participation.

- Gather Your Case Documentation: Common requirements include: Police reports, the original demand letter, complaint filing, medical records or bills, and insurance correspondence.

- Compare Offers Carefully: Scrutinize terms for interest rates, fees, and repayment expectations—it should be non-recourse and not require repayment if you lose the case.

- Understand the Risks: Without legal review, you are solely responsible for understanding what you’re signing.

- Sign and Receive Funds: Once you’re confident in the terms, you can sign the agreement electronically or in person and receive your funds, often within 24 to 48 hours.

Top Alternatives to Pre-Settlement Funding

If your attorney won’t consent to legal funding, or you’re looking for other financial solutions, consider these alternatives. While they may not be tied to your case, they can provide temporary relief and quick cash flow during a legal dispute:

- Personal Loans: Borrow from a bank or credit union based on your credit and income (note: requires repayment regardless of case outcome).

- Credit Card Cash Advances: These are useful for covering urgent expenses, but they come with immediate fees and high interest rates, which can be risky.

- Borrowing from Family or Friends: A personal option that avoids interest or credit checks, though it may come with emotional strings attached.

- Disability or Unemployment Benefits: If applicable, these government programs can provide financial support while you’re unable to work.

- Crowdfunding: Platforms like GoFundMe allow you to raise money from your network or the public.

- Payment Plans with Medical Providers: Some providers offer flexible billing arrangements if you explain your situation.

While these options aren’t tied to your future settlement, they may help bridge the financial gap if pre-settlement funding isn’t viable.

👉 Looking for other ways to cover expenses while your case is pending? Read our complete breakdown: 15 Alternatives to Lawsuit Loans

Conclusion: Is It Worth Getting Pre-Settlement Funding Without Attorney Consent?

While it’s technically possible to obtain pre-settlement funding without your attorney’s consent, it’s rarely the best path forward. Attorney involvement helps protect your legal rights, ensures the funding terms are fair, and supports a smoother resolution of your case.

That said, we understand that real life doesn’t always follow ideal circumstances. If your attorney is unresponsive or unwilling to assist, and you’re facing urgent financial hardship, you may feel compelled to explore funding options independently. In such cases, proceed with caution.

Carefully research any lender you’re considering, compare terms in detail, and, if possible, consult a legal or financial professional before signing anything.

Express Legal Funding: The Trusted Choice for Plaintiff Law Firms Nationwide

At Express Legal Funding, we strongly encourage clients to involve their attorneys in the funding process to promote transparency and protect everyone involved. However, due to industry best practices and ethical standards, our policy is to only provide funding when we receive formal acknowledgment from the client’s attorney.

In fact, we instruct potential clients to tell their attorneys about their funding applications as soon as our customer service team finishes their intake.

That’s also why, combined with our low rates and transparent contract terms, many law firms trust Express Legal Funding to help their clients get fast pre-settlement funding in times of need.

🟢 Ready to move forward? Apply for legal funding today!

Frequently Asked Questions About Getting Legal Funding Without Attorney Consent

Legal Eligibility & Basic Understanding

Can I legally get pre-settlement funding without my attorney?

Yes, in many states, it is legal to get pre-settlement funding without your attorney’s consent. However, most reputable legal funding companies still require attorney involvement to verify your case and protect all parties.

While some jurisdictions allow funding without attorney participation, it is not a common industry practice. Always check your state’s laws and speak with a legal or financial professional before applying.

Can I get a lawsuit loan if my lawyer doesn’t approve?

Yes, it’s possible to get a lawsuit loan even if your lawyer does not approve, but it largely depends on the policies of the funding company. Most reputable providers, like Express Legal Funding, still require attorney approval to ensure fair terms and verify your case details.

Risks & Consequences

What are the dangers of obtaining funding without attorney consent?

The main risks of getting pre-settlement funding without your attorney’s consent include signing predatory contracts, paying excessive fees, and damaging your attorney-client relationship. Without legal guidance, you may agree to unfavorable terms or jeopardize your case coordination.

What happens if I get legal funding without telling my attorney?

Getting pre-settlement funding without your attorney’s knowledge can damage your attorney-client relationship, lead to communication breakdowns, and cause confusion during settlement negotiations.

In some cases, attorneys may even choose to withdraw from representing you if they feel their trust or control over the case has been compromised.

Can I still get funding if my attorney refuses to sign lien documents?

In most cases, no. If your attorney refuses to sign lien documents or acknowledge the funding agreement, most legal funding companies will decline your application. Some high-risk or niche lenders may still approve funding, but often at higher rates and with less favorable terms.

Application Requirements

What documents do I need to apply for pre-settlement funding without my attorney?

To apply without your attorney, you’ll typically need your case complaint, medical records or bills, and any related insurance correspondence or police reports. These documents help the funding company evaluate your case when attorney verification isn’t available.

Does applying for pre-settlement funding affect my credit score?

No, applying for pre-settlement funding usually does not affect your credit score. Most legal funding companies do not perform hard credit checks. However, it’s important to verify the lender’s underwriting process before applying.

How much pre-settlement funding can I get without attorney involvement?

The amount of pre-settlement funding you can get varies widely but is typically lower than if your attorney cooperates. Lenders assume greater risk without attorney input and may offer smaller advances with stricter repayment terms.

Lender Policies & Availability

Why do legal funding companies need my attorney’s consent?

Legal funding companies require your attorney’s cooperation to verify the strength of your case, confirm estimated settlement value, and coordinate lien agreements for repayment.

Are there any lawsuit lenders that don’t require attorney involvement?

Yes, some non-traditional or high-risk lenders offer funding without attorney involvement. However, they often charge higher rates and may use less transparent practices.

Which companies offer legal funding without attorney participation?

Only a limited number of niche funders provide this option, and they should be approached with the utmost caution. The lack of attorney participation often results in higher interest rates and unfavorable terms.

Advice & Comparisons

What should I do if my lawyer won’t help me get legal funding?

Start by discussing your financial needs with your attorney. If they still refuse to assist, you may consider switching attorneys or seeking alternative funding sources—but proceed with caution.

Is it better to wait until my attorney agrees to legal funding?

Yes, it is better to wait. Waiting for your attorney’s approval can help ensure better pre-settlement funding terms, legal protection, and a stronger relationship with your lawyer.

How does pre-settlement funding differ with and without attorney consent?

With attorney consent, you’re more likely to receive better funding terms, clear legal communication, and protection from predatory lenders. Without it, expect higher risk, limited options, and fewer safeguards.

Additional Resources

Express Legal Funding Guides

For more context, check out our guides about guaranteed pre-settlement funding or how attorney cooperation is crucial for your eligibility for same-day pre-settlement loans.

External Resources

- American Bar Association Best Practices for Third-Party Litigation Funding – americanbar.org

- Find Legal Aid in Your State – LSC.gov

By understanding the nuances of pre-settlement funding without attorney consent, you can make informed decisions that best suit your financial and legal needs.